FrozenShutter

There was a time when the streaming site Netflix, Inc. (NFLX) was larger than The Walt Disney Company (NYSE:DIS). Since then, the times have changed. Netflix has dropped to a market capitalization of less than $100 billion, while Disney is almost double the size. As we’ll see throughout this article, investors who are sitting in Netflix stock should rate to Disney.

Netflix’s Financial Weakness

Netflix has had weak financial and subscriber performance as the cost of content has gone up and existing content has gone to other platforms.

Netflix Financials

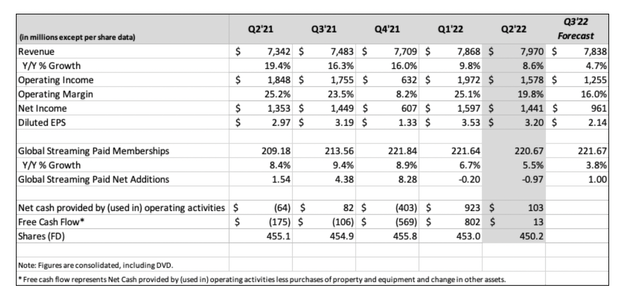

Netflix has seen revenue appear to plateau. The company did manage to see almost 9% YoY revenue growth, however, that’s revenue growth indicating that the company barely managed to keep up with inflation through price increases. The company’s subscriber growth was by less than 4% indicating the majority of revenue growth was through price increases.

Surveys indicate that Netflix’s history of price increases won’t be able to continue for much longer. For a single-business company watching subscribers plateau, having used up a substantial % of its customer goodwill, we see the company as having plateaued. That’s a big problem for a company with a $100 billion market cap.

FCF (free cash flow) is barely positive, as the company continues to spend on content. Content investments are 70% of revenue alone. All of that is tough when you have a single business model, streaming. Disney has built up an ecosystem around its content, whose business models with fewer customers (like ESPN) are setting up the company to continue competing.

Disney Diversified Portfolio Of Assets

Disney’s largest strength is its diversified portfolio of assets and its unique ability to drive returns at each step of the process.

The company has its legacy assets that it has spent decades building up. It has the core sports properties, it also captivates adults with assets like ESPN. Many of the most popular movies of recent years come from its Marvel acquisition, making it one of the largest players in the “superhero” move genre and theater movie genre in general.

The company has classic channels like ABC. It operates some of the largest theme parks in the world and has its own segment of Disney branded cruises. The company controls some of the most popular media assets in the world, and it has become incredibly efficient and generating results at every step of the value chain from those assets.

When compared to any of its peers, none can compete with Disney’s efficiency and driving results from its brands. The success of Disney+ in the short-term as users flocked to it is an example of this strength.

Disney Earnings

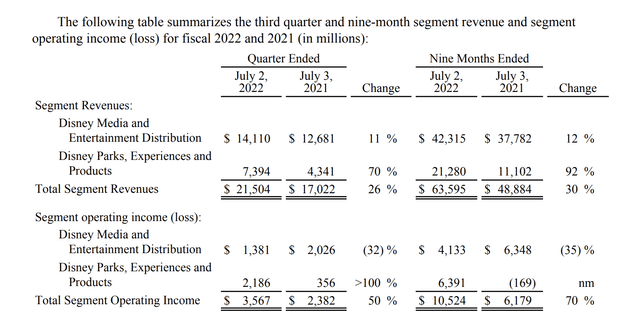

As a result of these various factors, Disney has managed to keep its earnings relatively strong.

Disney Press Release

Disney Shareholder Return Potential

Disney has the ability to drive substantial shareholder returns from its portfolio of assets.

The company has almost $15 billion in operating income, and a market cap of $170 billion. That means the company has a low double-digit P/E in an environment where its profits are continuing to recover. The company’s profits still have substantial room to recover, as seen in the YoY improvement of the company’s parks division.

The company halted most of its shareholder returns, but it has an impressive portfolio of assets that will enable substantial shareholder returns. The company does have a substantial amount of long-term debt at almost $50 billion, which could get more expensive as interest rates go up, but it’s all manageable for the company.

Regardless of how the company spends its cash, we expect substantial shareholder rewards.

Thesis Risk

The largest risk to our thesis is that, at the end of the day, Disney is an entertainment company. The company has an incredibly strong positioning in the markets, with a built-up multi-decade legacy. However, there’s no guarantee that that’ll continue. A recession could cause the company’s pricing power to erode as customers view vacations as a luxury.

All of that together can hurt the company’s ability to continue growing.

Conclusion

Disney for some time was seen as the forgotten stepchild. Netflix led the way as the largest streamer with a market capitalization substantially above that of Disney despite Disney’s strong and diversified business profiles. That diversification was seen as a legacy of times that had passed. However, since then those times have changed.

Investors realized that Netflix’s business model wasn’t impossible to reproduce. Disney has now built a much stronger streaming service, and the company did it while diversifying its content assets with numerous others of revenue. That means the company’s margins are much stronger. Its current diversified asset portfolio makes it a valuable long-term investment with numerous sources to drive substantial shareholder returns.