[ad_1]

Gujarat has consistently maintained its position as one of India’s most fiscally prudent States. From maintaining low levels of debt to keeping its fiscal deficit way below the Finance Commission’s prescribed limits to an enviously low unemployment ratio to attracting a major chunk of the country’s foreign direct investments, the western coastal State has scored well in most of the fiscal and economic parameters over the last several decades.

Thanks to its long coastline, business-oriented society, well-developed ports, connected highways and industry-friendly policies and reforms over the last 2-3 decades, Gujarat has been at the forefront of industrialisation and exports-led growth.

The incumbent Bharatiya Janata Party government came to power in Gujarat in December 2017. With the State gearing up for the 15th Assembly election on December 1, businessline looked at how the current government performed under some of the key fiscal parameters.

The term was marred by over two years of the Covid-19 pandemic, therefore not much can be expected on the growth front. But the State has proved very resilient thanks to the entrenched reforms and progressive policies and scored well on most parameters.

Stable economic growth

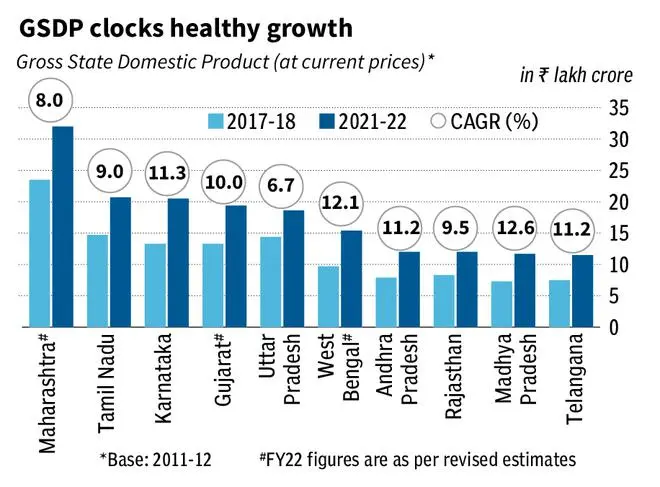

Gujarat has improved its rank in terms of GSDP under the incumbent Bhupendrabhai Patel government. While it was the fifth-largest State in terms of GSDP in FY17, the rank improved to fourth position by FY22. The State’s Gross State Domestic Product (GSDP) grew at a compounded annual growth rate of 10 per cent to ₹19.44-lakh crore as of FY22, from a GSDP of ₹13.29-lakh crore in FY18.

But this strong growth performance is not new. Himani Baxi, Faculty, Department of Economics, School of Liberal Studies, Pandit Deendayal Energy University, said irrespective of the political party in power in the last 3-4 decades, Gujarat’s GSDP growth has always been higher than the national average. She attributed the GSDP growth to historically strong performance of all the core economic sectors, including petrochemicals, dairy, textiles, gems and jewellery and marine exports.

Baxi added that the ‘Gujarat Model’ of development is not just restricted to industrial growth. “In recent times, many farmers have shifted to cash crops. Reforms for selling farm produce through APMCs were brought in way back in 2016. The Narmada irrigation has helped farmers to move from one crop a year to three crops. All this has increased the share of agriculture to state GDP.”

Fiscal deficit

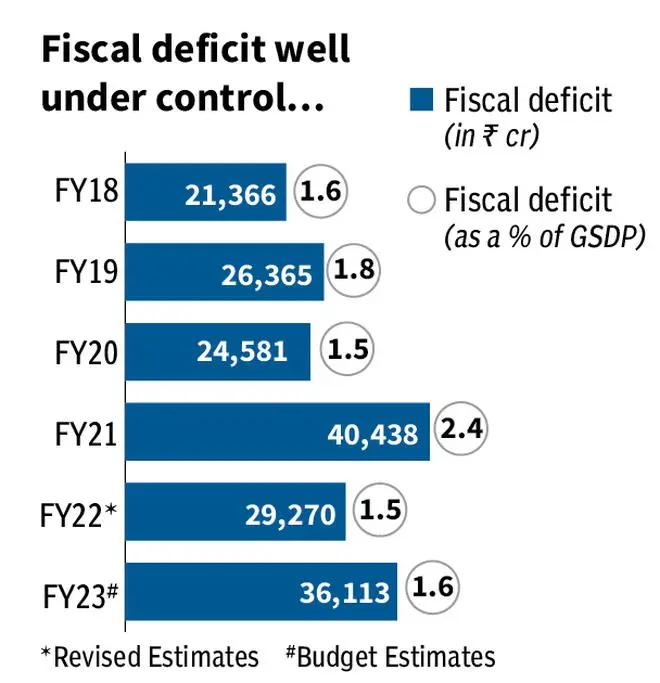

The State’s fiscal deficit, as a percentage of GSDP, also remained under control in the last five years, except for FY21, when all States faced the challenge of falling revenues and raising expenditure due to the pandemic.

According to the revised estimates for FY22, Gujarat’s fiscal deficit stood at ₹29,270 crore or 1.51 per cent of GSDP, much lower than the permissible limit of 4 per cent. The Fiscal Responsibility and Budget Management (FRBM) Act allows a fiscal deficit of 3.5 per cent of GSDP. In the FY23 Union Budget, the Centre allowed an additional 0.5 per cent deficit for States that undertake power sector reforms.

Baxi said even before the Centre introduced the UDAY Scheme, Gujarat had already undertaken power sector reforms under its Electricity Act, 2003. “So, Gujarat was never under any financial mess in the power sector like the way other States were/are.”

The State also moved from the Old Pension Scheme (OPS) to the National Pension System (NPS) to reduce the fiscal burden on the State exchequer. “The move has helped the State to reduce its committed expenditure, which, in turn, means reduced borrowings,” said Baxi.

The shift to NPS has led to wide-spread agitations by government officials with the Congress and Aam Aadmi Party promising to revert to the OPS if elected to power.

Stagnating capex

Fiscal deficit is the excess of total expenditure over total receipts. The State was able to keep its fiscal deficit under check by deftly controlling its expenditures. The State’s total expenditure grew from ₹1.44-lakh crore in FY18 to ₹1.87-lakh crore in FY22. Within that, while the revenue expenditure went up by over ₹41,000 crore, capital expenditure rose only by ₹1,800 crore.

Baxi acknowledged that the State’s total expenditure has been stagnant for the last few years. “Gujarat is very advanced in implementing Public-Private Partnership (PPP), be it in highways, road construction, bullet train projects or ports. As a result, while infrastructure is building up, the government doesn’t have to spend much on capital expenditure.”

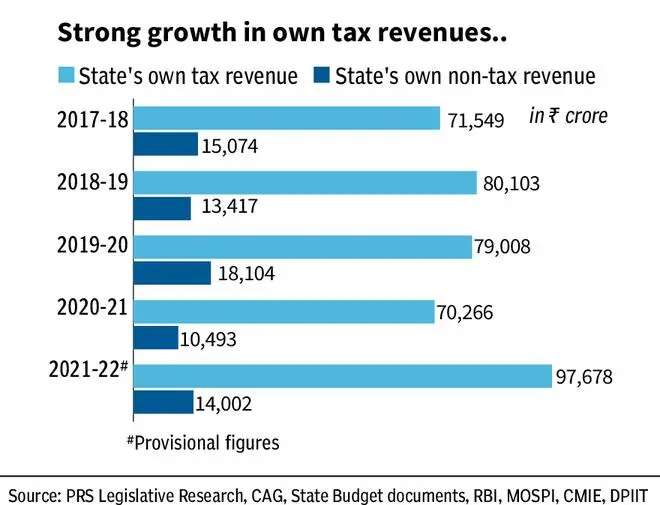

The State also recorded a strong growth in its own tax revenue collections. From ₹71,549 crore in FY18, Gujarat’s own tax revenues went to ₹97,678 crore in FY22. The State has projected its own tax revenue of ₹1,14,883 crore for FY23, of which, State GST accounts for 46 per cent followed by Sales Tax/ VAT (27 per cent) and Stamp Duty and Registration Fees (11 per cent).

FDI inflows

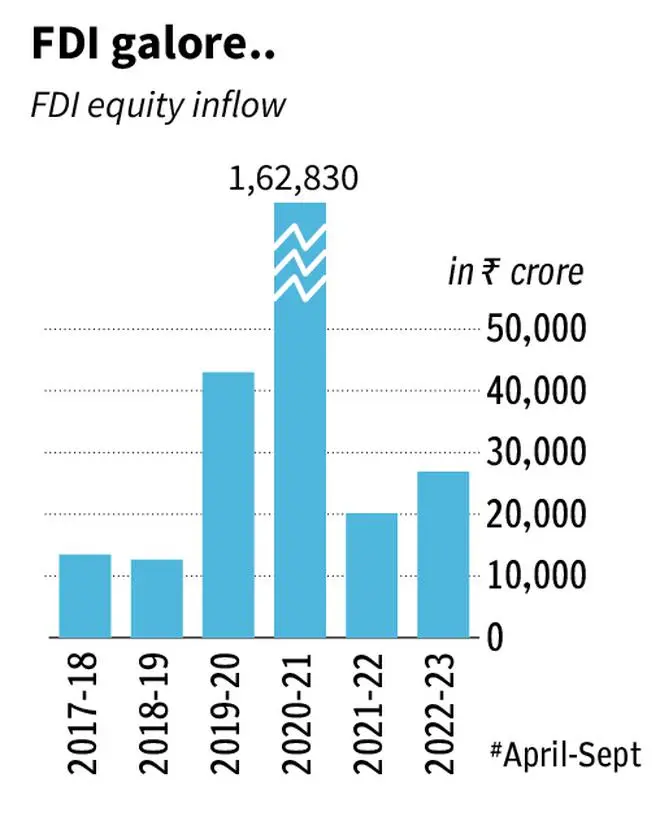

Gujarat has been among the top destinations for foreign direct investment (FDI) inflows over the years. Despite a pandemic-hit year, the State attracted highest ever FDI flows of ₹1.62-lakh crore in FY21. The year saw many multinational corporations such as MG Motor, Procter & Gamble (P&G), ESR India and Indian Oil Corporation pouring thousands of crores in investments.

Even in the current fiscal, the State attracted some large-scale investments, including multi-billion semiconductor manufacturing projects by Vedanta Group and Taiwan-based Foxconn; ₹21,000-crore C-295 aircraft manufacturing joint venture between Tata and Airbus; and a 2,000 acre Diamond Bourse in Surat, to name a few. A Financial Times report on Friday reported that billionaire Gautam Adani is planning to invest more than $4 billion in a petrochemical complex in Gujarat.

Baxi said land acquisition is not as much a problem in Gujarat as it is in other States. “Farmers here are more entrepreneurial. Some farmers hold parcels of land with the very idea of selling them under the Land Acquisition Act.”

She also added that business facilitation and time-bound approvals have always been a key part of Gujarat’s administration even before the idea of ‘ease of doing business’ came about. That partly explains why the State has been a go-to destination for multinational companies and corporations looking to set up large manufacturing units.

Unemployment

Gujarat’s monthly unemployment rate in October stood at 1.7 per cent as opposed to other major industrial States such as Maharashtra and Tamil Nadu, whose unemployment ratio stood at 4.2 per cent and 3.3 per cent, respectively.

Baxi noted that like many other States, Gujarat has also put recruitments on hold in the education sector and other government bodies. However, she added a lot of Special Purpose Vehicles (SPVs) are being opened, which are taking care of manpower recruitments to run the quasi-government entities or parastatal bodies. “So, the government is not expected to spend much on these aspects.”

[ad_2]

Source link