Scotland, 1437.

King James I had been sitting on the throne for simply 12 years however just about each second of his reign was chaotic. Usurpers from inside a number of branches of the the Aristocracy had been out to get him from the second he ascended along with his English bride after a decade of captivity. He fought with the Highland lords, he quarreled with the Catholics, he jailed and assassinated his familial rivals. And when he wasn’t scrapping, he retreated to the serenity of the tennis court docket. James spent a whole lot of time taking part in tennis. A lot in order that he requested an adjoining sewer drain be closed off as a result of too lots of the tennis balls had been rolling into it and getting misplaced – a minor annoyance that will ultimately have main penalties, however we’ll get there in a second…

James and his spouse, Queen Joan, had been spending the winter at Blackfriars, a Dominican abbey in Perth. One February evening, among the nobles who supported a rival declare to the throne got here for him. Sir Robert Graham and his co-conspirators got here bursting by the entryway to the church compound on horseback and shortly started chasing down members of James’s household. Queen Joan escapes the plot however her husband just isn’t so fortunate. James finds himself trapped in a room with one of many queen’s handmaidens, Catherine Douglass – Kate. When the marauders try to interrupt by, Catherine thrusts her arm by the brackets to switch the lacking bar in an try to carry the door closed. This doesn’t work and her arm is damaged. She does grow to be well-known for this tried protection of the king, ultimately changing into referred to as “Kate Barlass”.

When the Scots-Irish immigrated to America, many settled within the South and so they introduced their folks songs and idioms with them. “Katy bar the door” included. It means be careful or brace for bother. When you had been ever questioning the place the expression initially got here from, now you already know.

We’re about to expertise a Katy bar the door second within the US inventory market due to the truth that the 2 most necessary shares are actually reaching a second of reality that might have massive ramifications for psychology. Apple and Microsoft, each in newly established downtrends, are shut sufficient to necessary assist ranges that each one of us must be paying shut consideration to what occurs subsequent.

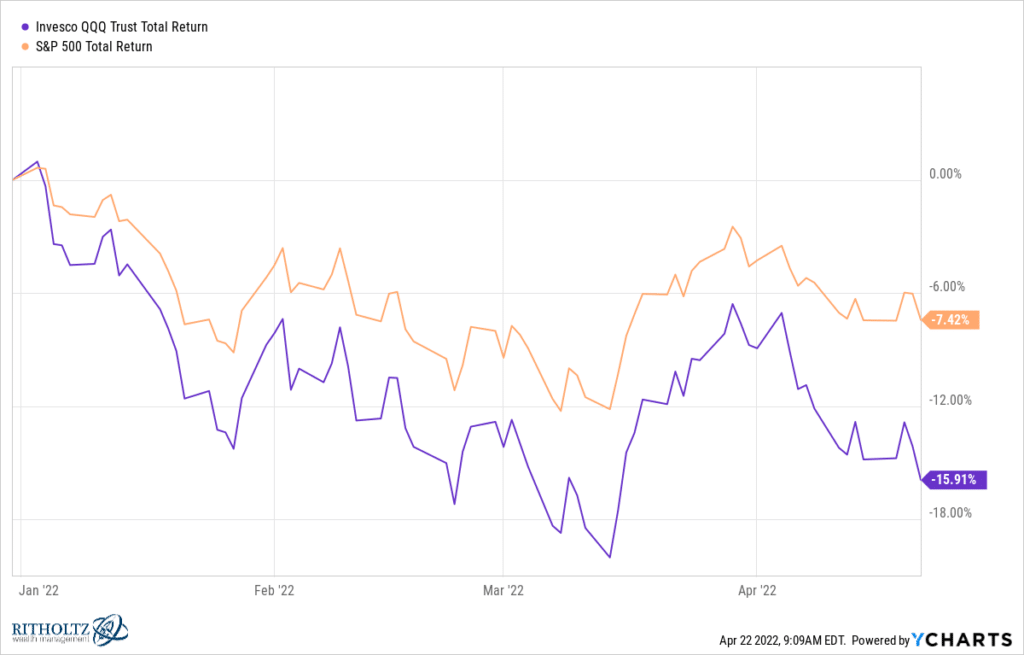

First, let’s get a year-to-date look at returns for the one two inventory indices that basically matter – S&P 500 and the Nasdaq 100 QQQ’s – that is the place all of the market capitalization is and the shares that make up these indices are those that affect individuals’s emotions and opinions concerning the near-term prospects for his or her portfolios…

It feels worse than it’s for the S&P 500. Whereas massively standard tech and communications shares like Meta and Netflix have not too long ago blown up, the inventory market as a complete has held up. That is, partly, as a result of so many different non-technology shares are benefiting from strong demand – industrials, supplies, vitality, and so on. However the reality is, many of the shares in these sectors are tiny and never mathematically necessary. What’s actually holding up the entire tent from collapsing right into a full-blown bear market is the energy of Apple and Microsoft. These two names are a mixed $5 trillion in market cap and are main weights for the QQQ’s, the S&P and even the Dow Jones. They’re extensively owned, extremely regarded and carefully adopted by tens of millions of pros everywhere in the world and tens of tens of millions of amateurs.

And in the event that they break, the inventory market is f***ed. Royally. The comparatively gentle year-to-date drawdown of seven% will grow to be one thing rather more critical if and when the bulls lose both of those shares to a technical breakdown. First comes the statistical injury after which comes the blow to sentiment. You may make the argument that, as a result of these are the final males standing, they’ve to interrupt down to ensure that the market-wide correction to lastly come to an finish (it’s been slow-rolling since February 2021). Okay, that’s one perspective. My perspective is that this correction can’t finish with Apple nonetheless promoting for 27 occasions earnings and Microsoft at 29. So, no, I don’t imagine a breakdown for these shares could be the tip of one thing, I feel it could be a giant occasion on the street to our eventual vacation spot: A double-digit drawdown for the S&P 500 and a 20% bear marketplace for the Nasdaq.

I’ve been speaking about it since January and now I feel the second is at hand. And my angle has all the time been “Let’s simply get it over with.”

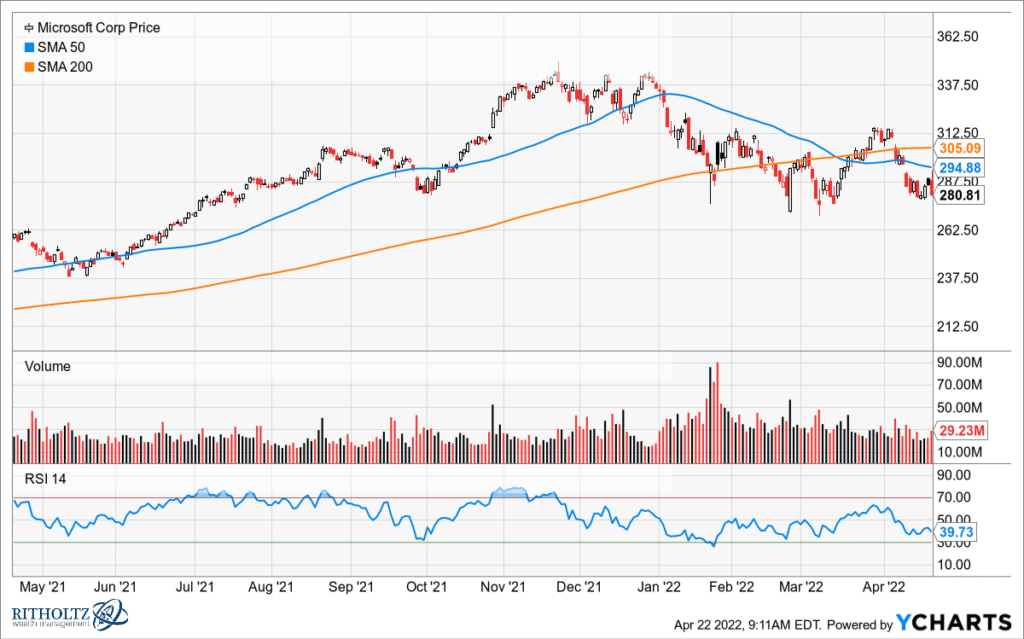

Let’s take a look at the charts. I don’t do a whole lot of fancy indicators or draw all these strains and ranges. You’ll be able to take a look at MSFT, for instance, and see that the inventory has been placing in decrease highs on every successive bounce and decrease lows on the best way down. The development is decrease. And we’re now difficult 275 – a stage at which consumers have are available in a number of occasions to assist the inventory. The extra occasions that assist stage is challenged, the extra probably it will definitely offers means. The consumers exhaust themselves and the sellers take management. Microsoft experiences earnings subsequent Tuesday April twenty sixth. Two questions: Can they beat estimates and, even when they will, will it matter?

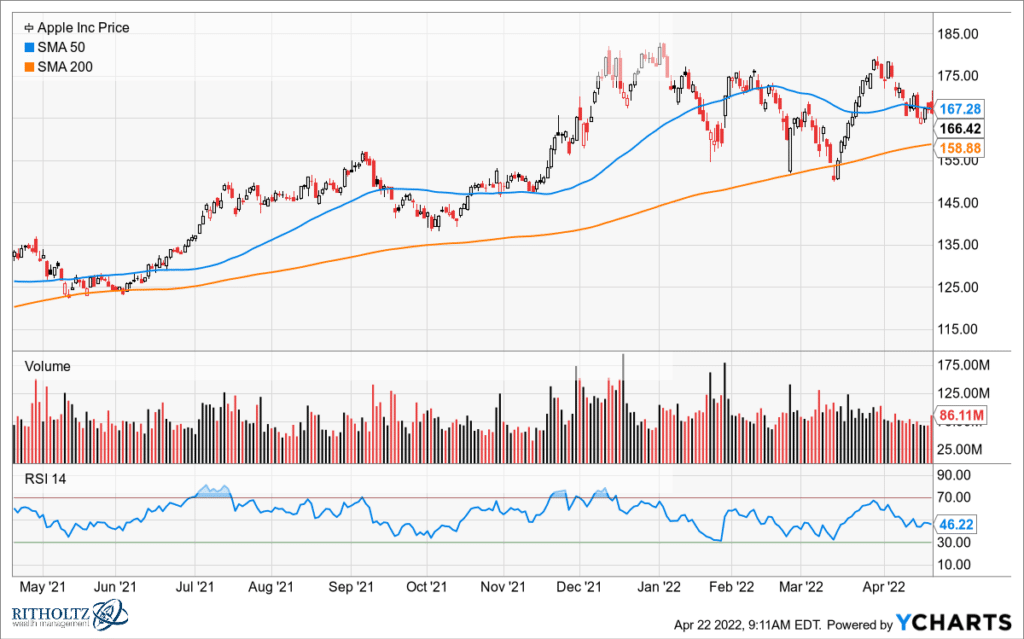

Apple appears to be like higher than Microsoft although its current excessive was additionally under the earlier excessive. This can be a inventory that truly appears to learn whereas different shares undergo – nearly as if the market cap is being magnetically sucked into Apple’s orbit because it bleeds away from different sectors and shares. At $2.7 trillion it’s an important inventory on this planet. It’s been nearly fully impervious to the autumn of the stay-at-home shares and the ARK-onauts and the remainder of the expansion fairness advanced. It’s not merely one other planet within the Nasdaq photo voltaic system like PayPal or Amazon, it’s the solar itself. There are only a few examples of mega-cap know-how tales that stay this near all-time highs. Tesla, Alphabet, can’t consider any others off the highest of my head. An elite membership. Apple experiences subsequent Thursday, April twenty eighth after the shut. Which suggests subsequent Friday we’ll know whether or not or not we’re in a bear market.

The 155 stage appears to have some which means to market contributors. It was resistance final September after which assist in February and March. That kick save after which vertical rally a month in the past in all probability saved the entire US inventory market. Wish to guess on that occuring twice?

So, for me, these are the degrees to maintain a watch out for subsequent week – we don’t know what the earnings experiences will likely be or how the market could react to them. However we all know that the bulls failing to point out up for a Microsoft retest at 275 wouldn’t be good. And Apple under 150 is Katy bar the door.

Again to Scotland…

How is it that King James discovered himself cornered to start with whereas most of his retinue had been in a position to escape the raid? Effectively, he did try and run down by the sewer into the outlet resulting in the Blackfriars tennis court docket, which might put him outdoors the partitions and on his strategy to freedom. Sadly, that very week he had ordered that the drain be blocked in order to cease his tennis balls from getting misplaced. Sarcastically, the game he had been pursuing to revive his well being would finally be the factor that will price him his life. James is stabbed sixteen occasions and bleeds to dying whereas making an attempt to fend off his attackers.

The metaphorical bloodshed {that a} breakdown in Apple or Microsoft – or each – may trigger this market might be the largest unknown hanging over our heads this earnings season. With just a little luck and a pair of nice earnings experiences, we received’t have to seek out out. Or will we?