Shoppers walk through a street market in Hong Kong, China, on Sunday, Jan. 30, 2022. Photographer: Chan Long Hei/Bloomberg via Getty Images

Bloomberg | Bloomberg | Getty Images

Hong Kong stocks kicked off 2023 with the most gains they’ve seen in the first trading session of a year since 2018.

The Hang Seng index on Tuesday gained 1.84%, or 363.88 points — its biggest first-day gain since January 2018, when the index rose nearly 2%.

That signaled an improved outlook as China continues to reopen despite a nationwide surge in Covid infections.

“While it is inevitable to see further surges and more widespread in inflection at the initial stage of opening, the outlook for the Chinese economy has brightened for 2023,” Redmond Wong, Saxo Capital Markets greater China market strategist, said in a note.

“In addition to the reopening, China has intensified its effort to support the distressed property sector and given property developers access to credits and equity financing which had been denied to them for the most part of 2022,” Wong wrote.

Property and technology stocks continued to lift the Hang Seng index, which rose more than 3% in Wednesday’s session. The index exceeded 20,600, the highest level it’s seen since July 29, according to Refinitiv data.

Chinese property developer stocks listed in the city rose: Country Garden jumped more than 7%, Longfor Group gained nearly 12% and Cifi Holdings Group jumped 13% on Wednesday.

The moves followed reports of Chinese officials planning to provide further policy support for ailing real estate developers.

Technology stocks also rallied, with shares of Alibaba rising 8% after Chinese regulators approved Ant Group’s plan to more than double its registered capital, a sign of progress in resolving regulators’ concerns.

Electric vehicle maker Baidu rose more than 8%; Chinese video and gaming app Bilibili gained nearly 9%; Netease rose more than 5%; JD.com climbed 7%; and Tencent also rose around 4%.

The Hang Seng rally came after Chinese Finance Minister Liu Kun told Xinhua in an interview that there will be more fiscal policy support.

Shoppers purchase festive sweets ahead of Lunar New Year at a street stall in Hong Kong, China, on Sunday, Jan. 30, 2022. Photographer: Chan Long Hei/Bloomberg via Getty Images

Bloomberg | Bloomberg | Getty Images

The government will work on expanding and improving the “effectiveness of the proactive fiscal policy to cope with multiple challenges ahead,” the minister was quoted as saying.

Chinese investment bank Guotai Junan Securities said the performance of Hong Kong stocks will affect the wider global market.

“The Hang Seng Index may lead other major global stock indices in 2023, with around 30% expected return,” analysts at the firm said in a Wednesday note.

“The index valuation may see further rerates, and we expect the HSI to recover to its previous level before Jun. 2022,” they said in the note.

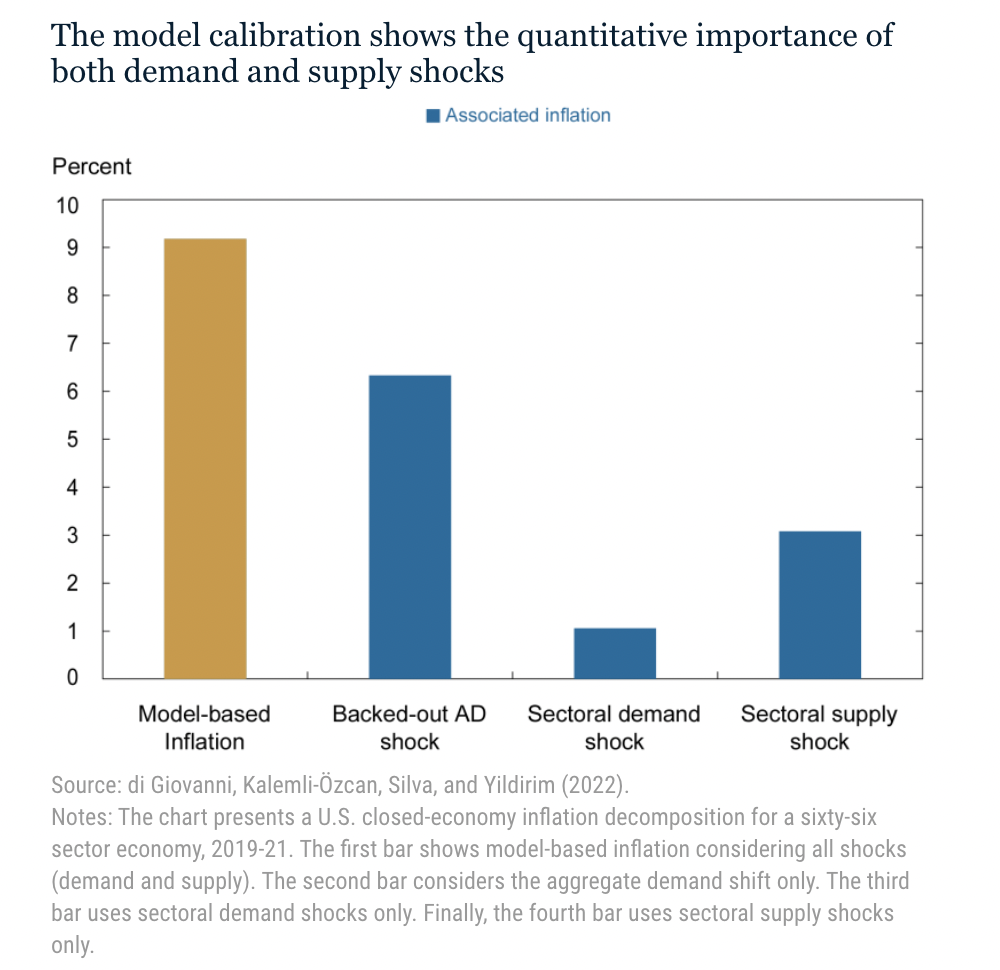

Implications for U.S. Fed

China’s reopening is a positive sign for Asian stocks and global economic growth in 2023, but it carries also inflationary risks, thanks to China’s role in driving demand for the global commodities market, analysts at Raymond James said in a note.

Weaker growth in the Chinese economy will likely increase the chances of a more dovish Federal Reserve, while stronger growth will raise the possibility of a “stubbornly hawkish Fed,” equity strategist Tavis McCourt wrote.

“Volatility seems certain with equities finishing either modestly higher or modestly lower depending on the rate path,” McCourt said in the note.