zhnger/iStock Editorial through Getty Pictures

Thesis

LVMH (OTCPK:LVMUY) inventory is down 20% YTD and accumulating and fairness place seems engaging at < $120/share. In my view, there isn’t any higher identify to purchase, if an investor wish to achieve publicity to the engaging luxurious business. Furthermore, given LVMH’s historical past of outperforming the market on the subject of each enterprise development and worth accumulation, a < x20 P/E a number of seems low cost.

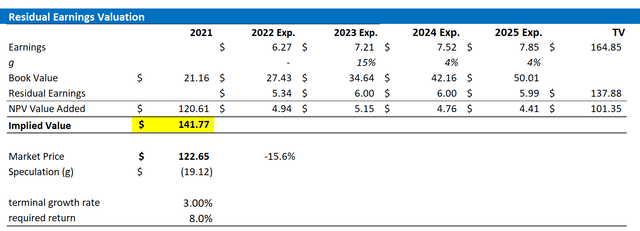

I worth LVMH based mostly on a residual earnings framework – anchored on analyst consensus estimates – and calculate a justifiable share worth of $141.77/share, implying roughly 15% upside.

About LVMH

LVMH is a holding firm based mostly in France and arguably the world’s main luxurious conglomerate. The corporate develops manufactures and distributes among the world’s hottest luxurious items in 5 core segments: Wines & Spirits, which is about 45% of gross sales; Vogue & Leather-based Items with roughly 10%; Perfumes & Cosmetics with one other 10%; Watches & Jewellery with 5%; and Selective Retailing accounting for the remaining. Moreover, LVMH can also be energetic in hospitality (Bulgari Resorts & Resorts). Most notably, LVMH’s portfolio includes greater than 70 manufacturers, together with names similar to Louis Vuitton, Bulgari, Dior, Kenzo, Givenchy. In 2021, LVMH additionally closed the acquisition of Tiffany & Co. From a geographical perspective, LVMH’s predominant goal market is Asia, accounting for 40% of gross sales, EMEA accounting for 25%, North America with about 25%. LVMH has outperformed the market significantly up to now 5 12 months—inventory is up about 170%, vs the Eurostoxx being flat over the identical time.

The Alternative

LVMH inventory is down roughly 20% YTD, as the corporate was pressured by a number of headwinds: 1) rising yield, inflation, and cautious sentiment in direction of threat property, 2) slowing client confidence, and three) macroeconomic headwinds, together with the Covid-19 lockdowns in China. That stated, because the inventory is now buying and selling at a one-year ahead P/E beneath x20, the inventory has by no means been cheaper up to now decade.

There are good elementary the reason why LVMH inventory is perhaps a very good shopping for alternative, in my view. First LVMH’s luxurious choices are much less cyclical—or no less than much less susceptible to recessions–than most buyers would possibly count on and assume. Throughout Covid-19, for instance, LVMH’s gross sales solely fell from $60.1 billion to $51.0 billion and net-income margins solely compressed by roughly 2 share factors. Notably, in 2021 the corporate recorded a net-income of $5.77 billion and money from operation of greater than $12 billion. Second, the Chinese language financial system is exhibiting indicators of strengthening client confidence and enterprise exercise, as Covid-lockdowns ease and the federal government is pushing extra financial stimulus. I consider LVMH is in a primary place to learn from the China’s reopening story. Thirdly, in my view LVMH is poised to proceed seeing a robust multi-year tailwind from the globally accelerating demand for luxurious merchandise. Based on BCG, the worldwide luxurious market is anticipated to develop at a 6% CAGR between 2022 and 2026. Lastly, buyers rightfully think about LVMH as one of many world’s finest managed corporations, as LVMH’s founder-led tradition, pushed by creativity and premiumization, sustained – over a protracted interval – high-brand fairness, pricing energy, accreditive M&A transactions, regular quantity and income development, and regular worth accumulation.

Financially, LVMH is doing very effectively. In 2021 the corporate generated revenues of $75.95 billion and internet earnings of $14.2 billion (18.7% margin). Money from operation was $22.06 billion. The corporate closed Q1 2022 with $12.02 billion of money and money equivalents and $39.3 billion of whole debt. Based on the Bloomberg Terminal as of July 2022, analyst consensus forecast estimates LVMH’s 2022 and 2023 revenues at $83.25 billion and $90.80 billion. Respectively, EPS are estimated at $6.27, $7.10.

Residual Earnings Valuation

Allow us to now take a look at LVMH’s valuation in additional element. I’ve constructed a Residual Earnings framework based mostly on the analyst consensus forecast for EPS ‘until 2025, a WACC of 8% and a TV development charge equal to nominal GDP development (3%).

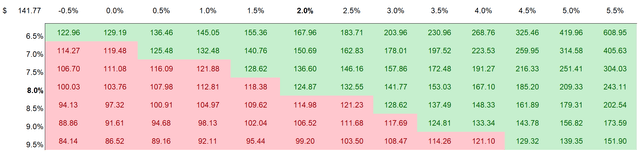

In my view, the long-term development assumption equal to GDP development would possibly positively be an underestimation, in my view, however I desire to be conservative. If buyers would possibly wish to think about a distinct situation, I’ve additionally enclosed a sensitivity evaluation based mostly on various WACC and TV development mixture. For reference, pink cells suggest an overvaluation, whereas inexperienced cells suggest an undervaluation as in comparison with LVMH’s present valuation.

Based mostly on the above assumptions, my valuation estimates a justifiable share worth of $141.77/share, implying roughly 15% upside potential based mostly on accounting fundamentals.

Analyst Consensus; Writer’s Calculation

Analyst Consensus; Writer’s Calculation

Dangers

In my view, LVMH inventory is considerably de-risked at a P/E (FWD) beneath 20 and the danger/reward seems favorable. Nevertheless, buyers ought to be aware the next dangers that may trigger LVMH inventory to considerably deviate from my goal worth: 1) slowing client confidence as a consequence of inflation outpacing wage development, rising rates of interest and rising unemployment; 2) LVMH’s important publicity to China, which is very Covid-19 lockdowns; 3) macro-economic uncertainty referring to the financial coverage actions of the ECB and actions of the European authorities in opposition to Russia.

Conclusion

Whereas 15% upside doesn’t appear a lot, I see LVMH as a shopping for alternative. My suggestion relies on LVMH’s undisputed management within the luxurious sector. In my view, LVMH ranks amongst the best-managed corporations with a confirmed track-record of EPS development, profitable M&A execution, and real enterprise creativity. Furthermore, model fairness is unmatched within the vogue business. In that context, a P/E <x20 seems extremely engaging. Purchase.