shih-wei

Introduction

In April 2023, I wrote a bearish article on SA about Mama’s Creations (NASDAQ:MAMA) in which I said that the company seemed overvalued in light of its weak balance sheet and anemic organic revenue growth.

In my view, organic growth and free cash flow continue to be underwhelming and reaching $1 billion in sales is likely to result in significant stock dilution. Considering the share price has increased by over 130% since my previous article, I feel comfortable slashing my rating on the stock to strong sell. Let’s review.

Overview of the recent developments

If you’re not familiar with Mama’s Creations or my earlier coverage, here’s a brief description of the business. The company was established in 2010 and is involved in the production and sale of line of beef, turkey, chicken, and pork meatballs that is based on a family recipe. It also produces ready to serve meals, single-size pasta bowls, and packaged refrigerated protein products among others and was known as MamaMancini’s until July 2023. The company employs about 250 people, and its products can be found in more than 8,000 stores across the USA.

Mama’s Creations Mama’s Creations

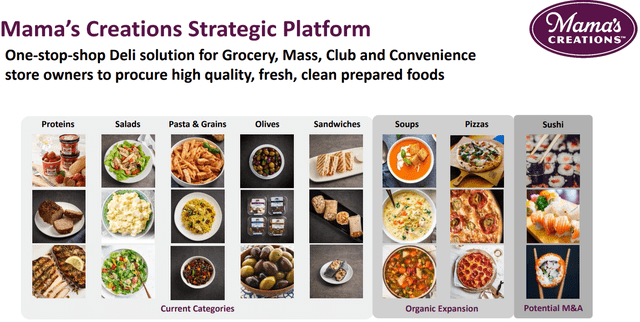

When I covered Mama’s Creations in April, the corporate presentation stated that it aimed to become a $1 billion one-stop shop deli solutions provider (slide 4 here). The December 2023 corporate presentation simply says that the objective is “to become the leading national “one-stop-shop” solution for high quality fresh, clean and easy to prepare foods” (slide 3 here). Yet, $1 billion in still sales seems still to be on the cards as mentioned in the Q3 FY24 earnings call.

As I mentioned in my previous article, Mama’s Creations has been focusing on inorganic growth and its two major acquisitions included Joseph Epstein Food Enterprises in late 2017, and T&L Creative Salads and Olive Branch in late 2021. Unfortunately, both of these companies performed well below expectations. In June 2023, Mama’s Creations announced the acquisition of the remaining 76% in deli prepared food sales agent Chef Inspirational Foods (CIF). This was a small purchase as Mama’s Creations paid just $3.65 million for the stake.

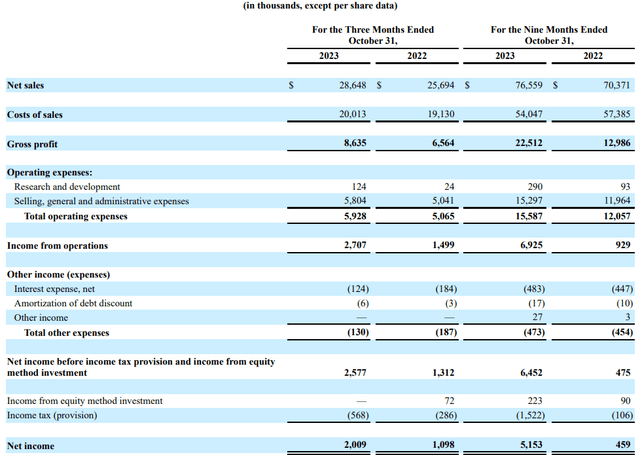

Turning our attention to the Q3 FY24 financial results, we can see that net sales rose by 11.5% year on year to $28.6 million while the operating income soared by 80.5% to $5.93 million. Mama’s Creations said that the net sales growth was “largely attributable to volume gains driven by same-customer cross-selling, the acquisition of new customers and successful pricing actions”. The gross profit margin improved to 30.1% from 25.5% a year earlier and this was thanks to “successful pricing actions, the normalization of commodity costs and improvements in procurement, manufacturing and logistics efficiencies” according to the company.

Mama’s Creations

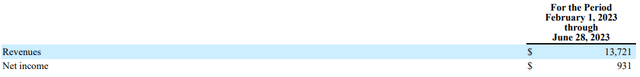

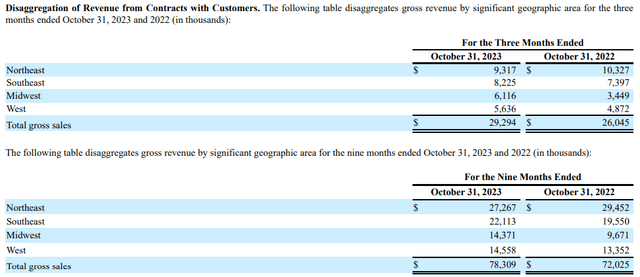

In my view, CIF played a major role in the improvement of sales and margins. While Mama’s Creations didn’t release pro-forma results for its business with the Q3 FY24 results, we can see from the table below that CIF has quarterly revenues of about $8.2 million and a net income of some $0.6 million (page 16 of the Q3 2023 financial report).

Mama’s Creations

In addition, Mama’s Creations said in June that CIF could immediately boost its gross margin by 1-2%. Comparing the Q3 financial results to the ones for Q2, we can see that the net sales growth has accelerated by just three percentage points or less than $0.8 million while the gross profit margin decreased slightly quarter on quarter.

Looking at other red flags here, I’m concerned that free cash flow was just $3.56 million for the first nine months of FY24, and that Mama’s Creations seems to be struggling with growth in its largest market – the Northeast (page 20 of the Q3 2023 financial report).

Mama’s Creations

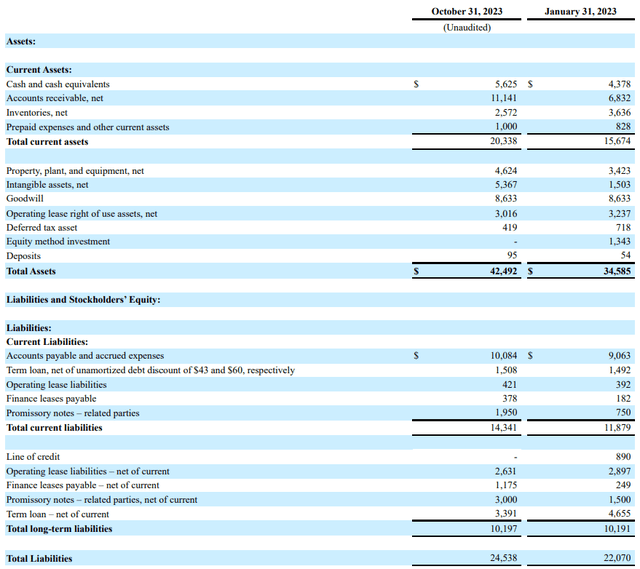

Turning our attention to the balance sheet, we can see that the tangible book value was just $3.95 million at the end of July while the net debt increased to $5.78 million from $5.34 million in January.

Mama’s Creations

Looking at what to expect for the future, I think that organic net sales growth is likely to remain in the single digit percentage points over the next few years. Mama’s Creations has an asset-light business model, and any major M&A deals could therefore result in significant stock dilution. In addition, I’m concerned that the company doesn’t have a good track record with acquisitions and integration of new subsidiaries.

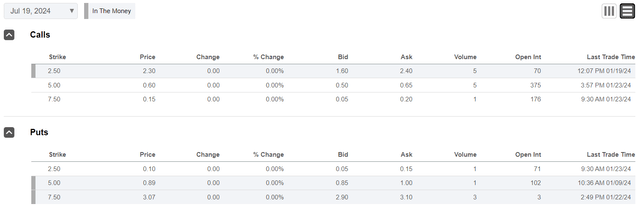

Turning our attention to the valuation, Mama’s Creations has an enterprise value (EV) of $176.9 million as of the time of writing and is trading at an EV/EBITDA ratio of 15.9x based on the adjusted TTM EBITDA. Considering the company has a single digit percentage organic net sales growth and a tangible book value of less than $4 million, I think it should be trading somewhere below 8x EV/EBITDA. As the share price has been hovering around the $4.50 mark since December, I now feel comfortable cutting my rating on the stock to strong sell and I think that there is a good short-selling opportunity here. Data from Fintel shows that the short borrow fee rate is just 0.34% and hedging the risk through July 2024 call options seems relatively cheap.

Seeking Alpha

In addition, the short squeeze risk seems low as the short interest is just 2.04% of the float and takes less than three days to cover.

Looking at the upside risks, I think that the major one is that the share prices of microcap companies can soar for spurious and unknown reasons. It’s also possible that the organic net sales growth improves in the next few quarters as Mama’s Creations has been expanding its marketing team. The company mentioned in its Q3 FY24 earnings call that it has grown from one to five dedicated sales employees since Adam Michaels became CEO in September 2022.

Investor takeaway

Mama’s Creations booked an 11.5% annual increase in net sales in Q3 FY24 and the gross profit margin remained above 30%. However, the growth seems underwhelming compared to the previous quarter when you take into account the financial results of CIF. In my view, organic growth remains a concern and the Mama’s Creations looks significantly overvalued at almost 16x EV/EBITDA in light of the weak balance sheet.