[ad_1]

anamejia18/iStock by way of Getty Photographs

Cryoport (NASDAQ:CYRX) is an organization that offers in medical provides. Their major focus is on the life sciences trade as they supply temperature-controlled provide chain options. Particularly, the corporate has invented and manufactured “Cryoport Categorical,” a liquid nitrogen dry vapor 2- to 8-degree Celsius answer. This permits producers of fertility therapies, sperm banks, genetics firms, and biopharmaceutical trade firms to ship temperature-sensitive labs and samples safely. Cryoport operates as a business-to-business options firm, which implies that they don’t promote on to clients, however quite market their providers to different companies. The corporate is frequently adapting its applied sciences, improvements, and logistical strategies to supply essentially the most environment friendly potential options regardless of the circumstances. In a always altering world, Cryoport does its finest to be essentially the most inexpensive, adaptable temperature-controlled shipper available on the market.

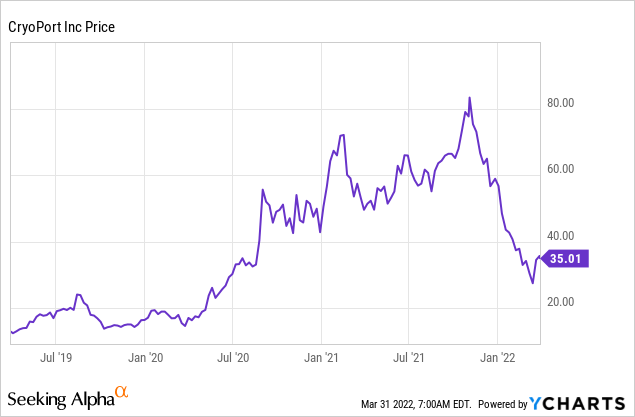

ycharts.com

This text goals to show that it’s a worthy funding regardless of the various dangers of investing in Cryoport. The primary cause for that is their dominance of their subject. Regardless of their comparatively small market, their place in it offers them stability and repeatedly will increase revenues. The price of operations is a contact regarding, particularly given their unfavourable web earnings postings in every of the final 4 years. Nonetheless, the overwhelming development within the financials reveals an organization that’s persistently rising and enhancing. This development is one which I consider is prone to proceed. For that cause, I’ve Cryoport as a purchase, and I consider traders ought to pursue this inventory with a bullish funding technique.

Causes for Optimism

The corporate has a number of causes to be optimistic about its future prospects. The primary amongst them is the market that they fall into. The medical provide market has loved a pleasant surge due to rising well being considerations and the pandemic surge. Whereas their projected progress price isn’t strong, it displays a sluggish, regular progress tempo that has been constant over a number of years throughout the market. As the necessity for brand new revolutionary medical expertise evolves, so too will the market. Because it stands, the medical provide market is projected to broaden its dimension to $189 billion by 2028 at a CAGR of 4.5%. This helps to show one other aspect of the corporate’s sluggish and regular strategy that has, up to now, paid off.

One other fascinating think about trying on the future potential of the enterprise is its construction. In distinction, many different opponents of their market depend on promoting their merchandise on to hospitals, docs, or particular person sufferers; Cryoport markets and sells their merchandise on to different companies. They’ve cemented themselves as a significant hyperlink for shifting samples and lab substances to and from numerous amenities temperature-controlled. This enterprise strategy is called B2B, and it has a number of benefits. The primary benefit of this enterprise fashion is that it has appreciable market enchantment. Whereas it is technically within the medical provides market, the providers the corporate sells are coveted by a variety of different companies in different markets, primarily the very profitable biopharmaceutical market. Due to this and the truth that B2B firms usually promote their merchandise in bulk, Cryoport has an in depth pipeline that generates extra earnings than a lot of its medical provide opponents.

Cryoport additionally not too long ago launched an initiative to purchase again $100 million value of widespread inventory and convertible senior notes in an effort to concentrate on shareholder return. This capital reallocation may have a really optimistic web impact for shareholders because it may very nicely result in a achieve by way of firm dividends to be paid out. Usually, when an organization repurchases its personal shares, it’s in an effort to extend its market worth by eliminating any extra dilution from its distributed shares.

Firm Dangers

Regardless of the profitable upside to funding in Cryoport, it additionally has its share of threat elements. A type of elements shall be lined extra totally within the finance part, which is the unfavourable string of web earnings totals over the past 4 years. One other reason for concern for the corporate comes from current occasions. A current fireplace in one of many firm’s manufacturing crops in New Prague, Minnesota, will seemingly decelerate manufacturing charges, adversely affecting earnings in 2022. Whereas the corporate doesn’t anticipate this to be a long-lasting impact, it’s tough to say till the total extent of the harm has been decided and repaired.

One other extra negligible threat comes from the corporate’s reliance on exterior partnerships to generate earnings. Whereas many of those partnerships are with extra profitable firms from extra profitable markets, that isn’t essentially optimistic. Cash is energy available in the market, and contractual obligations are an clever option to maintain Cryoport’s charges down whereas preserving the partnership. Any alteration to the chemical market that forces their price of manufacturing to spike up may go away them beholden to promoting their merchandise at a contractually agreed price. This might lead to an enormous loss.

Monetary Overview

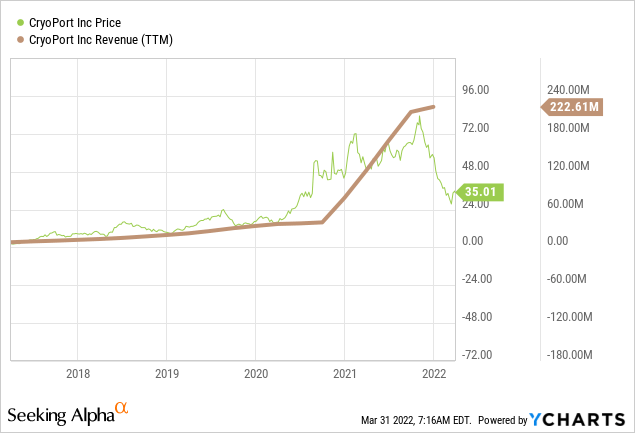

ycharts.com

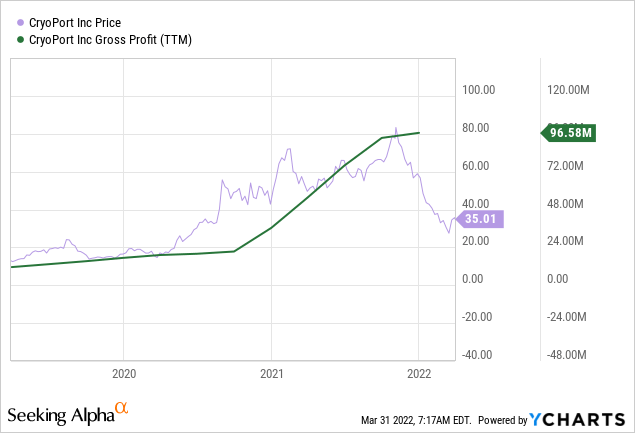

Firm revenues have elevated yearly since 2018. In 2018 the corporate made $19.6 million in income. In 2019 that quantity elevated to only beneath $34 million. In 2020, revenues improved once more, this time exponentially to a staggering $78.6 million. In 2021 that quantity practically tripled once more, with Cryoport reporting $222.6 million in revenues. Gross earnings have averaged round 40% of the income or higher in every of these 4 years. In 2018 the corporate took residence $10 million in gross earnings. In 2019 the corporate made, much more, taking in $17 million in earnings. 2020 elevated earnings once more, this time to $36 million. 2021 noticed the corporate set a file in earnings, sweeping in a powerful $96.5 million.

ycharts.com

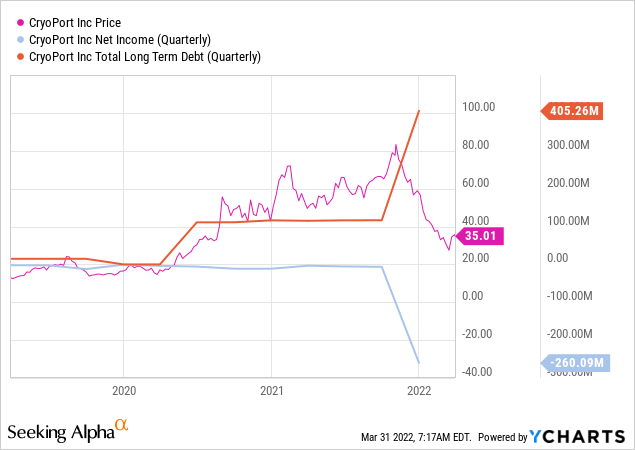

One of many extra problematic reads from Cryoport’s financials resides within the web earnings column. In every of the final 4 years since 2018, the corporate has posted negatives for web earnings. Revenues and gross earnings have elevated impressively however haven’t but resulted in optimistic numbers. In 2018 the corporate posted a web earnings of unfavourable $9.5 million. In 2019 the corporate reported a unfavourable web earnings of $18.2 million. The web earnings whole declined once more in 2020, this time to a lack of $32.7 million. It received worse once more in 2021, with the corporate posting a unfavourable web earnings score of $ -260 million.

ycharts.com

The corporate has additionally managed to amass a big sum of long-term debt over the past 4 years. In 2018 the corporate had simply $14.7 million in debt. In 2019 the corporate paid down nearly all of its debt, getting its debt whole down to only $9,000. In 2020 the debt ballooned again as much as a strong $116 million earlier than practically tripling in 2021 to an astounding $405 million. The truth that they’ve continued to ask in debt whereas on the identical time posting a unfavourable web earnings score may undoubtedly be seen as a major concern.

ycharts.com

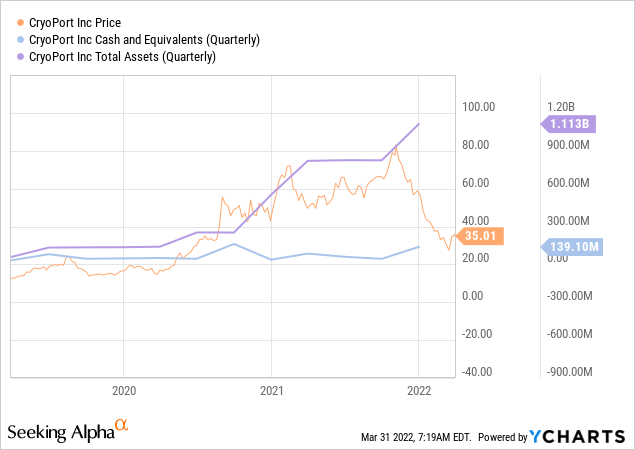

Nonetheless, the corporate has executed nicely to safeguard itself by acquisitions, enlargement, and money move. In 2018 the corporate held simply $37 million in money. In 2019 that quantity grew to $47 million. 2019 noticed a decline in money, with the corporate closing the 12 months at $36 million earlier than exploding to an unprecedented $139 million in 2021. Moreover, the corporate closed out 2021, holding a strong $1.1 billion in property, leaving them well-positioned for no matter turns the market takes.

Conclusion

Cryoport represents one of many decrease yield “risk-reward” shares available on the market and will simply be neglected. There are vital threat elements at play when contemplating an funding, corresponding to the corporate’s unfavourable web earnings charges and its incapacity to drag these numbers into the positives regardless of record-setting revenues. It’s value questioning if the price of manufacturing will finally sink them. With that being mentioned, their strong pipeline and their place throughout the market go away them primed for continued progress. This may be a inventory that an investor must be prepared to develop with. Nonetheless, in my estimation, it’s one that would repay handsomely down the highway. For these causes, I consider the longer term is bullish for Cryoport.

[ad_2]

Source link