Tomsmith585

Investment Thesis

I rate Marriott International as a hold at this time and will be watching RevPAR growth in China as well as overall RevPAR growth heading into the summer months to determine if an upside is possible for the stock once again.

In a previous article back in November 2023, I made the argument that Marriott International, Inc. (NASDAQ:MAR) has the potential for further upside based on encouraging growth in RevPAR (revenue per available room) and EBITDA.

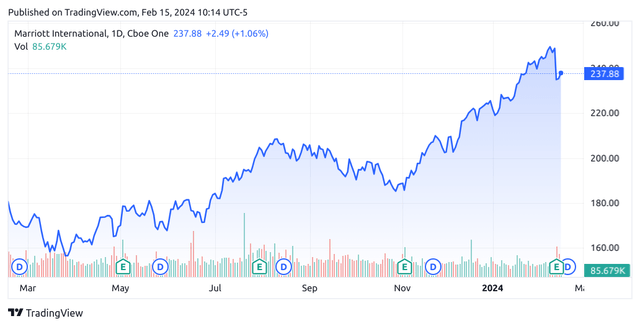

Since then, the stock has ascended to a price of $237.88 at the time of writing:

TradingView.com

The purpose of this article is to assess whether Marriott International has the ability to see continued growth from here, taking recent performance into consideration.

Performance

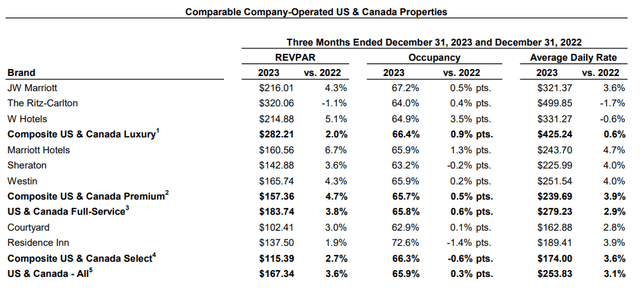

When looking at the most recent earnings results for Marriott International, we can see that growth in RevPAR was relatively modest in the single digits – with overall RevPAR growth across the US & Canada of 3.6%.

Marriott International: Q4 2023 Press Release and Financial Tables

Given that Q4 marks the autumn and winter months where travel demand is typically lower owing to seasonality – the modest RevPAR growth that we have seen is not overly surprising. However, it is notable that the Ritz-Carlton – which is Marriott’s highest-priced brand by ADR – saw a fall of -1.7% in the average daily rate and a fall of -1.1% in RevPAR. This is an indication that we are starting to see a plateau in demand across higher-priced brands, and the ability to continue raising prices is eroding as post-COVID travel demand is maturing.

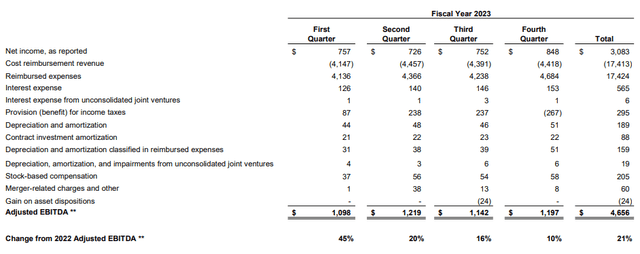

In terms of earnings, I had previously remarked that we had seen a slowdown in adjusted EBITDA growth as compared to prior year quarters in 2022 – which was primarily due to higher cost reimbursement revenue – or reimbursements for costs that Marriott incurs in operating property-level and centralized programs and services for the benefit of hotel owners. For Q4 2023 – this came in at $4.418 billion as compared to $4.420 billion in the prior year quarter.

Marriott International: Q4 2023 Press Release and Financial Tables

In this regard, while a leveling off in cost reimbursement revenue is encouraging – as this indicates that the cost of operating properties is also leveling off – growth in EBITDA is clearly showing signs of plateauing.

My Perspective and Looking Forward

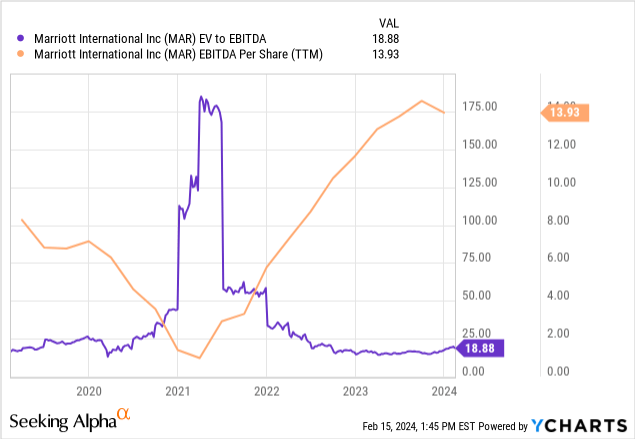

As regards my take on the above results and the implications for the growth trajectory of the stock going forward, I had made the assertion in my previous article that given the fact that 1) we had seen EV to EBITDA trading near a five-year low and 2) EBITDA per share had reached a five-year high and was continuing to see growth – it was quite possible that Marriott International could rebound to the prior high of $210 that we had seen earlier in the year.

Given the price of $237.88 at the time of writing, the stock has clearly exceeded this target. With that being said, we see that while the EV to EBITDA ratio is still trading at 2019 levels – growth in EBITDA per share has hit a plateau in the last quarter.

ycharts.com

Given that we are seeing more modest growth in RevPAR and EBITDA following post-COVID travel demand, I take the view that the stock could potentially see short-term consolidation from here. Specifically, my view is that investors will want to see evidence that 1) RevPAR can start to see more significant growth and 2) EBITDA sees a rebound in growth before the stock can see an upside once again.

Given that overall travel demand is set to rise once again in the summer months – it may be in the latter half of the year before we see investor enthusiasm for the stock rebound depending on performance. Particularly, while normalization of RevPAR growth is expected following post-COVID demand, I take the view that investors will be looking to see if Marriott International is on track to meet the company’s expected RevPAR growth of 3 to 5 percent worldwide, in addition to expected net rooms growth of 5.5 to 6 percent going forward.

Particularly, investors may pay particular attention to room growth heading into the summer months – as this can ultimately allow for further growth in overall revenue even if RevPAR itself sees little growth in its own right.

Risks

In terms of the potential risks to Marriott International at this time, I take the view that while growth normalization is largely expected across North America – investors will be looking to see if growth across China can ultimately compensate for this. In this regard, a significant slowdown in growth across the Chinese market may give investors pause.

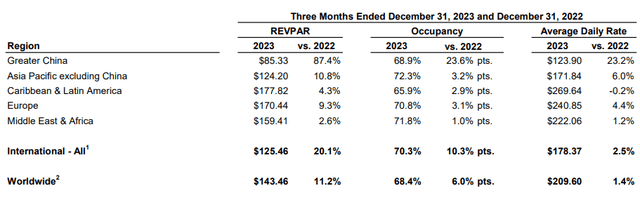

For instance, we have seen that RevPAR across Greater China was up by 87.4% from that of the prior year quarter – which was well above that of other regions. Moreover, it is notable that the average daily rate was only up by 23.2% over the same period, indicating that growth in RevPAR was largely driven by a rise in demand.

Marriott International: Q4 2023 Press Release and Financial Tables

While some normalization in growth is expected, investors will be looking to see if Greater China can continue to lead growth – particularly taking into account Marriott’s strategic cooperation with Delonix Group, which provides Marriott with the opportunity to incorporate more than 100 full-service Delonix hotels into Marriott’s Tribute portfolio. In this regard, with Marriott International taking steps to further expand its presence into China – investors would like to see further growth in RevPAR towards levels seen across other international regions. A slowdown in Chinese growth could be a risk factor for Marriott in this regard.

Conclusion

To conclude, Marriott International has seen a moderation in RevPAR and EBITDA growth, as expected, given the normalization of hotel demand post-COVID. My view on the stock is that while long-term upside potential still exists if we continue to see strong growth across China – the stock is trading at fair value at this point in time. I view Marriott International as a hold at this time and will be looking at RevPAR growth heading into the summer months to judge whether the stock could see significant upside once again.