Published by Nate Parsh on October 28th, 2022

The Dividend Kings are an illustrious group of companies. These companies stand apart from the vast majority of the market as they have raised dividends for at least 50 consecutive years.

We believe that investors should view the Dividend Kings as the most high-quality dividend growth stocks to buy for the long term.

With this in mind, we created a full list of all the Dividend Kings. You can download the full list, along with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking the link below:

This group is so exclusive that there are just 46 companies that qualify as a Dividend King. The newest member to join this index is Middlesex Water Company (MSEX), a water utility company that has been in business for 125 years.

This article will discuss the company’s business overview, growth prospects, competitive advantages, and expected returns.

Business Overview

Middlesex Water Company was formed in 1897, making the company one of the oldest water and wastewater utility names in the U.S. The company has operations primarily in New Jersey, a market capitalization of $1.55 billion, and annual revenue of approximately $160 million.

Like many of its peers, Middlesex is primarily focused on the regulated portion of its business.

Source: Investor Presentation

Middlesex’s provides basic water-related services to customers, such as selling, distributing, collecting, and treating water. The non-regulated business includes service contracts that include the operation and maintenance of municipal private water and wastewater systems in New Jersey and Delaware.

The vast majority of revenue comes from the regulated side. One of its largest service areas includes Middlesex County, where the company provides water services to 61,000 retail customers. This business contributed 59% of revenue last year.

Middlesex most recently reported quarterly earnings on July 29th, 2022.

Source: Investor Presentation

Revenue grew by more than 8% to $39.7 million. A 4% increase in operating expenses to $29.6 million hampered the bottom-line, however. As a result, net income fell 19% to $8.9 million while adjusted earnings-per-share decreased 19.3% to $0.50. In addition, income taxes were $2.4 million above the prior year due to the expiring tax benefits. Middlesex also recorded a $5.2 million pre-tax gain on the sale of its regulated wastewater subsidiary in Delaware earlier this year.

Growth Prospects

Utility companies are typically classified as slow, but steady growers.

This myth doesn’t necessarily apply to Middlesex, however, as the company had an earnings-per-share compound annual growth rate of 9.7% for the 2012 to 2021 time period. This is a strong growth rate for a business that is mostly regulated. It should be noted that growth for the company hasn’t always been in a straight line up over the long-term.

Since the majority of revenue comes from regulated business, Middlesex is at the mercy of the approval of rate increases to grow.

Fortunately, the company heavily invests in its infrastructure in order to justify customer rate increases. For example, the New Jersey Board of Public Utilities approved a 40% increase in Middlesex’s rates in one of the company’s largest service areas for 2022. This wasn’t just a one-time raise either, as the approval board has always approved the company’s request to raise rates.

It is likely that rate increases will continue to be a major factor for the company as Middlesex continues to make heavy investments into aging water infrastructure. This will not only improve the quality of operations, but also lead to rate hikes being approved.

In addition to rate increases, Middlesex can grow by adding new customers while also keeping current customers.

For example, Middlesex completed a new agreement to continue to manage water and sewer utility operations with the Borough of Avalon, New Jersey. Effective September 1st, 2022, the new 10-year agreement takes the place of the prior contract. The new contract provides for maintenance of operations and customer services.

The non-regulated business could be a major source of growth as well. In 2013, Middlesex was awarded a $32 million contract to construct and maintain the water distribution network for the Dover Air Force Base in Delaware. This contract will provide decades of recurring revenue as the contract is for 50 years.

Middlesex has also divested certain businesses to focus on its core holdings. This includes the sale of its regulated business in Delaware in early 2022. This loss of this business lowered second quarter results by just $0.7 million.

We project that Middlesex will earn $2.52 per share in 2022, which would be a nearly 22% improvement from the prior year.

Competitive Advantages & Recession Performance

Utility companies often benefit from multiple advantages. The first is that they usually operate in a near-monopoly on the areas that they service.

In the case of water utilities, Middlesex and its peers provides the most basic staple of all, water. Customers are going to need the services that the company offers regardless of the strength of the economy. Water bills are also often low compared to other utility bills.

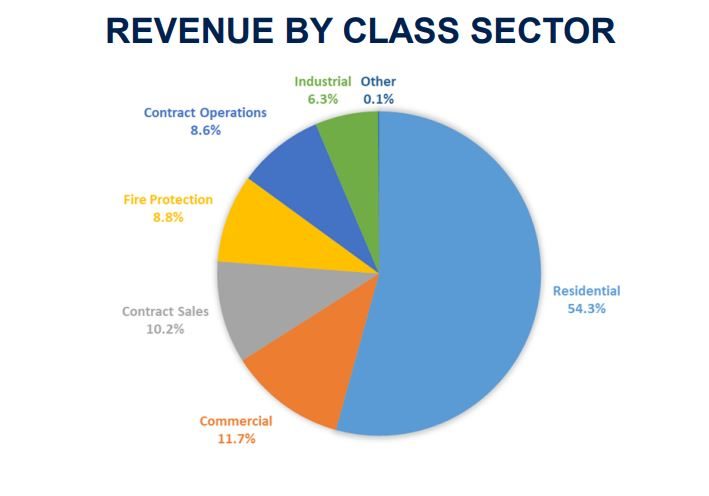

Middlesex also benefits from its diversified business.

Source: Investor Presentation

Middlesex receives slightly more than 50% of its revenue from residential customers, but there are other categories, such as commercial, contract sales, and fire protection, that contribute meaningfully to the company’s business.

Given these built-in advantages, many utilities often outperform other sectors of the market during recessions. Below are Middlesex’s earnings-per-share results before, during, and after the Great Recession:

- 2006 earnings-per-share: $0.82

- 2007 earnings-per-share: $0.87 (6.1% increase)

- 2008 earnings-per-share: $0.89 (2.3% increase)

- 2009 earnings-per-share: $0.72 (19.1% decrease)

- 2010 earnings-per-share: $0.96 (33.3% increase)

Middlesex’s earnings-per-share initially grew during the recessionary period before falling by a high double-digit amount in 2009, showing that the utility wasn’t completely immune to the economic backdrop of the period. One positive was that revenue stayed relatively flat for the 2008 to 2009 period.

Importantly, the company rebounded in a substantial way the very next year and set a new high for earnings-per-share. Growth has mostly been in an uptrend since.

The Covid-19 pandemic didn’t impact business as earnings-per-share grew 8.5% in 2020.

Valuation & Expected Total Returns

Despite high expected growth for 2022, we believe 3.5% annual earnings growth through 2027 is a more conservative view of Middlesex.

Middlesex gained entrance into the Dividend Kings following the company’s announcement on October 21st, 2022, that it would be increasing its quarterly dividend rate 7.8% to $0.3125. This is above the compound annual growth of 4.6% over the last decade. Shares yield 1.4%. The company has paid a continuous dividend since 1912.

Finally, the last component of total returns will be valuation. Shares are currently trading at nearly 35 times our earnings-per-share projection for the year.

Given the company’s tailwinds and business model, we believe fair value is 31.3 times earnings, which is the average valuation of the stock for the last five years. Reverting to our target valuation by 2027 would result in a multiple contraction reducing annual returns by 2.2%.

Therefore, Middlesex is forecasted to return 2.6% annually through 2027, stemming from an earnings growth rate of 3.5%, a starting dividend yield of 1.4%, and a low single-digit headwind from multiple reversion.

Final Thoughts

There is much to like about Middlesex, namely its monopoly status, the high success of rate increase approvals, and the long history of dividend growth. Only the most well-run businesses can pay dividends for as long as Middlesex has.

That said, the stock is trading at a premium to even its own lofty valuation average since 2017. Despite the attractiveness of the company and its dividend growth streak, we believe investors are better off elsewhere as forecasted returns over the medium term are very weak.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected]