damedeeso/iStock through Getty Photographs

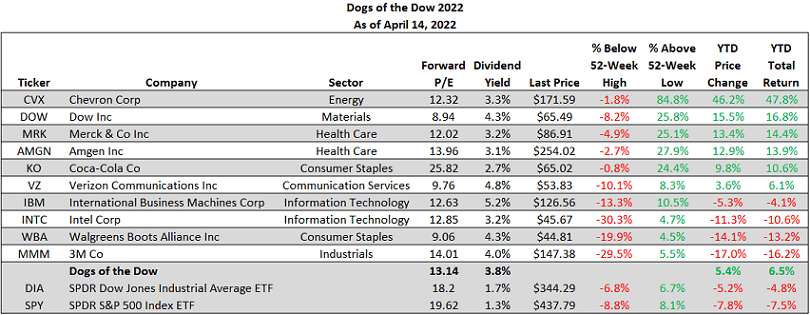

With a little bit greater than a fourth of the 12 months behind buyers, and within the face of rising rates of interest, dividend paying shares have been insulated from a few of the fairness market volatility that has impacted progress shares. Possibly one of many higher recognized revenue funding methods is investing within the Canines of the Dow. The recognition of the technique is its singular concentrate on dividend yield. The Canines of the Dow technique is one the place buyers choose the ten shares which have the very best dividend yield from the shares within the Dow Jones Industrial Index after the shut of enterprise on the final buying and selling day of the 12 months. As soon as the ten shares are decided, an investor invests an equal greenback quantity in every of the ten shares and holds them for the complete subsequent 12 months. Because the beneath desk reveals, the 12 months to this point return for the Dow Canines by means of April 14, 2022 equals 6.5% versus the Dow Jones Industrial Common ETF (DIA) down -4.8% and the SPDR S&P 500 Index ETF (SPY) down -7.5%. The technique has had combined outcomes over time.

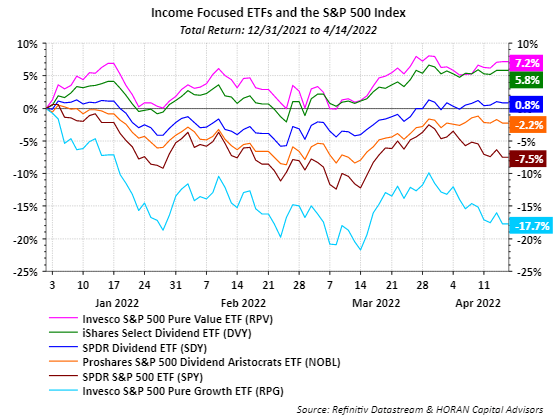

The Dow Canines’ technique is solely centered on dividend yield and the beneath chart consists of different dividend centered fairness methods. The highest 4 performing methods are largely dividend revenue ones. Every of the highest 4 performing ones are additionally outperforming the broader S&P 500 Index. The highest performing one is the Invesco S&P 500 Pure Worth ETF (RPV), up 7.2% and the underside performing technique is the Invesco Pure Development ETF (RPG), down -17.7% 12 months to this point. The Pure Worth ETF technique is just not a pure dividend centered one, nevertheless, out of the 119 shares within the index, solely 12 don’t pay a dividend.

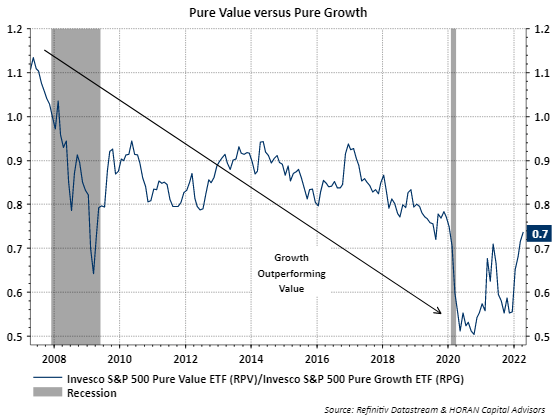

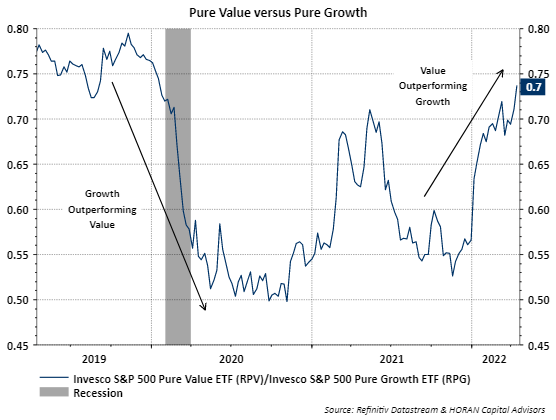

The expansion fashion has largely outperformed worth because the finish of the 2008/2009 monetary. The primary chart beneath reveals this outperformance. The second chart is a shorter three 12 months timeframe, and because the pandemic backside in March of 2020, outperformance has vacillated between progress and worth. Once more, the worth fashion is outperforming this 12 months.

Contributing to worth’s outperformance is its obese within the monetary sector, 31% versus 12.5% for progress. The opposite two outperforming sectors for pure worth are Shopper Staples and Supplies, with the pure progress fashion having no publicity to these two sectors. With increased rates of interest possible this 12 months, this might function extra of a profit for worth fashion shares versus progress fashion ones.

Disclosure: Agency/Household lengthy DOW, MRK, VZ, INTC, MMM

Authentic Submit

Editor’s Observe: The abstract bullets for this text have been chosen by In search of Alpha editors.