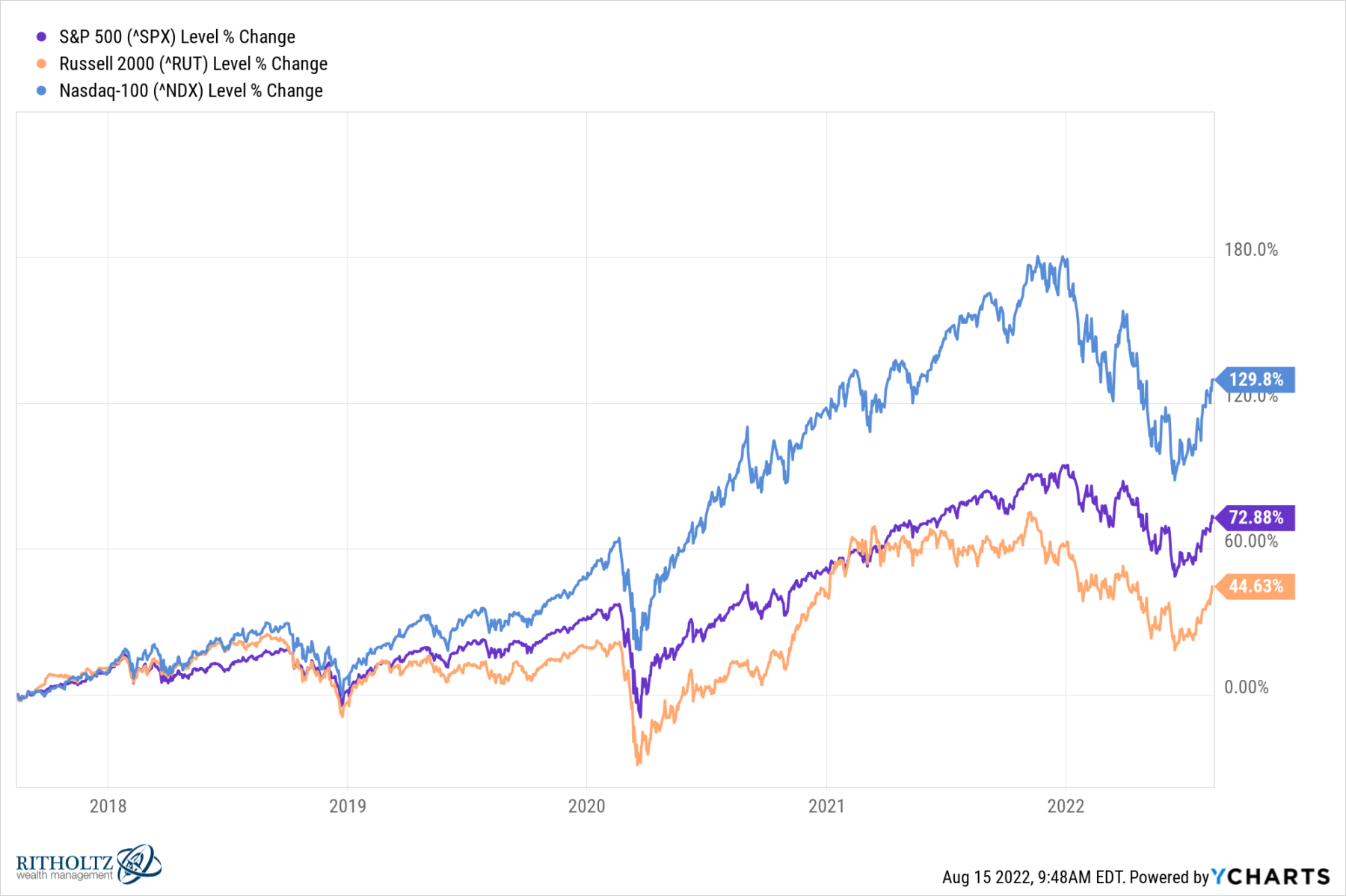

Certainly one of my favourite methods to contextualize market traits is to divide lengthy durations of time into secular bull and bear markets.

After we have a look at the previous century, we are able to see decades-long eras the place the economic system is usually strong, supporting markets trending greater, with increasing multiples. We name these eras Secular Bull Markets. The very best examples are 1946-66, 1982-2000, and 2013 ahead.

The alternate durations of time are Secular Bear Markets: The economic system is fraught with weak spot, poor client spending, and unfavourable job progress. Company revenues and earnings are weak; fairness costs go sideways, with vicious rallies and sell-offs widespread. Traders are decreasingly keen to pay the identical quantity for a greenback of earnings.

No matter which of those secular market durations we occur to be in, no market goes straight up or down ceaselessly. Markets will transfer in the other way of the dominant development. Throughout secular bull markets, we get cyclical bears; throughout secular bear markets, we get cyclical rallies.

Some individuals are describing the present transfer off of the June lows as a bear market rally. for this to be the case two issues should have occurred: 1) The secular bull market that started in 2013 has ended, and a pair of) We are actually in a brand new secular bear market.1

In the event you imagine that the 2013 secular bull market remains to be in impact then it’s affordable to make the declare that the primary half sell-off was a countertrend cyclical bear inside the context of a secular bull. That is supported typically by financial energy within the labor market, robust client spending, and document excessive company earnings.

The counterargument is the spike in inflation has modified the dynamic of the economic system. We should always count on to see slowing industrial manufacturing, weakening client spending, elevated layoffs, and rising unemployment because the Fed tightens to kill inflation.

Sometimes, secular bull and bear markets are greatest recognized after the very fact – one thing that permits precision however is ineffective for buyers. In real-time, it’s a must to make your assumptions and place your bets.2

The query that determines how merchants may wish to place themselves this merely which form of counter-trend rally is that this?

Cyclical rally inside a Secular Bear?

Or Restoration from a Bear Cycle inside a Secular Bull?

Maybe we are able to glean some perception from Bryan Jordan, Deputy Chief Economist at Nationwide. Because the June lows, we now have seen 4 consecutive weeks of market good points (+16.7%) which recovered greater than half of the YTD losses.

Jordan asks the query “How does the present rally stack up?” Taking a contrarian stance, he notes “The uptrend remains to be broadly anticipated to fizzle — think about the prevalence of the phrase “bear market rally” of late.”

However he additionally observes a key historic measure:

“Observe that it has already outstripped the most important countertrend good points in eight out of the final ten bear markets. The one bear market rallies within the final seven many years stronger than the rise of the final two months had been will increase of 19.0%, 21.2%, and 20.7%, respectively, in the course of the 2000-02 downturn and a 24.2% upturn close to the tail finish of the 2007-09 cycle. Each different rally of this magnitude that started throughout these durations represented the beginning of a brand new bull market.”

We received’t know for certain till after the very fact nevertheless it actually harm helps us to know this context higher.3

Beforehand:

Finish of the Secular Bull? Not So Quick (April 3, 2020)

Bull Markets & P/E A number of Growth (June 22, 2018)

Bull Markets Can’t Begin Till Bear Markets Finish (March 9, 2018)

Redefining Bull and Bear Markets (August 14, 2017)

Are We in A Secular Bull Market? (November 4, 2016)

Bull & Bear Markets

___________________

1. We’ve got mentioned beforehand why the pandemic externality was not an finish to the prior secular bull market. See this. that viewpoint was affirmed by the next transfer in 2020 and 2021.

2. Until you’re a purchase and maintain investor as we’re which signifies that you journey out the ups and downs of the counter-trend rallies as a way to profit from the longer-term secular development.

3. I might be doing a disservice to Jordan if I omitted his caveats:

“There are, in fact, elementary causes to stay cautious. The Federal Reserve remains to be aggressively tightening financial coverage and, consequently, the chance of an eventual recession remains to be on the climb. As famous on this area on a number of events, nevertheless, the market has already priced in a reasonably unfavourable consequence. The S&P was down by 23.6% from peak within the late spring and remains to be off by 10.9% even after the rally of current weeks. Traditionally, the index has fallen by a mean of simply 7.6% in pre-recessionary durations.”