Eyeing the costs at a Budapest market corridor, retired faculty nurse Maria Veres mentioned she was grateful for a giant January pension bonus from Viktor Orban’s authorities. It inspired her to vote to re-elect the premier this month, however the windfall is nearly gone already.

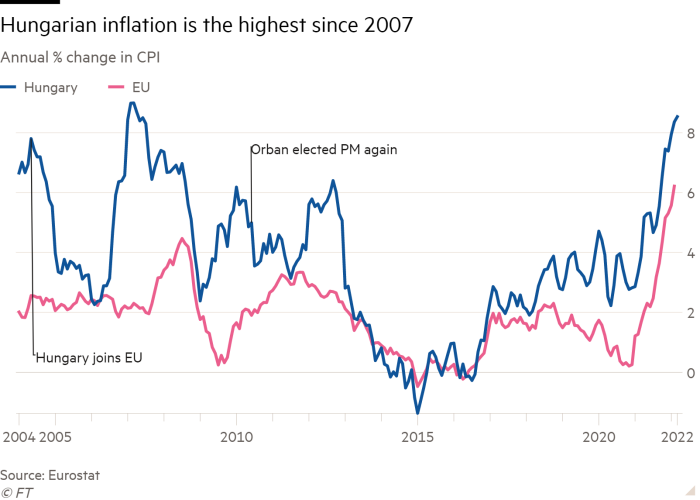

Hungary’s highest inflation in 15 years is reducing into her freshly padded financial savings however has not but hit her confidence in Orban, who she expects can defend residents from rising costs and different financial issues.

“These value tags are horrific,” she mentioned, a dozen eggs costing about 600 forints, or simply over €1.50, up one-third from a 12 months in the past. “This kind of inflation, I believed it was a factor of the previous. I hope Orban defends us from this someway.”

Whereas he’s buoyed by a fourth consecutive election win that extends his tenure because the EU’s longest-serving chief, Orban — who has mentioned he’s decided “to protect monetary stability” — faces a number of the greatest financial challenges of his time in workplace.

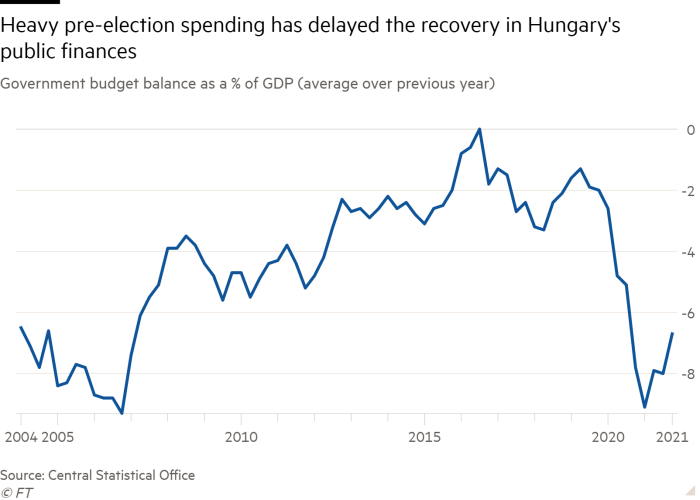

Hovering power prices are straining Hungary’s means to take care of state-imposed value caps, whereas world disruption from Russia’s invasion of Ukraine is denting prospects for development. Heavy pre-election spending, and a row with Brussels that’s delaying greater than €7bn in EU assist, is additional constraining room for financial manoeuvre.

The EU funds are supposed to finance tasks to spice up Hungary’s restoration from the pandemic. Orban desires to borrow the funds within the meantime however analysts mentioned that will improve Budapest’s debt ranges and financing prices.

“If we are able to entry [recovery funds], we should take smaller steps towards the monetary market; if not, then we can be compelled to take bigger ones,” Orban instructed journalists this month, calling the technique “prefinancing” till the EU cash arrives.

A part of the squeeze on Hungary’s funds stems from Orban’s generosity within the run-up to the April 3 election. The federal government gave away about €5bn within the first quarter in household tax rebates and pension bonuses. It additionally now faces decrease development and tax receipts due to the financial disruption attributable to the Ukraine struggle.

KBC’s Hungarian economist David Nemeth mentioned the EU funds “would go a great distance to assist clear up the finances issues” for Orban, who might then spend extra on sustaining value caps and different measures to battle inflation.

Regardless of his want for EU money, Orban has mentioned he won’t make concessions to enhance relations with the EU. “Regardless of the stress on us, we’ll by no means again down,” Orban mentioned.

Fitch Rankings mentioned this month that Orban’s clear election victory, and Brussels’ determination to start out a course of to penalise alleged rule of regulation abuses within the nation, “might sign a hardening of each side’ stances” and threaten development forecasts.

It additionally warned {that a} deterioration in governance requirements in Hungary might undermine investor confidence and have an effect on the nation’s credit standing. Budapest’s score is now two notches into funding grade with a steady outlook from all three main score companies.

Decrease scores would elevate borrowing prices. A damaging spiral of upper debt, rising debt funds and decrease credit score scores is a chance, mentioned Peter Oszko, Hungary’s final finance minister earlier than the Orban period, which started in 2010.

“Market debt may be very costly, hurts the finances stability, the curiosity on it’s rising, however [Orban] can faucet that for some time, hoping for an settlement with the EU,” mentioned Oszko. “Time is tight however he’ll attempt to take his time, strive just a few vetoes, kind just a few alliances.”

Oszko mentioned the federal government ought to fear most about inflation. “Orban just isn’t afraid to levy additional taxes on profitable enterprise sectors or difficulty bonds, so long as he can keep away from leaning on the voters immediately,” he mentioned. “However a sustained double-digit inflation fee hurts everybody.”

Gergely Suppan, an economist at Takarekbank, mentioned he anticipated Orban would halt funding or enable the finances deficit to exceed 5 per cent, in contrast with the EU’s common 3 per cent restrict, earlier than he touches value caps, which preserve fuel payments under €100 a month for a mean family, far under western Europe’s.

“If market costs had been launched, most individuals would fail to pay their payments,” mentioned Suppan. “Utility costs haven’t modified since 2014, throughout which period internet salaries greater than doubled. We might deal with 10, 20 per cent, however a fivefold improve can be nonsensical.”

Orban has not dominated out extra taxes on sectors like finance, power, telecommunications and retail. “Whether or not particular taxes on multinationals or others turn into obligatory is as much as the EU,” he mentioned. “If Europe is unable to halt the power value improve, we can be compelled to take steps in Hungary.”

Peter Virovacz, an economist with ING, mentioned a fiscal adjustment of about 1 per cent of gross home product may very well be achievable through spending cuts however better recalibration would imply tax will increase.

“We wouldn’t count on measures affecting the tax burden on labour however moderately some sectoral taxes [in] banking, telecommunication and/or retail,” Virovacz mentioned. “The caveat with these may very well be that corporations will go on the prices to households — which might strengthen inflation additional.”