After an incredible decade of above-average returns, and a spectacular two-year interval of even stronger features, the markets have entered a 6-month interval of weak point and volatility.

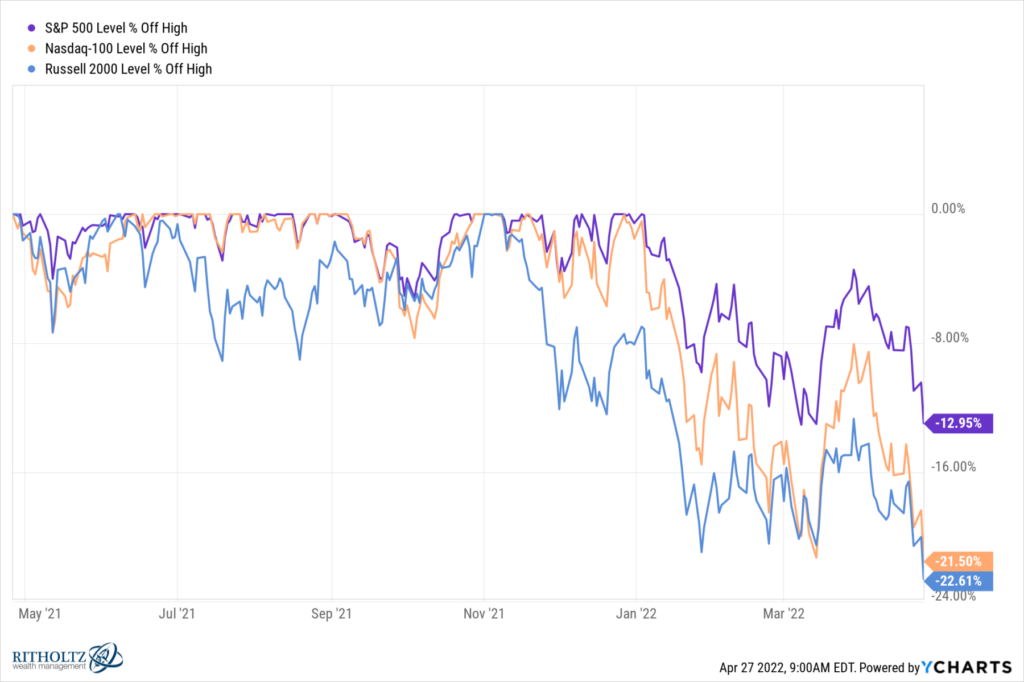

Particularly, the sell-off yesterday introduced the S&P500 down 12.4% year-to-date; the small-cap Russell 2000 is off 15.8%; the Nasdaq 100 tech index is down 20.3%.1 These are comparable to every indices’ drawdown from all-time highs: 12.9%, 22.6%, and 21.5% respectively.

We have no idea precisely what that is: Mere consolidation after these features? Pricing in of upper charges and inflation? Even perhaps the tip of the bull market that started in 2013?

One factor I do know from my previous expertise is that proper round these ranges, everybody turns into an knowledgeable in what it’s best to have achieved to keep away from the drawdowns and seize the alternatives which might be so completely apparent at present. It’s a cyclical glory second for “Hindsight Capital, LLC. 2

Managers of this enterprise succeed by making substantial buys and sells with excellent perception and infallible timing. They know which sector to embrace and which to keep away from; what shares to personal and which to brief. After all, actual property is a part of their portfolio, as are collectible cars, artwork, NFTs, and even uncommon wine.

Hindsight Capital sends out its staff – approved or in any other case – to talk to the press, fund managers, RIAs, VCs, and household workplaces. They share their wit and knowledge, clarify exactly what you bought fallacious, and let you know precisely what it’s best to have achieved.

They by no means point out “course of,” don’t talk about what’s talent or luck, or how repeatable any strategy have to be. Intellectually defendable philosophies aren’t on the agenda, nor are any unknowns or random occasions. Slightly, they all the time give particular and actionable recommendation (albeit too late to behave upon).

Regardless, I’m all the time grateful to obtain their bountiful knowledge. Over the previous few months, I’ve spoken to a wide range of staff of Hindsight Capital. I’m happy to let you realize they’ve shared the next insights:

Bonds: The 30-year bull market in bonds that started in 1982 is useless! Any skilled cash supervisor who couldn’t see this coming have to be blind and/or dumb.

Actual Property: Whoever bought a home or land in 2018 and 2019 was a idiot, given the apparent post-pandemic rise in costs. Suburban rental demand is off the charts and the acquisition demand from locked-down condominium dwellers was apparent to see (even in 2019).

Tech: After all, Tech was going to come back in! It had gone too far, and for too lengthy to not endure a significant pullback. And the entire lockdown shares like Peleton and Netflix had been toast after the pandemic ended.

Power: It was apparent that vitality demand was going a lot increased, and that these costs would lead the majors to have an enormous rally. The Russian invasion of Ukraine was coming, for those who solely knew the place to look.

These criticisms are useless on, with two minor points which might be hardly price mentioning. They’re included right here for the sake of completeness.

The primary:

The entire above critiques are years previous. The 30-year bond bull courting again to 1982 solely will get you to 2012; we have now been listening to concerning the demise of the bull market in bonds for a full decade! The entire features since then – each yield and precept – don’t depend for those who bought your Treasuries, TIPS, and high-grade Corporates a decade in the past and sat in cash market funds for that complete time incomes 10 bps.

As to actual property – for those who had been a leveraged (mortgaged) purchaser renting out properties, you needed to survive 2 years of eviction moratoriums. This implies you may need been receiving little or no rental earnings with restricted authorized to get well receivables (however you continue to had all of these mortgage and upkeep prices to cowl throughout that interval).

And that tech valuation criticism? It’s been constant since (checks notes) 2010 ahead. As to the WFH/lockdown shares like Peleton – it started falling in January 2021; Netflix has been largely flat since July 2020 earlier than its collapse started in October.

The second critique:

In investing, we don’t get to function backward, we should make investments forwards. With out the advantage of figuring out what already occurred. We have no idea what random geopolitical occasions will happen, what shifts will happen in sentiment, and the way revenues and margins and income will change.

ALL WE HAVE IS PROCESS.

For those who do not need a defendable course of, you might be simply spit-balling, speculating, guessing, dart-throwing. Slightly than inform folks what they need to have achieved 6 months in the past, how about sharing your brilliance with us about what we must be doing for the subsequent 6-months to a yr?

To the entire staff of Hindsight Capital, I pose the next questions:

– Are you a purchaser or vendor of Actual Property at present? Single-family houses or multi-family flats? Which components of the nation? Cities?

– What tech shares are you brief now? Which of them are you lengthy? Which particular areas of tech do you want?

– Money: Do you go to money now? For a way lengthy? When and the place will you redeploy that into threat belongings?

– Bonds: Purchaser or vendor? Which of them? What period?

– Fairness: What sectors are you patrons of? Sellers? Which shares?

– Alts/Privates: How a lot of this funding technique must be a part of your portfolio right here? When do you get in or out? Which asset varieties?

– Power: How a lot increased is oil going? How lengthy does the struggle final? When do costs come down?

– Lastly, what’s your foundation for the entire above determinations?

As a lot as we could all need to work for and with the parents at Hindsight Capital, it’s not possible they’ll do enterprise with you. A part of their attract is that received’t take your cash, however they’re all too completely happy to let you know the way you ought to have invested it . . .

Beforehand:

Judgment Underneath Uncertainty (March 25, 2022)

Hindsight Bias Free for All (Might 27, 2020)

Explaining the Correction, with Good Hindsight (October 15, 2018)

Traders and Political Pundits Fooled by Randomness (November 11, 2016)

_______

1. I not perceive why anybody cites the kind of irrelevant 30 inventory Dow Industrials anymore. One way or the other, inertia retains us discussing this meaningless concentrated mutual fund as if it issues anymore; it doesn’t. Maybe that is fodder for a future dialogue.

2. The earliest printed model of the phrase “Hindsight Capital” I might discover was through my colleague John Authers, who printed the phrase in a Monetary Instances column in 2008: “Hindsight Capital LLC had an awesome 2008. It has all the time been profitable as a result of it makes use of the technique that yr in and yr out is best than every other: hindsight.” Authers has revisited the subject yearly ever since.