After seven straight months of declining prices, the S&P/Case-Shiller U.S. National Home Price Index increased in February, and March seems to be carrying the same upward momentum.

The latest data from Black Knight finds that out of the 100 largest markets in the nation, 93 had price increases from February to March, up from 79 in January-February.

This, of course, is traditionally expected as the spring months tend to bring a bump in prices as homebuying demand ramps up. But the rise is more than expected. “A modest bump in homebuyer demand ran headlong into falling for-sale supply,” said Andy Walden, Black Knight’s vice president of enterprise research. “Just five months ago, prices were declining on a seasonally adjusted month-over-month basis in 92% of all major U.S. markets. Fast forward to March, and the situation has done a literal 180, with prices now rising in 92% of markets from February.”

It should be noted that most key year-over-year metrics indicate a correction environment and show more similarities to the 2019 market than any of the pandemic years. As of March, only 28.5% of homes sold over list price, down -26% YoY. Price drops are up to 14.3% (+7.7%), new listings are down -22.5%, and median days on market have increased to 44 (+23). In short, demand is lower, and more homes are sitting on the market, but new listings are also not coming online at the same rate as before, which helps explain why national prices are only down -3.3% YoY instead of more.

Personally, I’m bearish about this market. I think when you have homeowners with low fixed-interest rates constraining supply, elevated mortgage rates keeping applications down, a real fear of an upcoming (or continued, depending on who you ask) recession, record-low affordability, persistent inflation, banking scares, and the fact that multifamily and commercial real estate at serious risk of crashing—it’s hard to be fully optimistic about the market.

However, some markets have shrugged off these dilemmas while others have taken a real hit. Real estate is local, and we have to deal with what’s in front of us.

What Markets Are On The Rise?

Despite the issues in the economy, just seven of the 100 largest markets in the United States saw month-over-month price declines. Leading the pack was Austin, Texas, which saw a -0.72% drop, according to Black Knight.

Among the markets seeing an uptick, Columbus, Ohio, had the highest increase (+1.08%). Below are the top 10 markets:

| Housing Market | Percent Change MoM |

|---|---|

| Columbus, Ohio | 1.08% |

| Dayton, Ohio | 1.04% |

| Hartford, Connecticut | 1.04% |

| Worcester, Massachusetts | 1.04% |

| Youngstown, Ohio | 0.98% |

| Cleveland, Ohio | 0.96% |

| Cincinnati, Ohio | 0.91% |

| Akron, Ohio | 0.91% |

| Wichita, Kansas | 0.90% |

| Toledo, Ohio | 0.88% |

Here are the bottom 10 markets:

| Housing Market | Percent Change MoM |

|---|---|

| Austin, Texas | -0.72% |

| Provo, Utah | -0.24% |

| Boise, Idaho | -0.13% |

| Salt Lake City, Utah | -0.12% |

| Ogden, Utah | -0.80% |

| San Antonio, Texas | -0.70% |

| Phoenix, Arizona | -0.40% |

| Dallas, Texas | 0.10% |

| Deltona, Florida | 0.13% |

| Houston, Texas | 0.15% |

The biggest takeaway is that the superstar markets of the pandemic boom, largely Boise and Austin, are the ones getting hammered the most. Austin continues its descent from its median sales price peak in May 2022 of $670,000 to $535,000, a -16% decline.

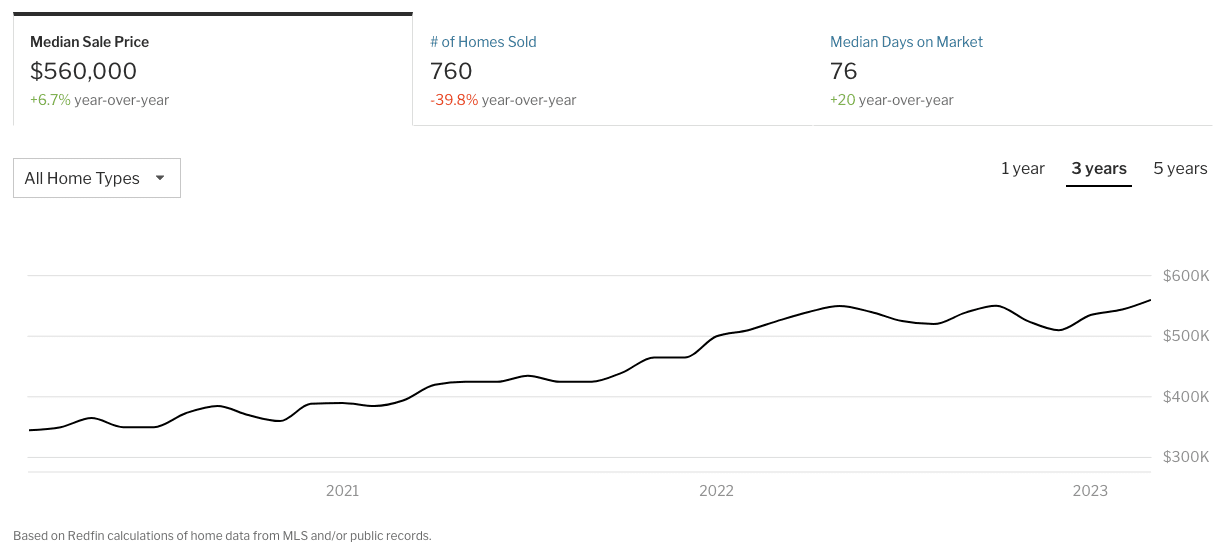

Meanwhile, Miami just notched a record-high of $560,000.

According to data from Redfin, Miami has emerged as the country’s leading city for inbound migration, which helps explain why it’s still appreciating. But, just like Austin during the pandemic, this rapid migration may ultimately lead to a similar decline later in the future once the dust settles—just food for thought for anyone investing in Miami-Dade County.

What About The Correction?

As I mentioned, prices tend to rise during this time of year. The bigger question going forward is whether the national market is finished falling. Come winter, prices will all but certainly fall, but by how much? Have we truly reached the “bottom” of the market?

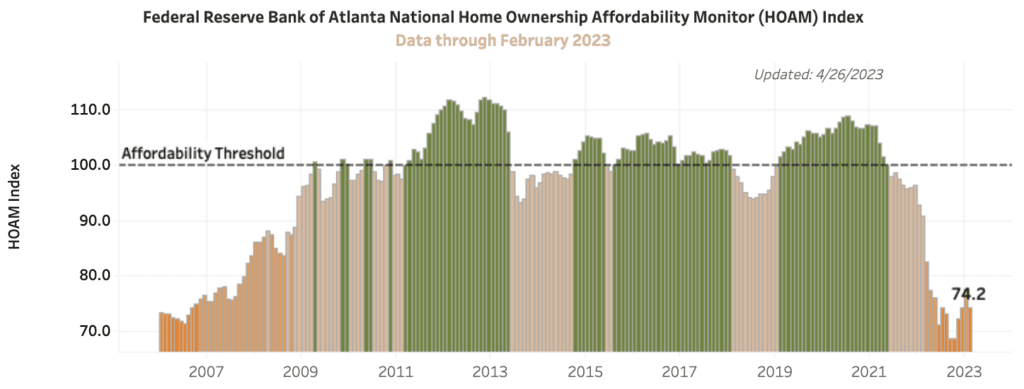

Who knows. Two specific factors have spurred the housing market’s correction. The first is affordability. Home prices in markets across the country hit all-time highs that locked a lot of potential homebuyers out of the market. This naturally leads to less demand as more and more buyers leave the market, putting downward pressure on prices. The second is the Federal Reserve’s rate hike policy, which has produced 10 rate increases since March 2022 and has pushed the Federal Funds Rate to above 5%, a 16-year high.

It’s been well-established that the Fed’s inflation battle would harm real estate and that it was sort of the point. Prices got too high (for everything, not just housing), and the Fed felt they needed to act, albeit too late.

Now that the correction is in full swing, affordability, which has improved ever so slightly this year, is a positive trend that can begin to work against it.

The Fed, on the other hand, is still hard to predict. For now, it’s reasonable to assume that they will continue to jack up interest rates until they can quell inflation back down to a sustainable level.

What’s that level, you ask? Well, 2% has been the standard for a long time, but these days the rumor is 3-4%. The Fed hasn’t said anything about changing its long-held target in public, but depending on how things go for the rest of this year, things might be changing, leaving even more uncertainty on the table.

Conclusion

Overall, it’s still too early to make definitive forecasts about where things are going. Zillow still maintains that prices will rise by 0.6% this year. CoreLogic is even more bullish, predicting a 4.6% increase. Fannie Mae, on the other hand, is forecasting price declines through 2024.

As investors, staying on top of this information and taking everything you read and hear with a grain of salt is important. Do your own research, make your own decisions, and protect your money.

Close MORE deals in LESS time for LESS money

Wealth without Cash will fully prepare you to find off-market leads, uncover sellers’ motivations, negotiate with confidence, close more deals, build a team, and much more. This book by Pace Morby has everything you need to become a millionaire investor without utilizing your own capital.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.