By Andy Mukherjee

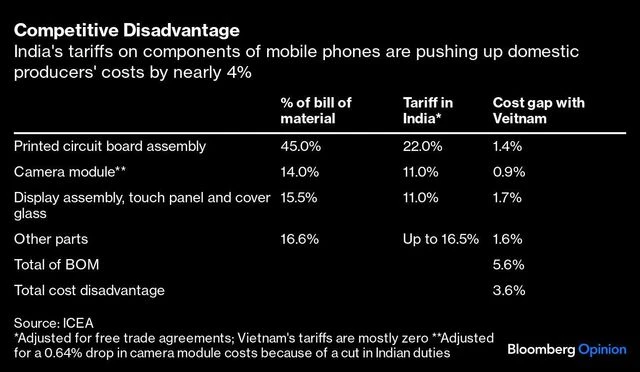

The printed circuit board assembly, the camera module, the touch-screen display and the glass cover.

Together, they account for three-fourths of the bill-of-materials cost of a smartphone. Vietnam, the world’s second-biggest exporter of handsets after China, sources these and most other components at zero tariffs from free-trade partners. But India, which has few such accords of its own but is still keen to emulate the manufacturing powerhouse in its neighborhood, has customs duties as high as 22 per cent.

The result? Making mobile phones in the world’s most-populous nation now comes embedded with a cost disadvantage of 4 per cent, says the 2023 edition of a comparative study of tariffs by India Cellular & Electronics Association, an industry body.

This extra burden is something India has deliberately imposed on assemblers even as it began remunerating them for its many existing cost disabilities, especially poor infrastructure and red tape. The so-called production-linked incentives, or PLI, promise to pay firms as much as 4 per cent to 6 per cent of their incremental sales for five years.

One way to think about this is that India is first damaging its competitiveness, and then compensating firms to set up factories in the country. Another perspective is that the handouts are being “supported through indirect revenue from increased indirect taxes from the same sector,” as the ICEA report says.

Policymakers are convinced that their strategy is a masterstroke. The PLI program, which kicked in for mobile phones in October 2020, is being touted as a success. Annual production has surged more than 60 per cent to $42 billion. Of this, $11 billion is exported, compared with virtually nothing when Prime Minister Narendra Modi came to power in 2014. From being a net importer, India has become a net exporter of handheld devices.

The pandemic and President Xi Jinping’s souring relations with the West have changed the thinking of multinationals. A Foxconn Technology Group plant in the southern Indian state of Tamil Nadu is preparing to deliver iPhone 15s only weeks after they start shipping from factories in China, Bloomberg News reported Wednesday. The likes of Apple Inc. are reluctant to rely too heavily on the People’s Republic to feed global demand. Their quest for a China+1 strategy has presented India with a once-in-a-generation chance to storm the supply chain. Vietnam’s phone exports last year were six times the South Asian nation’s thanks to Samsung Electronics Co. It is this gap that New Delhi wants to close.

However, conflating correlation with causation could jeopardize this goal. Just because an apparent change in the country’s fortunes has occurred despite a lurch toward protectionism, government ministers are angrily dismissing critics who dare to question the wisdom of the tariff-subsidy combo. The official view is that as long as exporters can claim back the duties on imported components, they won’t grumble about India’s cost disadvantage against Vietnam — not when they’re being paid generous PLI incentives.

Following up on this thinking, the Modi government in 2018 announced a “calibrated departure” from more than two decades of greater trade openness, and raised import duties on mobile phones to 20 per cent from 15 per cent. That project has continued unabated. In 2020, the duty on printed circuit board assembly and display was raised by 11 percentage points.

)

Add the impact from the rupee’s 11 per cent slide against the dollar since the start of last year — double the decline in the Vietnamese dong — and Indian-made phones would be uncompetitive by more than 4 per cent, the ICEA says.

This cost may not be showing up in export performance because it is being borne by India’s 1.4 billion consumers. Costlier imports are hurting local demand amid high inflation. Component manufacturers have no incentive to become globally competitive if they can hawk whatever they make in their home market at an inflated price, shielded by tariffs.

Exporters, meanwhile, have every reason to keep importing components — and claim duty drawbacks. Self-reliance, the slogan under which the program is being sold to the public, may be an illusion. Raghuram Rajan, a University of Chicago economist and a former governor of the Indian central bank, has shown that after adding major parts that go into phones, the country may have become a bigger net importer than before.