[ad_1]

The European Central Bank’s quarterly Bank Lending Survey this week failed to attract much attention, which is no surprise. Headline findings — that European lenders expect to tighten credit access this quarter as higher interest rates weigh on demand — were hardly shocking news.

But take a dig through the details and it becomes obvious how rapidly credit conditions are deteriorating, which makes predicting one aspect of Thursday’s ECB meeting unusually tricky.

Lending standards for European non-financial corporations have returned to peak eurozone-crisis levels, with Italian borrowers hardest hit. Mortgage lending and consumer credit are as tight as they were in 2008, led by a squeeze in Spain and Germany.

Demand side’s no better. Corporate loan demand has been kept artificially high this year by slow supply chains and rising production costs. That effect now looks to be fading . . .

… while for households the crash in demand looks well advanced:

The ECB lenders’ survey typically foreshadows downstream credit supply by about a year. The pace of withdrawal seen since June, when the ECB flagged the end of negative rates, “corroborates our view that the euro area is headed towards a sharp recession”, said Barclays.

Because lending standards vary between countries — shaped by employment markets and sovereign-bank relationships — the financial-industry response has been uneven. Lenders in Spain, Austria and Belgium have been tightening credit much more than those in the Netherlands, Ireland and France. Charts via Redburn:

A worsening macro environment with higher rates (hence refinancing challenges for borrowers) suggest a European bank cost of risk that’s more than double the 0.40 basis points currently assumed by the market, Redburn estimates.

Doubling the cost of risk would move the sector’s valuation back to its long-term average of 10 times forward earnings, versus its ostensible bargain-basement level of 6x currently. Neither ratio deserves much attention as they’re just snapshots, not guides. Where cost-of-risk eventually peaks will depend largely on how much unemployment climbs. And at today’s prices, investors seem to be assuming it will rise by no more than a couple of percentage points.

For that reason, it’s useful to take a granular view of European unemployment expectations. Employers in the Netherlands and France appear optimistic; those in eastern Europe, Italy, Germany and Belgium do not:

All of which can be put on a scatter plot:

We’re reminded often that in the average hiking cycle, the margin boost that banks get from rising interest rates tends to eclipse weaker loan growth. But a deeper recession also means banks have to work harder to obtain wholesale funding, around which there are already some signs of deterioration:

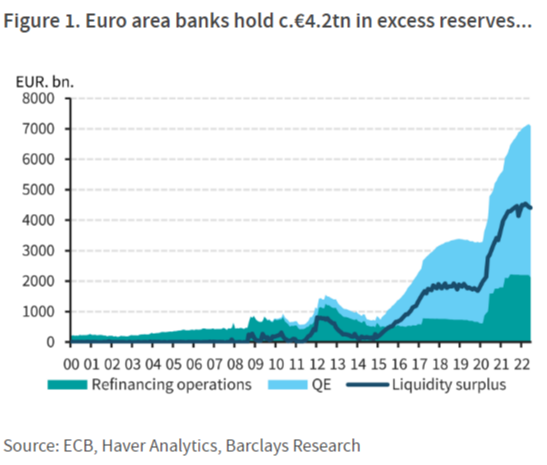

Another thing to remember is that capital buffers reserves across the European banking sector are ridiculously fat:

Nevertheless, signs of tighter wholesale funding are badly timed for the ECB, which needs to scale back its pandemic-era loan subsidy known as targeted longer term refinancing operations. Banks can borrow through the TLTRO almost for nothing then park their excess liquidity at the ECB’s overnight deposit facility, which pays 0.75 per cent at the moment.

About €1.1tn of the €2.1tn in outstanding TLTRO loans have been used for ECB deposit arbitrage, Barclays estimates. Keeping the scheme in current form at higher rates would mean the ECB pays around €110bn to euro area banks over the next 12 months, for very little reason.

But with two-thirds or thereabouts of TLTROs repayable in the first half of 2023, a full withdrawal would represent a cliff-edge risk for periphery economies in particular:

The ECB might reduce the attractiveness of TLTRO arbitrage by repricing outstanding loans to match its deposit rate. Or it might apply some kind of tiering threshold on parked reserves. The simple way to approach tiering would be to exempt a percentage of TLTRO borrowing from deposit interest — but that might throttle liquidity in Italy and Spain, as well as creating very little incentive to pay loans back.

A tricksier solution would be to avoid direct action, and use Swiss National Bank-style reverse-tiering, whereby deposit interest will no longer be paid on liquidity in excess of some arbitrary threshold. Overfunded banks would be encouraged to pay back their TLTROs to avoid the effective penalty, while underfunded ones would still have access to the carry trade.

Here’s how that looks across the zone with the threshold set at 6 times minimum required reserves, and again at 25 times.

Too complicated? Too political? Right now, given everything, probably. So analysts expect nothing more this week than some light tweaking of the deposit terms and conditions. Here’s Barclays:

We think the ECB is likely to intervene directly as reverse-tiering would carry a greater risk of impairing the transmission of monetary policy. With circa 65 per cent of TLTRO borrowing set to mature by June 2023, which will reduce the liquidity surplus, we think the least disruptive strategy for the ECB would be to simply wait.

[ad_2]

Source link