ktsimage

I’ve all the time discovered that mercy bears richer fruits than strict justice.”― Abraham Lincoln

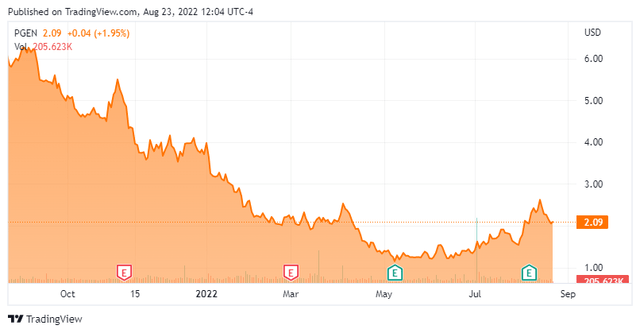

We final took an in-depth look at Precigen, Inc. (NASDAQ:PGEN) to start with of 2022 in January. We famous that regardless of the developmental firm having a number of “photographs on purpose” focusing on potential profitable elements of the market, the inventory was an “keep away from” on the time for a number of causes. One of the notable of which was its funding wants. The inventory is off some 40% since that article ran and this summer time the corporate bought off a part of its enterprise to boost wanted capital. Subsequently, it appears a very good time to circle again on this small cap identify. An evaluation follows under.

Looking for Alpha

Firm Overview:

Precigen is a clinical-stage biopharmaceutical firm based mostly in Maryland. Precigen was a very long time subsidiary of Intrexon (“XON”) and took its new type in 2021. Some extra element on that firm’s historical past is contained on this article. Presently, the inventory trades simply above two bucks a share and sports activities an approximate market capitalization of roughly $425 million.

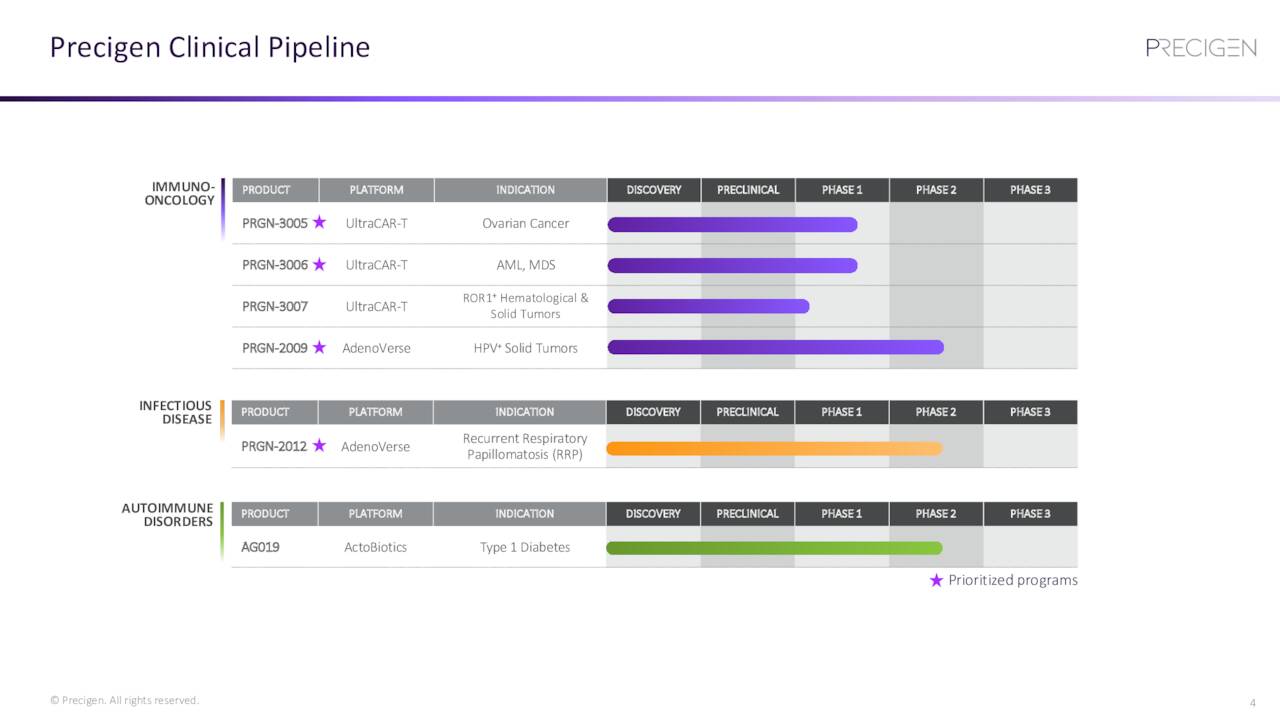

Precigen’s pipeline is constructed on high of its quite a few therapeutic platforms: UltraCAR-T Benefit, AdenoVerse Immunotherapy Benefit, ActoBiotics Benefit, and the Multifunctional Therapeutics Benefit.

Current Developments:

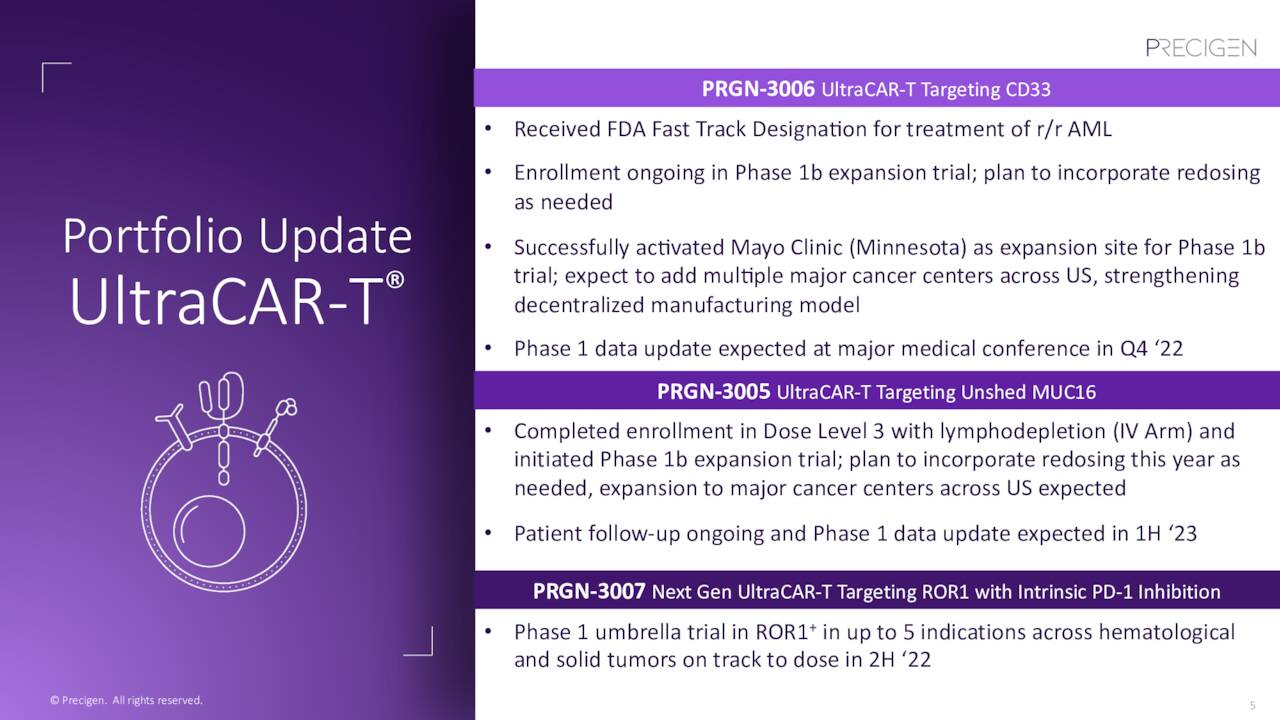

In early April, the corporate’s candidate PRGN-3006, which is focusing on sufferers with relapsed or refractory acute myeloid leukemia, a most cancers of the blood and bone marrow, garnered Quick Monitor Designation from the FDA. PRGN-3006 is an UltraCAR-T is a multigenic autologous chimeric antigen receptor [CAR]-T cell remedy inside Precigen’s pipeline (under).

August Firm Presentation

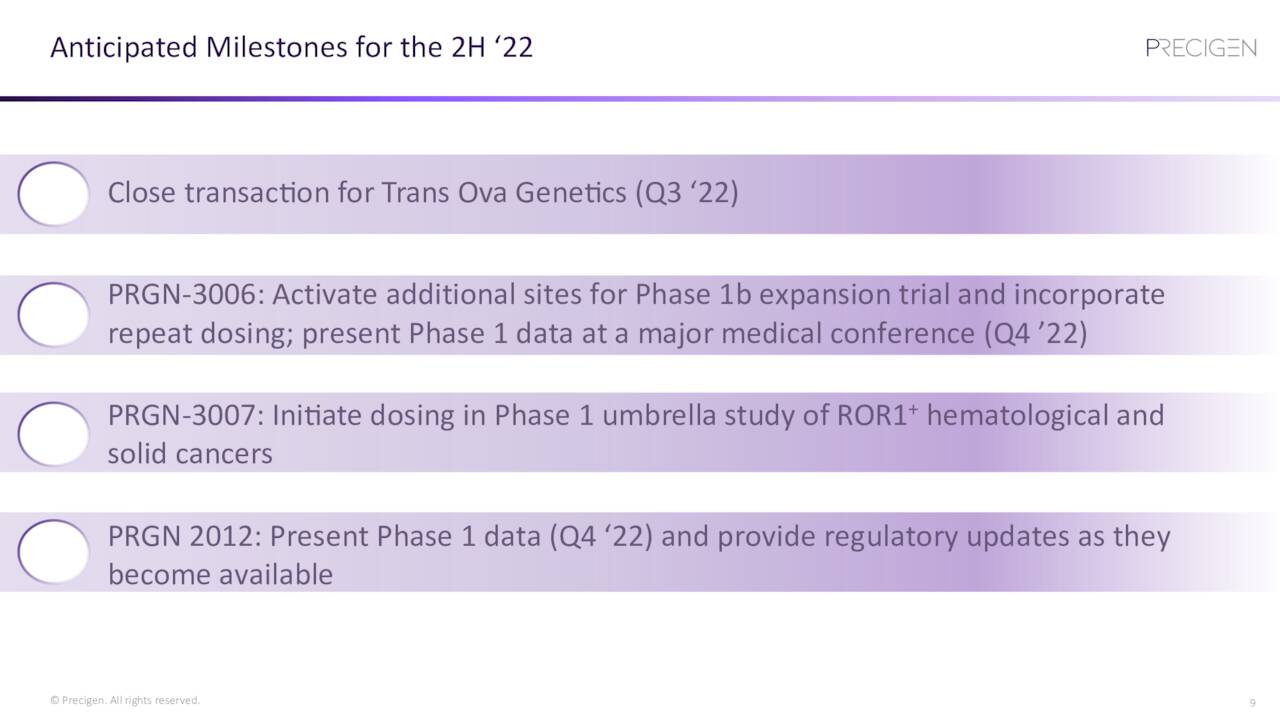

Then in early July, the corporate introduced that it’s going to promote its wholly-owned non-healthcare subsidiary, Trans Ova Genetics, to URUS. The transaction will web $170 million upfront fee when it closes this quarter in addition to potential earn outs totaling $10 million in FY2022 and FY2023. The proceeds will bolster the Precigen’s steadiness sheet considerably and permit it solely to give attention to advancing its pipeline.

August Firm Presentation

August Firm Presentation

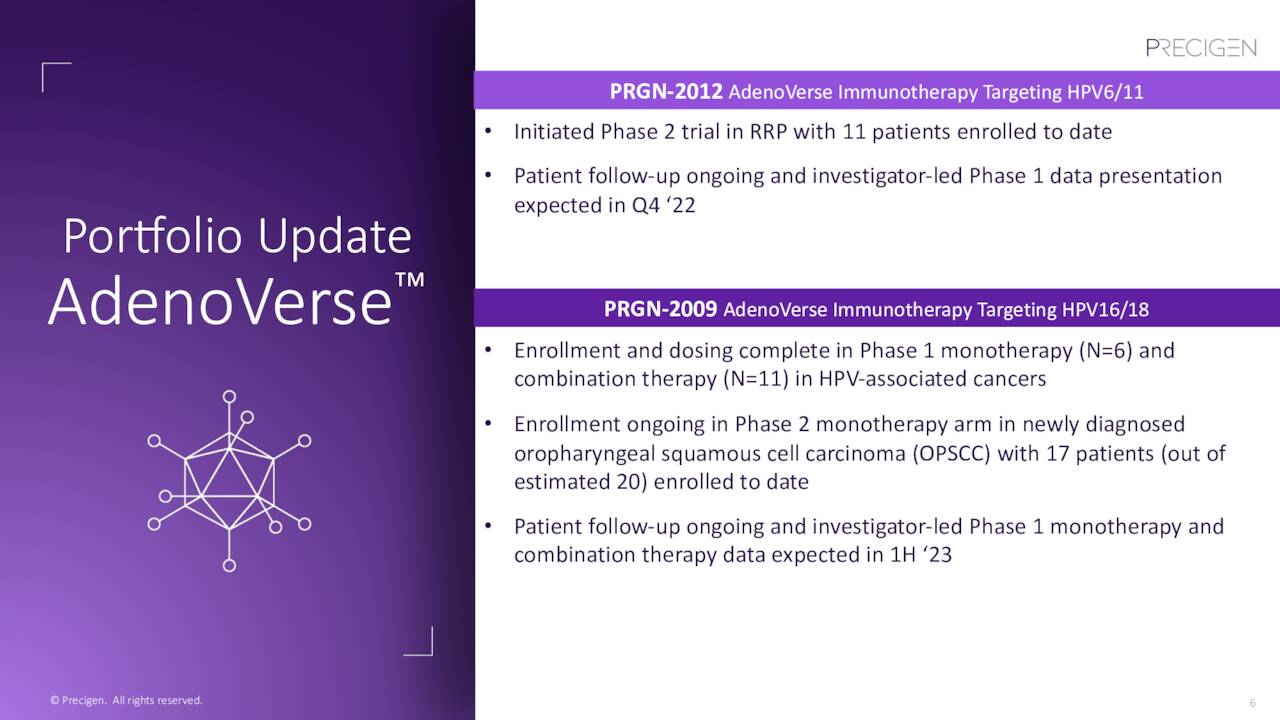

It is very important notice that Precigen’s pipeline is basically made up of early stage property. Solely two of the corporate’s candidates (PRGN-2009 and PRGN – 2012) have reached Section II improvement they usually each are nonetheless within the enrollment part of this stage. PRGN-2009 is an “off-the-shelf” investigational immunotherapy designed to activate the immune system to acknowledge and goal HPV-positive strong tumors. The candidate is being developed in cooperation with the Nationwide Most cancers Institute. PRGN – 2012 is an AdenoVerse Immunotherapy focusing on recurrent respiratory papillomatosis or RRP.

Analyst Commentary & Steadiness Sheet:

Analysts are largely sanguine on Precigen’s prospects. Since April, Wells Fargo ($17 worth goal), Stifel Nicolaus ($15 worth goal), JMP Securities ($13 worth goal) and H.C. Wainwright ($6 worth goal) have reissued Purchase rankings on the inventory. The final two above got here proper after second quarter numbers had been posted.

A number of insiders have been frequent however comparatively small sellers of the share thus far in 2022, disposing of simply over $500,000 in mixture of inventory thus far within the yr. There was no insider purchases up to now in 2022. Roughly one among our seven shares are at the moment held brief. After utilizing web money of $25.8 million for working actions within the first half of 2022, the corporate ended the quarter with simply over $130 million in money and marketable securities previous to the approaching $170 million upfront fee for the corporate’s latest divesture. That fee supplies the flexibility to repay the excellent convertible notes using a non-dilutive funding supply once they come due in July of subsequent yr. The corporate ended the second quarter with practically $200 million price of long run debt. Management acknowledged on its second quarter convention name that it now has a ‘money runway‘ into the fourth quarter of subsequent yr.

Verdict:

August Firm Presentation

Precigen purchased a little bit extra wiggle room with its latest divesture plans. Nevertheless, the corporate continues to be many, a few years away from any potential commercialization. As could be seen above, whereas the pipeline is advancing, it’s doing so at what typically appears a glacial tempo. One other vital capital increase is probably going within the first half of 2023, if not sooner.

So, regardless of some positives since we final checked out Precigen and a few good analyst help, our advice continues to be to remain on the sidelines till the corporate advances its various pipeline into later stage improvement.

10 p.c of any inhabitants is merciless, it doesn’t matter what, and 10 p.c is merciful, it doesn’t matter what, and the remaining 80 p.c could be moved in both course.” ― Susan Sontag