[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

The IMF has issued a biting criticism of the UK’s plan to implement £45bn of debt-funded tax cuts, urging the government to “re-evaluate” the policy and warning that the “untargeted” package threatens to stoke inflation.

The multilateral lender said it was “closely monitoring” developments in the UK and was “engaged with the authorities” after Chancellor Kwasi Kwarteng’s tax cut announcement last week sparked a collapse in the value of sterling and a surge in borrowing costs.

“Given elevated inflation pressures in many countries, including the UK, we do not recommend large and untargeted fiscal packages at this juncture,” the IMF said.

Borrowing costs are expected to nearly triple to 6.25 per cent, the highest level in 25 years, by May, after the Bank of England’s chief economist warned that the economic plan required a “significant monetary response”. But Huw Pill signalled that the central bank did not expect to act before November.

Kwarteng has promised to publish a medium-term fiscal road map on November 23 to reduce debt as a share of GDP. Here’s what business leaders from Stuart Rose to Crispin Odey have to say about his plans.

More than 2mn households already face sharp rises in mortgage costs over the next two years, dramatically raising the risk of a property crash if many are forced to sell. HSBC and Santander suspended new mortgage deals yesterday, while Nationwide increased rates.

With the collapse of the sterling and surging cost of borrowing, FT economics editor Chris Giles asks, is the UK in a full-blown economic crisis?

Have your say by voting in our poll, or share your thoughts at [email protected]. Thanks for reading FirstFT Europe/Africa — Jennifer

Five more stories in the news

1. US presses EU to speed up Ukraine financial aid Senior Biden administration officials have voiced frustration over the slow disbursement of European assistance, according to four officials speaking under the condition of anonymity, while the IMF is exploring new ways to send cash to Kyiv.

2. ‘Gas sabotage’ suspected in Nord Stream leaks Officials in Denmark, Germany and Poland signalled that leaks in the Nord Stream 1 and 2 pipelines were probably caused by sabotage, heightening concerns over the vulnerability of Europe’s energy infrastructure.

3. Slovakia: energy crisis could ‘kill’ economy Prime Minister Eduard Heger said soaring electricity costs had left the country’s economy at risk of “collapse”, in the starkest comments yet by an EU leader on the global energy crisis arising from Russia’s invasion of Ukraine.

4. UK health chiefs push vaccines ahead of winter ‘twindemic’ Health officials have appealed to millions of people in England to get vaccinated against both coronavirus and flu. The dominant flu virus worldwide is H3N2, a subtype associated with more severe disease.

5. Nigeria raises rates by 150 basis points The country’s central bank raised interest rates to an all-time high of 15.5 per cent as it struggles to contain inflation that hit 20.5 per cent in August, leaving citizens facing soaring costs for fuel and food.

The day ahead

Porsche IPO The German sports car maker is on course to deliver one of Europe’s biggest initial public offerings today after pricing at the top of its range, with a valuation of as much as €75.2bn.

Economic indicators France, Germany and Italy publish consumer confidence data, while the British Retail Consortium Nielsen monthly shop price index is out. Sir Jon Cunliffe, BoE deputy governor for financial stability, delivers a keynote speech at the AFME Operations, Post-trade, Technology & Innovation conference.

Corporate earnings Analysts expect Lego’s half-year results to show sales normalising after a pandemic boom, but with earnings still outpacing toymaking rivals. Other companies reporting include Boohoo, Media for Europe and Shepherd Neame.

The Times’s new editor The 238-year-old British newspaper is set to announce deputy Tony Gallagher as editor, replacing John Witherow, who has run the London-based publication since 2013.

US-Pacific Island Country summit President Joe Biden will host the first-ever US-Pacific Island summit in Washington, where the US will try to further efforts to counter China’s influence in the region.

What else we’re reading

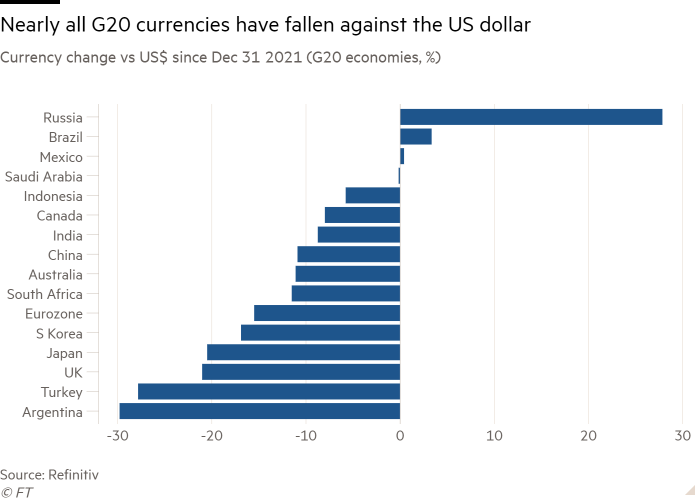

Why the strength of the dollar matters In times of trouble, the dollar is the world’s refuge. Messing up macroeconomic policies, especially fiscal management, proves particularly dangerous when the dollar is strong, interest rates are rising and investors seek safety. Kwasi Kwarteng, please note, writes Martin Wolf.

The 90km journey that changed the Ukraine war A lightning assault by Ukrainian forces this month allowed Kyiv to reclaim as much territory in a few days as Moscow had captured in months. Our interactive traces how the counteroffensive dramatically turned the tide of the invasion.

Giorgia Meloni’s victory merits concern but not panic A despondent Italian electorate, on a record-low turnout, has once more chosen change. But the very causes that propelled the hard-right Brothers of Italy party — a stagnant economy and political system — should constrain its leader, writes our editorial board.

Inside the struggles of Britishvolt When it formed three years ago, Britishvolt had nothing: no factory site, no in-house technology, no customers and little funding. Since then, the battery company has built what it hopes will transform it into the UK’s automotive industry future. But there are road bumps ahead.

Deflecting asteroids is only one thing on our worry list Nasa’s mission to slam a small asteroid 11mn km from Earth was, literally, a striking achievement that gives hope we can defend our planet. But human nature and technology present risks of their own, writes Anjana Ahuja.

House & Home

Dame Prue Leith’s Gloucestershire house is colourful. Immensely colourful. Take a look inside the Bake Off star’s showstopping home.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to [email protected]

Recommended newsletters for you

The Climate Graphic: Explained — Understanding the most important climate data of the week. Sign up here

Long Story Short — The biggest stories and best reads in one smart email. Sign up here

[ad_2]

Source link