Sean Gallup/Getty Images News

Since our last update, ‘Higher Guidance To Price In,‘ Infineon Technologies AG’s (OTCQX: IFNNY) (OTCQX: IFNNF) stock price has declined by more than 10%. Since 2022, the company has been one of our top selections, and we believe it is now back to an exciting entry point. Post Q3 results, here at the Lab, we report the following negative vital takeaways:

- Profitability slightly declined quarter on quarter with an adjusted gross morning from 48.6% in Q2 to 46.2% in Q3;

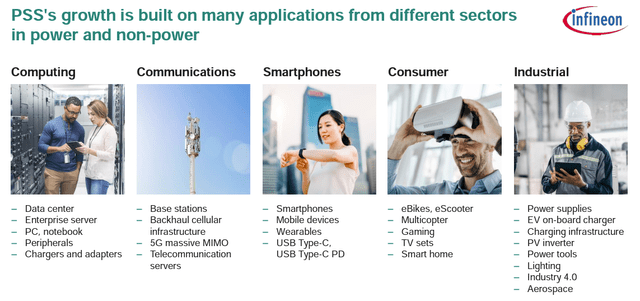

- A negative MIX effect due to lower top-line sales in the best-performing segment (PSS division). As a reminder, in 2022, PSS achieved a core operating profit margin of 27.9% compared to a group average of 23.6%.

Here at the Lab, before moving forward with our supportive buy, we note that the above two negative trends could reverse in the coming quarters. Why? Looking at the first point, the gross margin evolution anticipates higher idle costs. Related to the product MIX, having listened to the Q&A analyst call, management believes that PSS recovery will likely materialize in 2024 thanks to the uplift expected in cyclical sectors.

Infineon PSS end-markets

Source: Infineon Technologies Q3 results presentation

Why is Infineon a buy?

Aside from the secular growth trend that we already analyzed in our initiation of coverage coupled with our automotive upside, today we report the following upside:

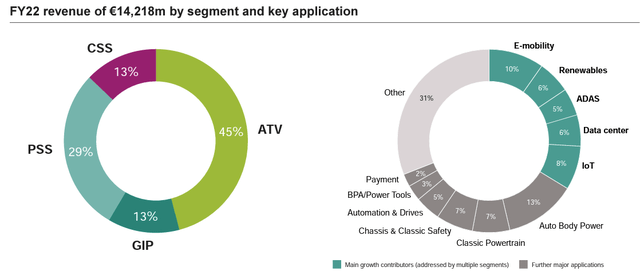

- The company is a top ten global semiconductor player with a diversified GEO and sales exposure. Assuming revenue growth as indicated by the management, an ongoing operating leverage, and a favorable product MIX, we are not anticipating a decline in margins even if we forecast lower pricing power and/or CAPEX underutilization. This balanced portfolio provided a solid margin of safety in case of an economic slowdown (Fig 1). We estimate a limited underutilization of €400 million with a step up from H1 at €180 million. This is mainly due to weaker demand in CSS and PSS sales;

- To support Infineon’s state-of-the-art facility, the company announced an expansion of the Kulim factory. This lab will be used to produce 200mm SiC and might provide an additional €7 billion top-line sales potential by the end of the decade (Fig 2). The company anticipates being in a better cost position vs. the closest competitors. Here at the Lab, we believe this is due to factory scale and building cost. Asian costs are half price vs. Europe/US;

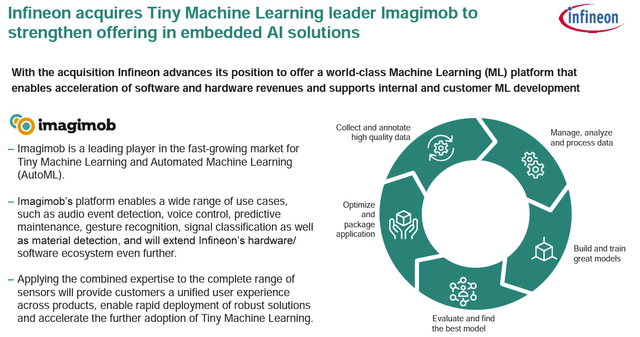

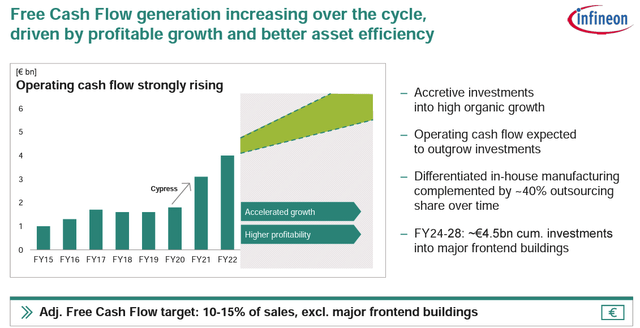

After acquiring Cypress in 2020, the company is now a leader in the IoT and power systems. Here at the Lab, we anticipate a solid growth rate of AI even in more traditional sectors (automotive, healthcare, and industrial). However, with the current Infineon portfolio, products will emerge in various sub-segments, such as security, connected secure systems, connectivity, sensors, etc. We believe Infineon will provide new strategies for further growth and greater functionality reach. In 2022, Infineon had €1.1 billion in sales; in our numbers, we provide sales of approximately €2.75 billion in 2027. External acquisitions will also support this. Recently, Infineon acquired a leading development suite player called Imagimob (Fig 3), and we believe the company is well-positioned to leverage its top status in programmable chips. There is a growing need for chips for machine learning solutions. Despite a qualitative market assessment, what is critical to emphasize is the fact that Infineon FCF remarkably increased since the Cypress add-on. Looking at the latest guidance, Infineon increased its yearly FCF to €1.2 billion (from previous estimates of €1.1 billion – Fig 4).

Infineon in a Snap

Fig 1

Infineon new CAPEX

Fig 2

Infineon acquisition

Fig 3

Infineon FCF evolution

Fig 4

Conclusion and Valuation

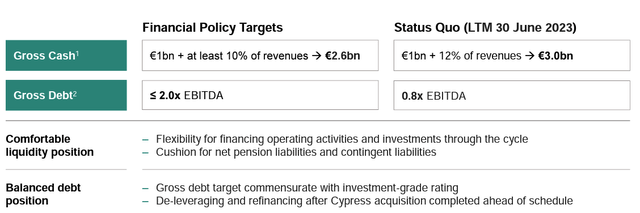

Combining all these elements and considering Infineon’s track record in cross-selling products, the company is poised for a solid growth rate in the industrial and consumer electronics markets. Energy transition and Power and Sensors Systems with IoT new design might provide a stable growth base over the mid-to-long term horizon. With a rock-solid balance sheet, Infineon is trading at a 2024 P/E 14x. This is not justified vs. its historical average (20x). Post Infineon’s Q3 results, we leave our EPS broadly unchanged and reiterated our €48 per share target price ($51 in ADR). There are also risks to our overweight, such as disruptions of new technologies, Wall Street concerns around margins, limited pricing power due to competition, and FX fluctuation, especially €/$.

Infineon Debt

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.