ipopba/iStock via Getty Images

A Quick Take On Lucas GC Limited

Lucas GC Limited (LGCL) has filed to raise $20.7 million in an IPO of its ordinary shares, according to an F-1 registration statement.

The firm provides human capital management services and software to organizations in China.

LGCL’s growth rate is declining sharply as is its operating cash flow.

I’ll provide an update when we learn more IPO information from management.

Lucas GC Overview

Beijing, China-based Lucas GC Limited was founded to develop a SaaS-based (Software as a Service) human capital management platform for the enterprise human resource function.

Management is headed by founder, Chairman and CEO Howard Lee, who has been with the firm since its inception in 2011 and was previously Vice President of corporate development at Western Digital Corporation.

The company’s primary offerings include the following:

Permanent employment recruitment

Flexible employment recruitment

Outsourcing services

Other services.

As of June 30, 2022, Lucas GC has booked fair market value investment of $17.4 million from investors including 51job, Inc., MLT Holding, and others.

Lucas GC – Customer/User Acquisition

The company seeks to connect job providers (enterprises) with job seekers (individuals) via a variety of online activities and social network connections.

The firm had approximately 382,650 active registered users on its system as of June 30, 2022.

Selling and Marketing expenses as a percentage of total revenue have trended higher as revenues have increased, as the figures below indicate:

Selling and Marketing | Expenses vs. Revenue |

Period | Percentage |

Six Mos. Ended June 30, 2022 | 7.6% |

2021 | 5.1% |

2020 | 4.2% |

(Source – SEC.)

The Selling and Marketing efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling and Marketing expense, dropped to 2.8x in the most recent reporting period, a negative trend, as shown in the table below:

Selling and Marketing | Efficiency Rate |

Period | Multiple |

Six Mos. Ended June 30, 2022 | 2.8 |

2021 | 13.1 |

(Source – SEC.)

Lucas GC’s Market & Competition

According to a 2022 market research report by iResearch China, the Chinese market for online recruitment was an estimated $2.25 billion in 2021.

This represented a growth rate of 48.2% versus the prior year.

The main drivers for this expected growth are a growth in the need for employees from small and micro enterprises and their increasing usage of online means to source new employees.

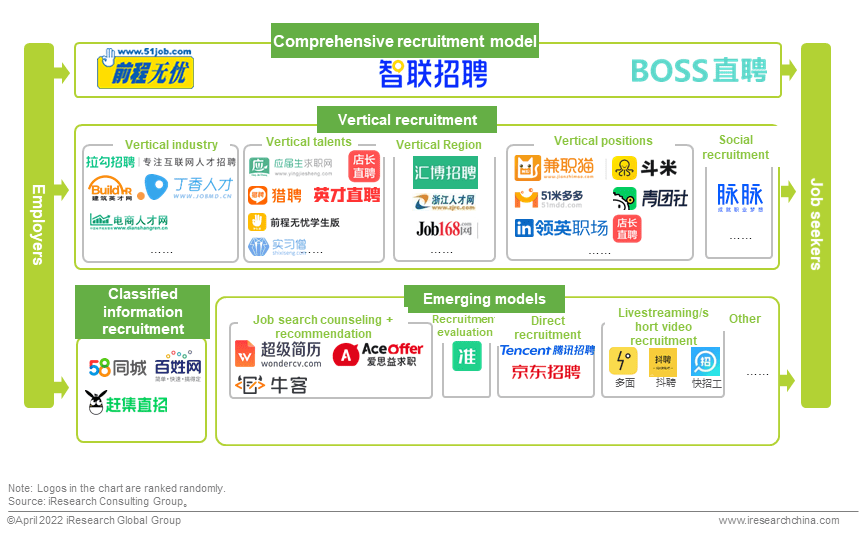

Also, below is a map of the online recruitment market in China:

Online Recruitment In China (iResearch China)

Major competitive or other industry participants include the following:

online agent-centric service providers;

online HR service providers;

traditional staffing companies; and

traditional workforce solutions providers.

(Source – SEC.)

Lucas GC Limited Financial Performance

The company’s recent financial results can be summarized as follows:

Slowing top-line revenue growth rate

Increasing gross profit and gross margin

Flat operating profit

A sharp drop in cash flow from operations.

Below are relevant financial results derived from the firm’s registration statement:

Total Revenue | ||

Period | Total Revenue | % Variance vs. Prior |

Six Mos. Ended June 30, 2022 | $ 45,112,000 | 26.6% |

2021 | $ 97,185,000 | 199.7% |

2020 | $ 32,423,662 | |

Gross Profit (Loss) | ||

Period | Gross Profit (Loss) | % Variance vs. Prior |

Six Mos. Ended June 30, 2022 | $ 13,826,000 | 57.3% |

2021 | $ 26,685,000 | 227.7% |

2020 | $ 8,142,958 | |

Gross Margin | ||

Period | Gross Margin | |

Six Mos. Ended June 30, 2022 | 30.65% | |

2021 | 27.46% | |

2020 | 25.11% | |

Operating Profit (Loss) | ||

Period | Operating Profit (Loss) | Operating Margin |

Six Mos. Ended June 30, 2022 | $ 2,639,000 | 5.8% |

2021 | $ 5,530,000 | 5.7% |

2020 | $ 407,042 | 1.3% |

Comprehensive Income (Loss) | ||

Period | Comprehensive Income (Loss) | Net Margin |

Six Mos. Ended June 30, 2022 | $ 2,763,000 | 6.1% |

2021 | $ 5,875,000 | 13.0% |

2020 | $ 622,254 | 1.4% |

Cash Flow From Operations | ||

Period | Cash Flow From Operations | |

Six Mos. Ended June 30, 2022 | $ 1,147,000 | |

2021 | $ 9,033,000 | |

2020 | $ 342,394 | |

(Glossary Of Terms) |

(Source – SEC.)

As of June 30, 2022, Lucas GC had $4.3 million in cash and $14.6 million in total liabilities.

Free cash flow during the twelve months ending June 30, 2022, was $5.8 million.

Lucas GC Limited IPO Details

Lucas GC intends to raise $20.7 million in gross proceeds from an IPO of its ordinary shares, although the final figure may differ.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

approximately 40% for investment in technology infrastructure and research and development to upgrade our service offerings and to improve technology capabilities in areas such as AI, big data analytics and blockchain;

approximately 30% for marketing activities relating to user acquisitions and to expand into broader geographical markets;

approximately 20% for exploration of new product and service offerings; and

approximately 10% for general corporate purposes, which may include strategic investments and acquisitions, although we have not identified any specific investments or acquisition opportunities at this time.

(Source – SEC.)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is “currently not a party to any material legal or administrative proceedings.”

The listed bookrunners of the IPO are The Benchmark Company and Valuable Capital Limited..

Commentary About Lucas GC’s IPO

Lucas GC Limited is seeking U.S. public capital market investment to fund its various corporate R&D and growth initiatives.

Lucas GC Limited’s financials have produced a lower top-line revenue growth rate, growing gross profit and gross margin, flat operating profit and a significant drop in cash flow from operations.

Free cash flow for the twelve months ending June 30, 2022, was $5.8 million.

Selling and Marketing expenses as a percentage of total revenue have trended higher as revenue growth has diminished; its Selling and Marketing efficiency multiple fell to 2.8x in the most recent reporting period.

Lucas GC Limited currently plans to pay no dividends and to retain most if not all of its future earnings for reinvestment back into its growth and working capital requirements.

The company’s CapEx Ratio indicates it has spent heavily on capital expenditures as a percentage of its operating cash flow.

The market opportunity for providing online recruitment services or software in China is large and likely will grow at an elevated rate of growth, so the company enjoys positive industry dynamics in the coming years, albeit with extensive and intense competition.

Like other companies with Chinese operations seeking to tap U.S. markets, Lucas GC Limited operates within a WFOE structure or Wholly Foreign Owned Entity. U.S. investors would only have an interest in an offshore firm with interests in operating subsidiaries, some of which may be located in the PRC. Additionally, restrictions on the transfer of funds between subsidiaries within China may exist.

The Chinese government’s crackdown on certain IPO company candidates combined with added reporting and disclosure requirements from the U.S. has put a serious damper on Chinese or related IPOs resulting in generally poor post-IPO performance.

Also, a potentially significant risk to the company’s outlook is the uncertain future status of Chinese company stocks in relation to the U.S. HFCA act, which requires delisting if the firm’s auditors do not make their working papers available for audit by the PCAOB.

Prospective investors would be well advised to consider the potential implications of specific laws regarding earnings repatriation and changing or unpredictable Chinese regulatory rulings that may affect such companies and U.S. stock listings.

Additionally, post-IPO communications from the management of smaller Chinese companies that have become public in the U.S. has been spotty and perfunctory, indicating a lack of interest in shareholder communication, only providing the bare minimum required by the SEC and a generally inadequate approach to keeping shareholders up-to-date about management’s priorities.

The Benchmark Company is the lead underwriter and IPOs led by the firm over the last 12-month period have generated an average return of 182% since their IPO. This is a top-tier performance for all major underwriters during the period.

Risks to Lucas GC Limited’s outlook as a public company include the firm’s exposure to unpredictable Chinese regulatory risks and the fragmented nature of human capital recruiting in China.

When we learn more information about the IPO from Lucas GC Limited management, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.