You usually hear about home hacking as a way to an finish, a easy option to begin your actual property journey, however what if it could possibly be extra? What if home hacking could possibly be your ticket to monetary freedom? At the moment’s visitor, Craig Curelop, creator of The Home Hacking Technique, shares how he reached monetary freedom via home hacking and methods to comply with alongside in his footsteps.

Craig began the place most do, hating his W-2 and dealing an excessive amount of. He started researching methods to earn a passive earnings and got here throughout BiggerPockets. Inside six months, Craig began working at BiggerPockets, moved to Denver, and determined to start out residing his life the best way he needed. Utilizing his home hacking technique, he went from being $30,000 in debt to monetary freedom in two and a half years.

Earlier than you get into home hacking, it’s essential to perceive the fundamentals, and immediately Craig breaks them down. He goes over the other ways to accommodate hack and its benefits and drawbacks. Craig additionally talks about methods to stay along with your tenants and the boundaries wanted on your ultimate home hacking scenario. Craig paints the entire image so you may make an knowledgeable choice and resolve if home hacking is the best way so that you can grow to be financially free too (or at the least construct extra passive earnings)!

Ashley:

That is Actual Property Rookie Episode 195.

Craig:

And so, it’s essential to have a look at the home with the right structure, so that you could separate the upstairs and downstairs. For instance, there’s many homes within the Denver space the place the facet door that’s proper the place the steps are to go downstairs. So, all it’s important to do is put just a little wall up or put just a little door up and also you’ve received two separate models. And that will be good to Airbnb the downstairs. We do this. I’ve received many properties which might be simply that and I believe that’s essentially the most environment friendly approach and the best way I like to accommodate hack now.

Ashley:

My identify is Ashley Kehr and I’m right here with my co-host, Tony Robinson.

Tony:

And welcome to the Actual Property Rookie podcast the place each week, twice every week, we provide the inspiration, info and motivation that it’s essential to kick begin your actual property investing profession. Ashley Kehr, my co-host, what’s occurring? What’s new in your neck of the woods?

Ashley:

Properly, I’m presently in a stretched place making an attempt to get my knee to cease being painful proper now. The six-month, the by no means ending complaining of me with my knee issues. However hopefully, I simply had my final surgical procedure and hopefully, I’m on the mend, however I prevented my ache tablet immediately, which I in all probability mustn’t have. However I needed to be of a sound thoughts for the podcast recording, however I really feel like that’s not even doable, even with out me on medicine, so yeah.

Ashley:

However yeah, aside from that, every part’s good. I’m going to have a look at a property tonight that might probably simply be a long-term purchase and maintain and getting excited. I believe when this airs, this has already occurred, however I’m going out to Boise, Idaho to a convention that I’m going to be the emcee at and talking at for AJ Osborne. And it’s his CRU Circle occasion, so it’s on principally about industrial actual property investing.

Tony:

Yeah, it’s thrilling. There’s like a loaded lineup of audio system for that one. I believe Thatch is talking there, Brandon is talking there, so fairly a couple of variety of folks. When is it once more? June, what via what?

Ashley:

June 14th to the seventeenth.

Craig:

Okay. I believe we’re at one other convention that overlaps with that, however yeah, I noticed the lineup. I assumed it was actually cool. I needed to attend. So, it’s important to give us the total obtain when you get again.

Ashley:

Don’t fear. Observe my Instagram tales and also you’ll have the ability to see all that.

Tony:

There’ll loads of that, yeah.

Ashley:

Nothing in regards to the convention, it’s simply the after occasion.

Tony:

Simply the yeah.

Ashley:

No, I’m kidding.

Tony:

Yeah. Extra hula hoops and masquerading views and stuff like that. How cool.

Ashley:

Yeah. Yeah, the final time I went to an AJ Osborne convention, it was in Coeur d’Alene, Idaho and it was a Self-Storage Convention. And I keep in mind the primary night time, he’s like, “Oh, I’m having similar to a small VIP little cocktail hour. It’s simply going to be some hors d’oeuvres and cocktails. Simply be a part of us.” And it was like oysters, recent lower prime rib. I’m like, “Wait. What does this cocktails and hors d’oeuvres? This is sort of a meal, a 10-course meal.” So, the meals is what I’m most wanting ahead to.

Tony:

There you go. All proper. Not the networking, not superb content material. It’s the meals. I like it.

Ashley:

So, what’s new with you, Tony?

Tony:

Really, whereas we had been recording this podcast, I received an electronic mail that we simply closed on one other one among our flips, in order that’s all the time thrilling. This one’s cool as a result of all of our different flips, we’ve been utilizing that cash in direction of the acquisition of extra short-term leases. However this would be the first flip that’s not earmarked for an additional buy. We really get to spend a few of it, in order that’s all the time thrilling. So, we began flipping homes late final yr and we’ve rehabbed, I don’t know, fairly a couple of in Joshua Tree now. So actually, actually excited that we will proceed to develop that a part of our enterprise.

Tony:

And we’re flipping these properties as turnkey short-term rental, so although it’s technically a unique kind of actual property investing it just about continues to be what we’re doing. However as an alternative of us preserving the property, we’re simply promoting to another person on the finish. So, it’s been cool to study this different facet of actual property investing and the properties prove, we get higher each single time. So, for those who guys wish to see the flips otherwise you guys wish to possibly purchase them from us, you guys can comply with on Instagram. It’s @TonyJRobinson. I often submit all of the flips we’re promoting there.

Ashley:

I believe that it’s so cool that you’re taking precisely what you’re doing and studying methods to have a unique exit technique primarily based off of it. But in addition serving to different folks get began. Having a turnkey property is a good way to get began in actual property investing if you already know nothing about rehab and particularly if you wish to get into short-term leases. A whole lot of the properties that you’ve purchased bought out in, and even Joshua Tree, however within the Smoky Mountains, too, quite a lot of them had been just about turnkey, right?

Tony:

Just about, yeah, every part we purchased within the Smoky’s has been turnkey. It was an current short-term rental, it got here absolutely furnished and we spent a few thousand bucks like changing linens and lacking silverware and stuff like that. However yeah, there’s positively a niche proper now I believe within the short-term rental trade, by way of turnkey alternatives in quite a lot of markets. In the event you have a look at long-term leases, there’s turnkey operators in virtually each main location, however that very same factor hasn’t occurred but for the short-term rental. So, we really feel like we’re filling a void there, yeah.

Ashley:

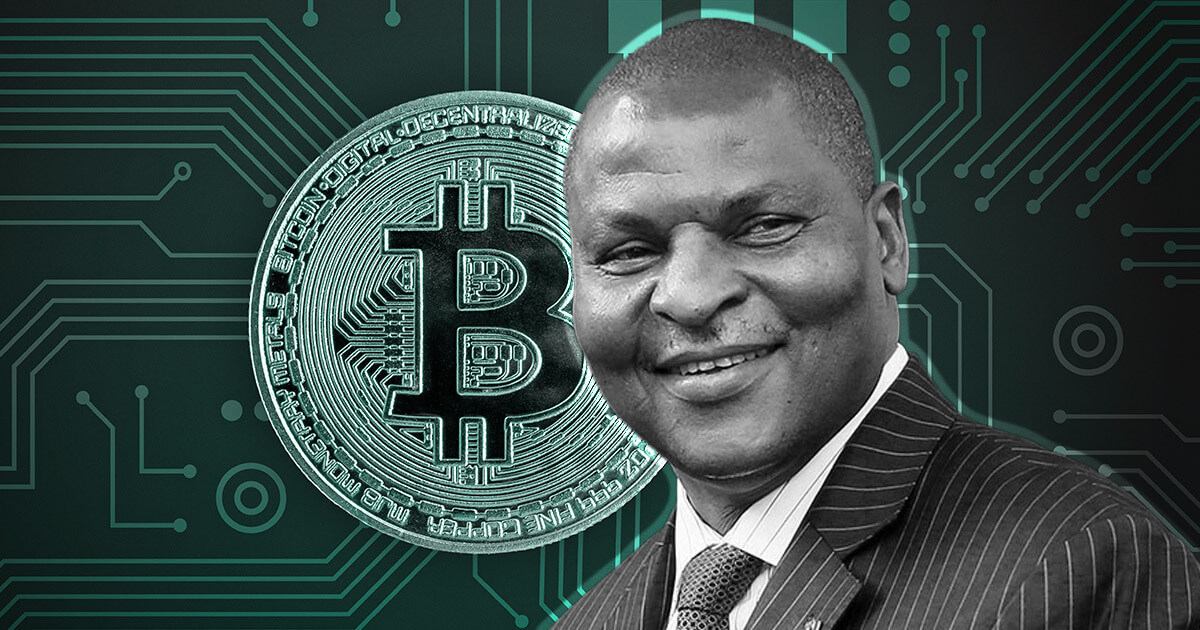

Properly, immediately, we’re speaking a few particular subject and that’s home hacking, not short-term leases. And we have now an skilled on immediately, Craig Curelop, who wrote the e book, the home hacking technique. So, Craig joins us from Denver the place he has his actual property workforce, but additionally not too long ago, we came upon simply moved to Idaho. So, Craig is approaching immediately to speak about home hacking, what it’s, is it nonetheless doable to do in immediately’s market? What are the benefits, the disadvantages of it?

Craig:

And I’m glad we introduced Craig on, as a result of in my thoughts home hacking is likely one of the lowest risked methods I believe to get began as an actual property investor. And Craig Curelop breaks down his five-year blueprint that most individuals can in all probability obtain monetary freedom by following or utilizing home hacking as a technique. So, total, simply Craig is a wealth of data in relation to home hacking and we hear just a little bit about his story, how he received began, how he was sleeping in a cardboard field in his personal front room. And the way that led to him reaching monetary freedom. So, total, only a actually cool dialog with Craig.

Ashley:

Craig, welcome to the present. Thanks a lot for becoming a member of us, since final time we tried to file with you, you ditched us.

Craig:

I do know, I do know. Properly, I missed the memo. I assumed we had been doing this podcast within the river within the Grand Canyon on the Colorado River. So, you guys didn’t present up, I used to be ready for you.

Ashley:

You realize what, I believe that’s the greatest excuse to not present as much as a podcast recording. And you already know what, you’ve positively left your mark since you’re the primary particular person to not present as much as a rookie podcast [inaudible 00:06:41].

Craig:

Actually? I’m within the file books?

Tony:

You’re within the file books, man.

Ashley:

Yeah.

Craig:

All proper, put me down.

Ashley:

And so Craig, inform us just a little bit about your self. For individuals who don’t know, you’ve written the e book, The Home Hacking Technique. You’ve been a giant a part of BiggerPockets and also you’re an actual property agent. So, simply give us a short backstory on you.

Craig:

Yeah. Actually, it began like lots of people begin out on this trade, simply completely hating my W2 job earlier than I labored at BiggerPockets. It was honestly-

Tony:

I used to be I going to say, I used to be like, “What did you’re employed for?”

Craig:

Yeah. Scott’s within the background there, like yeah. No, so it was once I was in California working like a enterprise capital job, being an analyst. And simply working a whole lot of hours every week and searching down the hallway and seeing that my development could be shifting 30-feet down the corridor to being my boss. And possibly I labored 100 hours every week, possibly he labored 80 hours every week, so it actually wasn’t a superb life.

Craig:

And so, I began getting the concept of a passive earnings after studying Tim Ferriss’s e book, the 4-Hour Work Week. And after studying that e book, I used to be like, “Oh, I ought to begin considering of my bills on a month-to-month foundation, my wage on a month-to-month foundation. After which if I can simply get sufficient passive earnings on a month-to-month foundation to cowl my bills, effectively, I’m financially free and I not must work.” And that sounds quite a lot of enjoyable. I get to journey, spend time with buddies, do no matter I need and stay alone time.

Craig:

And so, being in Silicon Valley, I used to be making an attempt to consider dumb startup concept after dumb startup concept and for those who didn’t know, Silicon Valley is full of dumb startup concepts. And so, none of these simply labored. And so then, I went again to my home and I appeared round and I used to be residing in a 20-unit condominium constructing. And I used to be like, “This little Spanish girl, who comes to gather hire each month has in all probability acquire in 100 grand on the primary of each month. And all she has to do is drive her automotive right here.” I used to be like, “That sounds fairly cool.”

Craig:

And so then, I began diving into actual property. Clearly, I discovered BiggerPockets, not lengthy after that after which I went down the rabbit gap. And so, inside six months of discovering BiggerPockets, I discovered myself working at BiggerPockets, shifting to Denver, bought my first home hack. And that’s the place it began.

Tony:

Craig. I like that you simply made that commentary of, “I’m working 100 hours every week. As soon as I get promoted, I get to look ahead to 80 hours every week.” Which is, it’s such a bizarre dynamic, however it’s what so many people are accustomed to and it was that mild bulb that made issues go off for you. It’s so humorous, man. The 4-Hour Work Week was one of many first books I examine entrepreneurship as effectively. So, for me, it was Wealthy Dad, Poor Dad and The 4-Hour Work Week got here shortly there afterwards and that’s once I went down the rabbit gap, too, man.

Tony:

However Craig, what makes you distinctive, man, is that you simply’ve constructed a reputation for your self round one particular technique throughout the world of actual property investing. So, breakdown for us precisely what home hacking is and why you felt it was a superb place so that you can begin your investing profession.

Craig:

Yeah. So, I believe anybody who’s younger or anybody actually, normally, home hacking might be one of the best place to start out. And so, what home hacking is, is the concept that you’re going to buy a one- to four-unit property with a low-percent down, sometimes, 3 to five% down. Since you’re doing a low-percent down mortgage, you’re required to stay there for one yr and when you’re residing there, you’re in a position to hire out the additional bedrooms or the additional models. So, the hire that you simply’re gathering covers your mortgage and also you’re in a position to stay hire free.

Craig:

And I’d wager that 90% of the folks listening proper now, their largest expense is their residing expense, except they’re home hacking, after all. And so then, so that you’re eliminating your largest expense, you’re investing in a property, you’re residing in your funding and so, issues aren’t going to go unhealthy once you’re residing there, since you’re seeing it each single day. So, it’s like landlording on coaching wheels and also you’re in a position to do that yr after yr after yr till you may have a fairly sizable portfolio. And you may simply obtain monetary independence simply via home hacking.

Tony:

Craig, thanks for that breakdown, man. So, I simply wish to recap it to make it possible for our listeners are following. So, basically, you exit, you purchase a property and then you definately hire out the additional area in that property to assist offset your value of proudly owning that house. Did I wrap that up the precise approach?

Craig:

Yeah, you bought it, man.

Tony:

So, Craig, let’s discuss why do you are feeling this technique is a good way for newer traders to start out. And particularly given the place the market is at immediately, there’s quite a lot of worry, I believe, of lots of people who wish to get into investing. Why is home hacking an ideal place to start out?

Craig:

Yeah. It’s an ideal place to start out since you don’t want some huge cash to get began. Easy as that. You want 3 to five% down. So, for those who’re in Denver, shopping for a $500,000 property, you want between $15 and possibly $30,000 down. That could be a lot lower than what it will sometimes value to purchase a $500,000 property over 100 grand. And so, you’re not placing an entire lot of cash down. Due to that, your returns on funding are large.

Craig:

Like I stated prior, it’s you’re landlording on coaching wheels. You’re residing in your funding, so that you’re seeing your tenants come out and in. You possibly can cease issues and nip them within the bud earlier than they get too unhealthy. And so, I believe these are two actually huge explanation why home hacking is a good way to get began.

Ashley:

Now, you discuss that half one million greenback home that anyone goes to go buy and possibly they’re shopping for that as a result of it has 4 bedrooms, to allow them to stay in a single and hire out the opposite three. How do you get authorised for these increased buy worth as an alternative of getting to purchase a two-bedroom one tub, as a result of that’s what you possibly can afford, however for those who’re home hacking this larger property with extra rooms, does the financial institution really have a look at that earnings that you simply’re going to be bringing in on the property?

Craig:

So, this appears to vary by the month, it feels. Generally, the financial institution will have a look at potential rents and take 75% of border earnings is what they name it. They had been doing that at one level. I believe they stopped doing that as of this recording. By the point this releases, they could begin doing it once more. So, my advice would simply be to speak to a bunch of various lenders and see if they’ll use any of the anticipated hire to offset the debt cost to extend your debt to earnings ratio. Now, you possibly can positively do this for those who use an FHA mortgage on a two-, three- or four-unit property. I’m simply unsure how that works with the bedrooms at this time limit.

Ashley:

So, now, the way you talked about issues change occurring with lenders and positively, every part out there is altering proper now than what we’ve seen previously a number of years. So, has that affected home hacking in any respect? And is it nonetheless doable to accommodate hack a property?

Craig:

So, I really assume that there’ll by no means be a time the place home hacking isn’t advantageous. I simply don’t see a time. The reason being one, there’s many various kinds of home hacks. And so, for those who’re shopping for a four- or five-bedroom home, you’re residing in a single unit, renting out the opposite. In a foul financial system, you’re offsetting your mortgage cost, which can solely allow you to. You’re providing cheaper housing to individuals who want cheaper housing as a result of clearly folks pay much less for a room than they are going to for a full unit.

Craig:

So, I don’t see the need for home hacking actually going away. I assumed, I legitimately thought I used to be nervous when COVID hit that folks might not wish to be residing in a room with 4 strangers that they don’t know the place they’re or how soiled they’re. However truthfully it’s prefer it wasn’t even the case. So, as a result of home hacking endured via COVID, lasted via COVID, I simply don’t see any state of affairs the place folks wouldn’t wish to do this.

Tony:

So, Craig, you additionally talked about there’s a number of methods that you would be able to home hack. So, I simply wish to break down a few of these and inform me if these completely different eventualities work with home hacking. So, you already talked about you possibly can exit and purchase a giant home. Purchase a five-bedroom home the place you hire out the opposite 4 bedrooms. What if I wish to hire out my basement? Can I home sack my basement?

Craig:

Yeah, we do that every one day. So, it relies upon. Clearly, it’s important to know what the homes appear like in your space. Many homes within the south don’t have basements. In Denver, quite a lot of homes do and so, it’s essential to have a look at the home with the right structure, so that you could separate the upstairs and downstairs.

Craig:

For instance, there’s many homes within the Denver space the place the facet door that’s proper the place the steps are to go downstairs. So, all it’s important to do is put just a little wall up or put just a little door up and also you’ve received two separate models, and that will be good to Airbnb the downstairs. We do this. I’ve received many properties which might be simply that. And I believe that’s essentially the most environment friendly approach in the best way I like to accommodate hack now. Now, that I prefer to have my very own area, now that I’m a couple of years in.

Tony:

What about like, I don’t know, say I’ve a indifferent storage or an ADU within the again. Can I home sack these?

Craig:

Certain. I imply you possibly can home hack something. You possibly can put a tent in your yard, you possibly can add storage models. There’s so some ways you may get cash out of your own home. However folks ask me rather a lot, “Ought to I renovate my storage and add plumbing and add electrical and add all of those various things?” Actually, I believe it’s going to value you 75 to 100 grand to do all that. You may as effectively simply purchase one other home is my thought. It could be much less work, much less stress, much less permits and fewer time. So, for those who received 75 to 100 grand, I’d say like, and also you get to maintain your storage. So, my two cents, I don’t love the storage conversion factor, however it all is dependent upon the place you reside.

Tony:

Yeah. And I’m asking these questions facetiously. The purpose I need the listeners to grasp is that no matter additional area you may have, whether or not it’s a basement, an ADU within the again, otherwise you purchase a multifamily the place you reside in a single unit and also you hire out the opposite three models. No matter additional area you may have in your property, you possibly can flip that into an earnings producing area versus a legal responsibility like it’s for most individuals.

Craig:

100%.

Ashley:

Additionally, parking for RVs and boats, that’s actually huge in our space, so lots of people have these in over the winter. They want someplace to retailer it of their driveway within the suburb. It may not be sufficiently big to truly retailer it and so, they want some other place to retailer it. And just a little facet be aware right here, our producer additionally chimed in with a studio area in your youngsters’ closet, which is how I recorded for the final three years.

Tony:

Yeah. And for those who guys don’t know-

Craig:

There you go.

Ashley:

I’m at my kitchen now. No, but-

Tony:

Yeah. In the event you guys don’t know Ashley’s youngsters, they’re really ruthless landlord. So, Ashley pays a premium for recording in that studio each single month. So, she taught them effectively.

Ashley:

Really, they did. My one baby has a very nice huge walk-in closet and I’m pressured to take the small naked minimal walk-in closet for my studio.

Tony:

Oh, my gosh. I like that.

Ashley:

The factor is with my knee, with hurting my knee, my knee has been straight for therefore lengthy, so I haven’t been in a position to bend it sufficient to get into the studio…

Tony:

Get again into the closet.

Ashley:

… aside from that. So, I ought to have the ability to transfer again in shortly.

Tony:

So, Craig, we talked about a number of the advantages of home hacking, a number of the other ways you are able to do it. However what do you assume are a few of possibly the disadvantages that come together with home hacking? Perhaps why is it a foul strategy for somebody?

Craig:

It’s a little bit extra work, clearly. You’re sustaining a home and it’s essential to get tenants and it’s essential to signal leases and do your diligence and all that. So, it doesn’t come and not using a value. Is that value giant relative to what you’re getting out of it? I’d say under no circumstances. My story is I went from a adverse $30,000 web price to financially free in two and a half years, primarily via home hacking.

Craig:

And so, it’s not get wealthy tremendous fast, however it’s get wealthy fairly darn fast if you wish to do it the precise approach and also you wish to actually be scrappy. And I used to be actually scrappy for these first few years. And so, yeah, I simply assume that, I believe it’s for anybody that desires to, once more, expedite their path in direction of monetary independence.

Tony:

All proper. So, Craig, respect you breaking down a number of the disadvantages of that. I believe it’s essential for brand new traders to listen to each the great facet and the unhealthy facet of actual property funding, as a result of each kind of actual property investing comes with some kind of draw back. And also you simply received to make it possible for for those who select this technique that it’s going to align or that you would be able to abdomen what these downsides are, I suppose.

Tony:

Now for me, Craig, one of many greatest issues that I’d be involved with from home hacking is having to share my private area with strangers. So, what ideas or recommendation do you may have for somebody that may be frightened about the identical factor?

Craig:

Yeah, so we discuss within the e book in regards to the consolation continuum. On one facet, it’s consolation and on the opposite facet is revenue. And on the far facet of that continuum, the revenue facet, it’s, yeah, you’re residing on the sofa in your front room and renting out each different room in your own home, so comprehensible for those who don’t wish to do this. So, you simply transfer alongside the continuum in direction of the consolation facet, which is what you talked about earlier than Tony, about having a home the place you simply hire the basement. So, that approach you may have your individual area. I’m positive you might hear them come out and in.

Craig:

However truthfully, once we’ve executed this, I don’t assume I’ve ever even seen my Airbnb friends. I’ve heard them strolling down the steps and stuff, however you actually don’t see them that a lot. And so, that often is sufficient privateness, so that you could nonetheless make some cash, you possibly can nonetheless cowl your mortgage or at the least get fairly darn shut and you’ll nonetheless make critical leaps in direction of monetary independence.

Ashley:

So, are there quite a lot of properties on the market which have the basements redone or what are some issues that me or anyone may search for once they’re in search of a home hack? What do you search for once you’re trying to find a property?

Craig:

Yeah, so in Denver, there are quite a lot of basements which might be accomplished. And so, these are very easy to Airbnb, particularly for those who don’t care so as to add a kitchen or something like that. Clearly, for those who add a kitchen, it can get you just a little bit extra after which you may have some extra flexibility with possibly splitting it up into two models afterward. However for those who’re simply taking a look at Airbnb, all you really want is sort of a microwave and a mini fridge and also you’re good to go.

Craig:

I personally like so as to add kitchens, as a result of I prefer to have that flexibility in case Airbnb ever goes away or something like that. And so, what I prefer to search for is huge utility rooms. You’ve received the washer and dryer in there, however you’ve received all of the uncovered pipes, you’ve received {the electrical}, so it’s very simple so as to add a kitchen down there. And often, it’s in regards to the area that you simply’d need for a kitchen. And so, it might value 15 or 20 grand so as to add that kitchen. And now, you’ve received a home with two kitchens, possibly two laundries. And so, you’ve received this true single household home with a mother-in-law suite that you may hire out either side. So, it’s like a duplex, however not technically a duplex.

Ashley:

Okay. So, if you are going to buy one among these properties, are there zoning requirement to say you’re simply doing home hacking the place you’re simply placing possibly an individual in every bed room? Are there zoning necessities for that? And we will discuss in regards to the short-term rental facet, too, however only for having anyone do long run rental in rooms, does that matter in any respect?

Craig:

So, every metropolis or every city has completely different guidelines for the utmost unrelated folks residing in a home, so that you’ll have to know these guidelines and my advice could be to not break these guidelines. I’d say that more often than not, these guidelines aren’t tremendous enforced. However once more, it’s as much as you whether or not you wish to take that threat or not. I do know loads of people who have taken the chance, they haven’t gotten caught, however it simply takes one annoying neighbor to catch you.

Craig:

So, my advice is work out what your jurisdictions legal guidelines are, surrounding most unrelated tenants, after which you should buy the four-or five- or six-bedroom homes primarily based on what that quantity is.

Tony:

That’s fascinating. I didn’t know that that was even an ordinance or a legislation that cities had. However fascinating as you go slim and deep on a few of these completely different methods, you begin to uncover all these completely different bizarre nuances. Craig, I wish to return since you stated you began off by renting out rooms in your own home. That was your first home hack and also you’ve graduated to this basement technique?

Craig:

So, my first home hack was the place I used to be residing in the lounge behind a curtain in a cardboard field. After which, I went to Hire Discover, then I found that I may have my very own bed room.

Tony:

Yeah. There was a step-up above that. That’s hilarious, man.

Craig:

Yeah, yeah. Having my very own room was a luxurious.

Tony:

So, discuss us via that. What are possibly some guidelines. I believe it’s just a little bit simpler if in case you have separate models. In the event you’re residing within the upstairs unit, another person resides within the downstairs unit, you’ve received a triplex the place there’s two different models. However for those who’re in the identical home and also you’re renting out spare bedrooms, what are some floor guidelines you need to set in place on your tenants? The way you display screen folks to ensure you don’t get some maniac residing with you? How do you set your self up for achievement?

Ashley:

First, Craig, earlier than you reply that that is bringing you again to varsity days the place that is, home hacking is quite common, the place you get your group of buddies collectively. You hire a home, every particular person pays by the bed room. However I believe that is very completely different is since you’re going and getting your mates to stay with you. So, there might not be as many set guidelines in the home, however you even have that different particular person as the owner that collects the hire from everyone, ensure that the utility is paid, issues like that.

Ashley:

The place now, you might be accountable to make it possible for everyone is paying and selecting the folks to stay in these rooms. You might have by no means have met them earlier than. So, yeah, I’m curious as to what, do you may have a guidelines checklist that’s posted on the fridge? How do you share the widespread space?

Craig:

I did have that guidelines checklist, however I can inform you, I don’t assume folks can learn. So, that is clearly, it’s a factor, however truthfully, it’s not as unhealthy as folks make it out to be. There’s this widespread false impression that once you consider hire by the room, you all the time assume very first thing is school, residing in a five-bedroom place along with your buddies. However the factor is you’re not residing along with your buddies. And so, nobody actually cares to work together with one another, so there’s probably not very like front room, folks aren’t actually hanging out of their widespread areas.

Craig:

More often than not, persons are throwing a DiGiorno’s pizza within the toaster oven or the oven, no matter, and bringing it again to their room and that’s it and also you’re not. And so, actually the principles, we set them proper to start with. So, I believe you all the time wish to make it possible for to start with and it’s “Clear your dishes, wipe up after your self.” After which as soon as a month, we’ll get a cleaner to wash the lavatory and the kitchen. And people fundamental areas like that.

Tony:

Craig, did you ever have any situations the place folks, your tenants weren’t following these home guidelines that you simply arrange? And in that case, how did you go about correcting that?

Craig:

Yeah, tenants, they’re not often that unhealthy. In my expertise, they only haven’t been that unhealthy. Perhaps I’ve executed an honest job at simply screening them. However within the occasion that one thing would occur, actually, it’s important to handle it quickly and handle it usually earlier than it turns into a behavior for them. Habits take a very long time to interrupt. And so, if they’ve a behavior of leaving that espresso stir spoon within the sink and that annoys anyone, you say, “Hey, you thoughts simply rinsing that off and no matter, throwing it within the dishwasher?” And simply inform them each single time that it occurs, in order that approach they don’t fall again into their behavior.

Craig:

And so, for those who inform them simply as soon as although, you possibly can’t get all mad at them in the event that they do it once more a second time. They’re in a behavior. You’re serving to them break this behavior, so it’s important to understand that it’s going to take time for them to regulate out of that. However to proceed to regulate, to asking them and asking them properly, so there’s no hostility in the home.

Ashley:

Come on, Craig. The reply we needed to listen to is that you simply laid down the legislation, you got here out, you had your mustache. You had your saved connected to you and walked round the home to verify all the principles are adopted.

Craig:

Yeah, I simply walked round with a shotgun.

Tony:

Yeah, Craig, good execution. So, you talked in regards to the screening piece, man, so assist us perceive. For me, I’d in all probability be much more stringent for home hacking tenants than I’d be for a conventional tenant as a result of I’ve to share the area with them. So, what did your screening course of appear like?

Craig:

Yeah, so we might ship out an software and that software would mainly make it possible for they provide us their credit score rating and a background verify. Personally, what I appeared for was 650 or increased credit score rating and a clear background verify. If there was a DUI like a couple of years in the past or one thing like that, I’d let that go, however clearly, nothing drug-related or nothing violent-related. That’s an automated move. After which, you may have the owner references, the employer references, the pay stubs and all that stuff. And so, attempt to collect as a lot info as you possibly can in regards to the tenant, confirm that info, after which you possibly can go forward and settle for them.

Ashley:

And Craig, there are separate guidelines for screening a tenant if you’re going to be residing in the identical property, right?

Craig:

Sure, that’s proper. So, for those who’re residing within the property, there’s the truthful housing legal guidelines, which you’ll be able to’t discriminate primarily based on race or intercourse or household or no matter. However for those who’re residing in the home, you possibly can mainly say any motive that you really want. I like to recommend, simply make your life simple and don’t deny anyone due to their race or their faith or one thing like that. Nevertheless it could possibly be like, “He appeared like a highschool bully of mine and I didn’t like that.” And so, that could be a completely legitimate motive to not wish to stay with anyone and so-

Tony:

Craig, was that an actual motive? Did you actually flip anyone away for?

Craig:

Yeah, I received afraid of 1 man. I used to be afraid he was going to steal my lunch. So, these are like, you possibly can. You’re proper, Ashley. You generally is a lot extra stringent and have weirder reply. In the event you simply don’t wish to stay with anyone, it’s high quality, however I’d attempt to keep on with the truthful housing legal guidelines as greatest as you possibly can.

Ashley:

After which, what’s a great way to just be sure you keep in landlord mode. And also you deal with this like a enterprise, in order that possibly you’re having everyone pay on-line or one thing. It’s simply mechanically deposited into your account versus getting like, “Oh, effectively.” Having the particular person subsequent door to you knocking in your door and be like, “Hey, right here’s $100. I’ll deposit the remainder later and stuff.” How do you retain that, deal with your small business and people methods and processes and it doesn’t get too relaxed right into a friendship mode?

Craig:

Yeah, no, that’s nice. So, I exploit a system referred to as Hire Prepared. I believe I’m positive, I believe they had been on the larger pockets podcast and all that. And so, it’s a software program that enables the tenants to submit upkeep requests. It permits them to do automated hire funds and all that. And so, mainly you simply ensure that they set that up within the first month and then you definately by no means must ask for hire ever once more, which I believe is superb. As for not getting too pleasant along with your tenants, that’s a very easy factor to slip into, particularly for those who’re very pleasant.

Craig:

What I’d do is I’d be civil and cordial with them in the home, however I’d by no means actually ask them to hang around, go someplace to hang around. I’d by no means ask them to go to a restaurant or go to a bar or go snowboarding or something like that. However that’s simply the tradition of my home. A method that lots of people get their homes stuffed is that they area of interest out their home, so they are saying like, “Snowboard is paradise,” or like, “Rock climber haven.” So then, they get a bunch of snowboarders after which they go and so they grow to be buddies. And that’s really a very good option to get tenants. So, it actually simply is dependent upon the way you market your own home hack and what home hack you need it to be.

Ashley:

That’s cool. I’ve by no means heard of that earlier than like choosing a distinct segment and making an attempt to get people who have widespread curiosity right into a home.

Craig:

Yeah, it really works rather well.

Tony:

Yeah. Ash’s could be, “Will need to have cool hip-hop T-shirts to stay on this home.”

Ashley:

Yeah. [inaudible 00:29:10]…

Tony:

Or actually unhealthy knees.

Craig:

Yeah. She’s got-

Ashley:

… I ought to say.

Craig:

She’s received some Kenny Chesney on there now, yeah.

Tony:

So, Craig, one follow-up query to that, so the opposite factor that all the time will get me caught on the home hack technique is how do you cut up up utilities, possibly widespread issues like toiletries and paper towels and dish cleaning soap? How did you account for all these issues? Was it only one flat charge? Was it variable? Switching off month by month? What was your technique for managing these?

Craig:

Yeah, so once I had these, I’d simply cost a $75 utility payment on prime of the hire. And that will change primarily based on what number of bedrooms it was. If it was a four-bedroom, it’d in all probability be $100. These days, I’d really enhance that to $100 as a result of costs are rising. However so, you simply have a flat payment. Within the winter months, your utility invoice is just a little bit increased and so, you’re going to lose just a little bit. However in the summertime it’s just a little bit decrease, so that you’re going to win just a little bit. And it nets out inside 100 bucks over the course of the yr.

Craig:

And so, that’s infinitely simpler than getting into, splitting it up 5 methods each single month, including all of it up. It’s a ache. I did that, too and I’d simply by no means do this once more. And so, that’s what I’d recommend, a flat payment, cut up it that some ways, and also you’re good to go.

Tony:

Does that embody all of the home goods, Craig? So, the dish cleaning soap, the paper towels, the bathroom paper. All the things that’s wanted only for the widespread areas, too?

Craig:

So, once I would furnish a home, I’d buy, I’ll go to Costco and I’d purchase a giant factor of bathroom paper, a giant factor of paper towels, a giant factor of, like all that stuff. It could possibly value 100 to 200 bucks and that will be actually good for the yr. And so, I don’t know if it contains it or not. Certain, but additionally if issues ran out and I wasn’t round, folks would exchange it. There’s by no means been a time the place we went with out rest room paper or something like that.

Tony:

Yeah. Final query, what in regards to the meals piece? Did everybody have their very own part within the fridge to say, “Hey, that is Craig’s stuff. Don’t contact it. That is Ashley’s. That is Tony’s.” How was the meals dealt with?

Craig:

Yeah, so there’s particular locations within the fridge and in addition, everybody has their very own cupboard. And so that you’ve received your dry items and your stuff it’s essential to refrigerate. There have been sections for positive, like section-ish, however generally, you place the milks collectively and also you simply keep in mind which milk is yours and all that stuff. And we by no means actually had a difficulty with that. I forgot to say this, if you’re going to have 5 – 6 folks residing in the identical home, I’d in all probability recommend getting two fridges. We all the time had one upstairs and one downstairs and that approach they’ll retailer their stuff within the fridge and fewer time coming upstairs and simply extra room for everyone.

Ashley:

Fascinating. Yeah. I don’t know if I may ever return to accommodate hacking sharing disaster as a result of I do know Tony would yell at me as a result of I’d steal his meals on a regular basis. We went to Tennessee collectively and we stayed at a cabin, a bunch of us. And Tony was meal prepping for his health competitors and he introduced, it’s from California to Tennessee, all of his meals in his little container. And that was the one factor within the fridge, I believe that we-

Tony:

And Ash, did you eat one among them or one thing?

Ashley:

You realize what, I used to be so ravenous once I received there. I used to be so tempted to, however Tony, you understand how good him and Sarah are, they really introduced me again some rooster. All of it labored out, yeah.

Ashley:

So, Craig, what different ideas and recommendation do you may have for rookies that need to get began of their home hack? Who’re a number of the folks they need to have on their workforce, possibly? Do they should discover an agent who’s pleasant to accommodate hacking and is aware of what that’s? Do they should go to sure mortgage lenders? What does their workforce appear like that they need to be constructing?

Craig:

Yeah. So, I believe the primary and doubtless, possibly I’m biased, however the first and doubtless, an important particular person in your workforce goes to be an actual property agent, as a result of your actual property agent is that node that is aware of everyone else. And so, for those who discover a good investor pleasant agent that has labored with home hackers earlier than in your space, then ensure that they’re home hackers, ensure you get together with them, clearly. But when they move all of your standards, they’ll introduce you to their home hacking pleasant lender and contractors and accountants and every part you really want.

Craig:

And so, you don’t want all that stuff up entrance. Get an agent, discover an agent is step one. After that, they’ll introduce you to everyone else. Allow them to do the work. And so, I believe that’s simply essentially the most essential piece. However I’d say take your time discovering a very high-quality investor pleasant actual property agent and let the remainder fall into place.

Ashley:

What in regards to the landlord piece? Is it widespread for for those who’re home hacking, to get a property supervisor or do you suggest that you simply self-manage?

Craig:

I believe at first it’s greatest to self-manage simply so you understand how to do it. And simply so you already know in case your property supervisor is messing up or not. So, the best way I did it was I managed my first two properties myself. As soon as I received to my third one is once I began hiring property administration and I even employed a property supervisor for the home I used to be residing in to hire out these different bedrooms. And the explanation for that was as a result of I used to be changing into an actual property agent on the time and it simply turned far more, my time was higher served displaying folks homes versus ready in the home, having folks not present as much as see your room. And so, you guys have to determine what your time is price. After which, you’ll know when it’s time to rent a property supervisor. It is rather apparent.

Tony:

So, Craig, you talked about earlier that you simply’ve basically achieved monetary independence inside lower than three years via the home hacking technique. So, what I wish to do is, for those who can possibly open up the kimono just a little bit and provides us the behind the scenes. If somebody immediately, they’re working a 9:00 to five:00 that possibly they’re not loopy about, how can they use home hacking to, possibly not two and a half years, that may be just a little bit aggressive, however say that they had 5 years. If somebody needed to realize monetary independence with home hacking over the following 5 years, what blueprint are you able to give our listeners to have the ability to do this?

Craig:

Yeah, so the best way that lots of people in Denver are right here doing it’s every home hack they purchase goes to money circulation them between $500 and $1000 a month. And so, you’re in a position to purchase a kind of a yr, yearly for 5 years. And so, if get nice offers and you may get $5,000 a month in 5 years, effectively, that’s monetary independence proper there. And that, after all, assumes that your rents don’t enhance and property values don’t enhance, as a result of when you begin getting increasingly properties which might be rising, you’re in a position to take the fairness from these properties via a HELOC or no matter else. And you should buy extra and you’ll purchase extra.

Craig:

And so, I believe Brandon has talked in regards to the stack the place everyone thinks linearly, however actually, it doesn’t work that approach. When you begin getting 1, 2, 3 properties, you’ll have extra money to then purchase 4, 5, 6, 7, 8, 9. And I assure you, for those who put your head down and purchase a property a yr, you’ll be very near monetary independence inside that five-year timeline.

Tony:

You might have my head spin just a little bit, Craig. So, I stay in Southern California, which is traditionally a fairly costly market and quite a lot of cities right here, simply shopping for a long-term rental wouldn’t make sense. And it’s not essentially home hacking, however simply the concept of renting by the room in possibly a costlier market could possibly be a option to actually unlock a unique stage of profitability. As a result of if I may hire, possibly a home by itself for $2,700, for those who rented the entire home, but when it’s a five-bedroom and I can hire every one for possibly $800 a month, that’s a giant distinction in profitability there. So, yeah, no, no, simply considering out loud. Perhaps I’ll exit and purchase a home hack or a multifamily, hire it out by the room now, so we’ll see.

Craig:

Yeah, so in-

Ashley:

I already texted Sarah. She stated, no.

Tony:

Yeah. No extra offers.

Craig:

So, in costlier markets, as a result of folks all the time are baffled that I believe anybody would say, “Oh, my gosh, I can get a property in Denver,” which appreciates 20% the final two years and nonetheless get $1000 of money circulation. I believe anybody would take that every one day. And I don’t do this by simply shopping for a home and renting it out historically. These are for Midwestern markets and in these markets the place you should buy homes for beneath 100 grand.

Craig:

It’s a must to get just a little bit inventive in these markets like Denver, Austin, Seattle, I’m not too positive about Southern California, however these tier-two cities, possibly not the LAs and San Franciscos, however what you do. And so, there’s some ways you are able to do it, whether or not it’s hire by the room. I’ve been doing this factor now with Airbnb arbitrage. And so, I believe lots of people get enthusiastic about discovering landlords to hire from, after which put it on Airbnb and maintain the distinction. Properly, I’m simply that landlord.

Craig:

And so, if somebody involves me and so they wish to Airbnb my place out, they pay me $400, $500 a month premium and so they tackle the administration of it. And so, I’m saving. I’m making $400 a month extra plus I’m saving on the property administration payment, which is a few $600 to $700 distinction than I’d simply historically. And so, I’m like all day, I’ll do this.

Tony:

Craig, you’re going to have so many individuals, who’re followers of short-term leases, who reaching out to now saying, “Please let me arbitrage your models in Denver.”

Ashley:

Yeah, Craig, let me dig into that. So, you’re not paying a property supervisor for these charges that the operator is taking up. So, are they caring for all the upkeep then? Is that included in your lease settlement that they’re answerable for that?

Craig:

So, at the least with my settlement, I believe each settlement shall be completely different. With my settlement, they care for the small stuff that the friends will in all probability do, like little leaks right here, little stuff there. If there’s one thing huge, the AC goes, the furnace goes, the roof must be changed, that’s on me, after all. And so, assume like most of my upkeep is taken care of.

Craig:

And I’m a fairly good dude and I don’t wish to spoil {our relationships}, so am I going to let $200 as soon as each 4 months actually destroy a relationship I’ve with this one that’s given me, say helped me save $600 a month? After all, not. And so I’m pretty lenient, however yeah, however the settlement often is that they pay for the small issues, I pay for the massive issues.

Ashley:

Okay. So, they might nonetheless contact you immediately as an alternative of the property supervisor?

Craig:

Yeah, if one thing must be changed. Yep

Tony:

Yeah. However so, you may have the arbitrage STR operator and also you even have a property supervisor or did you take away the property supervisor collectively?

Craig:

I eliminated the property supervisor as a result of for me, these issues simply don’t break that always. Perhaps every year I’ve to name a plumber and oftentimes, I’ve an assistant, too. I simply have them do it. And so, it’s probably not. It’s positive it’s me managing it, however it actually doesn’t take a lot time in any respect.

Tony:

Cool. Properly, thanks for that breakdown.

Ashley:

Yeah. Would you wish to undergo simply the numbers of a home hack for us actual fast? You stated possibly like $500 to $1000 on common, somebody can get from the Denver market. However are you able to possibly present what the acquisition worth could be? How a lot you’d must put down? What possibly your rate of interest could be? After which what they need to cost per room? And the way a lot you’d get again in your pocket?

Craig:

Yeah, I can undergo my most up-to-date one. Again in July of 2021, I purchased this property in a fairly up and coming space of Denver. It was really a seven-bed, three-bath. And on this, it’s referred to as Virginia Veil. It’s proper subsequent to Cherry Creek. It’s a very up and coming space. It’s very nice. What I appreciated about it’s received that top-bottom setup with that huge utility room that I described earlier.

Craig:

And so, I purchased this for $585,000. I can’t keep in mind the curiosity of my mortgage. It was 3 level one thing, so rates of interest had been decrease again then. After which my mortgage on that’s $3,000 a month. So, that was my mortgage. I ended up making one of many bedrooms downstairs right into a front room. And so, now it’s a six-bed, three-bath with a front room and I transformed that, that downstairs to an Airbnb. I actually didn’t like managing the Airbnb and so, that’s once I received the concept of doing the arbitrage with anyone else.

Craig:

And so, anyone’s renting that downstairs from me for $2,400 a month and she or he’s placing on Airbnb. And I believe she’s making some huge cash as a result of I haven’t heard any complaints. So, that works. So, in Denver, you actually can solely have one Airbnb per residence. And so, that was a difficulty in Denver Metro and this one is in Denver Metro versus within the suburbs, the principles are completely different. And so, the upstairs I’ve a conventional common tenant and so they pay $2,400 a month as effectively.

Craig:

And so, you possibly can see the distinction there. It’s $2,400 for a prime unit, three-bed, two-bath. It’s fairly good with a yard versus the identical precise quantity for a basement unit, three-bed, one tub, no yard. And so, that’s making me $4,800 a month in hire on a $3,000 mortgage, so I’m making $1,800 over the mortgage. And I set possibly $400 or $500 apart for emptiness. Emptiness, I do pay utilities on that every one the opposite belongings you’re reserved for.

Craig:

And so, I’m making just a little over $1000 a month on that property proper there. And that’s not a house run, out-of-this-world deal. I discovered that in a short time and simply went with it and so, you may get stuff like that every one day.

Ashley:

That’s so cool. I like that you simply checked out that property and also you’re okay, I wish to do short-term rental. And then you definately’re like, “You realize what? It’s not for me. Let’s twist and switch it. And let’s do Airbnb arbitrage.” Particularly, that’s one among my favourite issues is taking a look at a property and discovering other ways to drag income off of it. And likewise, having these completely different exit methods on it the place if one thing’s not working, “Okay, I can do that now with that property.”

Tony:

And Craig, simply actually fast. You say $1000 fairly nonchalantly, however it’s a fairly wholesome amount of money circulation for one property. My first long-term rental, I used to be making 150 bucks a month, so you probably did virtually 10x that. So, don’t promote your self too brief there.

Tony:

One of many factor I wish to spotlight. You talked to Ashley about a number of income streams, the completely different alternatives from a chunk property. And episode 107, we had Kai Andrew on, and he talked about land hacking, which has similarities to accommodate hacking, however his was with land. And he was making 10 earnings streams off of 1 piece of land. So, for those who guys return to episode 107 with Kai Andrew, you possibly can hear just a little bit extra in regards to the cousin to accommodate hacking, which is land hacking and the way he set that up.

Craig:

We’re going to have to provide that one a hear.

Ashley:

Properly, Craig, thanks a lot for becoming a member of us. We do have a pair segments right here to undergo. Tony, you wish to take the primary one?

Tony:

So, Craig, are you prepared for the rookie examination?

Craig:

Oh, man, I didn’t research. However let’s do it.

Tony:

The way forward for your life is dependent upon this examination, so fortunately for you, I believe you’re going to do effectively, man. So, three questions for you, similar three questions we ask each visitor now. So, the primary query is what’s one actionable factor a rookie ought to do after listening to this episode?

Craig:

I believe you need to attain out to a investor-friendly actual property agent in your space. And simply begin asking questions and begin having these conversations, to allow them to assist. for those who want a while to arrange, they can assist you in order that you already know what to arrange. And in order that approach, when it comes time, you’ve received your down cost saved up. You possibly can hit that floor rolling versus getting all of the training and getting the workforce collectively then. So, begin constructing your workforce now.

Ashley:

The subsequent query is what’s one software, software program, app or system, in your small business that you simply use?

Craig:

For the home hacking piece, I’d say Hire Prepared goes to be one of the best factor that I’ve seen. It was Cozy, however Cozy received crappy as soon as flats.com purchased them. So, I all the time suggest Hire Prepared now and yeah, they do nice for the property administration facet for those who’re going to be managing your own home hacks your self.

Tony:

Superior. Final query for you, Craig. The place do you propose on being in 5 years?

Craig:

Man, my future does rely upon this.

Tony:

Are you going to rooster on me? We’ll.

Craig:

That’s all the time a troublesome query. We simply purchased our endlessly house up in Idaho. And so, I believe we’re going to be there. We’re going to be settled in there just a little bit extra. We’re going to proceed to develop the true property workforce in Denver and possibly in a couple of completely different different markets and simply attempt to assist as many individuals as we will obtain monetary independence via actual property investing. And so, just like BiggerPockets mission, we have now a really comparable mission. So, yeah, we’re simply going to maintain taking it day-to-day.

Ashley:

And even higher, I like Idaho. That might be my dream place to stay out of all of the locations that I’ve been to.

Craig:

Yeah. We’ll positively, come by and hang around.

Ashley:

Yeah, I’ll be in Boise and Coeur d’Alene in June.

Craig:

We’re in Coeur d’Alene, so let me know, yeah.

Ashley:

That’s even higher. That’s superb there, so good for you.

Craig:

Yeah, yeah. Let’s at the least seize lunch or you possibly can come see the place, yeah. You possibly can meet Grace.

Ashley:

Cool. Properly, let’s give out a shout out to our rookie rock star, who’s Jason Beckett this week, closed on models two, three, and 4. He bought a triple triplex in an extremely sizzling and classy Tremont neighborhood in Cleveland, and by some means managed to get it under asking with an FHA 203K mortgage. Record worth was $329,000. He received it for $290,000, out of pocket $15,200. The rehab was $70,000, which was constructed into the mortgage, which is a part of the 203K mortgage. And his anticipated ARV is to be $400,000. And the hire potential goes to be between 1500 to 1650 per unit. So, congratulations, Jason, that’s superior.

Ashley:

Properly, Craig, the place can everybody discover out some extra details about you and attain out to you apart from displaying up at the doorstep in Coeur d’Alene?

Craig:

Yeah. Properly, you’re greater than welcome to Instagram. I’m the Fi Man. We now have a podcast of our personal, too, referred to as Make investments to Fi. And for those who’re in Denver, you possibly can all the time have a look at thefiteam.com as effectively. We’re all the time joyful to assist.

Ashley:

Properly, Craig, thanks a lot for becoming a member of us. We loved having an skilled on to speak about home hacking. I’m Ashley @Wealthfromrentals, he’s Tony @TonyJRobinson on Instagram, and we shall be again on Saturday with a Rookie reply.

Concerned about studying extra about immediately’s sponsors or changing into a BiggerPockets associate your self? Take a look at our sponsor web page!