The S&P 500 rose on Tuesday for its first achieve in 4 days, as oil costs continued to drop additional beneath $100 and a studying of wholesale inflation got here in lighter than anticipated.

The beneficial properties got here as merchants continued to eye the newest with ceasefire negotiations in Ukraine and China Covid lockdowns that might wreak havoc on tech provide chains. Buyers are anticipating a giant Federal Reserve financial determination Wednesday, by which the central financial institution is anticipated to hike charges for the primary time since 2018.

The broad market index rose 2.1% to 4,262.45, although it stays greater than 11% from its report. The Dow Jones Industrial Common added 599.10 factors, or 1.8%, to 33,544.34. The tech-heavy Nasdaq Composite gained 2.9% to 12,948.62.

CFRA chief funding strategist Sam Stovall stated a unstable and complicated market that has fatigued traders was due for a reduction rally, even when it is simply that.

“As a result of this market has been so weak, so unconvincing since its all-time excessive on January 3, and due to intraday reversals, nobody actually is aware of what’s going to find yourself being,” Stovall stated. “However what’s inflicting the market to be completely within the inexperienced immediately is it is simply getting bored with going straight down for such an prolonged interval. So even when this have been merely a reduction rally, I feel we’re due for one.”

Falling oil costs and inflation information are each catalysts for that rally, Stovall added. Moreover, with traders wanting ahead to the result of the Fed’s assembly, Stovall famous that the market remembers shares are likely to rise within the first, third and twelfth months after an preliminary charge enhance.

“The market expects seven [rate] hikes in 2022. Given the sell-off within the commodity markets, there’s rather less concern of inflation, and when that is the case, the pure inclination is to go towards the growthier sectors,” Julian Emanuel, Evercore ISI senior managing director of fairness, advised CNBC’s “Closing Bell” Tuesday.

Tech shares led the bounce after current losses. Microsoft and Netflix every rose 3.8% after Wall Road analysts reiterated their chubby rankings. Oracle climbed 4.5%. Chipmakers climbed, with Nvidia 7.7% increased and Superior Micro Gadgets up 6.9%.

Disney and McDonald’s added 4% and a pair of.8%, respectively. Peloton jumped 11.9% after Bernstein initiated protection of it with an outperform ranking and stated current losses make this an “absurdly engaging” entry level for traders.

Airline shares received a lift after some main carriers raised their income outlooks. United and American every rose greater than 9%, whereas Delta added 8.7%.

Falling oil costs pushed up different journey shares as effectively, together with cruise traces, inns, on line casino and gaming firms and journey reserving web site operators, which have been among the many prime gainers within the S&P 500. The Invesco Dynamic Leisure and Leisure ETF gained about 2.7%.

In the meantime, the drop in oil costs put stress on vitality shares. Chevron and Exxon every fell about 5%. The Power Choose Sector SPDR Fund was down about 3.7%, for its third straight adverse day and its worst day since November.

Oil costs continued their decline Tuesday. U.S. crude futures slid about 6.4% to settle at $96.44 per barrel, after topping $130 a few week in the past. In the meantime, the worldwide Brent benchmark settled 6.5% decrease at $99.91 per barrel.

February’s surge in vitality costs led wholesale items costs to their largest one-month bounce on report, the Labor Division reported Tuesday. The headline producer worth index (PPI) rose 0.8% in February from the earlier month. Whereas that was barely decrease than the 0.9% estimated by Dow Jones, it nonetheless confirmed a ten% achieve from the identical time final yr.

Nonetheless, core PPI, which excludes meals, vitality and commerce companies, rose simply 0.2%. That was beneath the expectation of 0.6%.

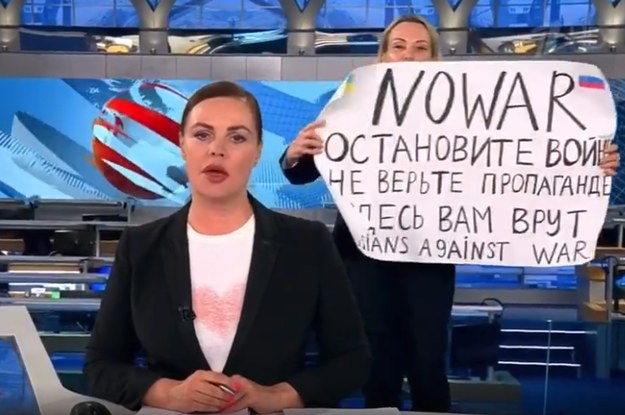

In Ukraine, the capital metropolis of Kyiv introduced a 35-hour curfew that begins at 8 p.m. native time following Russian missile strikes that hit a number of residential buildings within the metropolis. Russia and Ukraine resumed talks Tuesday, following a fourth spherical of negotiations Monday. In the meantime, Russia is approaching a sequence of deadlines to make funds on its debt.

On Monday, United States officers held “intense” talks with China to debate, amongst different issues, considerations that Beijing might try to assist Russia blunt world sanctions. The dialogue adopted reviews that Moscow requested navy tools from China for its warfare in Ukraine.

China can also be dealing with its worst Covid outbreak for the reason that peak of the pandemic. Shenzhen, a serious metropolis in a key manufacturing hub in China, has shut down nonessential companies and imposed city-wide testing, elevating concern over the worldwide financial restoration going ahead.

The Federal Reserve kicked off an essential two-day assembly Tuesday, with traders anticipating a quarter-point charge hike to be introduced Wednesday. That may be only the start of the central financial institution’s unwinding of the large financial assist it supplied in the course of the pandemic.

Rising inflation is anticipated to be the focus of the assembly, nevertheless. On the final replace, in December, officers projected inflation would run at 2.7%. Nonetheless, February’s core private consumption expenditures worth index, the Federal Reserve’s main inflation gauge, indicated inflation is up 5.2% from a yr in the past.

Policymakers may also replace their outlook for charges in addition to GDP, inflation and unemployment.