grinvalds/iStock by way of Getty Photographs

I am going to proceed to repeat the identical message: proper now, because the market continues to vacillate between beneficial properties and losses in a really uneven surroundings, buyers ought to be positioning themselves for a near-term rebound. The area that has gotten essentially the most hammered by latest volatility is small/mid-cap progress, and inside this area, there are lots of engaging and high-quality tech shares which were diminished to very modest valuations.

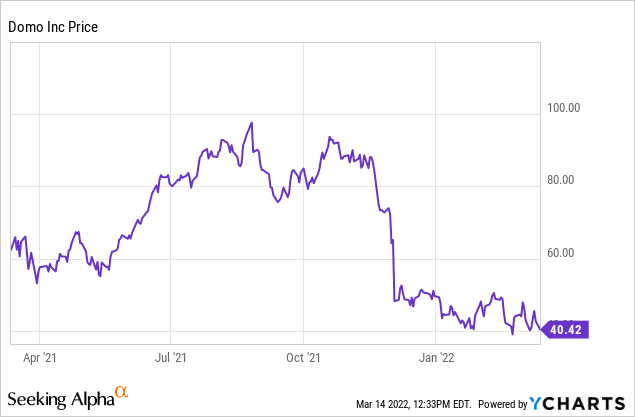

Domo (DOMO) is one such title. The Utah-based supplier of BI (enterprise intelligence) software program has seen its inventory worth drop by greater than half, even supposing its fundamentals are trying higher than ever. When Domo first went public in 2018, the corporate was rising income within the mid-20% vary whereas producing large GAAP and non-GAAP losses. In the present day, at a a lot bigger scale than earlier than, Domo continues to be rising at roughly the identical tempo whereas additionally having considerably shrunk its professional forma working loss margins to the low teenagers – proving that the enterprise is able to scaling, and that earlier fears that Domo competes in a extremely aggressive BI market in opposition to the likes of Tableau (now a part of Salesforce (CRM)) and Microsoft Energy BI (NASDAQ:MSFT) has had little impression on its total progress trajectory.

12 months so far, shares of Domo are down roughly 20%, and regardless of a powerful This fall earnings print launched in early March, Domo inventory has but to see a rebound. It is a good time, for my part, for buyers to re-assess the bullish thesis for this title.

I stay solidly bullish on Domo and consider it is an awesome near-term rebound play. It is also a inventory that’s now flying beneath the radar (particularly given its very small ~$1 billion market cap), so it is a title which will transfer shortly as soon as the course of the market begins to show. Regardless of the “danger” of investing in such a small-cap inventory, I feel the mix of Domo’s enhancing fundamentals plus its low valuation makes it a comparatively guilt-free, secure option to spend money on.

As a refresher for buyers who’re newer to this title, here’s a rundown of the bullish thesis for Domo:

- Domo has gotten right into a constant progress groove, and billings acceleration is an effective signal for robust progress forward. Income has been rising within the mid-20s over the previous a number of quarters. In its most up-to-date quarter, Domo additionally managed to speed up billings to 30% y/y progress – which is an effective main indicator of potential progress enchancment forward.

- There’s some proof that competitors arguments are overblown. One of many authentic criticisms of Domo is that it performs in a closely aggressive BI area in opposition to different powerhouses like Tableau (now owned by Salesforce.com) and Microsoft Energy BI. Domo founder Josh James is of the assumption that many Domo prospects aren’t precisely trying to rip out their present BI methods, however to complement them with different merchandise for various use case. So whereas there may be actually competitors, it is probably not a dealbreaker for a lot of prospects.

- Excessive professional forma gross margins. Domo’s subscription professional forma gross margins are north of 80%, which provides the corporate loads of room to scale its operations profitably because it grows.

- Domo is closing the profitability hole. The corporate is trending towards a -10% professional forma working margin and steadily enhancing.

- Acquisition risk. Whereas it is by no means good to financial institution a whole funding choice on hoping for a takeout, Domo is a really small firm with a compelling expertise platform and recurring income. I might simply see a bigger software program firm wanting to soak up Domo into its portfolio.

Valuation, in the meantime, stays fairly modest. At present share costs close to $40, Domo trades at a market cap of $1.32 billion. After we web off the $83.6 million of money and $104.0 million of debt on Domo’s most up-to-date steadiness sheet, the corporate’s ensuing enterprise worth is $1.34 billion.

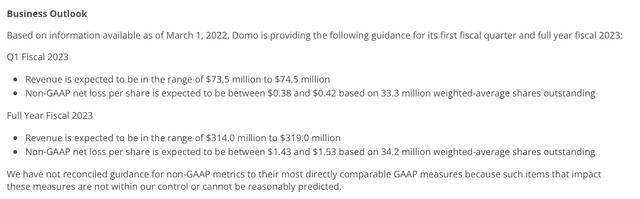

In the meantime, for the next fiscal 12 months FY23 (the fiscal 12 months for Domo ending in January 2023), the corporate has guided to $314-$319 million in income, representing 22-24% y/y progress. Contemplating that Domo exited This fall at a 30% y/y billings progress fee, this estimate could show a couple of factors too conservative.

Domo FY23 steerage (Domo This fall earnings launch)

Regardless, if we take Domo’s outlook at face worth, the corporate’s ensuing valuation is 4.2x EV/FY23 income – which, to me, is sort of low for an organization rising its billings at a 30% y/y tempo.

The underside line right here: Domo appears to be like prepared for a restoration rally. With all the basic upside the corporate has pushed over the previous a number of quarters plus the accommodating valuation and risk of a takeover/acquisition, I can see Domo recovering to at the least ~5.5x EV/FY23 income, representing a worth goal of ~$53.

This fall obtain

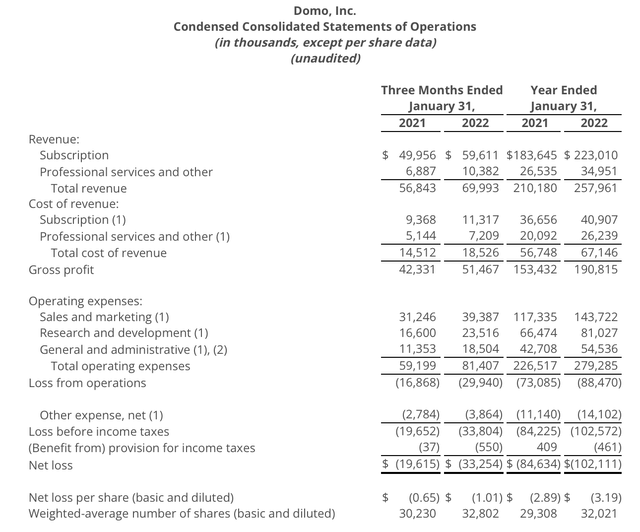

Let’s now undergo Domo’s newest This fall leads to higher element. The This fall earnings abstract is proven beneath:

Domo This fall outcomes (Domo This fall earnings launch)

Domo’s income grew 23% y/y within the quarter to $70.0 million, beating Wall Avenue’s expectations of $67.1 million (+18% y/y) by a big five-point margin. Word as effectively that Domo’s income accelerated two factors versus 21% y/y progress in Q3.

Extra acceleration could also be on the best way. Domo’s billings within the quarter clocked in at $108 million (including a big $38 million build-up to deferred income), representing 30% y/y progress. As seasoned software program buyers are conscious, billings symbolize a greater long-term image of an organization’s progress trajectory, because it captures offers signed within the quarter that might be acknowledged as income in future quarters.

This is some extra commentary from Domo CFO Bruce Felt on the This fall earnings name discussing the drivers behind the corporate’s This fall outperformance:

We completed fiscal 2022 with a powerful This fall, closing out with 30% billings progress, the best progress within the final 14 quarters. A few of the foundational progress drivers we’ve been investing in contributed to billings within the quarter and these vital drivers must also assist us obtain our fiscal 12 months 2023 progress aims.

One of many key drivers was gross sales hiring. We grew our direct gross sales drive by over 25% in fiscal ’22. Our gross sales productiveness per ramped rep was over $1 million in first 12 months contract worth in FY ’22. We’re more than happy with this stage of manufacturing, notably because it occurred whereas we accelerated gross sales hiring. This provides us the boldness to proceed hiring reps at a tempo at the least as excessive as final 12 months’s tempo.

Different key drivers are enhancing gross retention, higher market positioning and consciousness, greater yields on advertising spend and improved accomplice contribution. We had a 12 months of accelerating new emblem progress whereas persevering with to see vital engagement sufficient promoting into our present prospects. The brand new emblem progress is primarily pushed from our company group which has develop into a heck of a brand new enterprise machine. We’re discovering that the entire platform pitch resonates extraordinarily effectively with these prospects due to the overwhelming quantity of performance and ease of use we convey to the market in comparison with all the software supplier rivals. We plan to proceed to lean into this class as we consider it will probably drive sustained, cost-effective excessive progress.”

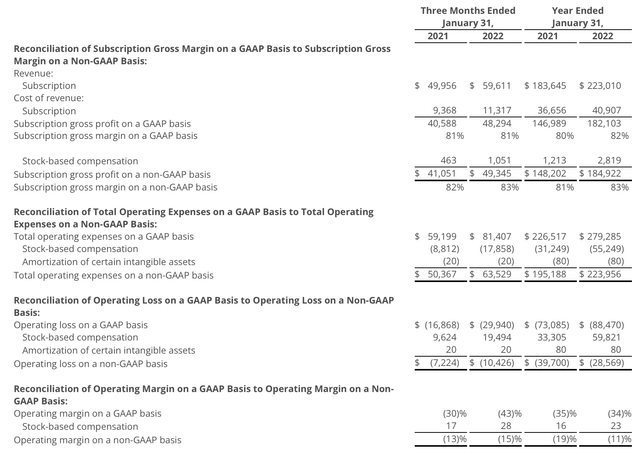

Regardless of the accelerated hiring in gross sales, nonetheless, Domo nonetheless managed to provide wholesome profitability. As beforehand talked about, subscription professional forma gross margins for the 12 months clocked in at a excessive 82%, two factors richer than the year-ago quarter:

Domo margin developments (Domo This fall earnings launch)

As well as, as seen within the chart above, professional forma working margins for the complete 12 months have been -11%, which is an eight-point enchancment versus FY21. Domo’s free money circulation burn of -$2.0 million for FY22 was additionally very close to breakeven and a considerable enchancment over a -$14.8 million burn in FY21.

Key takeaways

There’s quite a bit to love about Domo heading into the rest of 2022: resilient and accelerating progress, revenue enchancment primarily based on economies of scale on excessive gross margins, and an undemanding valuation. Use the latest dip as a shopping for alternative.