leminuit/E+ by way of Getty Photos

Actual property possession is without doubt one of the greatest paths to long-term revenue era. Nonetheless, as with all asset class, valuation issues as shopping for too excessive can chip away at years of revenue.

That is why it might be worthwhile to layer into lesser adopted REITs that haven’t but been “found” by the mainstream market. This brings me to Gaming and Leisure Properties (NASDAQ:GLPI), which can be one such case. On this article, I spotlight why GLPI is a worthy decide at present costs, so let’s get began.

Why GLPI?

Gaming and Leisure Properties is considered one of simply 2 publicly-traded REITs that focuses on proudly owning properties leased to gaming operators. At current, GLPI owns 55 properties diversified throughout 17 states, and will get greater than 85% of its hire from well-known publicly-traded gaming corporations comparable to Caesars Leisure (CZR), Penn Nationwide (PENN), Bally’s (BALY), and Boyd Gaming (BYD).

GLPI continues to display accretive development, with AFFO per share bettering by $0.02. GLPI continues to be a internet consolidator within the fragmented gaming phase with the latest acquisitions of Reside! On line casino & Resort in Philadelphia and in Pittsburgh with the Cordish Corporations, bringing the overall variety of acquired properties to 31 since GLPI went public in 2011. Each of those are top quality regional operators that include very lengthy lease phrases of 39 years.

Trying ahead, GLPI has loads of alternatives to pursue improvement on its elevated asset base, as famous within the latest press launch:

We now have additionally positioned GLPI for future development alternatives with Cordish with our settlement to co-invest in all new gaming developments by which Cordish engages over a 7-year interval starting with the time limit of the PA properties.

Trying ahead, GLPI is properly positioned to drive additional development based mostly on our rising broad portfolio of blue-chip regional gaming belongings, shut relationships with our tenants, our rights and choices to take part in choose tenants’ future development and enlargement initiatives, and our skill to construction and finance transactions that we consider will likely be accretive to rental money flows. We consider these components will assist our skill to extend our money dividends and additional our aim of enhancing long-term shareholder worth.

Dangers to the expansion thesis embody larger rates of interest, which raises GLPI’s value of debt. Nonetheless, this additionally will increase the substitute worth of GLPI’s current asset base. Additionally, macroeconomic uncertainty presents a danger for tenants, however the gaming sector has confirmed to be slightly resilient as demonstrated by its bounce again from 2020. Administration additionally famous strengths in tenant hire protection, as famous through the latest convention name:

As macro uncertainty persists and the capital markets volatility is clear, I need to remind everybody on the decision right now that GLPIs enterprise mannequin was constructed with an atmosphere like this in thoughts. In reality, our reported 4 wall protection has once more elevated throughout the portfolio with a variety of leases now at all-time highs. This sturdy protection displays continued working resiliency, whereas it additionally offers a buffer or margin of security for our lease funds.

In the meantime, GLPI maintains a fairly protected quantity of leverage, with a internet debt to EBITDA ratio of 5.6x. The dividend was not too long ago raised by 2% and at present yields a decent 6.3%. It additionally comes with a protected 82% payout ratio, based mostly on Q1’22 AFFO/share of $0.86.

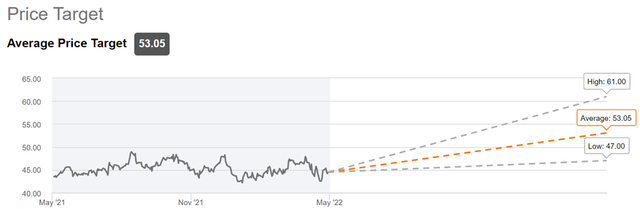

I additionally see GLPI as buying and selling with an affordable margin of security, with worth to annualized AFFO/share of 12.9. Promote aspect analysts have a consensus Purchase score with a worth goal vary of $47 to $61, with $53 on the midpoint, implying a possible one-year 26% whole return together with dividends.

GLPI Value Targets (Looking for Alpha)

Investor Takeaway

Gaming and Leisure Properties is an attention-grabbing choice for traders in search of a excessive yield mixed with regular development. The corporate has sturdy ties to among the largest names in gaming, and its long-term lease agreements present stability and visibility. In the meantime, GLPI has loads of alternatives for each inside improvement and exterior acquisitions. GLPI seems to be engaging on the present worth for top revenue and development.

Gen Alpha Groups Up With Revenue Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Looking for Alpha. Members obtain full early entry to our articles together with unique income-focused mannequin portfolios and a complete suite of instruments and fashions to assist construct sustainable portfolio revenue concentrating on premium dividend yields of as much as 10%.

Whether or not your focus is Excessive Yield or Dividend Progress, we’ve obtained you lined with actionable funding analysis specializing in actual income-producing asset lessons that provide potential diversification, month-to-month revenue, capital appreciation, and inflation hedging. Begin A Free 2-Week Trial Right now!