Hey, dealer. Tim right here.

Shedding small is my mantra.

Nonetheless, lots of you battle to place it into observe.

Merely put, you don’t know how you can outline your trades.

I need to use Jiuzi Holdings Inc. (JZXN) for instance this level.

No, this inventory didn’t turn into a winner.

However verify this out…

My winners outweighed my losers!

There isn’t some secret formulation that creates this sort of consequence. It’s primary math.

All of it boils all the way down to how three components relate to at least one one other.

Right here’s what I imply.

Framing Your Setup

Each single commerce begins with a setup.

And each setup has three components:

- Entry

- Revenue goal

- Cease loss

You must be capable of inform me every of those BEFORE you enter a commerce.

That sounds easy. I agree.

So, right here’s the second step.

That you must outline how these relate to one another.

Consider a coin flip.

You might have a 50% probability of getting heads or tails.

If I guess you $1 to make or lose $1 for each flip, over time, I’d break even.

Positive, we may see a run of wins or losses. However flip the coin and make this guess sufficient, I’d break even.

Now, think about I purchased a inventory at $1 per share. It has a 50% probability of hitting $1.10 and a 50% probability of hitting $0.90.

Identical because the coin flip, if I reproduced this commerce time and again, I’d break even.

However what would occur if as an alternative of shopping for at $1.00 I entered the commerce at $0.99?

Assuming I nonetheless had a 50/50 shot on the revenue and loss stage, over time, I might become profitable. It wouldn’t be a lot, however it might be a worthwhile enterprise.

You see, merchants can become profitable one in all two methods (and all over the place in between):

- A excessive win price with small wins that outweigh the massive losses

- A low win price with large wins that outweigh the small losses

Your means to become profitable over time is predicated on an idea often known as anticipated worth.

Anticipated worth (EV) is the quantity you anticipate to make or lose over time given sufficient trades that happen beneath the identical circumstances.

It boils all the way down to your threat and your win-rate.

Right here’s the formulation:

EV = (% Likelihood of Win x Potential Revenue) – (% Likelihood of Loss x Potential Loss)

Let’s return to the instance the place I purchased a inventory at $0.99 and had a 50/50 shot it might get to $0.90 or $1.10.

Right here’s the anticipated worth:

EV = (50% x $0.11) – (50% x $0.09) = $0.055 – $0.045 = $0.01

Now, right here’s the cool half.

Assuming your chance of success doesn’t change, a decrease entry creates a multiplier impact in your anticipated worth.

Going again to our instance, let’s now assume you will get $0.98 on your entry.

What’s a penny matter proper?

On this case fairly a bit.

EV = (50% x $0.12) – (50% x $0.08) = $0.06 – $0.04 = $0.02

You’ve doubled your anticipated worth!

Why?

Since you gained extra potential earnings WHILE decreasing your potential loss.

And that is the important thing once I speak about shedding small.

I need setups with incredible entries that give me tiny losses and large potential earnings. That approach, I don’t have to win all that always. Simply sufficient to make it rain.

Software – $JZXN

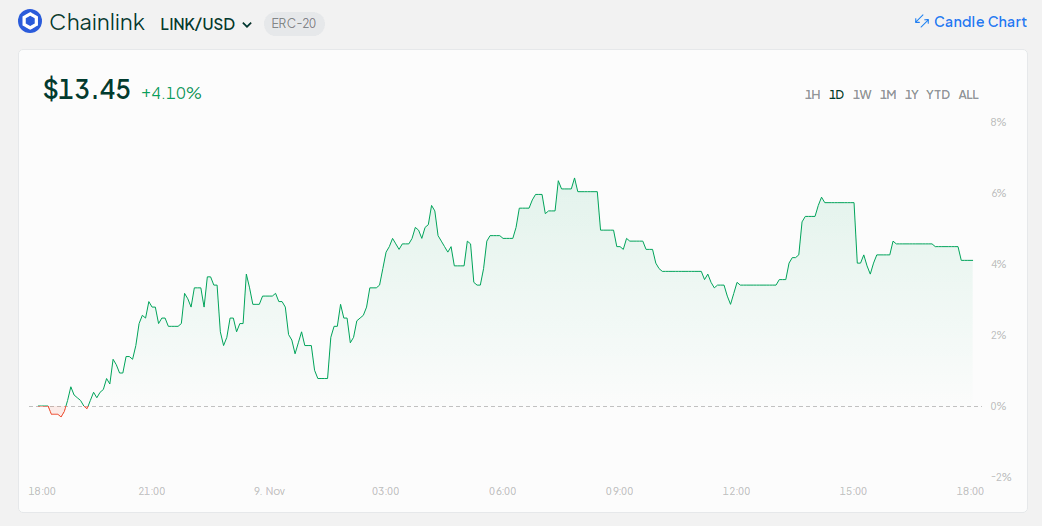

Let’s step right into a chart of JXZN.

Because of our Breaking Information Staff, I picked up on this inventory because it acquired a lift within the premarket.

From there, shares consolidated round $2.40 earlier than dropping all the way down to round $1.75.

I need you to note the help proper round $1.75.

We didn’t know that the inventory was going to cease there.

However, we had some clues.

In case you look to the left, that was the spot the place value spent a quick, and I do imply temporary, minute or so consolidating earlier than taking the subsequent leg greater.

Now, I’m not saying that’s the place I need to purchase.

Nonetheless, as soon as that reveals me the help stage, I’ve my cease loss space to commerce towards.

From there, I need to establish all of the potential situations the inventory may take.

Because the market opened, shares briefly spiked that value earlier than beginning a run greater.

That to me signaled the help would maintain and the inventory may make a run for the current highs round $2.35-$2.40.

I absolutely admit I didn’t get the best entries right here at $2.04.

However, let’s take a look at the mathematics.

If my cease was $1.75 (which in actuality I minimize at $1.99), and my goal was $2.35, with an entry of $2.04, I can really calculate the win-rate I would wish to breakeven…which is 48.3%.

That’s not nice. However like I mentioned, I didn’t get the entry I ought to have.

Now, what would this commerce have regarded like had I gotten what I set out in my video evaluate?

My very best entry was nearer to $1.90.

Guess what win-rate I would wish to breakeven with that entry?

25%.

Do you suppose with some observe, you would win a commerce like this greater than 1 out of 4 instances?

That’s what I need you to seek out out.

Do your self a favor. Take a look at my SuperNova program and the place you study all you want to establish and commerce these wonderful setups.

Click on right here to study extra about SuperNova.

— Tim