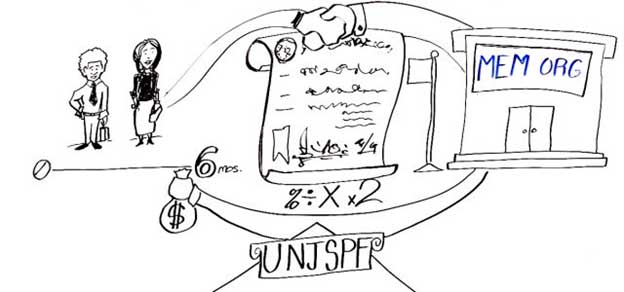

UNITED NATIONS, Mar 18 (IPS) – The United Nations Joint Workers Pension Fund (UNJSPF), which is anticipated to offer retirement, dying, incapacity and associated advantages for workers, upon cessation of their services– has a staggering portfolio amounting to over $81.5 billion rating far, far forward of the UN’s annual finances of $3.1 billion and its common peacekeeping finances of over $6.4 billion.

The hundreds of UN retirees and their beneficiaries, numbering over 71,000 eventually depend, who rely on their pensions for financial survival, are relentlessly protecting of the Fund—whereas protesting all makes an attempt at dangerous investments.

The Coordinating Committee for Worldwide Workers Unions and Associations of the UN system (CCISUA), which represents over 60,000 staffers worldwide, is protesting a brand new proposed plan to “outsource a big a part of the pension fund’s investments to Wall Avenue”.

In a letter to Pedro Guazo, Consultant of the Secretary-Basic for the funding of UNJSPF belongings, Prisca Chaoui, the CCISUA President warned final week that the proposed outsourcing “finally calls into query the character of our pension fund.”

“Is it one which continues to be managed prudently by consultants employed by the fund, who by being UN workers have a stake in its long-term well being, a system that employs the fund’s economies of scale to maintain down prices and that has by the fund’s personal telling outperformed the personal sector to date?” she requested.

“Or is it one that’s outsourced to Wall Avenue to be the sufferer of a short-term get-rich-quick bonus tradition with little regard to the welfare of beneficiaries all over the world?”

“Primarily based on the knowledge that has been shared with us”, says Chaoui, “we fail to know the explanations behind the transfer to exterior administration, given the pointless and expensive duplication of inner capability.”

“We additionally consider that your intention to “cease the bleeding” has been addressed by the administration adjustments you will have carried out in response to points highlighted by the UN’s Workplace of Inside Oversight Providers (OIOS), and thru a brand new Strategic Asset Allocation that considerably reduces our publicity to dangerous belongings”.

Provided that the pension fund has entry to the identical monetary devices as Wall Avenue, and employs equally skilled funding officers, she argues, there needs to be no cause for a decrease efficiency.

“Certainly, the pension fund’s different portfolios have labored tremendous beneath inner administration.”

“We stand right now at a fork within the street that can resolve the way forward for our fund. We ask that you simply reverse the outsourcing technique and hold the administration of our belongings safely in-house,” she declared.

In the meantime, a petition at the moment in circulation amongst retirees and UN staffers, says Secretary-Basic Antonio Guterres claims this can be a non permanent measure that can enhance efficiency.

“Nonetheless, the plans authorize a rise in outsourcing over a interval of three years. And over the long run, our conservative, internally-managed UN pension fund has carried out higher than many externally-managed remaining wage funds which have since been pressured to shut. Certainly, our fund is in actuarial stability,” says the petition in search of signatures.

“Underneath the proposal, as much as 75 p.c of the fund’s fixed-income portfolio might be externally managed.”

The Secretary-Basic is continuing with the outsourcing regardless of sturdy issues expressed on the February assembly of the pension board, regardless of a letter of protest from CCISUA (https://www.staffcoordinatingcouncil.org/wp-content/uploads/2022/03/PF-protest-letter.pdf) and regardless of the UN’s personal Board of Auditors noting that the fund shouldn’t be capable of successfully consider its exterior managers.

In 2007, one 12 months earlier than the worldwide monetary disaster and the collapse of many monetary establishments, former Secretary-Basic Kofi Annan thought-about outsourcing to Wall Avenue. However he properly modified course following workers protests and saved our fund secure, says the petition.

“By handing our pension fund to Wall Avenue in these financially turbulent instances, it dangers changing into the sufferer of a short-term, greed-is-good bonus tradition that has little regard for the welfare of our workers and retirees all over the world and little regard for the moral values of the UN”, says the petition titled “Secretary-Basic Antonio Guterres: Don’t hand our UN pension fund to Wall Avenue.”

“By signing this petition, you name on the Secretary-Basic, to as soon as once more cease the outsourcing of our pension fund and hold its administration in-house. Please share this along with your colleagues throughout the UN and specialised companies”.

Responding to the continuing protests, Pedro Guazo, Consultant of the Secretary-Basic for the funding of UNJSPF belongings, stated on 16 March the Fund is conscious of further issues expressed on the non permanent outsourcing of a part of the mounted earnings portfolio.

“As offered on the final Pension Board assembly on 24-25 February 2022 (see right here) and in my message of 12 March 2022, the investments of the UN Pension Fund are doing very effectively general, given the present financial and geopolitical context.”

Nonetheless, argued Guazo, the Fund can do higher within the mounted earnings portfolio. For a few years that portfolio has underperformed in opposition to its benchmark, as outlined on the Fund’s web site right here.

He identified that the Mounted Revenue Group of the Fund’s Workplace of Funding Administration put a proposal to handle a part of the portfolio internally (35%) and, briefly, utilizing an exterior advisor beneath the supervision and management by the identical inner group (65%).

This 65% of the mounted earnings portfolio represents round 18% of the overall portfolio managed by the Workplace of Funding Administration.

“This proposal has been reviewed by the interior committee, by the Pension Board and the Fund’s Investments Committee, concurring this can be a good non permanent resolution to boost the efficiency of the mounted earnings portfolio. Using non permanent exterior advisors is a greatest apply within the pension fund trade to handle underperforming asset courses,” he famous.

The quick profit for the UN Pension Fund, he stated, might be further USD 60 million a 12 months in income and this resolution is solely non permanent. When the group is prepared in some months the Workplace of Funding Administration will once more handle the portfolio internally.

“I hope this clarifies the target and the advantages of this operation, that can, once more, be utilized just for a restricted time,” he added.

IPS UN Bureau Report

Follow @IPSNewsUNBureau

Observe IPS Information UN Bureau on Instagram

© Inter Press Service (2022) — All Rights ReservedUnique supply: Inter Press Service