peterschreiber.media

A bear market rally began last week and the inflation picture could give rise to a big move before stock resume a downward trajectory, Morgan Stanley equity strategist Mike Wilson says.

“From our vantage point, inflation has peaked,” Wilson wrote in a note. “8% is hardly a rate the Fed can live with but if you look out 6 months, the seeds have been sown for lower prices in many goods and services.”

If rates begin to discount falling inflation “it will give legs to the rally that began last Thursday, particularly if 3Q earnings season does not bring the step function decline to 2023 EPS forecasts we still think is coming,” Wilson said.

Wilson said the equity team is “becoming more skeptical this quarter will bring enough earnings capitulation from companies on next year’s numbers for the final price lows of this bear market to happen now.”

S&P to 4,150?

If the rally holds it could push the S&P 500 (SP500) (NYSEARCA:SPY) to 4,000 and an attempt retake of the 200-day moving average around 4,150 shouldn’t be ruled out, according to Wilson.

“While that seems like an awfully big move, it would be in line with prior bear market rallies this year and prior ones,” he noted.

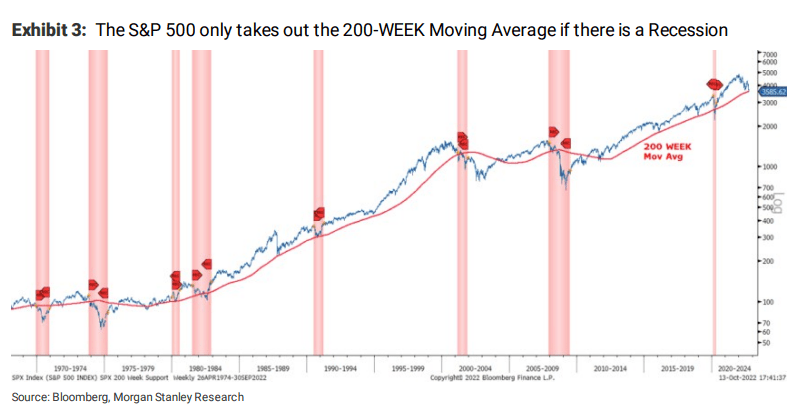

But while the 200-WEEK moving average around 3,585 was take out on Friday’s close, it is a “formidable” level that won’t be taken out without a fight, he added.

“In fact, it usually takes a full blown recession, which we don’t have yet (i.e., a 1-2% rise in the unemployment rate),” Wilson said. “Second, not all recessions result in a break of the 200-week moving average so there is also a case to be made we won’t take it out even if a recession arrives. Obviously, Friday’s breach on a closing basis is notable; but given the very positive divergences in many momentum indicators (RSI, MACD) combined with the extremely bearish sentiment, this is exactly where the equity market should make a stand if one is going to happen.”

Longer term, though, the broader market will keep falling.

“To be crystal clear, we think a tradable bear market rally began last Thursday; however, we also believe the 200-week moving average will eventually give way like it typically does when earnings forecasts fall by 20%+. The final price lows for this bear are likely to be closer to 3000-3200.”

Dig deeper into last Thursday’s mysterious rally.