The reactions to the 2 most up-to-date main financial crises present a beautiful laboratory to do a examine and distinction between various kinds of rescue insurance policies.

Take into account if you’ll the federal government response to the good monetary disaster (GFC) of 2008-09. To unfreeze credit score markets and guarantee there was adequate liquidity for the system as a complete to maintain working, the Federal Reserve took charges to zero, arrange quite a lot of amenities to make sure banks may keep open, specializing in the monetary system as a complete however largely ignoring the broader economic system.

To their credit score, the Federal Reserve prevented a disaster. The monetary system managed to maintain working, companies met their payrolls, and banks have been in a position to carry out their essential service. That is no small factor – Ben Bernanke and the Federal Reserve deserve credit score for efficiently stopping a good greater catastrophe from occurring.

However the prices for the best way we prevented the monetary abyss have been consequential. Particularly, after we contemplate how absent Congress was by way of offering a considerable fiscal response to the crash of your complete economic system.

Past the Federal Reserve unfreezing credit score markets, there have been two essential outcomes of their actions: First, the low value of capital and borrowing helped company America enhance its margins considerably. The subsequent decade noticed document revenues and earnings resulting in an epic bull market in U.S. equities. Annual common returns of 13% have been far in extra of historic averages of 8%; fairness house owners noticed a 700% acquire over the following dozen or so years. Equally, single-family houses and house buildings (actual belongings) noticed an enormous enhance in worth.

The important thing takeaway of this was that asset house owners did nicely (and in lots of circumstances, exceedingly so).

However the second repercussion was extra problematic: A largely financial stimulus left behind a lot of the American inhabitants. The highest 10% of America owns 89% of the general public traded equities; there are 82.51 million owner-occupied houses. Which means that the Federal Reserve response benefited someplace between the highest ten and prime 25% of People.

On the time many people decried the shortage of fiscal stimulus, however the deficit Hawks and partisan hacks one out. Congress did enact a modest fiscal stimulus of $787 billion. However a 3rd of this was a short lived extension of tax cuts, and one other third a short lived extension of unemployment advantages; this left a modest $200 billion because the fiscal stimulus, an quantity that has confirmed to be laughably inadequate.

The result’s a subpar restoration, finest characterised as gentle GDP weak job restoration poor retail gross sales, and little or no wage beneficial properties.1

How do we all know this? As a result of now we have seen the outcomes of the $4 trillion in 3 separate CARES Act fiscal stimulus in 2020 and 2021. The U.S. put $1.395 trillion in Unemployment Insurance coverage into the arms of American households — about 5X what was accomplished in the course of the GFC. The end result has been huge beneficial properties by the underside half of the nation, particularly entry-level and minimal wage staff. All of that money within the arms of the typical family was used to buy items to switch the providers that have been not obtainable as a result of pandemic.

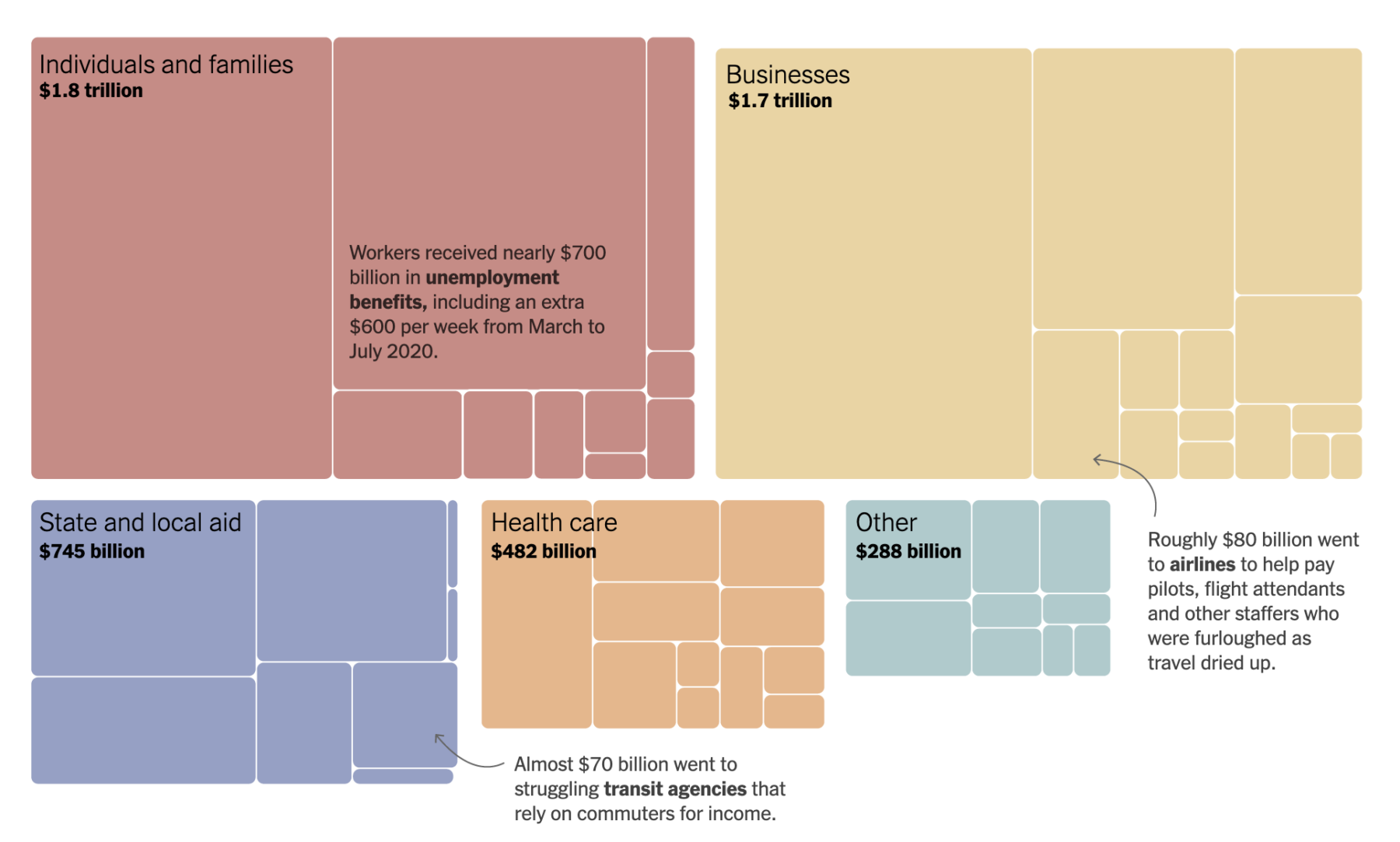

Because the graphic at prime exhibits, one other $1.7 trillion in support went to companies along with the $1.8 trillion to households; states acquired $745 billion whereas healthcare was given $482 billion.

The online end result?

Unemployment has fallen to three.8%, retail gross sales are at all-time highs and the money, together with provide chain tangles and semiconductor shortages—all brought on by the lockdowns—have despatched inflation again to 40-year highs. The Russian battle towards Ukraine is sending vitality and meals costs even larger.

None of this could come as a shock. Ever since Lord Keynes wrote so eloquently on the topic, we all know the results of fiscal stimulus as an alternative choice to family and enterprise spending. We additionally know that austerity solely makes financial downturns worse, and the time for balancing the price range is when the economic system is doing nicely, not poorly. Countercyclical spending would have been much more helpful in 2008-09 than the tax cuts we noticed in 2017.

One of the crucial helpful instruments within the strategist’s toolbox is the counter-factual. Hypothesizing different realities had completely different choices been made by policymakers at key factors in historical past is an excellent technique to contemplate the ramifications of these choices. (I’ve used this software regularly and every so often with nice success).

Had we seen substantial fiscal stimulus in response to the Nice Monetary Disaster, the following restoration would have been extra strong jobs would have regained their pre-financial disaster ranges a lot sooner, wages wouldn’t have lagged by as a lot as they did. Hopefully, policymakers hold this in thoughts the following time the nation is confronted with a considerable financial disaster.

Beforehand:

Time to Cease Believing Deficit Bullshit (September 3, 2021) $1.395 Trillion Peak Unemployment Insurance coverage (March 4, 2022)

Shifting Stability of Energy? (April 16, 2021)

Stimulus, Extra Stimulus and Taxes (January 25, 2021)

Go Large: The U.S. Wants Manner Extra Than a Bailout to Get better From Covid-19 (April 30, 2020)

Unintended Penalties, Half III: The Nice Monetary Disaster (April 29, 2020)

Go Large (little model) (Could 3, 2020)

All Hail the Counterfactual ! (November 12, 2018)

Why America Has a Two-Observe Financial system (September 27, 2018)

How Development, Taxes & GFC Impacts GDP (August 6, 2018)

Can We Please Have an Trustworthy Debate About Tax Coverage? (October 2, 2017)

Deficit Rooster Hawks vs Ronald Reagan (July 13, 2010)

Counter-factual

_______

1. There’s a credible debate available as as to if this weak restoration was accomplished on goal – partisan sabotage designed to get well the White Home – however I’ll save that dialogue for one more date.