Justin Sullivan

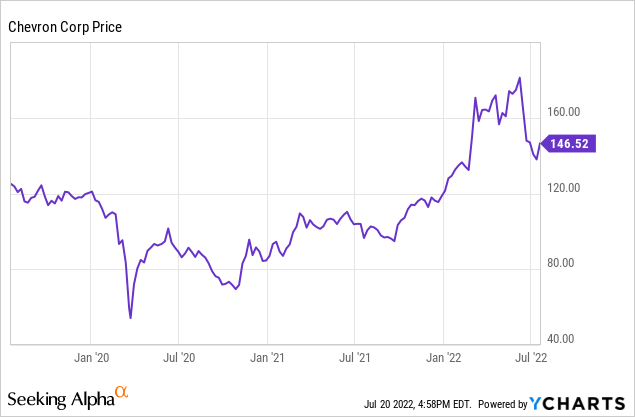

Main multinational vitality firm Chevron Company (NYSE:CVX) stays a staple for vitality traders. Whereas the inventory value is up 40% from my final evaluation, it’s off latest highs.

The corporate provides traders a 3.9% dividend, coupled with a inventory buyback program that flexes between $5 billion and $10 billion per 12 months, relying on oil costs.

Chevron’s low-royalty Permian acreage is an even bigger aggressive benefit that many understand. Nevertheless, given as we speak’s large want for pure fuel abroad, Chevron’s worldwide operations are additionally a sometimes-overlooked boon, e.g. Chevron has an curiosity in an Angolan LNG enterprise.

Worth investor Warren Buffett elevated his stake within the firm from 2.5% in early 2020 to eight.1% at March 31, 2022.

I like to recommend Chevron to dividend-seeking and progress traders excited about vitality.

Chevron First Quarter 2022 Outcomes and Steering

Within the first quarter of 2022, Chevron earned $6.3 billion, or $3.22/share, in distinction to earnings of $1.4 billion or $0.72/share in 1Q21.

Quarterly money movement from operations was $8.1 billion, in distinction to money movement of $4.2 billion for 1Q21. Free money movement was $6.1 billion. Capital expenditures had been $2.8 billion.

Earnings by main working space:

$MM | 1Q22 | 1Q21 |

Upstream | 6934 | 2350 |

Downstream | 331 | 5 |

All Different | -1006 | -978 |

6259 | 1377 |

Upstream is US and worldwide exploration and manufacturing; downstream is US and worldwide refining and chemical compounds. “Different” contains worldwide money administration and debt financing, company administrative capabilities, insurance coverage operations, actual property actions, and know-how firms.

Complete worldwide manufacturing was 3.06 million barrels of oil equal (BOE)/day, 39% within the U.S. and 61% worldwide. Of the full, 56.7% was liquids (oil, condensate, and pure fuel liquids).

Within the U.S. manufacturing was simply above that of a 12 months in the past at 1.18 million BOE/D. Liquids (oil, condensate, and pure fuel liquids) had been important at 880,000 BPD.

U.S. manufacturing included a file 692,000 BOE/D from the Permian Basin, or 59% of the corporate’s US complete.

Refinery inputs had been 1.5 million barrels per day (BPD), about 60% of which had been within the U.S. and the remainder worldwide. Refined product gross sales had been bigger at 2.55 million BPD, over half worldwide.

Critically, the corporate paid $2.7 billion in dividends and repurchased $1.3 billion of inventory throughout 1Q22.

In 1Q22 Chevron introduced the acquisition of Renewable Power Group, an organization with 34,000 BPD of biodiesel and renewable diesel manufacturing for $3.15 billion. The acquisition is predicted to shut within the second half of the 12 months.

Chevron supplied 2Q22 steering:

*share repurchases of $2.5 billion

*turnarounds and downtime will subtract about 160,000 BOE/D from manufacturing

*expiration of Thailand concessions will subtract about 50,000 BOE/D

*refinery turnarounds will price $250-$350 million

The corporate’s Indonesian contract can be resulting from expire in 2022.

On a progress notice, it raised 2022 Permian Basin manufacturing steering to 700,000-750,000 BOE/D, a 15% improve from 2021. It additionally expects to comprehend $250 million-$350 million in capital returns from its Angolan LNG mission. The 2022 capital expenditure finances is $15.3 billion.

Outcomes for 2Q22 can be launched July 29, 2022.

Macro Setting

It’s no exaggeration to say the vitality atmosphere has flipflopped (once more) within the final two years, significantly after main vitality producer Russia’s invasion of Ukraine and the follow-on reactions. Previous to the invasion, Russia accounted for about 10% of the world’s oil manufacturing and 40% of Europe’s pure fuel consumption.

Nevertheless, Europe—now desperately wanting inexpensive pure fuel—had already been experiencing difficulties earlier than the invasion resulting from over-reliance on intermittent renewables that had no backstops.

Certainly, ESG proponents have pushed world authorities and banking officers—as in Sri Lanka–to cease investing in or utilizing hydrocarbons, a restriction that impoverishes folks worldwide.

Some nations have restricted or lowered purchases of Russian vitality. Russia has retaliated by chopping pure fuel flows. Russian oil IS being offered at a reduction to China and India. Certainly, Chevron’s CEO, Mike Wirth has stated Russia’s oil manufacturing will seemingly fall as a result of departure of Western oil firms with their know-how and capital.

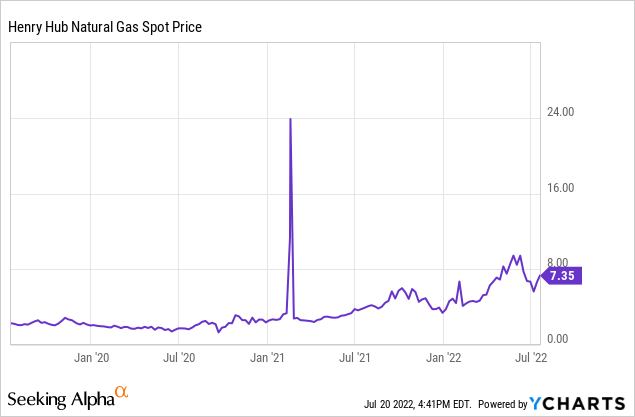

Most alarmingly, excessive liquefied pure fuel (LNG) prices in Europe could result in obligatory consumption cuts and industrial constraints on (for instance) fertilizer—which might have a follow-on impact on meals manufacturing. (Chevron produces pure fuel within the U.S., Angola, Australia, and the jap Mediterranean.)

Different issues are the Biden administration anti-hydrocarbon authorities insurance policies that discourage U.S. oil and fuel manufacturing.

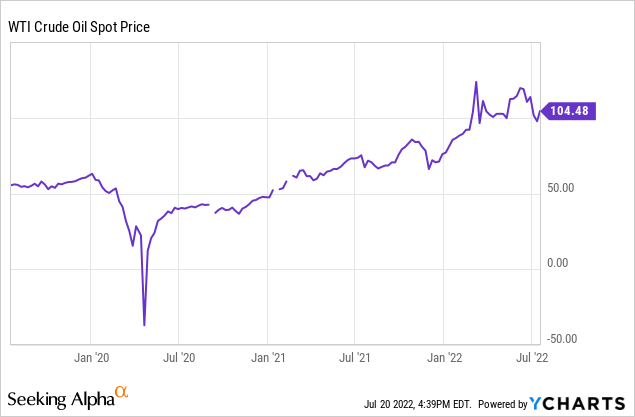

Oil and Fuel Costs

The July 20, 2022, NYMEX oil value was $102.26/barrel for August 2022 supply of West Texas Intermediate (WTI) crude oil. Henry Hub pure fuel, additionally for August 2022 supply, was $7.87/MMBTU. Dutch Title Switch LNG for August 2022 supply was greater than 5 instances as excessive at $46.51/MMBTU.

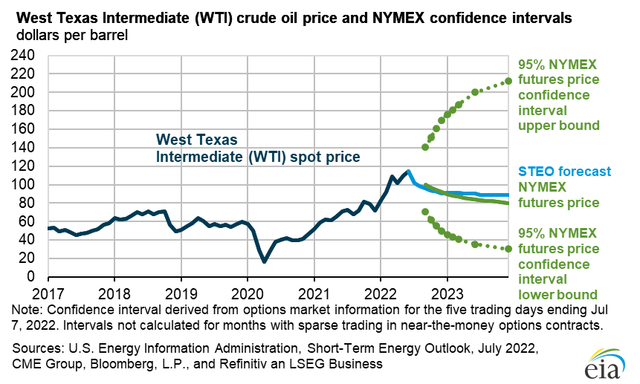

The U.S. Power Info Company (EIA) reveals a 5-95 confidence interval of about $30/bbl to $210/bbl for WTI costs at year-end 2023.

US Power Info Administration

Chevron’s Worldwide and US Reserves

At year-end 2021, Chevron’s SEC PV-10 reserves had been valued at $52.7 billion for the US, $103.9 billion for its consolidated firms (together with US and worldwide consolidated firms), and $128.9 billion for its consolidated and affiliated firms. At December 31, 2021, 34 p.c of the corporate’s web proved reserves in the US, 19 p.c had been in Australia and 16 p.c had been in Kazakhstan.

That is nicely over twice the 2020 year-end complete of $58.5 billion, a good thing about 2021’s a lot increased oil and fuel costs.

The corporate’s proved (developed and undeveloped) reserves complete 11.3 billion BOE.

These proved reserves consists of the U.S., worldwide operations, and affiliated operations. Proved developed reserves are 7.4 billion BOE.

Slightly below half, or 5.1 billion barrels, are liquids: oil, condensate, and artificial oil.

U.S. proved (developed and undeveloped) reserves are 3.86 billion BOE. U.S. proved developed reserves are 2.12 billion BOE.

Rivals

As famous, Chevron operates within the upstream and downstream sectors within the U.S. and internationally. The corporate is headquartered in San Ramon, California, nevertheless it plans to maneuver to a brand new headquarters constructing in California and—notably—is encouraging California workers excited about doing so to maneuver to Houston, Texas.

Rivals within the Midland and Delaware sub-basins of the Permian are quite a few, together with small firms, non-public firms, in addition to different medium, massive, and really massive public firms like ConocoPhillips (COP), EOG Sources (EOG), Diamondback Power (FANG), EOG Sources (EOG), Occidental (OXY), and Exxon Mobil (XOM).

Completely different from its opponents, Chevron has appreciable legacy, low-royalty-cost Permian manufacturing and acreage.

Worldwide opponents embrace BP (BP), Equinor (EQNR), ExxonMobil, Shell (SHEL), plus all non-OPEC and OPEC+ (akin to Saudi Aramco and Gazprom) nationwide oil and fuel firms.

Governance

At July 1, 2022, Institutional Shareholder Providers ranked Chevron’s general governance as a 7, with sub-scores of audit (7), board (6), shareholder rights (1), and compensation (9). On this rating a 1 signifies decrease governance threat and a ten signifies increased governance threat.

As of Might 2022, Chevron’s ESG rankings from Sustainalytics had been extreme (below-average) with a complete threat rating of 43 (92nd percentile). Element components are environmental threat 22.4, social 10.6, and governance 9.9. The one problematic space famous is animal testing.

Controversy degree is 3 on a scale of 0-5, with 5 because the worst.

On June 30, 2022, shorts are 0.91% of floated shares. Insiders personal solely 0.07% of shares.

The corporate’s beta is 1.13, as one would possibly anticipate for a big multinational with each upstream and downstream operations and thus solely barely above the general market degree of volatility.

The corporate introduced a significant structural reorganization, efficient October 1, 2022. Upstream, midstream, and downstream can be mixed into one group and overseen by one government vp. Multi-regional upstream operations can even be consolidated into simply two areas: Americas and Worldwide. The purpose of the reorganization is capital optimization.

At March 30, 2022, the 4 largest institutional stockholders, a few of which characterize index fund investments that match the general market, are Vanguard (8.5%), Berkshire Hathaway (BRK.A, BRK.B) (8.1%), State Avenue (7.0%), and Blackrock (6.5%).

There are two factors of curiosity. First, Berkshire Hathaway’s holdings of Chevron, together with its important place in Occidental (OXY) of practically 20%, suggests a Berkshire/Buffett evaluation that each firms are undervalued.

Individually, Vanguard, Blackrock, and State Avenue are signatories to the Glasgow Monetary Alliance for Internet Zero, a gaggle that, as of Might 31, 2022, manages $61.3 trillion in property worldwide and which (regardless of high-cost energy-all vitality—due partially to hydrocarbon vitality provide constraints) limits hydrocarbon funding through its dedication to realize web zero alignment by 2050 or sooner.

Monetary and CVX Inventory Highlights

Chevron’s market capitalization is $288 billion at a July 20, 2022, inventory closing value of $146.52/share.

Trailing twelve months’ EPS was $10.64/share for a value/earnings ratio of 13.8. Analysts’ common estimates for 2022 and 2023 EPS are $17.68 and $15.79, respectively, for a ahead price-earnings ratio vary of 8.3 to 9.3.

With a 52-week value vary of $92.86-$182.40 per share, the July 20, 2022, closing value is 80% of its one-year excessive. The corporate’s one-year goal value is $176.27/share placing its closing value at 83% of that degree.

At March 31, 2022, the corporate had $101.9 billion in liabilities and $249.0 billion in property giving Chevron a liability-to-asset ratio of 41%. Of the liabilities, debt totals $29.3 billion (29.0 billion of which is long-term debt), or 11.8% of property.

The corporate’s ratio of debt to market capitalization is a small 10%. The debt-to-EBITDA ratio is comfy at 0.76.

Chevron’s dividend of $5.68/share represents a 3.9% yield at its present value. As famous, relying on oil costs, the corporate plans to repurchase a number of billion {dollars}’ value of inventory yearly.

Imply analyst ranking is a 2.1, or “purchase,” from the 24 analysts who observe it.

Notes on CVX Inventory Valuation

Ebook worth per share at $74.42 is nicely under market value, implying constructive investor sentiment.

Its ratio of enterprise worth to EBITDA is within the cut price (sub-10.0) vary at 7.5.

Chevron’s present market capitalization is $288 billion. SEC PV-10 reserve worth at year-end 2021 was $128.9 billion. As of March 31, 2022, property are $249 billion and liabilities are $102 billion for balance-sheet fairness of $147 billion.

The corporate’s market capitalization/flowing BOE is $94,100 and its market capitalization/flowing barrel of liquids is $166,000. These are much like the present metrics for ExxonMobil.

Constructive and Unfavourable Dangers

Traders ought to take into account their oil and pure fuel value expectations because the issue almost definitely to have an effect on Chevron’s operations.

Worldwide operations within the jap Mediterranean, Kazakhstan, Australia, and elsewhere carry country-specific dangers, however so do operations within the U.S. given the present administration’s anti-hydrocarbon stance. Certainly, the corporate’s worldwide diversification is (once more) a major profit that layers on high of its aggressive low-royalty benefit within the Permian basin.

Suggestions for Chevron

Regardless of the inventory value improve, I like to recommend shopping for Chevron inventory now since it’s off the 52-week excessive. Oil and pure fuel costs stay constructive for the close to future. Chevron is returning to money to shareholders within the type of a 3.9% dividend and a share buyback program of $5-$10 billion/12 months, relying on oil costs.

The corporate has loads of flexibility in its steadiness sheet with a comparatively small debt share in addition to an investor-friendly ahead price-earnings ratio of 8.3-9.3 and a horny enterprise value-to-EBITDA ratio of seven.5.

In December 2020, value-oriented Warren Buffett’s Berkshire Hathaway had a 2.5% fairness stake in Chevron. He has elevated his stake to over 8%, presumably for long-term upside.

Different favorable components embrace Chevron’s sturdy Permian place, globally diversified operations, and good money movement.

chevron.com