Madmaxer/iStock through Getty Photos

|

To December 31st 2021: |

LRCP Fairness Fund I Gross |

LRCP Fairness Fund I Internet |

S&P 500 |

Russell 2000 |

MSCI World Index |

|

Trailing 1-yr Complete Return: |

41.8% |

32.4% |

28.7% |

14.8% |

22.4% |

|

Trailing 2-yr Complete Return: |

56.8% |

44.3% |

52.3% |

37.8% |

42.5% |

|

Trailing 3-yr Complete Return: |

60.8% |

47.9% |

100.4% |

72.8% |

82.5% |

|

Trailing 4-yr Complete Return: |

54.6% |

42.3% |

91.6% |

51.8% |

69.9% |

The figures above are on a cumulative foundation and are unaudited. Future outcomes may also be offered on a cumulative foundation on this part. Annual outcomes will probably be illustrated beneath for individuals who want to measure us based mostly on 12-month cycles. Nevertheless, we view the cumulative outcomes as most significant since we are attempting to construct wealth far into the longer term and the annual outcomes are solely essential in as a lot as they contribute to a 3, 5, 10, and 20-year observe document.

|

Annual Outcomes |

LRCP Fairness Fund I Gross |

LRCP Fairness Fund I Internet |

S&P 500 Power |

AMZ |

XAL |

|

2021: |

41.8% |

32.4% |

53.3% |

39.9% |

-1.7% |

|

2020: |

10.6% |

9.0% |

-33.7% |

-28.8% |

-24.2% |

|

2019: |

2.5% |

2.5% |

11.8% |

6.5% |

21.3% |

|

2018: |

-3.8% |

-3.8% |

-18.1% |

-12.4% |

-22.4% |

To reiterate, our purpose is to have good absolute returns initially, which ought to result in good relative returns versus the broader markets. Nevertheless, I additionally suppose it’s essential to spotlight the efficiency of the first sectors during which we really feel we have now a bonus and during which we make investments. There isn’t any purpose to current this aside from for transparency causes. Proudly owning a extremely concentrated portfolio will stop our outcomes from trying like something we examine them to in most years, however figuring out the efficiency of power broadly, midstream power particularly, and North American airways will add some context for these companions who want to do some higher-level evaluation. Please see the accompanying disclaimer & footnotes on the finish of the letter for a broader description of every of those indices.

“a enterprise incomes 20% on capital can produce a unfavorable actual return for its house owners below inflationary situations not way more extreme than presently prevail. If we must always proceed to attain a 20% compounded acquire—not a straightforward or sure consequence by any means—and this acquire is translated right into a corresponding improve out there worth of Berkshire Hathaway inventory because it has been over the past fifteen years, your after-tax buying energy acquire is prone to be very near zero at a 14% inflation fee…

…the inflation fee plus the proportion of capital that should be paid by the proprietor to switch into his personal pocket the annual earnings achieved by the enterprise (i.e., atypical earnings tax on dividends and capital features tax on retained earnings)—may be considered an “investor’s distress index”…We have now no company answer to this drawback; excessive inflation charges won’t assist us earn greater charges of return on fairness.

One pleasant however sharp-eyed commentator on Berkshire has identified that our e-book worth on the finish of 1964 would have purchased about one-half ounce of gold, and fifteen years later, after we have now plowed again all earnings together with a lot blood, sweat and tears, the e-book worth produced will purchase about the identical half ounce. An identical comparability might be drawn with Center Jap oil. The rub has been that authorities has been exceptionally ready in printing cash and creating guarantees, however is unable to print gold or create oil.”

Warren E. Buffett—from the 1979 Berkshire Hathaway shareholder letter.

Buffett’s evaluation of the deleterious affect excessive charges of inflation have on wealth creation is related to all buyers right this moment. He wrote this forty-two years in the past, a time that the majority carefully resembles the present macro surroundings than any interval since. And whereas Nate and I received’t hold forth on future charges of inflation, we do know December’s Shopper Worth Index (CPI) superior 7%, the best fee in forty years, and the Producer Worth Index (PPI) rose 9.6%, the best fee because the information was first tracked in 2010. Buffett’s “investor’s distress index” is pointing up.

Our portfolio may be very effectively positioned to excel in such environments.

Outcomes For 2021

The partnership gained 42% gross of efficiency charges final 12 months. I might characterize the outcomes as acceptable. Whereas four-times the prior 12 months’s return, Nate and I believe we did a a lot better job in 2020. Placing up respectable outcomes when every part you personal was down within the 12 months is far more durable than placing up respectable outcomes when every part was up. And whereas investing is rarely simple, final 12 months felt a bit simpler. Absolutely the return of the portfolio was nice, and relative to broader indices it was good, however in comparison with power indices we may have executed a bit higher. Midstream power shares underperformed upstream shares by an honest quantity, and we have now a basic aversion to most upstream investments. Returns on and of capital are typically fairly poor for these companies, and whereas that’s altering for some, we all know that what’s good for upstream will in the end be good for midstream, so we’re at present centered there.

The cumulative gross return of the partnership because it was began 4 years in the past is +55%. That’s underwhelming when in comparison with the broader indices referenced above. Our specialties are capital intensive, un-ESG(ish), cyclical, and “worth”, which have been investing gale pressure headwinds the previous a number of years. No excuse, simply an statement. Regardless, it’s crucial we beat the broader indices over the long-haul if we’re to have executed our job correctly.

The nice information is that we really feel like these headwinds are lastly shifting to tailwinds for a method like ours—a method that focuses on free money circulation and returns of capital, whereas insisting on cheap returns on our capital. The passive investing neighborhood has forfeited their alternative for cheap returns in our opinion. With the S&P 500 doubling the final 3-years, anticipated future returns have definitively come down. It’s the one option to justify shopping for “the market” at present costs. In the event you anticipate low-single-digit returns you may pay over 20x for an asset. We proceed to anticipate extra from our investments.

We stay optimistic about our portfolio

There are a number of causes we expect our portfolio nonetheless has significant upside, even after an excellent 12 months.

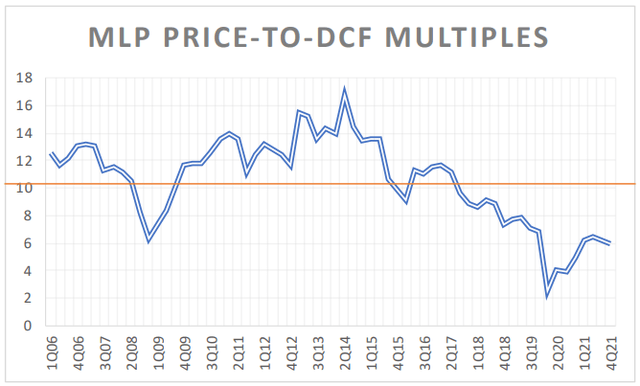

- Midstream power stays low-cost. Updating the Distributable Money Circulate chart for 2021 outcomes reveals that valuations are nonetheless a great distance off from historic averages. And whereas the common can transfer down if there’s a structural shift in multiples, we’re tremendous betting there’s nonetheless a powerful bias in opposition to power that at the least partially reverts in time. Over the previous 15-years the common DCF a number of is 10.5x and we ended 2021 at 5.9x, suggesting 78% upside to get again to the common. And that math assumes no basic enchancment within the denominator (money flows), which isn’t in any respect in keeping with commodity costs, present E&P exercise ranges and implied future power manufacturing. Moreover, though the cumulative return of our portfolio over the previous 4-years is constructive, the returns within the sectors we’ve been specializing in are usually not. The Alerian Midstream Index (AMZ) and S&P 500 Power sub-sector are every down 7% cumulatively, whereas the NYSE Arca Airline Index (XAL) is down near 30%. These sectors stay large underperformers over a multi-year interval, so we’re nonetheless fishing in fertile waters.

- If valuations don’t revert nearer to the imply, we’ll nonetheless get acceptable returns. Do not forget that DCF is actually a FCF metric for midstream, however it makes use of upkeep capex versus complete capex. Most of midstream is in upkeep mode and will probably be for a number of years as asset utilization will increase on present infrastructure. The money circulation yield on these firms is near 17% and we personal a number of with yields over 20%. Whether or not the money will get returned by way of distributions, inventory repurchases, and even debt discount, we don’t notably care. And whereas Vistra (VST) isn’t a midstream firm it does supply the identical worth proposition. Shares commerce at a 20%+ FCF yield, administration pays a modest dividend, progressively reduces debt, and most significantly, is repurchasing over 20% of the excellent shares over the subsequent 12 months.

- We obtain an honest amount of money each quarter from dividends, which permits us to seek out new alternatives or add to present positions with out having to promote something. Proudly owning a handful of unstable shares makes this compelling since a number of of our positions had a 60%+ dispersion between the 52-week excessive and 52-week low in calendar 12 months 2021. We consider ourselves as long-term buyers, however we have now no drawback profiting from volatility on both facet.

- The portfolio we personal right this moment is hardly the portfolio that received us right here. Not certainly one of right this moment’s prime 3 positions gained as a lot as the general portfolio in 2021. We aren’t relying on outperformers persevering with to outperform.

- Our portfolio ought to fare effectively in periods of excessive inflation.

Inflation vs. LRCP

If a interval of sustained excessive inflation is forward of us, our portfolio ought to carry out effectively on an absolute and relative foundation as a result of we personal brief period investments, excessive inflation is synonymous with excessive power costs, our firms predominantly personal belongings with contract constructions that alter for inflation, and we personal actual belongings.

Greater inflation results in greater rates of interest, and better rates of interest result in greater low cost charges. Future money flows are merely price much less right this moment as low cost charges go up and the additional out sooner or later that money is obtained, the extra negatively its current worth is impacted. Bond buyers simplified the concept and name it period. Excessive period money circulation streams are essentially the most impacted by altering rates of interest, e.g., zero coupon bonds or low-to-no money circulation equities. Charges go down, value goes up; charges go up, value goes down. We personal low period belongings. The current worth of our holdings is captured within the very close to future. Whether or not transmitted by way of significant money dividends, large share repurchases, or vital deleveraging, we personal excessive free money circulation shares that return capital to us in a single type or one other.

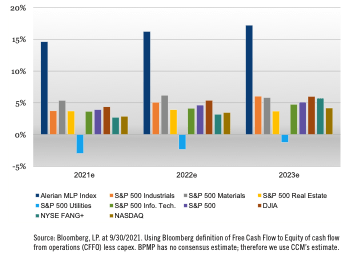

In truth, each inventory within the portfolio has at the least a mid-teens FCF yield and single-digit EBITDA a number of, versus the S&P 500 at a double-digit EBITDA a number of and low-single- digit FCF yield. Mathematically our investments ought to be extra resilient.

Beneath is a chart produced by Chickasaw Capital Administration evaluating the FCF yield of the Alerian MLP Index to different sectors and indices. The dislocation in relative values couldn’t be extra obvious.

ESTIMATED FREE CASH FLOW YIELD

Subsequent, a serious element of CPI and PPI baskets is power, and though it’s stripped out of “core” inflation, power impacts most different parts straight by way of enter prices. When inflation is excessive, power costs are excessive, and excessive power costs are good for the basics of the companies we personal, although the direct correlation is comparatively modest. Our firms primarily profit from the sign greater oil and gasoline costs give producers, which in the end results in elevated manufacturing. The amount affect on our firms is significant since asset utilization will increase and incremental returns on capital enhance. With the US land rig depend nonetheless 27% beneath pre-pandemic ranges, and hydrocarbon manufacturing over 1 million barrels a day decrease, we have now room to enhance, and all indications are we’ll. There have been 586 rigs ( Baker Hughes Rig Rely Information as of December 23, 2021) drilling on US land as of year-end, up from a low of 244 in August 2020, however effectively beneath the two,000 or so we noticed within the center a part of the final decade. We doubt we get again to that stage of drilling exercise, however a doubling of the rig depend over the subsequent few years is believable, and because of this crude oil, pure gasoline and pure gasoline liquids volumes may develop mid-to-high-single-digits over that timeframe and probably for much longer.

Moreover, most midstream belongings have contracts that alter in keeping with a value index. For instance, interstate liquids pipelines in non-competitive markets have regulated tariffs that reset each July based mostly on the prior 12-month Producer Worth Index, plus .78%. With PPI about 6-7% greater recently (ignoring the most recent studying of +9.6%), FERC regulated liquids pipelines will have the ability to alter their charges by 7%+ in July 2022. Other than federally regulated pipelines, most different midstream belongings have contracts that comprise inflation adjusters embedded in them as effectively. In truth, when Enterprise Merchandise Companions’ administration was requested on their third quarter name how a lot of their enterprise had “inflation offsets”, they estimated over 90% of the corporate’s income had such escalators benchmarked to varied indices. And when requested how their capital allocation coverage would possibly alter in the next inflation surroundings, they stated their purpose was to keep up buy energy parity by way of distribution development. The enterprise and the capital allocation coverage will assist offset probably rampant inflation.

Lastly, the previous investing cliché of “personal actual belongings in inflationary durations” is again in vogue. Actual asset costs admire as substitute value goes up. And never solely are the belongings price extra, however the barrier to entry goes up as future returns on capital for aspiring rivals goes down, all else equal. We personal land, buildings, pipes and vegetation. Our belongings are as actual because it will get.

A Fast Phrase on Taxes

The opposite element of Buffett’s “investor distress index” is taxes. Whereas political stagnation most likely prevents taxes from going up near-term, our portfolio can be constructed to attenuate their burden.

Other than final 12 months once we exited our most well-liked securities, our technique ought to restrict turnover and capital features simply because of the nature of the investments we make and the business-owner mindset we make use of. We try to purchase firm’s we need to personal for a very long time at valuations that enable us to take action.

Moreover, most of our dividend earnings is tax deferred as a result of it comes from MLPs. Roughly 80% is handled as return of capital since heavy depreciation drives a big wedge between the reported GAAP earnings and precise money earnings of midstream companies. As Partnerships, these features or losses get handed by way of to us, the Companions. Between 2019 & 2020, I personally confirmed an Strange Enterprise Loss (as reported on my Ok-1s) of roughly 19% of my common capital steadiness, regardless of a portfolio acquire of 14%. These losses will probably be used to offset future Strange Enterprise Revenue that will get handed by way of in time.

Present Portfolio Traits

We have now totally exited the popular securities we bought in March of 2020. Costs converged again to or above par, and whereas the yields are nonetheless respectable the upside is restricted. This was a extremely opportunistic funding and far shorter than we anticipated. We took benefit of compelled promoting by over levered closed-end funds, which allowed us to purchase Crestwood most well-liked securities yielding 40% and DCP preferreds yielding 59%. We hope we get extra alternatives like that sooner or later.

One other noteworthy change within the portfolio was our shift from solely proudly owning Vistra LEAPs (lengthy dated name choices), to constructing a large place within the widespread fairness on the again of the Texas deep-freeze final February. As shares fell into the mid-teens we rapidly made it a prime place believing that occasions had been an anomaly and will in actual fact make VST a stronger firm within the long-term.

As of year-end the portfolio was closely weighted to three shares, Enterprise Merchandise Companions, MPLX and Vistra. We just like the administration group and capital allocation technique of every firm and plan on proudly owning them for a very long time. These three present the ballast of the portfolio whereas a number of smaller investments present the jet gasoline. There are 9 positions within the portfolio, however 2 are usually not significant. The dividend yield is ~6%. Money is close to an all-time low at ~4% however it grows 1.5% each quarter!

Inventory Evaluation: Summit Midstream Companions (SMLP)

Considered one of my greatest pet-peeves with respect to funding managers is an “error of omission” being a highlighted mistake—lacking out on Amazon, Google, and so on. In a career the place a 51% success fee can result in distinctive outcomes, everybody has legit errors—errors the place cash was misplaced, not simply the misplaced alternative value of cash.

SMLP was certainly one of my larger errors (lazy evaluation and unhealthy timing perpetuated by inertia) and has been a significant detractor to multi-year partnership efficiency, even regardless of the inventory being up 78% final 12 months. However what’s previous may be new in investing as info and costs change, and we expect the inventory has significant upside from right here. To start out with the conclusion: shares commerce for ~$25 and we expect truthful worth is over $75, suggesting 200%+ upside. The market cap is roughly $250 Million and the Enterprise Worth about $1.7 Billion. Based mostly on 2021 outcomes SMLP trades at an EV/EBITDA a number of of 7x, a Free Money Circulate to Fairness yield of 60%, and has 5x leverage.

Because the title suggests, SMLP is a midstream power firm. Particularly, they personal and function Gathering and Processing belongings along with a brand new long-haul pure gasoline pipeline known as Double E.

Gathering & Processing:

As mentioned within the 2020 write-up on DCP Midstream Companions, gathering and processing is vital to the manufacturing of hydrocarbons. Gathering includes amassing hydrocarbons from completely different effectively websites and transporting them through pipeline to a central level, often a processing plant. As soon as on the processing plant the hydrocarbons get separated into the moist parts (oil, naptha, propane, and so on.) and the gassier parts (primarily methane, however can be ethane relying on economics). E&P firms often pay a midstream firm to construct, personal and function these belongings and producers will typically dedicate a variety of acres and/or a specific amount of quantity to a gathering system.

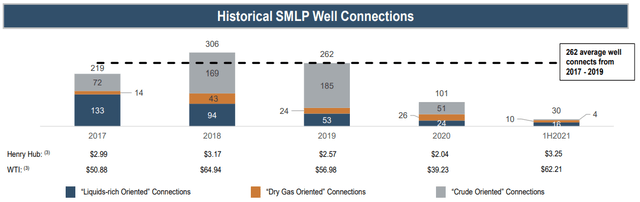

The enterprise relies on exercise, which relies on commodity costs. It’s additionally capital intensive and aggressive. For these causes it’s not an excellent enterprise. Nevertheless, when manufacturing is rising it may be fairly profitable for present infrastructure with spare capability, and with their complete G&P footprint at a 37% utilization fee, SMLP has loads of spare capability. As oil and gasoline inventories proceed to tighten the decision on US oil and gasoline manufacturing will resume. The beneath graph reveals effectively connections to SMLPs methods over the previous 5-years. Not surprisingly, EBITDA adopted effectively connections, declining from $288mn in 2017 to $240mn in 2021. Whereas we suspect the correlation will maintain as costs and exercise transfer within the different route, our base case is that EBITDA stays flat round $240mn a 12 months for the G&P phase.

- Quantity and capability proven on an 8/8ths foundation.

- SMLP owns ~38% of the Ohio Gathering JV.Represents easy common per eia.gov.

We don’t know what the proper EBITDA a number of for G&P belongings is. It’s been as excessive as 12x and as little as 6x up to now a number of years. Neither are most likely appropriate. We consider it extra on a FCF to fairness yield foundation, particularly when that FCF is paid to fairness holders or is used to scale back debt. SMLP’s G&P phase generates near $150mn of FCF. That FCF will go in the direction of the steadiness sheet for the subsequent a number of years and if the decreased debt steadiness will get transferred to fairness worth (because it ought to), the fairness worth will develop to $55 per share over the subsequent two years, simply by way of accretion.

Double E:

Double E is a joint-venture between SMLP (70%) and Exxon (30%) that owns a 135-mile pure gasoline pipeline put in service on the finish of 2021. The pipeline runs by way of the core of the Delaware Basin and flows from SMLPs Lane processing plant in New Mexico to the Waha Hub in Texas. Whereas the basin isn’t identified for pure gasoline exploration and growth, drillers inevitably produce related gasoline as a byproduct of the crude oil and pure gasoline liquids they’re searching for. Mixed with a extra financial value for gasoline, environmental insurance policies that restrict gasoline flaring, and corporations’ give attention to ESG, related gasoline should discover a industrial market. By partnering with Summit to construct and function Double E, Exxon is discovering an outlet for his or her gasoline.

Exxon subscribed to 75% of the present capability below a 10-year take-or-pay settlement. Securing further third social gathering agreements will probably be key to maximizing Double E’s worth, however with Permian manufacturing rising and with 10 Bcfd of gasoline already processed within the neighborhood of Double E, administration is optimistic. Complete present capability on the pipeline is 1.35 Bcfd, however is expandable to 2 Bcfd by including compression stations. At full capability Double E will

generate $45mn of incremental EBITDA to SMLP, with upside to $66mn if the pipeline is expanded. Compression would solely value $50mn, taking the fee to construct EBITDA a number of from 6.2x to 5x for the venture. Typically, a long-haul gasoline pipeline with long-term commitments from a counterparty like Exxon would promote for 10-12x EBITDA. Subsequently, the bottom case worth of Double E 2-3 years from now’s $450mn, with an upside case of $790mn. With roughly $200mn of venture stage financing SMLP’s fairness stake in Double E is price $250mn to $600mn, or $25 to $60 a share.

Combining our assessed worth for the G&P phase and Double E, we expect shares will probably be price $80 to $115 inside a few years, with a gift worth of roughly $75.

Inertia redux?

The transformation the corporate has gone by way of because the fund’s preliminary buy is stark, so we expect the funding proposition is new and my prior errors are unlikely to be perpetuated.

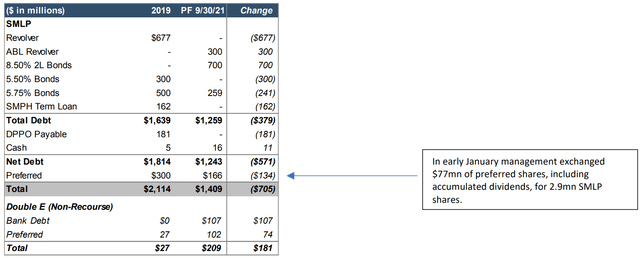

Apart from diversifying and bettering the asset base with Double E, different key modifications embody a brand new CEO, a restructured steadiness sheet and improved company governance. I don’t suppose I’ve ever seen an organization enhance in so many areas in such a brief period of time exterior of a chapter course of.

CEO Heath Deneke was recruited to SMLP from Crestwood Fairness Companions (CEQP, owned within the fund) in late-2019. Heath was the COO of Crestwood and was instrumental in constructing out their footprint and making them one of many extra extremely revered G&P firms within the sector. With Summit and Crestwood having a number of overlapping basins of operation, we had been very inspired by Heath’s hiring.

Since Deneke took the helm, essentially the most dramatic change has been with the steadiness sheet. Administration opportunistically repurchased deeply discounted debt, exchanged widespread for most well-liked shares, prolonged maturities and simplified the capital construction. Consequently, near $800mn of mounted capital obligations have been eradicated in 2-years. There’s nonetheless work to do, however we just like the progress that’s been made to date.

One other significant, albeit much less quantifiable change has been with the company construction and governance. For all intents and functions SMLP is now ruled like a C-corp. reasonably than a Partnership. Personal fairness sponsor Power Capital Companions is gone, the Common Accomplice stake was bought by SMLP and is now owned by LP unitholders, Incentive Distribution Rights have been eradicated, and the board is now comprised of largely unbiased administrators who’re elected by Restricted Companions beginning this 12 months. Incentives at the moment are totally aligned with LPs.

Whereas I’m not pleased with the harm SMLP inflicted on previous efficiency, we aren’t within the enterprise of blindly promoting positions to keep away from the psychological anguish of unhealthy recollections. We’ve re-analyzed this one what looks like tons of of instances and re-weighed the danger/reward, the outcomes of which hold it within the portfolio as a smaller place, however one with numerous potential upside.

Joyful New Yr!

Kristopher P. Kelley

Unique Submit

Editor’s Be aware: The abstract bullets for this text had been chosen by In search of Alpha editors.