All through historical past, there has virtually by no means been a foul time to purchase shares of Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B). The corporate, led by legendary investor Warren Buffett, has merely been among the finest investments of all time.

Nonetheless, now valued at practically $1 trillion, Berkshire is not the identical firm it was once. The longer term remains to be very vivid, however there are different related choices traders ought to strongly think about. Even Buffett agrees with this. Over the previous 12 months, he is plowed billions of {dollars} into an organization with a whole lot of similarities to Berkshire.

Buffett is betting billions on this insurance coverage firm

On the core of Berkshire’s empire is a portfolio of insurance coverage corporations. These companies have been the muse of Buffett’s funding technique for many years. The worth of working an insurance coverage firm is that you simply often have investable money accessible. That is as a result of insurance coverage suppliers gather money each time a coverage premium is paid, however they solely must pay out that money when a declare is filed. Within the interim, they get to maintain the capital freed from curiosity. Trade specialists name these interest-free capital “float.”

Float is accessible to insurance coverage corporations no matter financial or market situations. It offers the proprietor of that float the flexibility to speculate capital when it is in scarce provide. In different phrases, it offers Buffett an enormous capital benefit when costs fall and outdoors capital dries up. Suffice it to say that Buffett understands the insurance coverage trade extremely nicely, and it has been key to Berkshire’s long-term success. It ought to come as no shock, then, that Berkshire has been plowing billions into one of many largest, highest-quality insurance coverage operators on this planet: Chubb Ltd (NYSE: CB).

What makes Chubb higher than Berkshire?

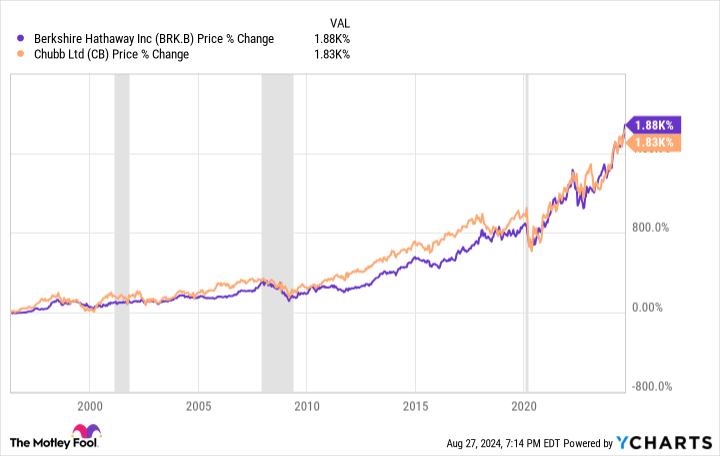

Over the long run, Chubb and Berkshire have posted very related performances, though a latest surge in Berkshire’s worth has pushed it excessive to date this yr. The place Chubb really shines, nonetheless, is throughout instances of turmoil. From 2008 by 2009, for instance — the worst years of the monetary disaster — Chubb outperformed Berkshire by 12%.

It hasn’t been an ideal efficiency, nonetheless. Berkshire’s diversified enterprise mannequin allowed it to sail by the 2020 flash crash extra simply. However over the past 5 years, Chubb has generated a beta of 0.67 versus Berkshire’s beta of 0.87. As a measurement of volatility, these numbers counsel that Chubb inventory is probably going a safer place to be if markets all of the sudden plunge.

BRK.B information by YCharts

Nonetheless, Berkshire and Chubb’s long-term efficiency and volatility are very related, even when Chubb has confirmed a barely superior possibility throughout bear markets. In actuality, maybe the very best cause to purchase Chubb over Berkshire proper now’s the valuation. Chubb inventory trades at simply 1.8 instances e-book worth, whereas the trade common for property and casualty insurers is above 2 instances e-book worth. The typical return on fairness for the trade can be round 10% — decrease than Chubb’s newest results of 14.7%. The valuation turns into much more engaging when you think about Chubb is shopping for again large sums of inventory, an act that creates shareholder worth however tends to depress accounting e-book worth. Greater than $3 billion stays below its present share repurchase program.

Need proof that Chubb’s present valuation is just too good to cross up? Proper now, Berkshire’s money hoard of $277 billion is at an all-time excessive. This comes at a time when Buffett continues to purchase again Berkshire inventory, which trades at a slight low cost to Chubb on a price-to-book foundation. But as a substitute of shopping for again extra Berkshire inventory or holding the capital as money, Buffett opted to construct a $7 billion stake in Chubb. Final quarter, Berkshire invested simply $2.6 billion in share repurchases, suggesting that Buffett views Chubb as a superior funding proper now.

Will Chubb be a much more superior funding within the years to return than Berkshire? Doubtless not. However Buffett is clearly a fan, and the corporate’s cheap valuation, robust returns on fairness, and long-term document of efficiency make it straightforward to grasp why. If you happen to’re a fan of Berkshire, strongly think about including Chubb to your portfolio.

Must you make investments $1,000 in Chubb proper now?

Before you purchase inventory in Chubb, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 finest shares for traders to purchase now… and Chubb wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $731,449!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 26, 2024

Ryan Vanzo has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Berkshire Hathaway. The Motley Idiot has a disclosure coverage.

Overlook Berkshire Hathaway, Purchase This Magnificent Insurance coverage Inventory As a substitute was initially revealed by The Motley Idiot