Sundry Photography

“I want every dollar we put into Cloudflare to be more productive at driving revenue, profit and shareholder value.” – Matthew Prince, Founder and CEO of Cloudflare on the conference call.

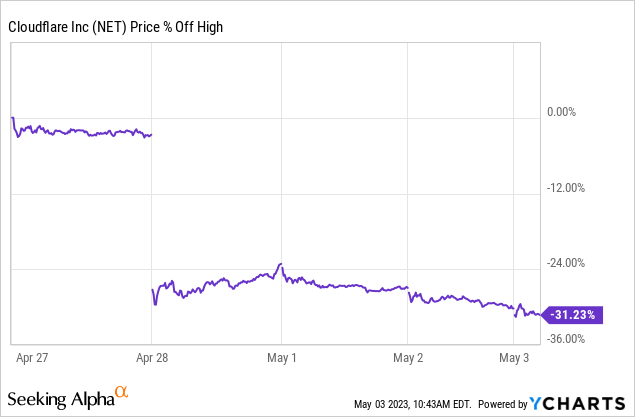

Last Thursday, after the market close, Cloudflare (NYSE:NET) announced its Q1 2023 earnings. If you are a Cloudflare shareholder, you have probably noticed that the stock dropped like a rock since then, down 31%.

Was this drop warranted? And does this quarter affect the long-term thesis? We will evaluate that in this article.

The Bad News: 3 reasons for the drop

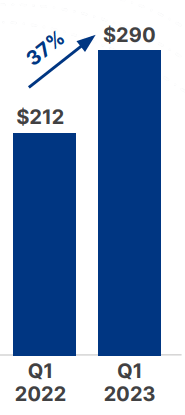

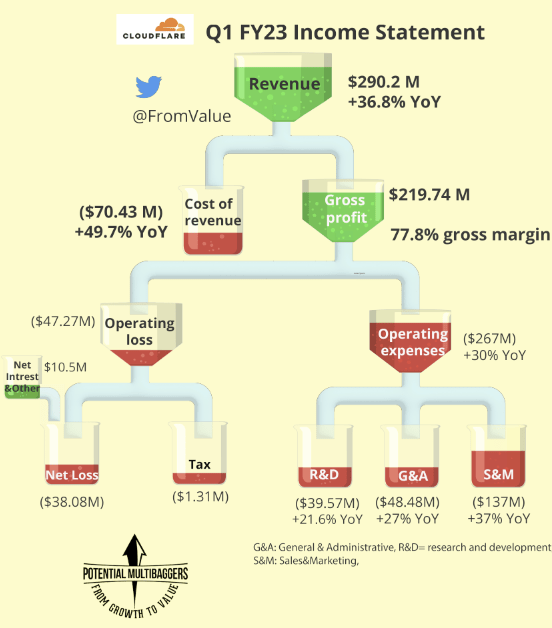

Revenue came in at $290.2 million, up 36.8% year-over-year.

From Cloudflare’s Q1 2023 earnings slides deck

That’s still remarkable growth in my book, but the headlines show that Cloudflare missed the consensus by $0.6M or 0.2%. Algorithms trade on earnings misses, especially for highly valued growth stocks. It’s almost a law of nature in investing: a growth stock priced at a premium that misses revenue estimates will crash hard, even if the miss is just tiny.

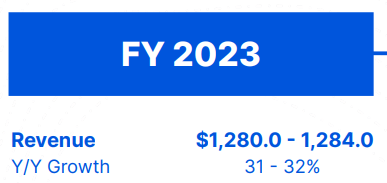

But there’s also a second and a third reason for the big drop. The second is guidance. Cloudflare lowered its guidance for the second quarter and the full year.

For Q2, Cloudflare now aims at $305 million to $306 million, while the consensus stood at $319.97M. At the midpoint, that’s 4.7% lower.

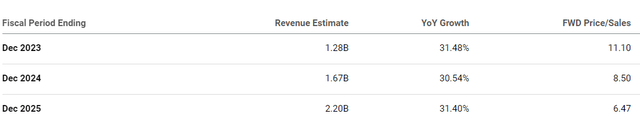

The consensus for FY 2023 stood at $1.33 billion in revenue, but Cloudflare now guides for revenue between $1.28 billion and $1.284 billion. That’s 3.7% lower at the midpoint. That means Cloudflare now guides for 31% to 32% revenue growth for the year.

From Cloudflare’s Q1 2023 earnings slides deck

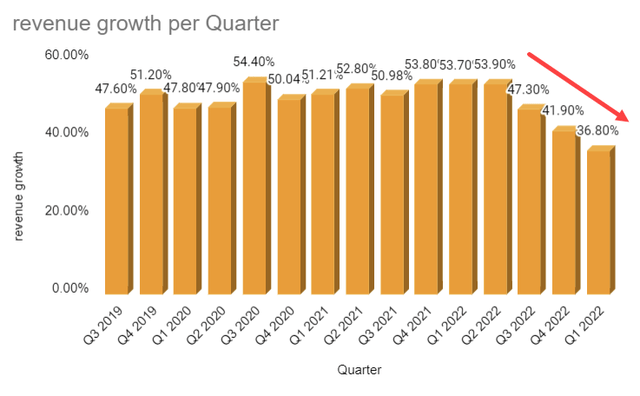

This is a graph I made about Cloudflare’s revenue growth per quarter. As you can see, this is the third quarter in a row revenue growth has decelerated.

Made by the author

There are two main reasons for the slowdown: size and the macroeconomic environment. Size because the bigger you get, the more difficult it is to keep growing at the same percentage rates, even if the dollar growth is much higher. That’s the law of big numbers in investing.

But there is also a significant impact of the macro environment. Everybody and their aunt now thinks we will go into a recession later in the year and that’s why companies spend less. Cloudflare’s management commented they didn’t see fewer deals but longer deal negotiations and more ramp-ups over time instead of going for the full suite option from the start. This is quite logical.

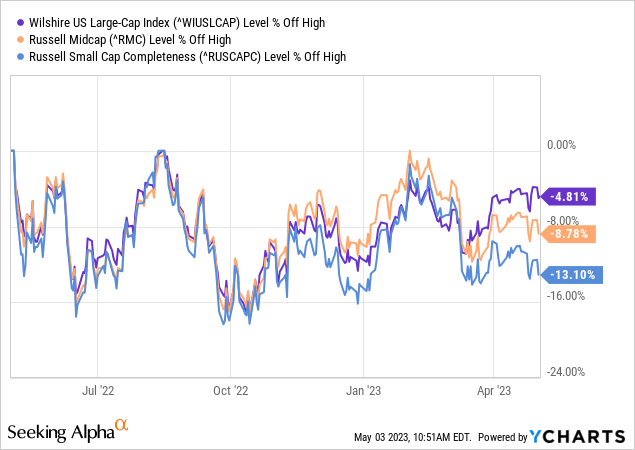

The third reason for the big drop is the flight to safety. What I mean is that investors are so scared of that recession they draw back money as fast as they can if they think something will not go up in the coming months. They prefer the safety of big tech above smaller and midcap companies.

So, unlike the two previous reasons, this one doesn’t have to do with Cloudflare specifically.

The Income Statement

This is an overview of the income statement. Mind you, this is on a GAAP basis, so stock-based compensation is included as a cost.

Made by the author

The Good News

If you saw the huge stock price drop, you wouldn’t say so, but there was also good news. And that was from the profitability front.

Free cash flow came in at $13.9 million, beating the consensus of -$8.3 million by a whopping $22 million. If people tell you Cloudflare is a money-losing company, they are not entirely correct. Cloudflare makes money. Yes, it’s on a non-GAAP basis, as there is stock-based compensation, but that doesn’t cost the company any money. Free cash flow is what goes to Cloudflare’s bank account.

Eventually, GAAP profitability is the goal for every company, but in the initial growth phase in tech, it makes no sense to focus on profitability. Taking market share and growing revenue is all that matters. You can’t expect 37% revenue growth when a company focuses on profitability.

A good way to assess the balance of the two is the Rule of 40. If you add up free cash flow and revenue growth, 40 or higher is a good score. In this quarter, we see Cloudflare gets to 42%, still exceeding 40, as we want but quite a bit lower than the previous quarters.

Earnings per share came in at $0.08, 166% higher than the consensus of $0.03. For the second quarter, the company guided for $0.07 to $0.08, versus the consensus of $0.03. For the full fiscal year, EPS guidance now stands at $0.34 to $0.35, more than double the consensus of $0.16. Founder and CEO Matthew Prince had a great quote on this on the earnings call:

When the going gets tough, toughs get profitable, and we are tough.

We have our hands firmly on the tiller of our business and are able to adjust to rapidly evolving market conditions.

This is just the first of Prince’s great quotes during the conference call that I’ll share.

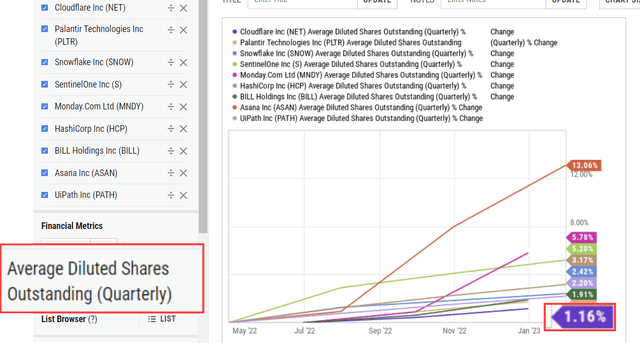

Stock-based compensation

I also look at stock-based compensation more now in this economic context. It was $61.75 million. That’s 21% of revenue. That may sound a lot and of course, it is, but you should also look at the context. There seems to be some vendetta now against stock-based compensation. It’s the typical manic-depressive pendulum of the market, as Benjamin Graham identified it. The market, which consists of people speculating with money or investing it. And it’s the people who constantly flip.

A year ago, SBC was not a problem; now, it’s the instrument of the investing devil, it seems. The truth is, as always, somewhere in the middle. SBC can be a good tool for growing tech companies if not used excessively. And that’s the problem. Some companies have issued just too many shares.

If you look at Cloudflare, its dilution was just 1.16% over the last year. This is the average diluted shares outstanding of some tech companies. Diluted means all stock options and other programs are already included.

Y Charts

And then you have to know that stock-based compensation was influenced to the upside because Cloudflare acquired Area 1. From the 10-Q:

In connection with the acquisition, the Company entered into compensation arrangements for stock-based and cash awards with a value totaling $15.9 million.

And then in a note:

As of March 31, 2023, there was $9.7 million of unrecognized stock-based compensation expense related to the Assumed Area 1 Stock Options that is expected to be recognized over a weighted-average period of 2.0 years.

Now, all this context doesn’t mean I’m happy with the stock-based compensation. I want it to go down over time. As we have seen, there will be an impact from the Area 1 acquisition and maybe there could be more acquisitions in the future, but still, reducing SBC should make it to management’s priority list.

More numbers

During the quarter, Cloudflare added 114 new large customers, defined as paying more than $100,000 per year. That was the lowest number in many quarters. Cloudflare now has 2,156 large customers, up 40% year-over-year.

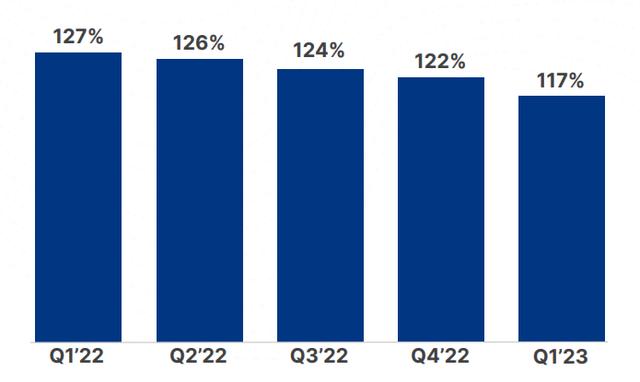

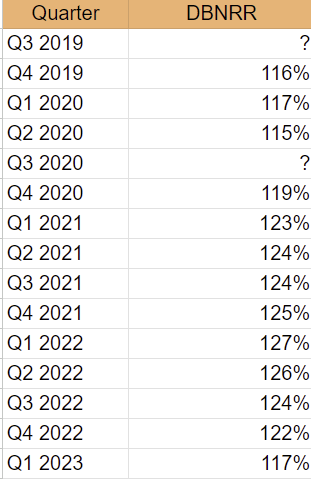

Dollar-based net retention rate fell to 117%, down 5% from Q4 2022. DBNRR was down for the fourth consecutive quarter.

Cloudflare’s Q1 2023 earnings call slides

If you look at the longer term, this is the overview of the DBNRR since the company went public in 2019.

Made by the author

As you see, it’s the lowest DBNRR since Q2 2020. But you can also see that this can go up again.

Matthew Prince added this important remark:

We did not see elevated churn across our broad customer base. Instead, we saw a slower expansion from existing customers.

(…)

Our win rate against the competition remained at record high levels, and renewal rates were consistent with the high levels experienced over the previous 4 quarters. Those were all positive signs.

Prince also said the pipeline was at a record level. That’s important, as it shows Cloudflare’s offerings remain attractive to companies. They are just a bit more hesitant to add extra services right now.

Prince also talked about the quarter’s challenges, especially the macroeconomic uncertainty, which intensified in Q1. That resulted in longer sales cycles and a decline in close rates. He also said win rates remained as strong as in the previous quarter. CFO Thomas Seifert also put numbers on how much longer sales cycles last:

More specifically, our average sales cycle during the first quarter was 27% longer than the average of the previous 4 quarters. Sales cycles increased most significantly in expansion deals with our contracted customers, which were 49% longer than the average of the previous 4 quarters.

I read some comments that the CFO did a horrible job. But you shouldn’t forget that he also guided for all previous quarters. In the previous 14 quarters, Cloudflare always beat guidance. And if the Fed specialists can have Q1 GDP growth wrong by 82%, why would a CFO not be allowed to have a slight miss?

Matthew Prince also pointed out that companies close immediately when they are under attack but that bigger projects, like moving to Zero Trust, are closing slower. But he added that Cloudflare closes much faster than its peers. That’s why they saw slower sales as one of the first in 2022. But he emphasized several times that there was nothing wrong with demand.

So no one is telling us that projects are getting cancelled in any significant way. (…)

People are saying we want to invest with you, we’re just being cautious with our IT spend, and that’s causing everyone to measure twice before they cut one.

Cloudflare is free-cash-flow positive, so it adds money to its bank account. There’s already $1.7 billion on that account in cash, equivalents and short-term investments. Yes, there are also outstanding convertible notes for $1.4 billion, but Cloudflare could buy those back and still have $300 million left.

Losing money on a GAAP basis doesn’t mean you don’t earn money. Cloudflare won’t go out of business, don’t worry about that.

Firing Right

Let’s go to the conference call.

Something that jumped out was that Matthew Prince, founder and CEO of Cloudflare, called out a small part of the sales team for underperforming. This caused some controversy in the comment section of Seeking Alpha, on Twitter and other platforms. Without any context, I can understand this.

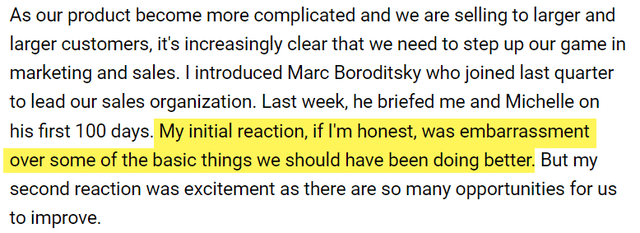

Cloudflare brought in Marc Boroditsky as the President of Revenue in November 2022. On the previous conference call, Matthew Prince already said Boroditsky had thoroughly examined the whole company and defined many areas ready for improvement. Prince said it was sometimes really embarrassing for him and Michelle Zatlyn, co-founder, COO and President of Cloudflare, as it made them look like amateurs. This is from the previous earnings call.

Seeking Alpha’s transcription of Cloudflare’s Q4 2022 earnings call

Prince continued that conversation on this conference call, being very straightforward and honest, as you know him if you have followed the company for a long time. Here follows a long quote from Prince. I wanted to make it shorter, but it’s more powerful if you read it in his words.

Although we’ve won 1/3 of the Fortune 500 customers, if we’re honest with ourselves, we saw a lot of our success with our enterprise customers because our products were so good and solved real problems that every big company faces. That allowed many on our sales team to succeed largely by just taking orders. When the fish are jumping right in the boat, you don’t need to be a very good fishermen.

But at the risk of mixing watering metaphors, as the tide goes out, you get a clear view who’s not wearing shorts. The macroeconomic environment has gotten harder, and we’re seeing that some on our team aren’t dressed for work.

Digging in with Marc, we’ve identified more than 100 people on our sales team who have consistently missed expectations. Simply put, a significant percentage of our sales force has been repeatedly underperforming based on measurable performance targets and critical KPIs. That’s obviously a problem. But it’s one in this environment with a particularly available and actionable solution.

We are now in the process of quickly rotating out those members of our team who have been underperforming and bringing in new with salespeople who have a proven track record of success, grit and a strong cultural fit.

To give you some sense, these 100-plus people contributed approximately 4% of annualized new business sold over the last year.

Transparency is one of Cloudflare’s core values. The company writes a blog post for every single issue, even if there was a very short outage. It calls these post-mortems to see what it could have done better. This is the same. Calling Prince arrogant because of this means you don’t know Cloudflare’s company culture of radical transparency. There’s a culture of radical transparency at Cloudflare and writing post-mortems is a part of that.

Now, of course, Matthew Prince does have an ego. But I know no visionary founders without a bigger-than-usual ego. Or do you believe Steve Jobs, Jeff Bezos, Elon Musk and so many others are humble?

Management often talks about hiring right but firing right is often completely ignored or underestimated. Matthew Prince is one of the most straightforward CEOs I know, so he’s one of the few who dare to discuss this.

Some comments claimed Prince threw his sales team under the bus, but that’s not true, as he also said:

While I’ve talked about our team that’s underperforming, that’s only half the story. Our top salespeople are terrific. On average, the top 15% of our sellers have achieved 129% of quota over the last 4 quarters. They’re incredibly consistent at bringing in new logos, expanding current customers and delivering results and approximately 27% of them started within the last 18 months.

Letting the underperformers go can boost a whole team. A team can be pleased that those people are shown the door. I think many of us have worked in a place where firing one or a few people would have had (or did have) a very positive influence on the atmosphere and stimulated the rest to work harder. Not because they are afraid to be fired but because they feel liberated that the dead weight is gone. And of course, you also get new high performers with the new people.

Matthew Prince said this about replacing the group of 100 salespeople:

While team upgrades are always hard, this is a uniquely good time for us to do this. A year ago, the tech labor market was extremely tight.

Today, there is an abundance of talent eager to work at Cloudflare. In Q1, we received more than a quarter of a million applicants, approximately 40% of which were for sales positions. That’s more applications than we received in all of 2021.

Cloudflare is proud that it didn’t have to fire people because of overhiring in previous years. They just slowed down their hiring. But that doesn’t mean Prince can’t look critically at himself and the management team.

We’ve always had a culture of high performance at Cloudflare. However, with the value of hindsight, I think we and most other businesses got a bit soft during the COVID crisis around performance management. That was understandable at the time, but that time is over.

More Insights

Cloudflare keeps innovating, more than ever even, but with more efficiency. Prince:

I want every dollar we put into Cloudflare to be more productive at driving revenue, profit and shareholder value. Innovation is a long-term competitive advantage, but productivity is too.

And the past innovation is also paying off in the present. Matthew Prince shared some impressive numbers about R2 and Workers. In this context, the inevitable buzzword of this earnings season was also mentioned. You guessed it: AI.

Traction among developers continues to be strong. We now have 4.92 million Workers applications running on our platform, up 146% over the last 6 months. 30,000 paying customers have activated R2 and are storing more than 7 petabytes of data, up 25% quarter-over-quarter.

AI companies, large and small, continue to build on Cloudflare at a breakneck pace. When we ask them why, they cite our neutral position, rapid innovation and modern, nimble development environment.

One last month called us a “The first cloud infrastructure company built for the age of AI.” I like the ring of that.

I think that the neutral position of Cloudflare should not be underestimated. After all, the hyperscalers form competition for AI companies. Especially Microsoft (MSFT) and Google (GOOGL) (GOOG) are fighting an AI battle and as a company, it is not too far-fetched to think people at those companies could cross the border and look at what you develop in cutting-edge AI. I don’t claim that happens, but I can see why start-ups would think like that.

That leaves Amazon’s (AMZN) AWS and Cloudflare. As Amazon got a lousy reputation by crossing the line of using the data of its third-party sellers on the marketplace to launch competing products. On top of that, Cloudflare is cheaper for things like egress fees, it’s not a stretch to see Cloudflare as the best choice for many starting AI companies.

Cloudflare is a super innovator, which means it is already working on making tools and applications for AI and developers of it. Next month, in its Developer Week, it will unveil some of those already.

In the Q&A, Matthew Prince was asked more about AI on Cloudflare. This was a part of his answer:

AI is something that I think surprised us last quarter in terms of the positive impact when it continues to surprise us. We’ve seen the revenue that’s coming from AI companies just quarter-over-quarter have substantial growth north of 20% quarter-over-quarter growth

20% quarter-over-quarter growth is impressive, especially if you know that it’s still very early in AI applications.

Should you worry about Cloudflare?

I understand if you start worrying about Cloudflare. After all, a 30% drop feels scary, making you wonder if your money is well-invested in Cloudflare. I think that’s a healthy reflex as long as it doesn’t go too far and turns into an emotion-fueled panic.

Let me be clear, this was not a good quarter, but at the same time, I don’t see any clear red flags in this earnings release.

I hear some say now that the CFO didn’t do a good job by projecting too aggressively. But that is also false, in my opinion, and stems from disappointment. Seifert has an excellent track record and this is only the first time since Cloudflare became a public company it has missed on earnings and then only by a paltry 0.2%.

Seeking Alpha

Management stressed several times during the quarter that the pipeline was at a record high and that companies are just slower to sign. While the assertions for the first quarter were already conservative, they have been turned down even more. This is one such example.

Also, we believe that currently depressed close rates and elongated sale cycles are temporary in nature, we cannot predict when the increasing caution is exhibited by the customers during the first quarter will recover. As such, we have assumed these headwinds, which identified in the month of March will persist through the end of the fiscal year.

The problem is not the product; it’s not the innovation, it’s not management, not finding talent; it’s a combination of macro and, to a certain extent, sales execution. The second is being handled. Or in the words of Matthew Prince:

That’s something we can fix, and we are committed to turning the current macroeconomic headwinds into a catalyst for positive change in growth at Cloudflare

Is this quarter a thesis breaker?

I see no fundamental reasons for bearishness for Cloudflare’s business. It also means I will add to my Cloudflare position.

I’m not going all-in for several reasons.

- That’s just not my style.

- Cloudflare is already a substantial position for me.

- There could be more short-term pain in the stock.

There are many traders and speculators in the stock market. They cause big price movements up and down. But the execution of the company will determine over the long term what the stock will do.

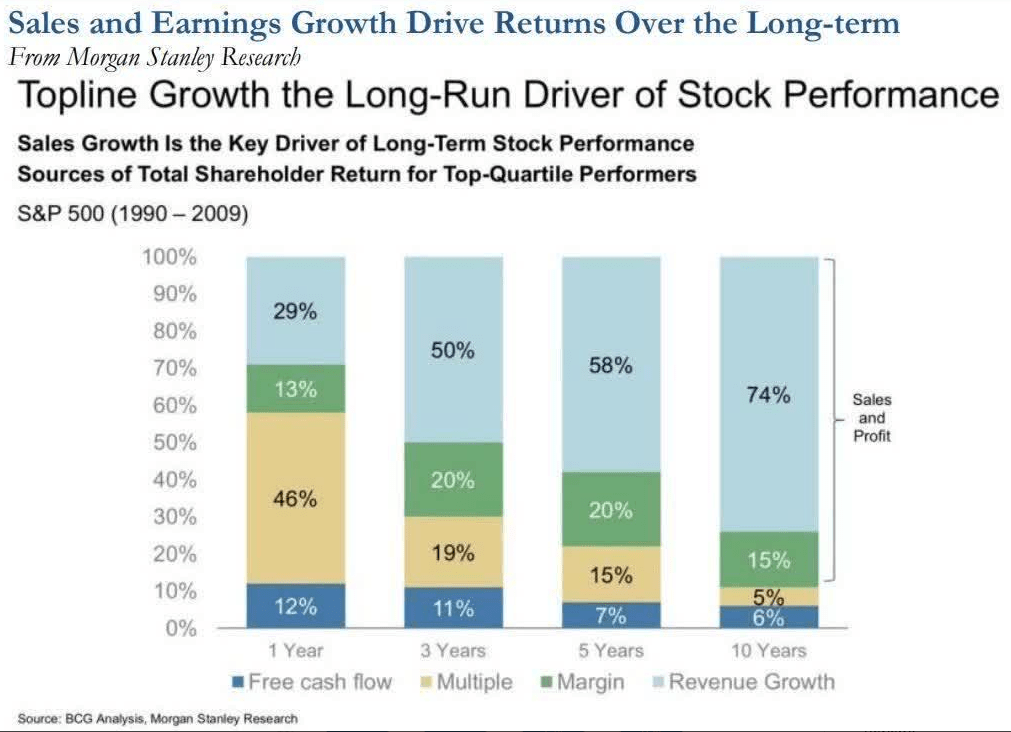

Cloudflare has never been a cheap stock and that’s an understatement. Over the short term, valuation is the most crucial element for price movements. But that’s not the case for long-term investing. Don’t forget this graph.

BCG

Over a 10-year period, sales mostly matter, not the multiple, which only accounts for 5% of the total return.

I think Cloudflare is priced relatively reasonably now. Yes, the forward PS ratio is still 11 but if you look at the future, the company is expected to continue to grow its revenue by 30%+, you see it going down fast.

Seeking Alpha

Combine that with high gross margins of 78%, which indicate the company may be more profitable in the future, and you get more or less a fair price right now, in my opinion. It’s not cheap, but it’s not at a nosebleed valuation anymore.

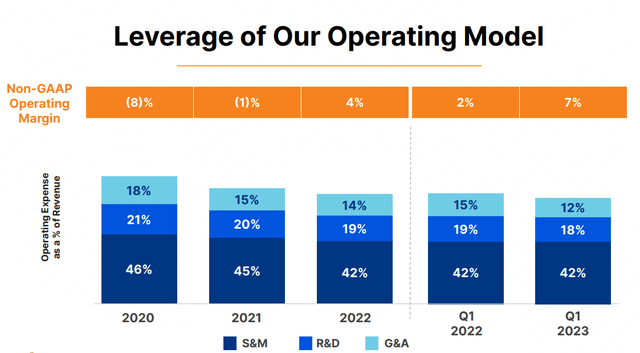

Cloudflare is also showing operating leverage. You can see that on this slide from the earnings presentation.

Cloudflare’s Q1 2023 earnings call slides

Of course, Cloudflare’s stock could still drop more and that’s why I always scale into positions. But I will add a bit more now. I don’t see elements in this earnings report that make me doubt. I see a company that’s still doing very well but was impacted by macroeconomic headwinds, just like many others.

The fact that its sales team was not optimal and that is being changed now, makes me think there is even margin for improvement. While these times are challenging for everyone, the strongest companies come out of such periods leaner, stronger and more determined than ever. From everything I saw in this quarter, Cloudflare is in that category.

Overall Conclusion

While this was not a great quarter, it was not even close to a thesis-breaker. That the stock plunged so much has everything to do with the fact that premium-priced stocks must have perfect earnings, or this is what happens. But for long-term investors like me, this is an opportunity to add to my position.

In the meantime, keep growing!