Amid inflation, rising rates of interest and recession fears, actual property executives’ confidence within the prospects for the trade and the financial system has declined quickly throughout the previous few months.

That’s the key takeaway from the latest CPE 100 Quarterly Sentiment Survey. The short-term impression of that rising pessimism on funding, improvement and company development plans are unclear, however the findings strongly recommend a consensus amongst govt {that a} recession or slowdown is on the horizon, and changes in technique could also be forward.

The important thing indicator is the CPE 100’s impression of a slowing financial system. Within the new survey, carried out in mid-June, 67 % of respondents stated that they anticipated financial situations to be considerably worse in six months. In the midst of one quarter, that share of the CPE 100 has practically tripled from 23 %. In contrast, throughout the fourth quarter of 2021, optimism dominated the CPE 100’s views. Half of survey contributors stated they anticipated higher financial situations in six months.

The important thing indicator is the CPE 100’s impression of a slowing financial system. Within the new survey, carried out in mid-June, 67 % of respondents stated that they anticipated financial situations to be considerably worse in six months. In the midst of one quarter, that share of the CPE 100 has practically tripled from 23 %. In contrast, throughout the fourth quarter of 2021, optimism dominated the CPE 100’s views. Half of survey contributors stated they anticipated higher financial situations in six months.

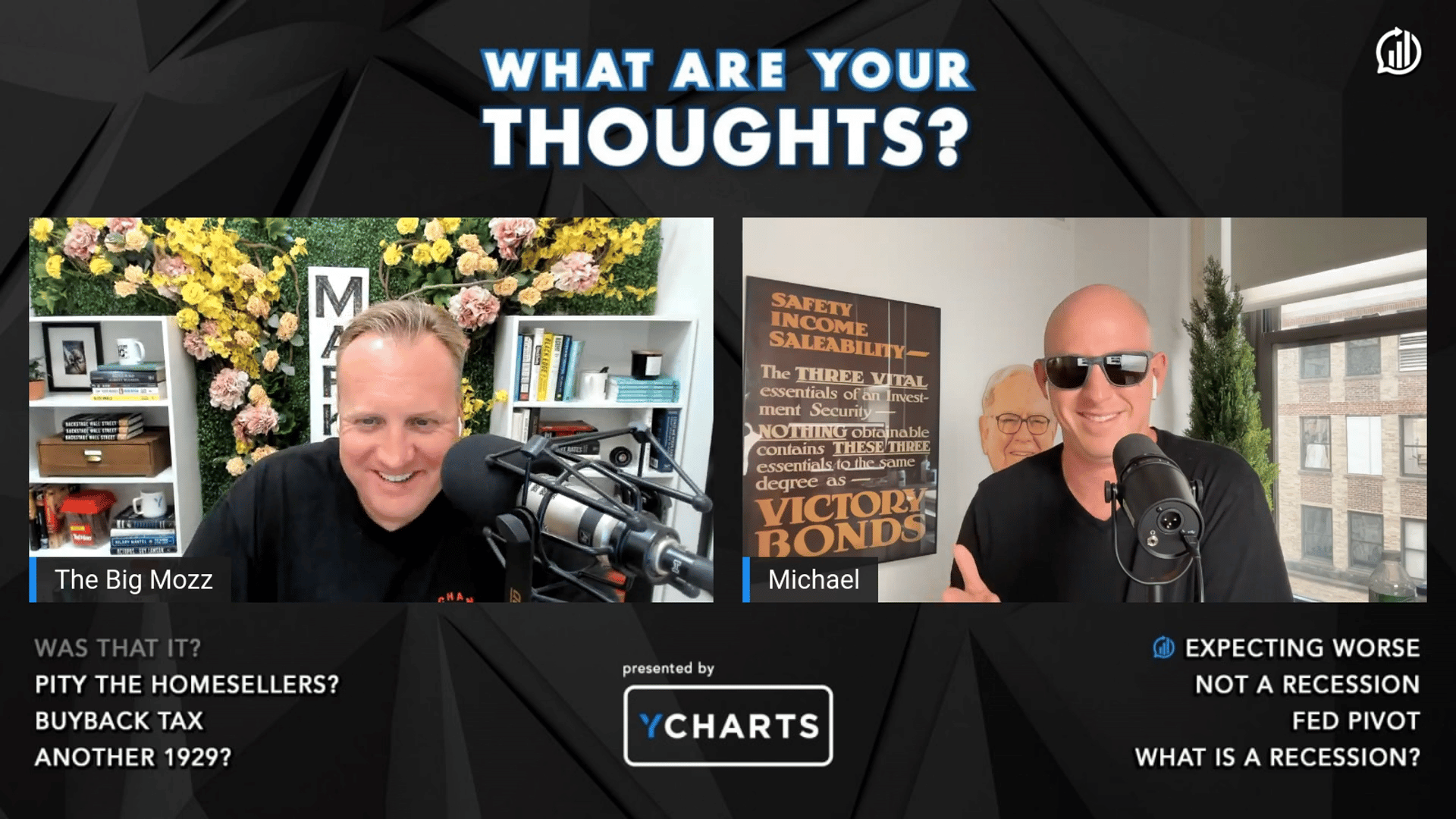

Executives’ expectations in regards to the prospects for the trade have declined much more drastically. Within the second-quarter survey, 92 % of respondents predicted that business actual property shall be performing worse in six months.

In the course of the first quarter of 2022, solely 23 % stated that the trade’s efficiency would weaken. And the consequence represents an almost whole reversal from a 12 months in the past. Within the second quarter of 2021, 86 % of the CPE 100 stated that the trade can be performing higher in six months.

In the course of the first quarter of 2022, solely 23 % stated that the trade’s efficiency would weaken. And the consequence represents an almost whole reversal from a 12 months in the past. Within the second quarter of 2021, 86 % of the CPE 100 stated that the trade can be performing higher in six months.

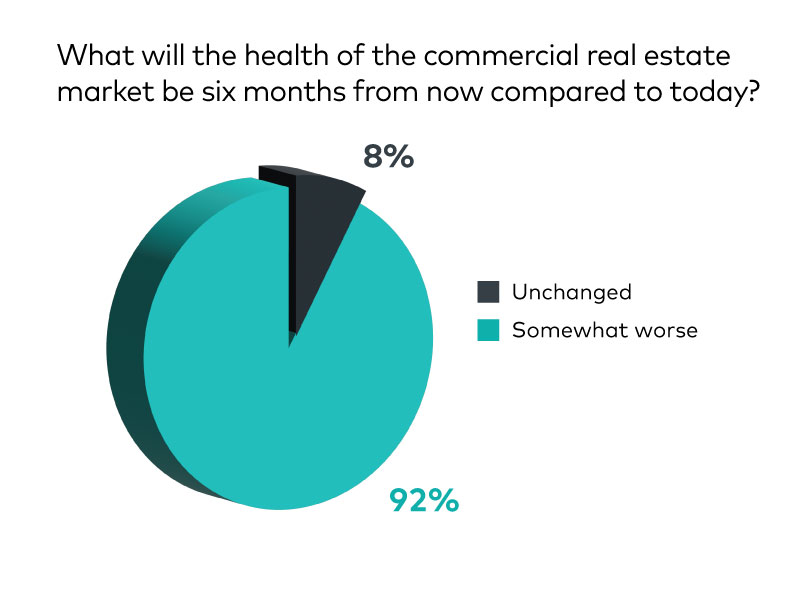

Rising rates of interest look like one of many components weighing on the CPE 100. Half of survey contributors consider that fee hikes will begin to have an effect on the trade throughout the third quarter. In all, 83 % say that the will increase will have an effect by the top of the 12 months.

Most respondents (58 %) see decrease deal quantity because the principal consequence of upper charges for improvement and funding. One third are primarily involved that the will increase will set off increased cap charges.

Most respondents (58 %) see decrease deal quantity because the principal consequence of upper charges for improvement and funding. One third are primarily involved that the will increase will set off increased cap charges.

Worries in regards to the capital markets vary from increased financing prices (50 %) and elevated issue in qualifying for financing (17 %) to diminished flexibility of mortgage phrases (8 %).

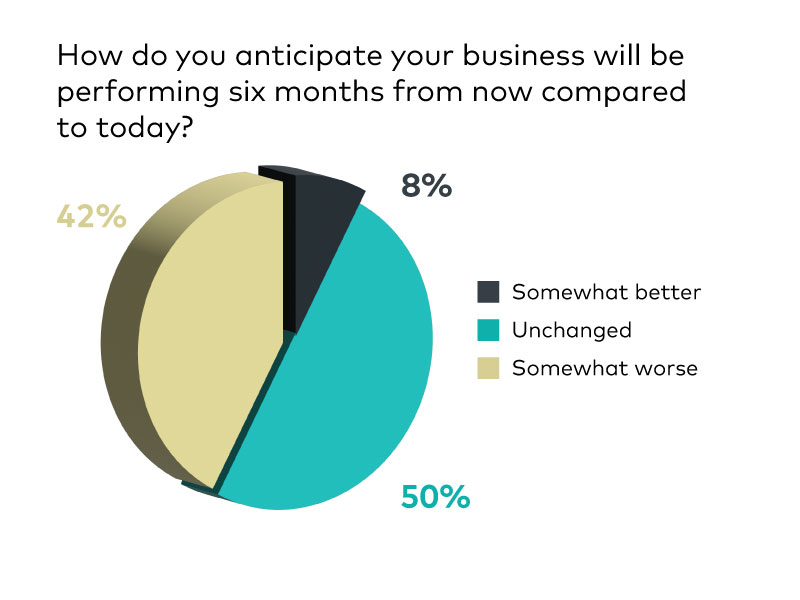

Expectations for survey contributors’ companies are guarded, if much less dire than for the trade as a complete. The share of executives who say their companies’ efficiency will stay unchanged over the following six months has declined modestly, from 62 % to 50 %. However considerably extra are actually involved a few decline. In the course of the first quarter, solely 8 % of respondents stated their corporations can be doing worse in six months; by mid-June, that share had jumped to 42 %.

Expectations for survey contributors’ companies are guarded, if much less dire than for the trade as a complete. The share of executives who say their companies’ efficiency will stay unchanged over the following six months has declined modestly, from 62 % to 50 %. However considerably extra are actually involved a few decline. In the course of the first quarter, solely 8 % of respondents stated their corporations can be doing worse in six months; by mid-June, that share had jumped to 42 %.