Andrii Dodonov

Introduction

It is no secret that anticipated decrease rates of interest are probably to supply tailwinds for REITs going ahead. Forward of the FED assembly on September 18th, many predict a 25 foundation factors charge minimize, which, I feel, is very probably. In that case, REITs may see a brief surge, even with the latest rally they have been having fun with for the reason that July CPI report.

Furthermore, decrease rates of interest forward will present nice advantages to REITs like decrease value of capital and elevated share worth appreciation. The profit decrease charges present their share costs additionally allows the chance for increased development, as this enables them to difficulty shares above their NAVs in addition to see stronger funding exercise.

And this appears to be the case concerning Easterly Authorities Properties (NYSE:DEA), a REIT that leases to mission-critical authorities companies. Though I proceed to charge them a maintain for causes listed on this article, their latest acquisitions and eight% dividend yield might be a horny funding alternative.

Earlier Maintain Ranking

I final coated Easterly Authorities Properties this previous Might in an article titled: Will Decrease Curiosity Charges And A New CEO Assist This REIT Get Again To Development? With their new CEO, Darrell Crate, coming onboard originally of the 12 months and anticipated decrease rates of interest, the query remained whether or not DEA may grow to be an excellent funding alternative.

Within the article, I additionally mentioned that the potential for the corporate to renew development remained probably because of potential decrease rates of interest and elevated funding exercise. This resulted in administration rising steerage and money accessible for distribution or CAD (just like AFFO) rising 5.7%. Nonetheless, the dividend payout ratio was nonetheless above 100% on the time.

However their share worth has rallied just lately, up practically 12% beating the S&P who’s up practically 3% over the identical interval.

In search of Alpha

1H 2024 Efficiency

With the primary half of the 12 months within the books for the REIT, issues appear to be wanting up for Easterly Authorities Properties. Though FFO was flat from the prior quarter and year-over-year, income grew 6.8% year-over-year and 4.7% from the prior quarter.

Taking a deeper dive into the corporate’s financials, they really noticed some stable development from 2023. Administration said they anticipated 2% to three% development going ahead, and up to now, they appear to be delivering on that promise.

Let’s have a look into the corporate’s financials over the primary six months of 2024 in comparison with the prior 12 months. Though this was flat at $0.29, core FFO truly grew 3.7% from $30,267 million to $31,373 million.

For comparability functions, each friends Piedmont Workplace Realty Belief (PDM) and JBG SMITH Properties (JBGS) core FFO declined year-over-year. The previous’s money accessible for distribution additionally noticed some development over the identical interval. I will contact extra on this later.

Q2’24 | Q2’23 | |

DEA | $0.29 | $0.29 |

PDM | $0.37 | $0.45 |

JBGS | $0.18 | $.036 |

For the primary half, here is how Easterly Authorities Properties managed to develop from 2023. Income, core FFO, CAD, and same-store NOI all noticed stable development from the prior 12 months’s first six months, which is nice to see.

1H ‘24 | 1H ‘23 | |

Income | $149,201 | $142,593 |

Core FFO | $62,129 | $59,767 |

CAD | $50,691 | $49,015 |

Identical-store NOI | $99,047 | $92,658 |

Tailwinds From Decrease Curiosity Charges

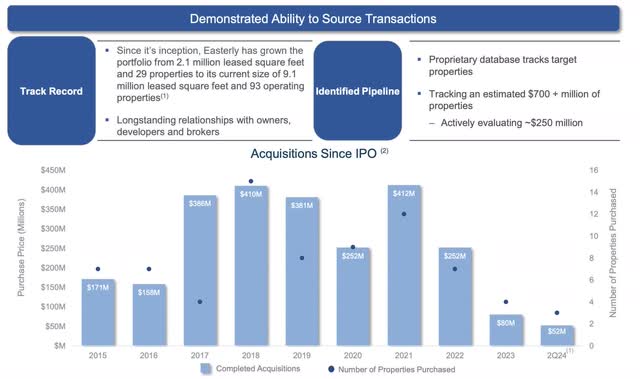

Other than the power in Dallas, TX the corporate closed on within the prior quarter, they just lately noticed an uptick in funding exercise, a profit from anticipated decrease rates of interest.

DEA closed on two further acquisitions, one being the third-largest Veterans Affairs facility within the nation in Jacksonville, Florida. This was 100% leased and stood at practically 100,000 sq. ft.

Additionally they just lately acquired a facility leased to BBB+ rated Northrop Grumman (NOC) earlier this month. This introduced their whole property rely to 95 properties, up from 86 within the 12 months prior.

Though it isn’t identified how these acquisitions will translate to the REIT’s backside line development as of but, it’s probably for them to boost steerage additional down the road because of their robust acquisitions.

Administration reaffirmed their core FFO steerage of $1.15 – $1.17 which they raised from $1.14 – $1.16 prior. Additionally they have a robust pipeline monitoring practically $700 million in future acquisitions and two energetic tasks in Atlanta and Flagstaff, AZ anticipated to be accomplished in 2025 and 2026 respectively.

Furthermore, with rates of interest more likely to be a lot decrease over the subsequent 12 – 18 months, I count on DEA to focus on extra authorities adjoining properties with investment-rated charges, just like Northrop Grumman.

DEA investor presentation

Stable Stability Sheet

DEA’s steadiness sheet was additionally stable, with well-staggered debt maturities within the coming years. That they had minimal debt maturing this 12 months and in 2025. That they had $15.6 million in money & equivalents and a internet debt to adjusted EBITDA of 6.9x.

DEA investor presentation

This was compared to friends Piedmont Workplace Realty Belief and JBG SMITH Properties, whose internet debt to EBITDAs had been 6.6x and a staggering 11.6x, respectively. Easterly’s debt totaled $1.4 billion, however most of it (97%) was fixed-rate with a weighted-average rate of interest of 4.39%. They may even probably get to refinance their 2025 & 2026 debt at a decrease charge, as this had rates of interest of 5.63% and 5.19%, respectively. Moreover, most of their debt is well-laddered, maturing in 2027 and past.

Elevated Payout Ratio

Though Easterly is a seeing development and stays a doubtlessly enticing funding because of its 8% dividend yield, their payout ratio nonetheless remained above 100%. This was in regardless of CAD rising year-over-year. As a collector of dividends, that is my essential concern when analyzing shares.

Moreover, an elevated payout ratio places the dividend liable to being minimize. I’ve the pleasure of incessantly talking with Easterly’s CEO and through a latest video name, he reassured administration’s plan to take care of the dividend. Furthermore, with rates of interest offering tailwinds, I feel likelihood is rising of sustaining the dividend, a minimum of for the close to to medium time period.

Utilizing their shares excellent of 107,998,356 and 1H dividend fee of $0.53, DEA would wish roughly $57.3 million in money accessible for distribution to cowl the dividend.

As beforehand talked about, CAD for the primary half was $50.7 million, giving them a payout ratio of 113% at present. Nonetheless, I count on CAD to proceed rising for the foreseeable future and for administration to take care of the present dividend.

Valuation

Regardless of their double-digit share worth appreciation in the previous couple of months, DEA’s valuation beneath its friends and sector median makes them a doubtlessly enticing funding alternative.

With a P/FFO a number of of 11.4x on the time of writing, they commerce effectively beneath the sector median’s 14.01x. That is additionally probably the rationale Quant assigns them a valuation grade of A-.

I do assume the REIT may see additional upside as rates of interest are decrease, they usually proceed to make acquisitions. In that case, I can see them commanding a minimum of a 13x a number of, giving buyers upside of roughly 12.9% from the present worth of $13.29. However as beforehand talked about, this all depends upon the place rates of interest are in addition to their funding exercise within the close to to medium time period.

Dangers

Presently, Easterly Authorities Properties’ greatest danger is their dividend. With an elevated payout ratio above 100%, this can probably weigh negatively on their share worth compared to workplace friends like Cousins Properties (CUZ) or Highwoods Properties (HIW).

Furthermore, that is the metric retaining me from upgrading the inventory from a maintain to a purchase. That is one thing I will probably be retaining a detailed eye on going ahead.

Backside Line

Easterly Authorities Properties stays a doubtlessly good long-term funding because of their leasing to mission-critical tenants. Moreover, anticipated decrease rates of interest appear to be offering tailwinds, with funding exercise selecting up in 2024.

Going ahead, I count on DEA’s administration to focus on properties leased to government-adjacent tenants, just like Northrop Grumman, within the coming months/years as funding exercise is more likely to proceed selecting up.

Whereas they’re enticing because of the excessive dividend yield at present, their payout ratio above 100% retains Easterly Authorities Properties at a maintain score.