Tempura/E+ by way of Getty Photographs

GIC Holds Regular

World Industrial Firm (NYSE:GIC), which operates within the industrial and MRO product gross sales in North America, focuses on territory gross sales administration applications to construct relationships. The non-public model stays a essential focus as a result of of its high-profit margin. The corporate’s end-to-end buy, service, and digital and multi-channel gross sales assist enhance working margin.

However, gross sales headwinds in Canada and commodity worth inflation can mitigate part of the anticipated revenue positive factors. The demand aspect, too, stays unsure given the evolving COVID scenario. Though money flows decreased in FY2021, normalization of stock balances can cut back the stress on working capital necessities. The inventory is fairly valued versus its friends. I don’t see sturdy drivers that may transfer the inventory in both route. Nonetheless, buyers may need to maintain the inventory within the short-to-medium time period, given the latest dividend hike.

Advertising Exercise And Methods

One of many key methods for GIC is to strengthen the non-public label and personal model technique, which has a considerable margin profit. Advertising initiatives are important in an trade that offers immediately with prospects. The corporate focuses on territory gross sales administration applications to construct public sector and personal market relationships. The non-public model stays a essential focus due to the high-profit margin related to the non-public section. One vital initiative undertaken by the corporate has been the Accelerating the Buyer Expertise (or ACE), which encompasses prospects’ end-to-end buy, service, and supply expertise. This works with the digital and multi-channel gross sales mannequin for product class enlargement in non-public model merchandise. This system goals to drive repeat orders and will increase prospects’ annual and common spending.

Enter Price Rise And Stock Price Administration

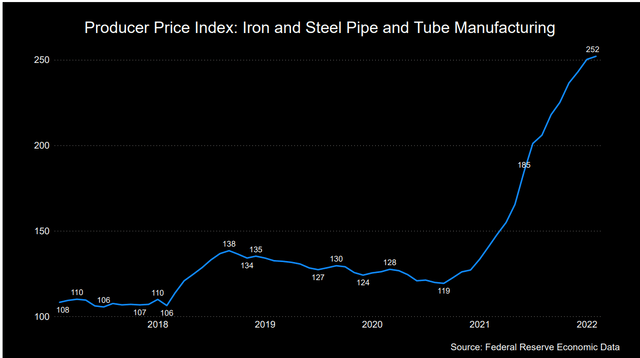

Federal Reserve Financial Information

Concurrently, it retains broadening the product verticals and leveraging vendor relationships to maintain prices down. GIC plans to enhance working revenue margin by means of pricing analytics, higher-margin sourcing channels, and freight optimization. One in all its advantages in late-2021 was utilizing lower-cost stock utilizing the FIFO technique. For the reason that commodity worth inflation and wage inflation are consuming away a lot of the revenue positive factors, the above initiative would matter to stability out the price hike and produce the margin again up. The Producer Value Index for iron & metal merchandise has elevated alarmingly (79% up) prior to now 12 months till February 2022. So, regardless of the higher product and buyer combine, I anticipate the margin progress to remain muted within the medium time period.

Additionally, throughout This fall, the corporate’s SG&A prices went up as a consequence of elevated advertising investments in product traces and different progress initiatives. For instance, it just lately began implementing superior slotting strategies in its distribution facilities. The method enhancements will enhance order processing speeds and improve productiveness. I anticipate numerous advertising initiatives to maintain the SG&A prices excessive in 2022.

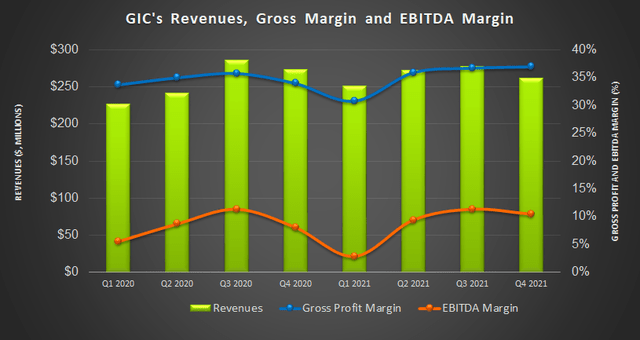

This fall Drivers And Margin Evaluation

In search of Alpha

The corporate’s revenues decreased by 5.6% in This fall 2021 in comparison with Q3. A lot of the topline loss could be attributed to decrease revenues from Canada following an hostile change in forex and decrease PPE gross sales. The corporate’s US operation, nonetheless, witnessed reasonable progress. Greater managed gross sales channels and e-commerce orders made up the majority of the order progress prior to now 12 months till This fall. Open order guide, nonetheless, has doubled over the previous 12 months. Regardless of that, the provision chain constraints led to elevated variable promoting bills and delays so as success.

The corporate’s working revenue elevated by 24% year-over-year. As I defined earlier than within the article, the non-public model providing improved gross sales combine and impacted worth rationalization, resulting in a good product margin. Decrease FIFO stock sell-through will proceed to mitigate greater enter prices within the brief time period.

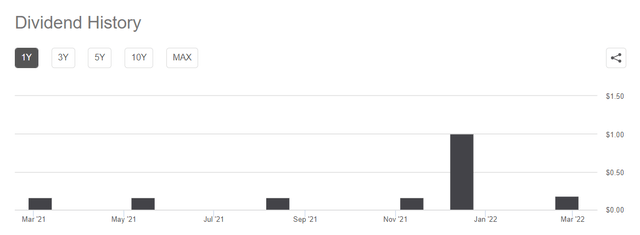

Money Flows And Dividend

In FY2021, greater working capital necessities pushed GIC’s money move from operations (or CFO) decrease (27% down) than a 12 months in the past. Elevated stock balances following greater freight price and security inventory and in-transit stock addition resulted within the CFO fall. So, free money move (or FCF) additionally declined prior to now 12 months. The administration expects 2022 capex to be within the vary of $7 million-$9 million, which is greater than double in comparison with FY2021.

In search of Alpha

GIC doesn’t have any long-term debt, which places it in a way more advantageous place than its friends (FAST, MSM, and MRC) as of December 31, 2021. Its liquidity was $81 million as of December 31, 2021. In early 2022, the administration elevated the quarterly dividend. It at present pays an annual dividend of $0.72, which interprets right into a 2.24% dividend yield.

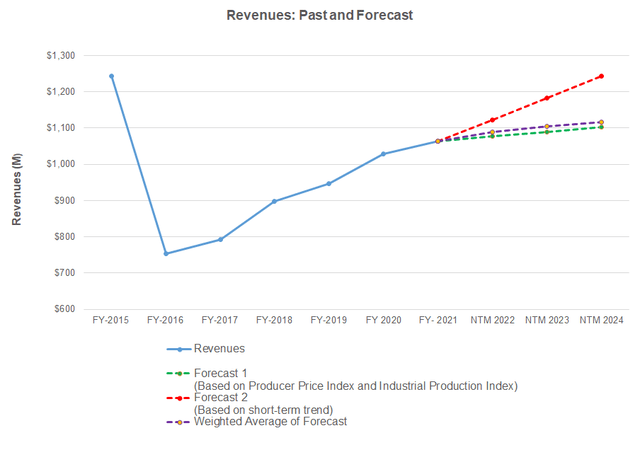

Linear Regression Primarily based Forecast

Writer created, In search of Alpha, and FRED Financial Analysis

Primarily based on a regression equation between Producer Value Indices for iron & metal merchandise, Industrial manufacturing Index, and GIC’s reported revenues for the previous seven years and the earlier 4 quarters, revenues can stay regular within the following three years.

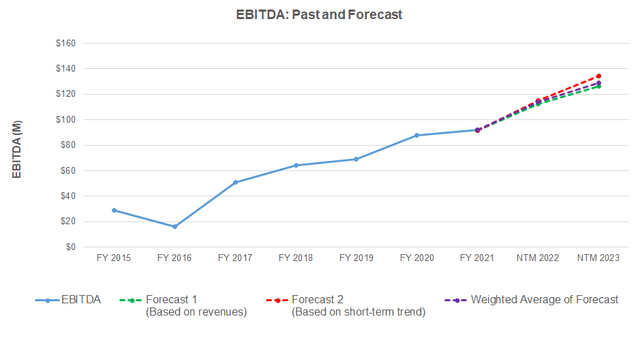

Writer Created and In search of Alpha

Primarily based on a regression mannequin utilizing the common forecast revenues, I anticipate the corporate’s EBITDA to extend within the subsequent 12 months (or NTM 2022) and can proceed to develop at a extra reasonable charge in NTM 2023.

Goal Value And Relative Valuation

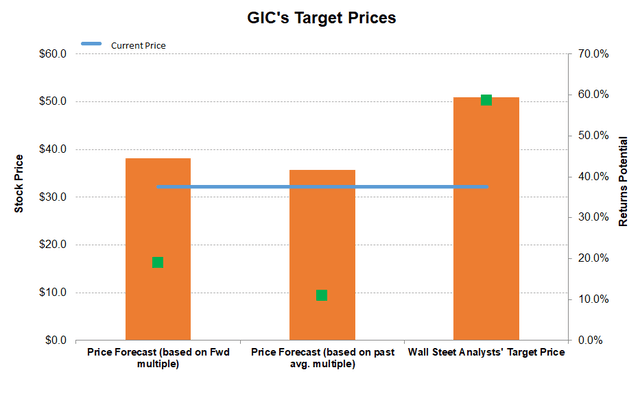

Writer Created and In search of Alpha

GIC’s returns potential (19% upside) utilizing the ahead EV/EBITDA a number of (12.6x) is decrease (than Wall Avenue’s sell-side analyst expectations (59% upside) however greater than returns potential (11% upside) primarily based on the previous EV/EBITDA a number of.

The corporate’s EV/EBITDA a number of (14x) is decrease than its friends’ (FAST, DNOW, and MRC) common. GIC’s ahead EV/EBITDA a number of contraction is much less steep than its friends’ EV/EBITDA contraction, usually leading to a decrease EV/EBITDA a number of in comparison with friends. So, the inventory is fairly valued on a relative foundation.

What’s The Take On GIC?

In search of Alpha

GIC engages within the sale of business and MRO merchandise. For the reason that market is often fragmented, it focuses on territory gross sales administration applications to construct relationships. Due to this fact, branding, particularly within the non-public section, stays a key differentiator to earn a high-profit margin. The corporate’s end-to-end buy, service, and digital and multi-channel gross sales assist enhance working margin. In This fall, the corporate’s working margin expanded.

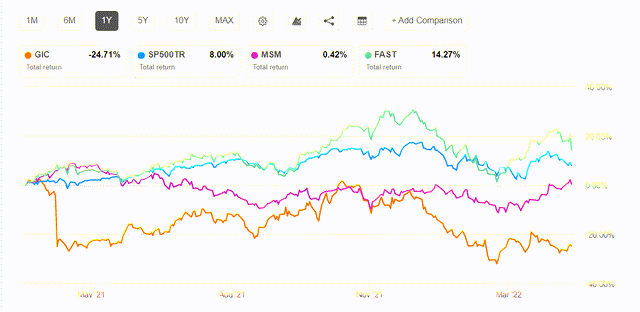

Commodity worth inflation and wage inflation are consuming away among the revenue positive factors, as evidenced by the upper producer worth index. In This fall, the corporate witnessed a topline loss in Canada. Additionally, throughout FY2021, working capital necessities elevated as a consequence of greater stock balances as a result of freight prices and security inventory, and in-transit stock swelled. As money flows fell, the inventory underperformed the SPDR S&P 500 Belief ETF (SPY) prior to now 12 months. Nonetheless, given the relative valuation, I believe the inventory worth will stay regular within the short-to-medium time period.