[ad_1]

Revealed on April 3, 2022, by Felix Martinez

The Hole Inc. (GPS) needed to reduce its dividend in the course of the COVID-19 pandemic. Since then, the corporate reinstated its dividend on Could 11, 2021, and it’s now thought-about a excessive yield dividend inventory.

We additionally cowl numerous different completely different high-yield shares in our database.

We now have created a spreadsheet of shares (and carefully associated REITs and MLPs, and so forth.) with dividend yields of 5% or extra…

You’ll be able to obtain your free full listing of all securities with 5%+ yields (together with necessary monetary metrics comparable to dividend yield and payout ratio) by clicking on the hyperlink beneath:

This text analyzes high-yield inventory The Hole Inc. intimately. Whereas it doesn’t have a 5.0%+ yield at present, its dividend yield of 4.5% remains to be excessive, particularly in at this time’s low-interest-rate atmosphere.

Enterprise Overview

The Hole Inc. is an American clothes and niknaks retailer worldwide. The corporate was based in 1982 by Nick Taylor, Donald Fisher, and Doris F. Fisher and is headquartered in San Francisco, California. The corporate has a market capitalization of $5.69 billion. The Hole operates six enterprise strains: Hole, Banana Republic, Previous Navy, Intermix, Hill Metropolis, and Athleta. The corporate has 3,399 retailer areas in over 40 nations, of which 2,835 have been firm operated.

The corporate reported fourth-quarter and full-year outcomes for Fiscal 12 months (FY)2021 on March 3, 2022. The corporate introduced in $4.5 billion in web gross sales, down 3.2% in comparison with 2019 pre-COVID. Strategic everlasting retailer closures and divestitures diminished web gross sales by roughly 9% versus 2019. On-line gross sales grew 44% in comparison with the fourth quarter of 2019 and represented 43% of the overall enterprise.

Fourth-quarter comparable gross sales have been up 3% versus 2019 and three% year-over-year, for the quarter web revenue was a lack of $16 million in comparison with a lack of $184 million in Q42019. Thus, for the quarter, earnings per share have been adverse $0.04 versus a adverse $0.49 within the fourth quarter of 2019.

The fiscal 12 months 2021 web gross sales have been $16.7 billion, which is a 2% improve versus the fiscal 12 months 2019. On-line gross sales grew 57% versus 2019 and represented 39% of complete web gross sales for the 12 months. Comparable gross sales for the fiscal 12 months 2021 elevated 8% versus 2019 and have been up 6% year-over-year.

The Previous Navy phase noticed gross sales barely flat on account of provide chain impacts. It was up 2% versus 2019, with comparable gross sales flat versus 2019. The model crossed $9 billion in web gross sales for the 12 months, up 14% in comparison with the fiscal 12 months 2019, with comparable gross sales up 12% versus 2019. The Hole phase noticed gross sales decline 13% versus 2019 for the quarter on account of retailer closures, which the corporate estimates are a 17% decline.

Total, the corporate reported diluted earnings per share of $0.67 with adjusted diluted earnings per share of $1.44, a major enchancment from 2020. The corporate additionally introduced a 25% dividend improve from $0.12 per share per quarter to $0.15 per share per quarter. This announcement was made on February 24, 2022.

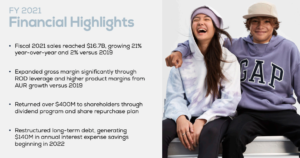

Supply: Investor Presentation

The administration staff offered the FY2022 monetary outlook. The administration staff expects diluted earnings to be $1.95 to $2.15 per share for the 12 months. We can be extra conservative and suppose that the corporate can earn $1.88 per share. Internet gross sales development is anticipated to be within the low single-digit vary versus the fiscal 12 months 2021, with first-quarter web gross sales anticipated to be down mid to high-single digits versus the primary quarter of 2021.

Development Prospects

The Hole Inc. manages a portfolio of manufacturers and has the scale and capital power to amass new manufacturers to bolster its enterprise or interact in aggressive share repurchases. Natural development by means of acquisitions might symbolize an upside to traders. The Hole also can capitalize on the retail business’s weaknesses by shopping for distressed manufacturers and belongings. An instance can be buying the high-end youngsters’s clothes line Janie and Jack from a bankrupt retailer, Gymboree, for $35 million.

Different types of development can come from rising on-line gross sales. For the 12 months, on-line gross sales have been 39% of the corporate income. This may be finished by working with web influencers and with on-line advertising. One other supply of development for the corporate can be to attempt to improve its market shares within the Asia and Europe area. Total, the Asia market made up solely 4% of the corporate’s complete income. Whereas the Europe market made up solely 2%. Thus, there are various enhancements that may be made in these markets.

Supply: Investor Presentation

One other development driver from the corporate is with is loyalty applications. Presently, the corporate has over 50 million members. These members usually tend to spend two occasions greater than non-members and thrice like to buy throughout.

Supply: Investor Presentation

Aggressive Benefits & Recession Efficiency

We expect that Hole doesn’t essentially have a aggressive benefit. The corporate does have effectively know manufacturers like Hole, Previous Navy, and Banana Republic, however we don’t suppose they’ve differentiated product or model power for premium pricing. The corporate Hole model is extremely depending on primary attire like T-shirts, denims, shorts, polo shirts, and sweaters.

The corporate carried out very effectively in the course of the Nice Recession of 2008-2010. Nevertheless, the inventory worth noticed a lower of over 46% from the excessive of 2007 to the low in 2009, however earnings elevated in that very same interval.

GPS’s earnings-per-share all through the Nice Recession:

- 2007 earnings-per-share of $0.93

- 2008 earnings-per-share of $1.12 (20% improve)

- 2009 earnings-per-share of $1.34 (20% improve)

- 2010 earnings-per-share of $1.58 (18% improve)

As you see, the corporate did effectively in the course of the 2008-2009 Nice Recession. Earnings elevated in these years. Additionally, the corporate was in a position to improve its dividend in these years. Throughout these years, earnings per share lined the dividend very effectively.

Dividend Evaluation

The corporate pays out a excessive dividend yield at present. Due to the latest dividend reduce that was precipitated due to the COVID-19 pandemic, the corporate dividend seems loads safer. Earlier than COVID-19, the corporate was paying a couple of 5.5% dividend yield. This was nonetheless lined by earnings, as the corporate earned $1.97 per share in FY2019 whereas paying out a dividend of $0.97.

Nevertheless, due to the reduce, the corporate is now paying a dividend of $0.60 per share for the 12 months. Because the firm earned $1.44 per share for FY2021, this provides us a dividend payout ratio of 42%. Thus, the dividend could be very effectively lined with earnings. As we talked about above, we anticipate the corporate to earn $1.88 per share for FY2022. Utilizing the identical dividend fee of $0.60 for the 12 months will give us a dividend payout ratio of 32%. Thus, giving us extra confidence that the dividend can be protected for the foreseeable future.

On a Free Money Stream (FCF) foundation, the dividend can be effectively lined. In FY2021, the corporate reported an FCF of $1.41 per share. This presents us with a payout ratio of 43%. FCF is anticipated to lower barely for FY2022, however it’ll nonetheless cowl the dividend with a payout ratio of 49%.

The corporate additionally has a shaky steadiness sheet. The corporate has a 2.3 debt-to-equity ratio, which is slightly excessive for us, and an curiosity protection ratio of two.9 which is low. Moreover, Hole Inc. has an S&P Credit score Score of “BB.” This credit standing isn’t an investment-grade score from S&P.

Thus, the steadiness sheet is in unreliable situation and traders ought to look by means of it completely.

Remaining Ideas

The corporate is present process a metamorphosis wherein prices can be incurred to restructure the enterprise and develop by means of natural initiatives or inorganic acquisitions. We estimate 4% EPS development yearly over the following 5 years. The Hole has a double-digit anticipated complete return. This is because of decrease valuation and better anticipated earnings for FY2022. Thus, we fee the Firm a Purchase for speculative traders and people who are on the lookout for a excessive dividend yield inventory.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link