by Lance Roberts of Actual Funding Recommendation:

Is there a bear market lurking within the shadows?

Such appears to be the query everyone seems to be asking me as of late. Over the past couple of weeks, we’ve got reviewed the bullish and bearish instances for the market.

In these discussions, I attempted to steadiness the bullish and bearish arguments into some actionable methods over the subsequent few weeks. The aim of analyzing each views is to reduce affirmation bias, which may negatively impression portfolios over time.

“When buyers hunt down info that confirms their current opinions and ignore information or knowledge that refutes them, such might skew the worth of their choices primarily based on their very own cognitive biases. This psychological phenomenon happens when buyers filter out doubtlessly helpful information and opinions that don’t coincide with their preconceived notions.” – Investopedia

Whereas analyzing the shorter-term possibilities of an additional advance or decline, the case for a extra important lurking bear market throughout the subsequent 18-months solidified. Such is the context of right this moment’s publish.

The Threat Of Prognostications

Nevertheless, there are a couple of disclaimers earlier than we dig into the technical and basic considerations.

- Longer-term timing is all the time difficult to pin down.

- We base assumptions on the present surroundings remaining establishment. (If the Fed reverses into QE and cuts charges to zero, then the evaluation is not viable)

- Lengthy-range assumptions don’t imply promoting every part and going to money right this moment. (That isn’t portfolio or threat administration, and such actions can have very adverse penalties if one thing adjustments.}

- Lastly, long-range predictions are usually not dependable statements of reality. They’re assumptions primarily based on analyzing the chances and possibilities of historic knowledge. Each interval is totally different.

In different phrases, take the evaluation beneath with a “grain of salt.” For us, the evaluation alerts us to issues we have to concentrate on to guard consumer capital. Nevertheless, as Nobel laureate Dr. Paul Samuelson as soon as quipped:

“Properly, when occasions change, I alter my thoughts. What do you do?”

That could be a placing assertion as issues can and virtually all the time do change. Such is especially the case with extra “bearish” outlooks because the extra dire prognostications not often occur.

Let’s study a number of the points suggesting the chance of a continued bear market cycle forward.

The Basic Drawback Of Tighter Coverage

From the basic view, we’ve got beforehand famous the quite a few challenges for the market over the subsequent a number of months. Most notable, after all, is the priority of overvaluation and company earnings. Because the Federal Reserve engages in a extra aggressive fee mountain climbing cycle and steadiness sheet discount program, the earlier helps get eliminated.

In 2008, 2000, and 1929, inventory valuations had been extremely excessive. As a result of lengthy previous bull market cycle, it was extensively believed “this time was totally different.” Finally, it wasn’t. Since 2009, the idea that “low-interest charges justify excessive valuations” was the first catalyst supporting the “this time is totally different” narrative. Nevertheless, with rates of interest now rising, the assist for overvaluation is in danger. Traditionally, the Federal Reserve hikes charges till “one thing breaks,” which resolves the overvaluation drawback. (i.e., costs fall sharply.)

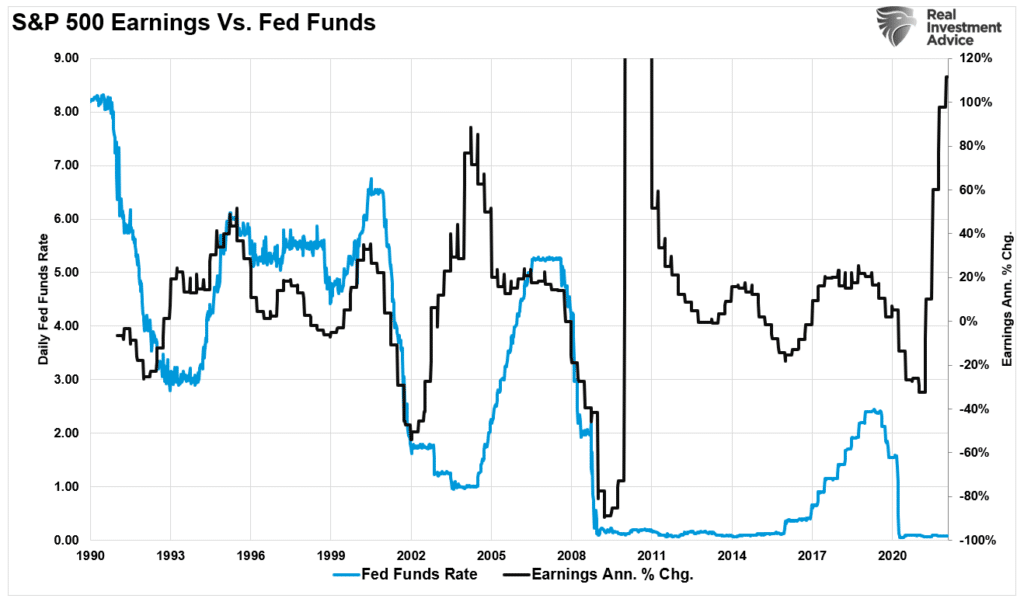

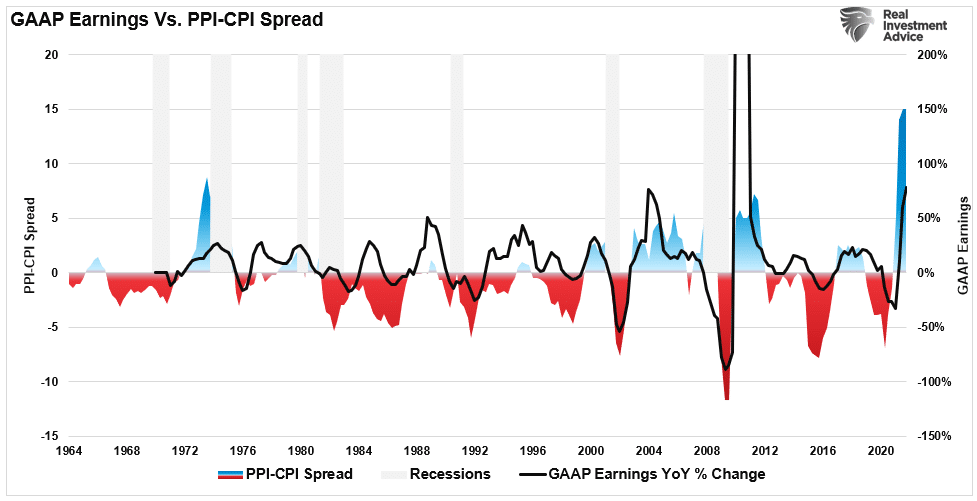

Secondarily, company earnings estimates stay elevated as we head right into a financial tightening marketing campaign. As famous in “An Earnings Reversion,” tighter Fed coverage and surging enter prices will put earnings in danger. Such will make excessive valuation much more difficult to justify.

“The entire level of the Fed mountain climbing charges is to gradual financial development, thereby decreasing inflation. Sadly, with the economic system already slowing, extra tightening might exacerbate the chance of an financial contraction, given the dependence on low charges to assist financial development. Provided that earnings are extremely correlated to financial development, earnings don’t survive fee hikes.”

Moreover, surging enter prices have gotten harder to cross to shoppers. Such suggests firms will soak up the enter prices they will’t cross on to shoppers. Ultimately, that absorption of prices impairs profitability.

The Technical Warnings Growing

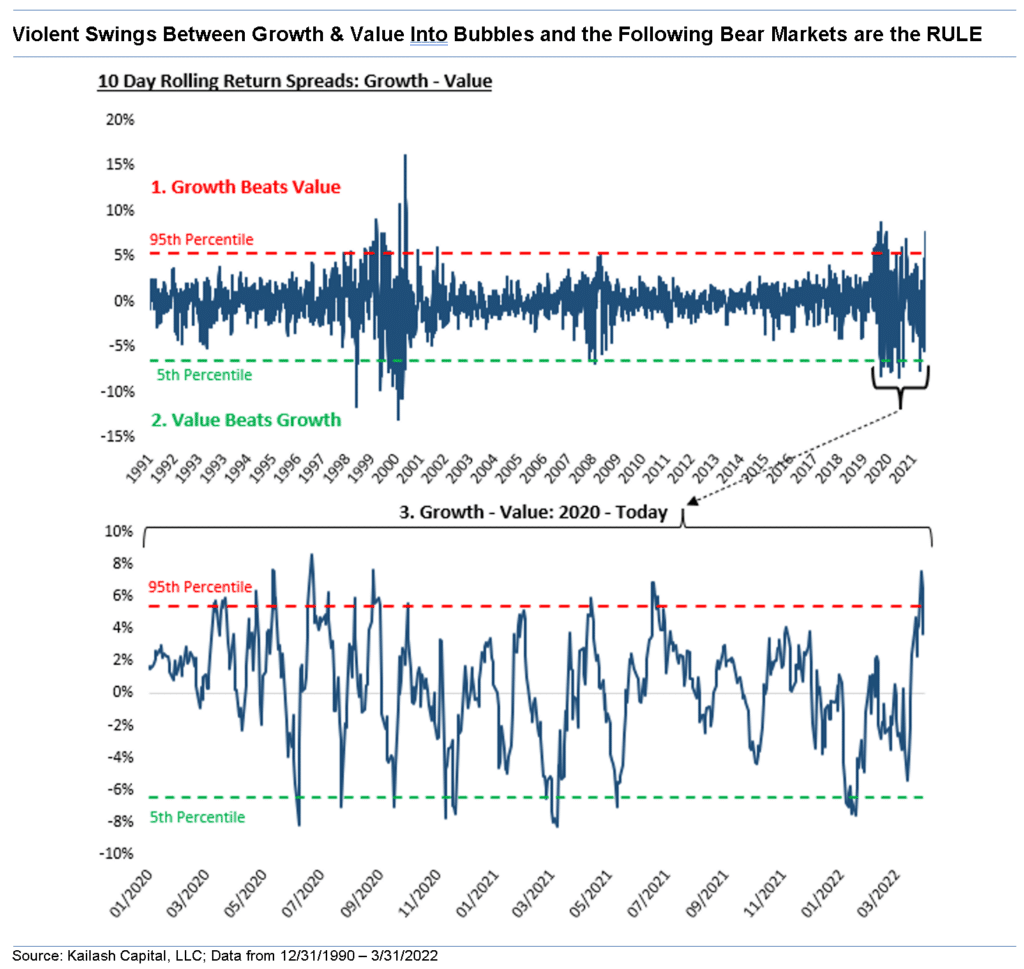

One of many harder challenges in 2022 stays the navigation of the fast swings between development and worth. Nevertheless, as Kailash Ideas not too long ago famous, these fast swings precede “bear markets.” To wit:

“A highly regarded narrative over the previous couple of years has been that fundamentals not work. That’s all the time the story at market peaks.

The chart beneath takes that ending stretch from January 2020 by right this moment and expands it to make it simpler to see. Have a look at the violent horse-trading between development and worth. Plenty of 10 day stretches the place development beats worth by 6% or extra and worth beats development by 6% or extra. This conduct isn’t in keeping with the value patterns we see on the backside of a bear market. The market bottoms in 2003 and 2009 had been characterised by a lot much less “warfare” between the 2 teams.”

The final interval the place worth and development persistently traded 6% blows each 10-days was between 1998 and 2001.

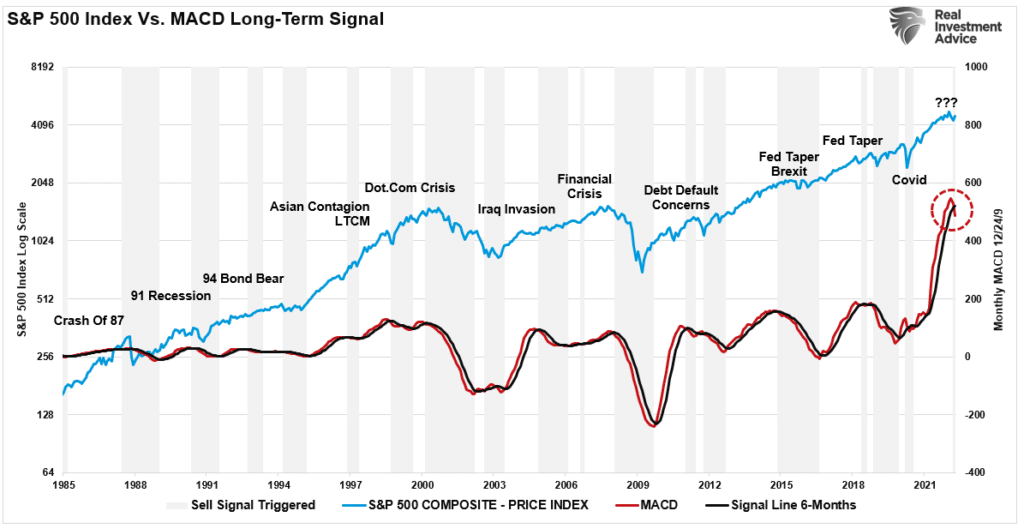

Lastly, from a purely technical perspective, the month-to-month transferring common convergence divergence indicator (MACD) additionally rings a major warning bell. The chart beneath measures the distinction between the 12 and 24-month transferring averages. When that line crosses beneath the 6-month sign line, such suggests the market is in danger.

Notably, after the large infusions of capital into the monetary markets following the pandemic, the MACD line surged to ranges by no means earlier than seen traditionally. Such suggests an eventual reversion will probably be equally dramatic. The shaded gray bars present when a earlier promote sign bought triggered. Whereas there are actually some false alerts alongside the way in which, it’s price noting that lots of the promote alerts are carefully related to extra crucial market-related occasions, corrections, and bear markets.

Failing To Plan

Does the present promote sign imply a bear market is lurking?

No. Given this indicator is predicated on month-to-month knowledge, it could take fairly a while for an occasion to play out. As such, it would get perceived the indicator is incorrect this time. Nevertheless, as famous above, if every part stays establishment, it doubtless received’t be.

However, if the Fed reverses course, begins reducing charges, reintroducing QE, and repurchasing junk bonds, then such would love arrest any approaching downturn at the least quickly. Such is what historical past has taught us.

In Bullish Or Bearish, we supplied some easy tips to comply with:

- Tighten up stop-loss ranges to present assist ranges for every place. (Gives identifiable exit factors when the market reverses.)

- Hedge portfolios in opposition to important market declines. (Non-correlated property, short-market positions, index put choices, bonds.)

- Take earnings in positions which were large winners (Rebalancing overbought or prolonged positions to seize positive factors however proceed taking part within the advance.)

- Promote laggards and losers. (If one thing isn’t working in a market melt-up, it probably received’t work throughout a broad decline. Higher to get rid of the chance early.)

- Elevate money and rebalance portfolios to focus on weightings. (Rebalancing threat repeatedly retains hidden dangers considerably mitigated.)

Discover, nothing in there says, “promote every part and go to money.”

Given the load of proof at present at hand, it actually doesn’t damage to plan and even take some actions to arrange for a storm if, or when, it comes.

If the surroundings adjustments, it’s a easy course of to reallocate aggressively to equities. By planning, the worst that may occur is underperformance if the bull market instantly resumes.

However failing to plan solely is one of the best ways to fail fully if the lurking bear market awakens.

Assist Assist Unbiased Media, Please Donate or Subscribe:

Trending:

Views:

24