Updated on January 23rd, 2023 by Samuel Smith

When it comes to dividend investing, the Dividend Aristocrats are the “cream of the crop.”

The Dividend Aristocrats are a group of stocks in the S&P 500 Index, with 25+ consecutive years of dividend increases.

There are just 65 companies that have attained Dividend Aristocrat status.

As a result, it is not easy to join the Dividend Aristocrats list. With that in mind, we created a downloadable list of all 66 Dividend Aristocrats, along with important metrics like dividend yields and price-to-earnings ratios.

You can download a free copy of the Dividend Aristocrats list by clicking on the link below:

There are thousands of dividend stocks to choose from, but the Dividend Aristocrats are a unique group. The Dividend Aristocrats have profitable businesses, and the ability to grow their profits over time. This allows them to withstand recessions, and continue increasing their dividends each year.

Franklin Resources (BEN) has increased its dividend for 43 consecutive years, and the stock has a high dividend yield of 4.0%.

Franklin Resources has endured a few tough years. Still, given the company’s track record of dividend growth and current yield, Franklin Resources is an attractive stock for income investors.

Business Overview

Franklin Resources is an investment management company. It was founded in 1947 in New York, by Rupert H. Johnson Sr., who had previously managed a Wall Street brokerage firm. He named the company after Benjamin Franklin, the founding father who was viewed as a symbol for frugality, saving, and wise investments.

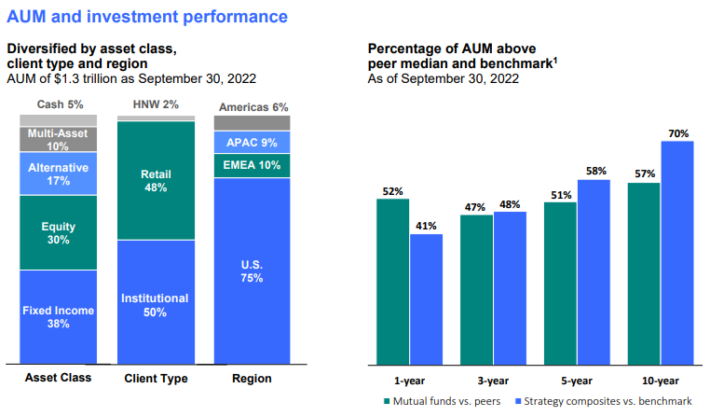

Today, Franklin Resources manages the Franklin and Templeton families of mutual funds. The company ended Q4 2022 with assets under management of $1.3 trillion. It has diversified AUM and a strong long-term performance track record.

Source: Investor Presentation

The past few years have been difficult for Franklin Resources. Franklin Resources was slow to adapt to the changing environment in the asset management industry. The explosive growth in exchange-traded funds and indexing investing caught traditional mutual funds by surprise.

ETFs have become very popular with investors due in large part to their lower fees than traditional mutual funds. In response, the asset management industry has had to cut fees and commissions or risk losing client assets.

Franklin Resources has also struggled the past few years due to the broad deterioration in the global economy caused by the coronavirus pandemic, as its funds have slightly underperformed peers and benchmarks on average over the past three years.

Growth Prospects

Despite the difficult operating environment, there are reasons to be optimistic about the company’s long-term growth. First, the U.S. is an aging population. There are thousands of Baby Boomers retiring every day. Combined with rising life expectancy, there is a great need for investment planning for those in or nearing retirement.

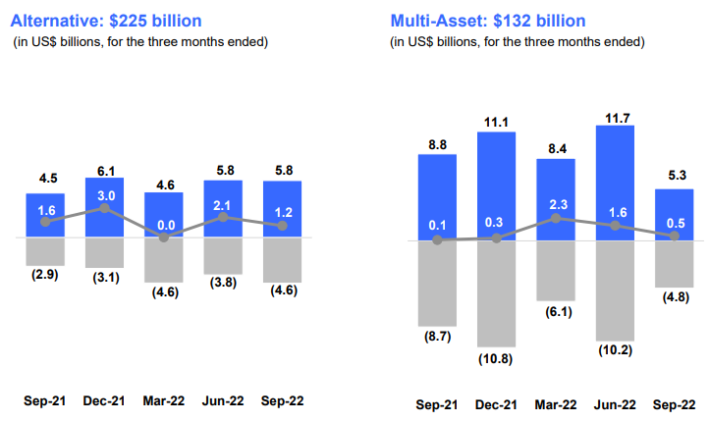

Franklin Resources is still making investments in driving long-term earnings per share growth. This past year the company funded two acquisitions and four investments and bought back stock fairly aggressively. In particular, the company has been strategically expanding into alternative investments in order to generate an alternative growth vertical. Some of these include Legg Mason, Lexington Partners, and Alcentra.

These investments have paid off thus far as the company generated net inflows in its alternative and multi-asset categories and reduced net outflows in equities this past year.

Source: Investor Presentation

On November 1st, 2022 Franklin Resources reported results for the fourth quarter of fiscal 2022. Total assets under management equaled $1.2974 trillion, down $82.4 billion compared to last quarter, as a result of $(62.1) billion of net market charge, distributions and other, and $20.4 billion of long-term net outflows. For the quarter, operating revenue totaled $1.939 billion, down 11% year-over-year. On an adjusted basis, net income equaled $394 million or $0.78 per share compared to $416 million or $0.82 per share in Q4 2021.

During Q4, Franklin repurchased 1.0 million shares of stock for $27 million. For the full fiscal year 2022, Franklin Resources earned $3.63 per share in adjusted net income, which was a 3% decline compared to $3.74 in FY 2021. Franklin ended the fiscal year with $6.8 billion of cash and investments, reflecting prudent balance sheet management in the face of headwinds.

We feel investors can reasonably expect 5% annualized earnings-per-share growth over the next five years. Earnings-per-share growth will be driven by revenue growth, mainly due to rising AUM, as well as a boost from share repurchases.

Competitive Advantages & Recession Performance

Asset management is a highly competitive business, and there are not many competitive advantages in the financial services industry. The ability to retain clients depends largely on performance. If funds perform worse than their benchmarks, clients typically withdraw their funds.

However, Franklin Resources has a few advantages going for it. The first, and perhaps most important, is brand recognition. Franklin Resources has been in operation for over 70 years. That indicates a certain developed expertise and some innate investment abilities. Franklin Resources also still has huge assets under management, allowing the company to offer a wide range of investment opportunities to clients and generate some economies of scale.

Counterbalancing these advantages, Franklin Resources’ most recent recession performance was poor:

- 2007 earnings-per-share of $2.37

- 2008 earnings-per-share of $2.24 (5.5% decline)

- 2009 earnings-per-share of $1.30 (42% decline)

- 2010 earnings-per-share of $2.12 (63% increase)

As you can see, earnings-per-share fell steeply in 2009 during the worst part of the Great Recession. This should come as no surprise since investing is hardly recession-resistant. During recessions, stock markets typically decline. For asset managers, this can lower assets under management and fees. That said, Franklin Resources recovered quickly, and saw earnings jump in 2010 and thereafter.

While the company entered another downturn in fiscal 2020 due to the coronavirus pandemic, the company remained profitable, which allowed it to continue raising its dividend. It is also in a position to return to growth in the current fiscal year, assuming a continued economic recovery.

Valuation & Expected Returns

We expect that Franklin Resources will earn $2.55 per share in the fiscal year 2023. The stock has a price-to-earnings ratio of 11.9. This is above our fair value P/E estimate of 9.0. A compressing valuation multiple could reduce annualized total returns significantly moving forward.

This valuation headwind will likely be offset by earnings-per-share growth and dividends. Franklin Resources has an attractive dividend yield of 4.0%, and the dividend payout appears to be secure. A breakdown of potential returns is as follows:

- 5.0% earnings-per-share growth

- 4.0% dividend yield

- 5.4% valuation headwind

If Franklin Resources can return to growth, investors buying the stock now could see annualized total returns of 3.6% over the next five years.

Final Thoughts

Franklin Resources’ future growth depends on a strong economy, rising stock prices, and increasing assets under management. Its recent investments in alternative asset managers and aggressive stock buybacks appear to be a good start in that direction.

With a strong 4.0% dividend yield and a positive growth outlook, Franklin Resources could be attractive for income investors.

However, given that expected annualized total returns are fairly weak, investors interested in the stock are encouraged to wait for a pullback or an improvement in fundamentals before buying Franklin Resources. As such, the stock receives a Hold recommendation.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].