Key Takeaways

- DeFi blue chips are surging because the market picks up.

- Aave, Maker, and Synthetix have all rallied following constructive protocol updates.

- Regardless of many blue chip protocols falling in worth over current months, they nonetheless play an important function within the DeFi ecosystem.

Share this text

Ethereum DeFi protocols Aave, Maker, and Synthetix have seen their tokens rally on the again of latest protocol upgrades and proposed progress methods.

DeFi Blue Chips Bounce Again

After an extended interval of suppressed worth motion, DeFi tokens look like waking up.

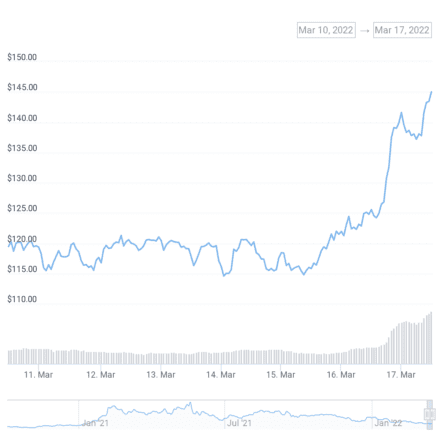

A number of early DeFi blue chips have registered double-digit features at the moment amid rising market momentum, probably as a consequence of a slew of constructive updates concerning their protocols.

Aave, the most important borrowing and lending platform on Ethereum, has damaged its multi-month downtrend, rising over 17% within the final 24 hours. Yesterday’s Aave V3 launch is probably going the largest catalyst for the AAVE token’s constructive worth motion. Aave V3 introduces cross-chain transactions by means of a brand new function known as Portals. The replace additionally reduces the gasoline prices for interacting with the Aave protocol by as a lot as 25% and gives extra instruments to assist customers handle the danger of their borrowing positions.

Maker, the decentralized credit score platform that helps the DAI stablecoin, has additionally seen its MKR token achieve 10.5% on the day. MakerDAO builders lately proposed a brand new progress technique on the MakerDAO governance discussion board with the intention of bootstrapping the protocol’s Actual World Asset market and diversifying its DAI collateral pool. The technique entails elevating capital by promoting MKR tokens from the treasury and issuing debt. Raised funds will then be used to extend the dimensions of Maker’s System Surplus, permitting the protocol to tackle higher-risk loans involving real-world belongings. Whereas the proposal remains to be within the early levels of debate, it seems to have been properly acquired by the MakerDAO neighborhood.

One other DeFi blue chip, Synthetix, can be having fun with constructive worth motion. The protocol’s SNX token is up 10.9%, probably in anticipation of the perpetual futures contracts launch on the Ethereum Layer 2 answer Optimism later this week. Perpetual futures will let customers enter positions with as much as 10x leverage throughout a variety of belongings, serving to to construct out Synthetix’s derivatives ecosystem. For SNX token stakers, the launch will even present an extra income stream.

In current months, tokens of distinguished DeFi protocols have slowly declined in worth after following Ethereum’s parabolic run in the beginning of 2021. Nonetheless, whereas key protocols reminiscent of Aave and Maker have seen their valuations fall, they nonetheless play an important function within the wider DeFi ecosystem, holding billions of {dollars} of their good contracts. In response to knowledge from DeFi Pulse, the overall worth locked in DeFi on Ethereum is about $76 billion, and a couple of third of that’s in Aave and Maker. However that sum doesn’t account for the entire worth locked on Layer 2 options like Optimism and Arbitrum or competitor networks like Solana, Terra, and Fantom. General, the overall worth locked in DeFi is over $200 billion at the moment. Because the ecosystem grows, the beneficiant yields supplied by newer protocols just like the Terra-based Anchor are more and more offering sizzling competitors to Ethereum’s blue chips.

Disclosure: On the time of penning this piece, the writer owned ETH and several other different cryptocurrencies.

Share this text

Aave V3 Heads to Ethereum Layer 2, Fantom, Avalanche

Aave has launched its V3 update. The upgrade will initially be deployed on Polygon, Fantom, Avalanche, Arbitrum, Optimism, and Harmony with Ethereum to follow in the future. Aave Unveils V3…