Up to date on April 21th, 2022 by Felix Martinez

Horizon Know-how Finance (HRZN) has a present dividend yield of greater than 8.5%. Horizon’s excessive dividend yield makes it extraordinarily enticing at first look. The S&P 500 Index, on common, provides only a ~1.4% dividend yield.

Not solely does it have a really excessive dividend yield, nevertheless it additionally makes its funds every month. Horizon is considered one of solely 50 month-to-month dividend shares.

You’ll be able to obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter like dividend yield and payout ratio) by clicking on the hyperlink beneath:

Horizon’s yield could be very close to the highest of the record of month-to-month dividend shares, a gaggle that features many different high-yield securities like REITs and different BDCs.

This text will focus on Horizon’s enterprise mannequin and whether or not it’s an interesting inventory for revenue traders.

Enterprise Overview

Horizon Know-how Finance is a Enterprise Improvement Firm, or BDC. These are firms that make investments in privately-held firms.

Horizon makes its returns by way of investments in firms via straight originated senior secured loans and, to a smaller extent, capital appreciation potential via warrants.

It supplies debt financing to early-stage firms throughout three business teams:

- Life Science

- Know-how

- Healthcare Data & Providers

Life science firms primarily embrace biotechnology, medical units, and specialty prescription drugs.

Know-how investments are usually made in cloud computing, wi-fi communications, cyber safety, information analytics and storage, web, software program, and extra.

Healthcare data consists of diagnostics, medical information, and affected person administration software program suppliers.

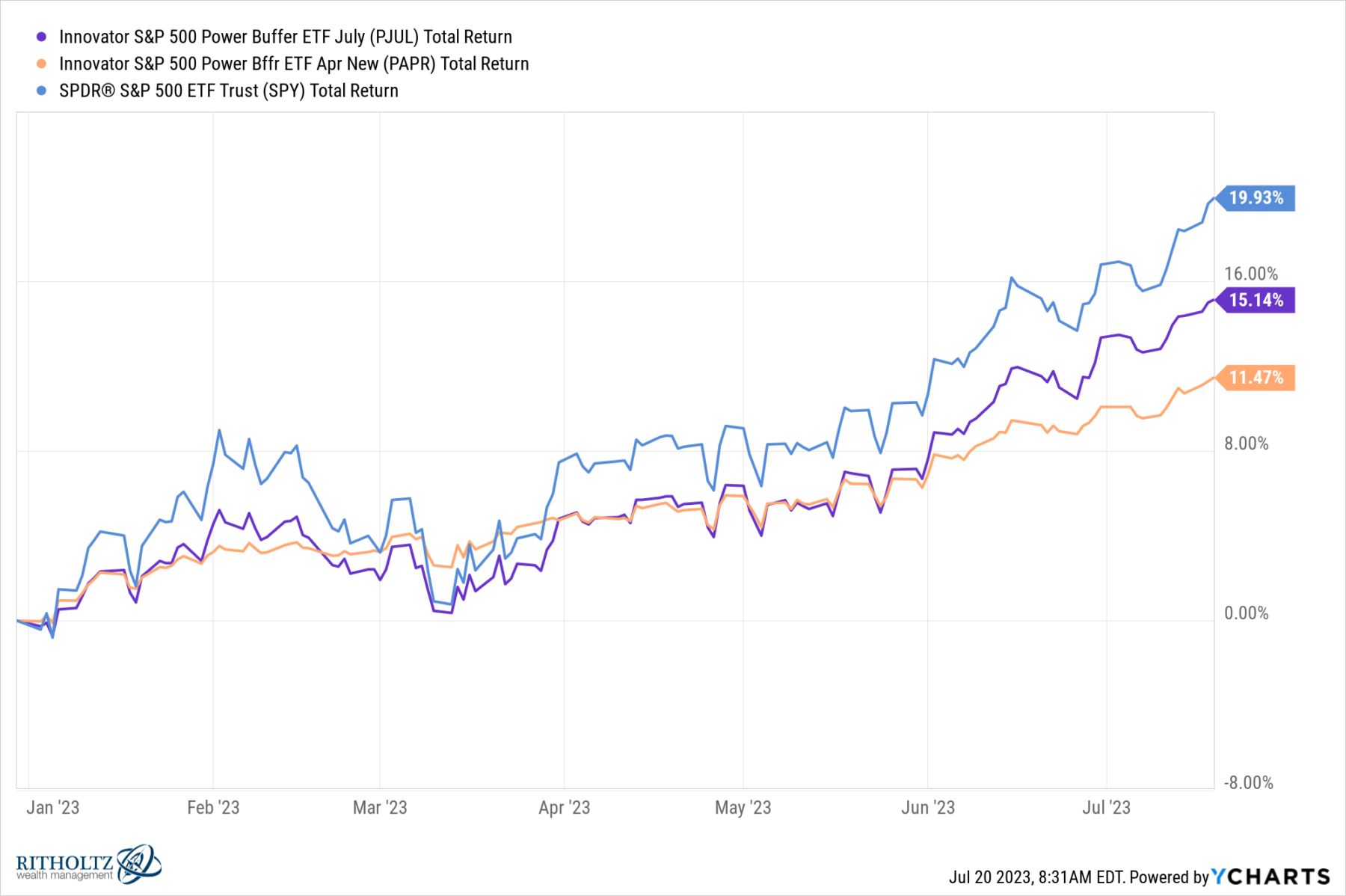

A breakdown of Horizon’s portfolio is as follows:

Supply: Investor Presentation

The portfolio is closely weighted within the expertise group, however even inside that group, industries are extremely diversified.

As well as, the corporate has a good mixture of secure and rising firms, respectively, in its portfolio, to supply a mixture of progress and security in its lending.

Horizon views potential investments via a long-term lens. It invests in firms which have progress potential, sturdy administration groups, superior expertise, and/or priceless mental property.

As of the top of March, Horizon had a web asset worth of $11.56 per share. The share value presently trades at a premium to web asset worth per share.

Horizon has a sound funding philosophy. It additionally has a high-quality mortgage portfolio that ought to present the corporate with progress going ahead.

Development Prospects

On March 1st, 2022, Horizon launched its This autumn outcomes for the interval ended December 31st, 2022. Whole funding revenue grew by 68% YoY to $16.9 million. This was as a consequence of progress in curiosity revenue on investments ensuing from a rise within the common measurement of the debt funding portfolio. Internet funding revenue per share (NIIPS) grew to $0.39, 85% greater in comparison with This autumn 2020.

The mismatch in progress to the total revenue was as a result of further share issuances that took place to fund the corporate’s portfolio enlargement. Internet asset worth (NAV) per share got here in at $11.56, in comparison with $11.02 within the earlier quarter, as Horizon earned greater than what it paid out in distributions.

The truth is, after paying its month-to-month distributions, Horizon’s undistributed spillover revenue as of December 31st was $0.51 per share, indicating a appreciable money cushion.

The portfolio remained comparatively secure, holding 76 companies on the finish of the quarter. Administration reassured traders of dividend stability going ahead by declaring its three ahead month-to-month dividends at a fee of $0.10. We proceed to anticipate FY2022 NIIPS/share of $1.28.

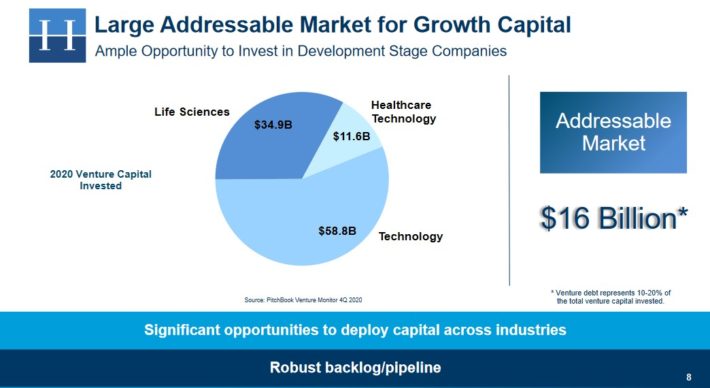

Horizon additionally has a rising and large addressable market.

Supply: Investor Presentation

Horizon sees a $16 billion addressable market in opposition to its present portfolio of $380 million. This could present a wealth of alternatives for Horizon, and it might probably due to this fact choose one of the best alternatives within the coming years.

Dividend Evaluation

Horizon presently pays a month-to-month dividend of $0.10 per share. The annualized dividend payout of $1.20 represents a yield of 8.5%, primarily based on Horizon’s present value. This demonstrates why BDCs are a well-liked funding for revenue traders, significantly one which has a yield as excessive as Horizon.

Nevertheless, abnormally excessive dividend payouts might be lowered if the issuing firm encounters monetary problem. That mentioned, Horizon nonetheless provides a excessive yield, which could possibly be very interesting for revenue traders.

Internet funding revenue for 2022 is anticipated to achieve $1.28 per share, which equates to a payout ratio of 94%. That is an enchancment from 2020, when the payout ratio exceeded 100% of NII-per-share, because the coronavirus pandemic triggered a decline within the portfolio outcomes.

If funding revenue declines sooner or later, the dividend can be in peril of a discount. Alternatively, if the U.S. financial system avoids a recession, and Horizon continues to see success from its investing methods, the dividend could possibly be maintained. To that finish, Horizon did preserve its dividend funds all through 2020 and in 2021.

Associated: 3 Causes Why Corporations Minimize Their Dividends (With Examples)

The corporate’s aggressive benefit lies in its experience to determine essentially the most promising firms in dangerous sectors, which requires skilled data and expertise past finance. Up to now, this perokay has stood strong, as the corporate’s outcomes have outperformed the remainder of its friends, lots of which have been compelled to chop their distribution as a consequence of elevated market stress.

In an optimum situation, Horizon may proceed to pay its distribution of $1.20 yearly for the foreseeable future. Nevertheless, any BDC has an elevated danger of chopping its distribution provided that it’s required to distribute basically all of its revenue. Ought to Horizon’s monetary outcomes deteriorate, a dividend lower is definitely potential, as occurred in 2016.

Remaining Ideas

Excessive dividend yields are sometimes an indication of elevated danger. On this case, there’s a appreciable danger that Horizon’s dividend could possibly be lowered sooner or later if its funding revenue deteriorates, which might possible happen in a deep recession.

Nevertheless, the outlook for Horizon is mostly constructive. It invests in expertise and healthcare, two secure industries with progress potential. The corporate’s underwriting ideas provide excessive yields and customarily protected lending circumstances, which assist web funding revenue and due to this fact, the dividend.

Horizon could possibly be a sexy excessive dividend inventory for revenue traders because of its 8.5% dividend yield, with the acknowledgment that the dividend could possibly be in danger within the occasion of a enterprise downturn.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].