Up to date on August twenty third, 2022 by Bob Ciura

Investing is all about incomes the very best return potential, whereas minimizing threat. After all, there are various routes traders can take to achieve this vacation spot.

Two of the most typical methods individuals make investments are the inventory market, and in actual property. The topic of dividend shares versus actual property is a posh subject, with nobody proper reply. What works for one particular person might not work for another person.

With regards to dividend shares, we consider traders ought to concentrate on the Dividend Aristocrats, a bunch of 65 shares within the S&P 500 Index which have raised their dividends for no less than 25 consecutive years.

You may obtain an Excel spreadsheet of all 65 Dividend Aristocrats (with metrics that matter resembling dividend yields and price-to-earnings ratios) by clicking the hyperlink beneath:

In consequence, there are various completely different viewpoints on the topic. When you have been to ask 10 completely different traders which is healthier, you may get 10 completely different solutions.

There are execs and cons to every technique, though research have proven over time that one method might certainly be higher than the opposite.

This text will talk about the varied benefits and drawbacks of dividend investing versus actual property investing.

Dividend Investing Execs and Cons

Investing in shares has been top-of-the-line methods to construct wealth over the long-term. Contemplate the historic efficiency of the S&P 500 Index:

Supply: Multpl.com

The S&P 500 Index just lately closed simply above 4,120.

On January 1, 2017, the S&P 500 Index was at 2,275.12. On January 1, 1871, the index was at 4.44 factors. Over that 150-year interval, the S&P 500 returned 4.7% per yr, on common, after inflation.

Dividend shares could be much more rewarding. Take, for instance, the checklist of Dividend Aristocrats, a bunch of corporations within the S&P 500 which have raised dividends for 25+ years.

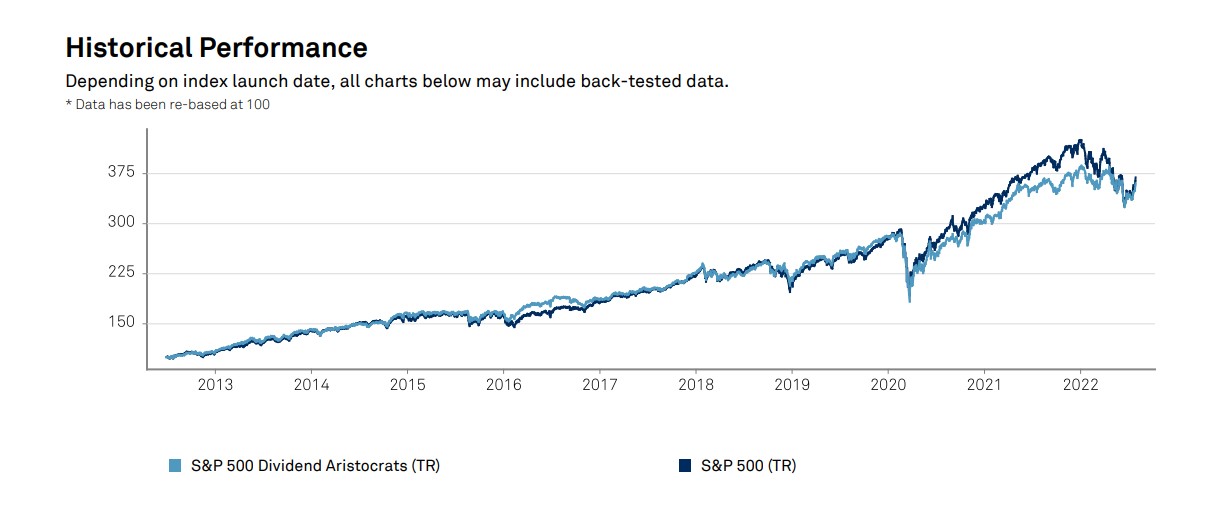

The S&P Dividend Aristocrats have barely underperformed the broader S&P 500 Index prior to now decade. Nonetheless, the Dividend Aristocrats generated robust complete returns of 13.5% per yr prior to now 10 years.

Supply: S&P Reality Sheet

The great thing about investing in dividends versus actual property, is that dividend shares pay you to personal them, not the opposite manner round.

Dividend shares are an particularly engaging choice for retirees, as a result of dividend revenue might help change misplaced wages after retirement, at a a lot decrease price than investing in actual property.

There are important tax issues for dividend investing.

Taxes generally is a drawback of dividend investing, significantly if the investor doesn’t make use of tax-advantaged accounts like IRAs.

Capital beneficial properties taxes, particularly short-term charges, can eat into the returns that dividend shares present.

Based on the Inside Income Service, long-term capital beneficial properties, that means beneficial properties on inventory investments that have been held for no less than one yr, are usually 15% for many taxpayers.

For these within the high tax bracket for peculiar revenue, the long-term capital beneficial properties fee is 20%.

That stated, short-term capital beneficial properties are topic to taxation as peculiar revenue.

And, if the shares are held in taxable accounts, traders must pay tax on the dividend revenue as effectively. Certified dividends are taxed on the similar fee as long-term capital beneficial properties.

Even so, capital beneficial properties and dividend taxes are often a a lot smaller tax invoice than actual property taxes.

And, there are tax-advantaged accounts that dividend traders can make the most of to protect themselves from taxes, such because the Roth IRA.

After all, the most important drawback of investing in dividend shares versus actual property, is that dividend shares received’t present a roof over your head.

Now that we’ve sized up the professionals and cons of dividend investing, we’ll transfer on to the professionals and cons of actual property investing.

Actual Property Investing Execs and Cons

Evaluating dividend investing to actual property investing shouldn’t be all the time an apples-to-apples comparability. It’s not an either-or proposition; most often, the dividend investor nonetheless wants a spot to stay.

The attraction of investing in actual property is that it permits traders to construct fairness and sooner or later repay their mortgage, relatively than paying hire to a landlord indefinitely.

A house might help construct important wealth for the home-owner, whereas renters must preserve paying hire in perpetuity, with no fairness constructed up.

Actual property may also generate revenue, for instance by renting, though that units up an extra set of points.

Nonetheless, actual property, on common, has produced pretty low returns over the previous a number of a long time.

Contemplate the Case-Shiller Dwelling Index, a widely-used gauge of U.S. residence values. As of December 1, 2021, the Case-Schiller Dwelling Index stood at 280.19; on December 1, 1890, the index was at 112.77 (all values are adjusted for inflation).

Which means, over the course of that 130-year interval, houses within the U.S. returned 0.7% per yr in actual phrases.

Now evaluate these returns with the S&P 500 Index, referenced within the opening part—the S&P’s historic annual returns are greater than 10 instances that of actual property.

What actual property traders want to remember are the prices of residence possession. That is what can erode the returns from actual property investing.

That’s the reason, if somebody tells you they purchased a house for $200,000 and bought it 30 years later for $500,000, you shouldn’t assume they earned $300,000 in revenue.

Exterior of a mortgage, there are a variety of further prices that actual property traders should pay that renters don’t—just some embrace mortgage curiosity, closing prices, home-owner’s insurance coverage, taxes, and residential proprietor’s affiliation dues (if relevant).

And, this doesn’t even embrace prices to maintain and keep a house in correct situation, resembling new home equipment, furnishings, and many others.

In some instances, a home-owner may truly lose cash, even when they bought their home at a a lot greater worth than what they paid for it, due to the prices of possession alongside the way in which.

Actual property investing does have its share of benefits. For instance, residence house owners can deduct a portion of mortgage curiosity paid annually.

Furthermore, proper now is a reasonably good time to purchase a house. Dwelling affordability stays strong in lots of markets across the U.S., because of low charges.

Whereas rates of interest have ticked up because the Federal Reserve started climbing charges, the common fee on a 30-year mounted mortgage hovers round 5.6% in response to Bankrate.

That is nonetheless not very excessive, by historic requirements. Within the early 1980’s, it was not unusual to see double-digit charges for 30-year mounted mortgages.

Remaining Ideas

There isn’t a single resolution that works for everyone. There have been many traders who made their fortunes within the inventory market, and lots of others who did so in actual property.

The Dividend Aristocrats have outperformed the broader market—and trounced actual property—with comparatively low volatility. Primarily, investing in dividend shares is the slow-and-steady path to constructing wealth.

Actual property investing includes an excessive amount of leverage—if you happen to’ve put down 20% on a house (which many owners don’t), you’ve borrowed 80% of the house worth.

For a $500,000 residence, which means traders are borrowing $400,000.

Leverage can amplify returns. However as many People realized the arduous manner in the course of the 2008 actual property crash, leverage works each methods.

Different Dividend Lists

The Dividend Aristocrats checklist shouldn’t be the one solution to shortly display for shares that commonly pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].