The workplace gross sales market is beginning to churn once more. However, it’s hardly a trigger for celebration, given the costs that many properties are going for.

It’s well-known that, as workplace customers carried out distant and hybrid work, many downsized their occupancies to replicate altering utilization. That’s when vacancies shot up and incomes took successful. Spiking rates of interest have been a double whammy.

Consequently, many buildings are promoting at a pointy low cost to earlier buying and selling costs and, in some circumstances, the remaining debt on the constructing.

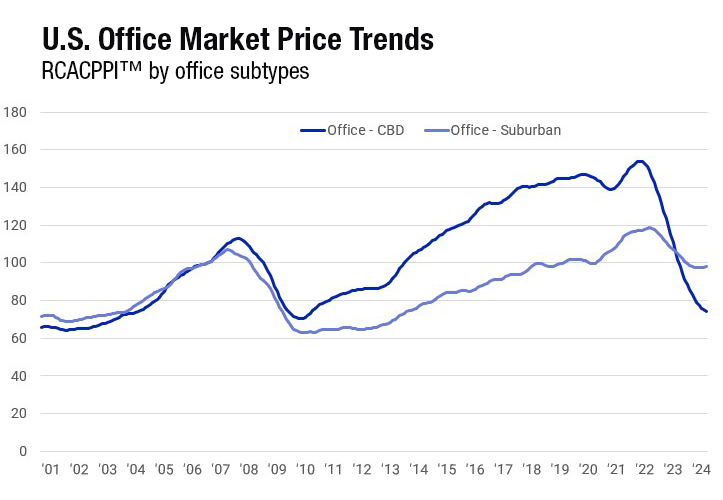

In accordance with MSCI, values for CBD workplace values have plummeted up to now about 52 p.c from a document RCA CPPI peak of $408 per sq. toes in Q1 2022, and proceed to say no. Suburban workplace values haven’t dropped as severely—declining 17 p.c from their RCA CPPI peak in Q3 2002—and have stabilized over the past three months, famous Jim Costello, chief economist of Actual Belongings by at MSCI.

READ ALSO: CBRE Finds RTO Insurance policies Largely Go Unenforced

Low mortgage charges in 2021 and early 2022 precipitated traders hungry for yield to put money into actual property, Costello mentioned. “There was quite a lot of capital circulation into actual property funding, even in places of work, and it pushed values to uncommon highs,” he harassed.

Rising rates of interest created turmoil on mortgage charges, charges of return and cap charges. Weaker monetary situations, mixed with low occupancy charges, have decreased CBD workplace costs and elevated traders’ notion of danger. “On condition that leases typically are 10 years in CBD areas, there’s going to be a sluggish, regular, drumbeat of the market reacting to the 2020 shocks effectively into the longer term,” he acknowledged.

Alternatively, transit in suburban workplace markets is car-focused, and folks are inclined to have shorter commutes as a result of housing is combined with workplace hubs, Costello continued. Moreover, he famous that in some Southern states like Florida, many individuals continued to go to the workplace throughout COVID, so there was by no means the identical stage of demand shock nor a work-from-home tradition like Northern and Western CBD markets.

However the diploma to which values have dropped relies on the kind of property, not simply location, famous Patrick Gildea, co-head of U.S. Workplace Capital Markets at CBRE.

“The worth for a excessive emptiness workplace constructing with heavy capital necessities could also be off by greater than 50 p.c, whereas a trophy workplace worth could also be nearer to a 30 p.c low cost when in comparison with 2022 ranges,” Gildea mentioned. “Fortuitously, lots of these trophy properties have skilled a lot stronger rental fee progress than was underwritten, which is able to assist uphold worth to some extent.”

With values dropping and a big variety of workplace loans maturing, many traders have been ready for extra distressed bank-owned belongings to come back to market at deep reductions. However that has not materialized in nice numbers as a result of lenders have been prepared to work with debtors, nearly all of which pursued short-term mortgage extensions with the hope that rates of interest will quickly come down, mentioned Alex Gregoire, senior supervisor in Technique and Transactions at EY.

That’s anticipated to vary within the short-term, nevertheless. In accordance with a current CommercialEdge report, mortgage defaults and delinquencies rose 7.5 p.c, totaling $1.87 billion, by the top of June—a 4.5 p.c improve over the identical interval final yr.

Additional, a considerable quantity of delayed mortgage maturities will come due in late 2024 and early 2025, famous Abby Corbett, senior economist & world useless of Investor Insights at Cushman & Wakefield.

“The misery course of is unfolding, producing demand for mortgage extensions, modifications, refi’s, bridge loans, mortgage gross sales and opportunistic asset auctions/purchases,” added Corbett, noting that opportunistic capital ought to have the ability to deploy into gateway cities, that are seeing most misery.

Listed below are a number of current examples of workplace properties acquired at a deep low cost or fraction of the remaining debt:

- Lloyd Goldman’s BLDG Administration Co. Inc. and David Werner Actual Property Funding acquired 100 Wall St., a 29-story Manhattan workplace constructing, from Barings for $116 million. Barings had bought the constructing for $270 million in 2015.

- The 2 historic Esperson Buildings in downtown Houston, which whole 600,000 sq. toes, have been acquired in a foreclosures sale by native non-public boutique fairness agency Interra Capital Group by way of a observe bought by Metropolitan Life Insurance coverage Co. for $12 million A complete of $41 million was nonetheless owned on the 2 workplace towers, one 32 tales and the opposite one 19 tales.

- Montgomery Park, a nine-story, 768,443-square-foot workplace constructing in Portland was offered to a division of Menashe Properties by the lender, Natixis for $33 million, when the previous house owners, whio acquired the asset in 2019 for $255 million, defaulted on the remaining mortgage of $149.7 million.

- Finmarc Administration just lately acquired Trinity Centre, a four-building workplace advanced in Centreville, Va., a Washington, D.C. submarket, for $39.4 million, which was about one-third of the $108.5 million the almost 500,00-square-foot property traded for 2012.

Some causes for optimism

Regardless of the weak spot in workplace fundamentals, the second quarter of 2024 noticed a noticeable uptick in workplace transaction quantity in core markets. In accordance with JLL, $25.8 billion in workplace gross sales closed through the first half of 2024, up 22 p.c from 2023. However, that’s nonetheless 50 p.c much less from “pre-pandemic” exercise.

“Quarterly enhancements witnessed in each volumes and pricing may be credited to a mix of each firming investor confidence and certainty on the trail of financial coverage in addition to gradual investor and proprietor acceptance of this normalized rate of interest atmosphere,” mentioned Corbett.

Nonetheless, the elevated exercise should be seen in context, she added: “Circumstances are nonetheless very challenged and deal exercise is far from a pattern.”

The rising inhabitants of opportunistic traders, nevertheless, believes the workplace market is on the backside of the cycle, mentioned Al Pontius, senior vp and nationwide director for Workplace, Industrial and Healthcare at Marcus & Millichap. They’re anticipating massive reductions, they usually wish to leap in earlier than it goes the opposite manner.

“However for the only a few exceptions that exist on the best high quality buildings in a given market, up to now, it’s very removed from being a vibrant gross sales market,” Pontius mentioned.

One vivid spot for the workplace gross sales market, notably in New York, is firms shopping for workplace buildings for their very own use, noticed James Nelson, principal & head of Avison Younger’s Tri-State Funding Gross sales group.

“Sometimes, emptiness is problematic and makes it tougher for an investor,” Nelson mentioned. “However for an end-user who needs to occupy and use the area, it’s clearly a constructive.”

Supply: MSCI Actual Belongings

Nelson cited the current sale of 980 Madison Ave. to Bloomberg Philanthropies for $560 million. Bloomberg paid a premium for this five-story, 100,000-square-foot constructing in Manhattan’s Higher East Aspect. It was appraised in 2021 at $350 million and values have fallen since.

In accordance with Matt Carlson, co-head of U.S. Workplace Capital Markets at CBRE, Jap markets— predominantly Miami, New York and the Sunbelt cities—are outperforming Western markets when it comes to workplace gross sales quantity.

“On the excessive finish of the market, we’re seeing prime belongings buying and selling in extremely amenitized, walkable neighborhoods with entry to transportation, housing and a talented workforce,” he mentioned. On the opposite finish of the market, transactions are pushed extra by lender motivations.

In Atlanta, for instance, a number of Class A buildings have traded over the past two months.

B Group Capital Administration in June acquired Ameris Heart One and Two, an workplace campus in Atlanta’s Buckhead district, that includes two mid-rise Vitality Star-certified workplace buildings totaling 532,000 sq. toes for $81 million, or about $152 per sq. toes, and about 10 p.c lower than its 2015 buy worth, in accordance with Bisnow. The mission has an onsite MARTA bus cease and is strolling distance to the Buckhead MARTA rail station and quite a few space facilities.

Moreover, a three way partnership of Cousins Properties and City Lane earlier this month acquired Proscenium, a 23-story, 526,000 workplace tower in Atlanta’s Midtown district, for about $83 million. The vendor, Manulife, had acquired the constructing in 2003 for $118 million. The brand new house owners plan to take a position capital in upgrades to reposition and modernize the constructing, which was 74 p.c leased on the time of sale.

Whereas there are extra particular person workplace gross sales in CBDs than in suburbs, suburban workplace values have held up higher, down 7.5 p.c YOY, in comparison with 24.7 p.c for CBD buildings.

Pontius famous that some suburban workplace markets are outperforming CBDs when it comes to each leasing and gross sales for a wide range of causes, however “none the least of which is the getting older of the millennial inhabitants, which is beginning households and taking a look at suburban (housing) choices very similar to their dad and mom did,” he mentioned.

Craig Tomlinson, a senior vp at Northmarq specializing in workplace leasing and gross sales, cited one other silver lining in workplace gross sales: smaller markets. Gross sales in some secondary cities, equivalent to Nashville, Salt Lake, and Oklahoma Metropolis, he mentioned, have solely declined 9 p.c because the pandemic because of decrease values for high-quality belongings and different benefits, like native tenants and lenders that perceive a property’s place within the market.

Again to enterprise

Danny Mangru, chief of U.S. Workplace Market Intelligence at Avison & Younger, attributed will increase in workplace gross sales exercise in core markets, partly, to extra firms determining their occupancy.

“I might say that return-to-work insurance policies have been cemented over the past 18 to 24 months, in order that’s an enormous driver that’s contributed to the uptick in gross sales exercise within the second quarter,” Mangru mentioned.

Leasing exercise has elevated throughout all gateway markets between 5 p.c and 25 p.c, he added. In Manhattan, leasing is up 20 p.c year-over-year and occupancy is now at 80 p.c of pre-pandemic ranges.

However, whereas quite a lot of area adjustment has already occurred, extra is anticipated as a result of a big variety of pre-COVID leases are but to rollover.

“Though smaller native and regional companies have usually right-sized and discovered their worker base and work schedules, many giant, nationwide firms are nonetheless working by way of a viable resolution,” added Scott Romick, principal/managing director at Lee & Associates.

Area allotted per worker has dropped 9 p.c to a 22-year low because the pandemic, Carlson famous. Nevertheless, office-using jobs have elevated 5.4 p.c, a metric that has traditionally aligned with elevated absorption. “Firms proceed to re-work their area as leases expire, however the knowledge exhibits they could be overcompensating,” Carlson mentioned.

Smith famous that many tenants have already exited leases early or subleased area, and/or downsized current leases previous to lease expiration. As a part of a current survey carried out by Cushman & Wakefield and CoreNet World, occupiers indicated that they anticipate their workplace footprints to remain flat over the following yr. “It is a reversal of lease measurement reductions that has been skilled since 2020,” he famous.

The return-to-the-office pattern is impacting how traders underwrite belongings, typically rising everlasting emptiness above 5 p.c, which lessens downward strain on exit cap charges, Gildea mentioned, Nevertheless, the price of tenant enhancements, availability of debt and total investor sentiment are having extra of an affect on gross sales exercise than enhancing occupancy.

Adjusting for brand new realities

In accordance with Gildea, purchaser composition at the moment is roughly 75 p.c non-public capital (fairness and hedge funds and household places of work), with nearly all of consumers utilizing vendor financing, shopping for money or signing a recourse with a relationship financial institution.

“Greater than half of workplace gross sales contain a lender in some type, whether or not a consensual quick sale, REO sale, mortgage sale, or outright disposition pushed by a pending mortgage expiration,” he mentioned.

Carlson, who oversees capital markets for the Western Area, contended that the current improve in workplace gross sales is being catalyzed by mortgage maturations, fee cap expirations, and lenders now not prepared to supply short-term, pandemic-era extensions to debtors. As well as, he mentioned the amount of trades has elevated as a result of consumers and sellers are accepting the brand new actuality of depressed workplace values and better rates of interest over the long term.

Main workplace hubs, notably alongside the East coast, have seen the best focus of gross sales, famous Gildea. “Though we’re seeing extra workplace properties being bought, it’s a small proportion in comparison with the variety of properties house owners that wish to promote,” he added, noting that the bid-ask spreads are nonetheless too large aside to maneuver traders.

In a year-end 2023 report, MSCI famous that traders and sellers might want to meet midway to shut the hole between purchaser vs. vendor expectations to attain liquidity-adjusted pricing. In different phrases, that CBD workplace asset that offered for $408 per sq. foot in 2022 would now have go for a market-clearing worth of about $245 per sq. foot.

Tomlinson contended that going ahead, rates of interest will proceed to be the only greatest issue affecting gross sales quantity, noting that when the Fed raised charges in 2023 525 foundation factors in simply over 90 days, workplace gross sales dropped 68 p.c from the prior two-year common.