IgorSPb

Investment Thesis

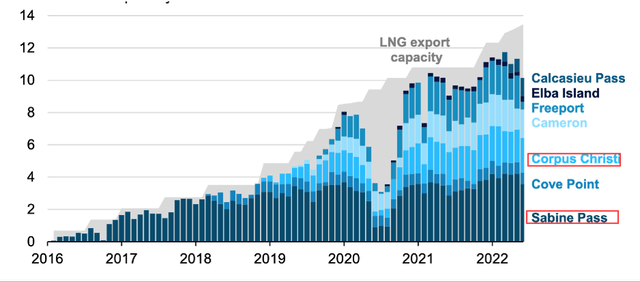

Cheniere Energy (NYSE:LNG) is one the largest US publicly-traded companies with complete exposure to LNG production. However, the company isn’t vertically integrated, but has long-term contracts to supply third-party dry gas. The company brought its ninth liquefaction train (the third train of the Corpus Christi growth project) to full capacity in 1Q 2022, which helped to boost LNG production capacity from 40 mln tons a year to 45 mln tons a year.

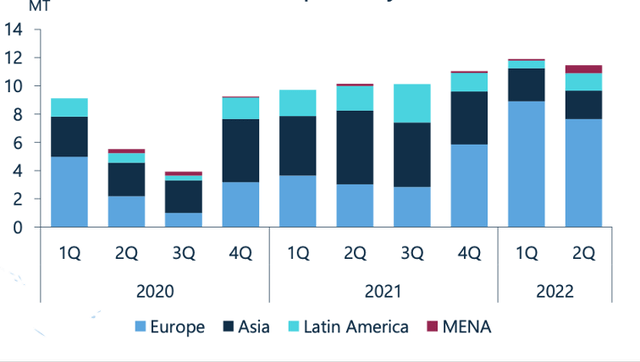

Cheniere Energy will become a key beneficiary of the urgent EU program to replace Russian gas with LNG, which we are already seeing. More than 80% of its physical LNG supplies go to EU countries. And the potential for expanding the export capacity allows the company to conclude long-term contracts at current high prices.

We believe that it’s still too early to buy the company’s stock due to the market sentiment amid the high amount of gas in EU gas storage facilities and the restart of the Freeport LNG plant, which are putting pressure on gas prices, and consequently on LNG shares.

Not to be mixed with Cheniere Energy Partners

Cheniere Energy is one of the largest LNG producers. The company makes up 11% of the global LNG market, and more than 50% of US LNG production. It’s important to note that Cheniere Energy is not vertically integrated. Cheniere Energy doesn’t extract gas from the ground, but it has long-term contracts for its supply.

In fact, Cheniere Energy just was lucky. It was believed that the US would run out of all its dry natural gas come the start of the 21st century, and Cheniere Energy built regasification plants. Revenue didn’t amount to much due to low domestic demand, and then came the discovery of shale oil and gas. Cheniere Energy changed course and re-equipped its regasification plants to produce LNG.

The company is quite complex in terms of its corporate structure. There is the parent company Cheniere Energy (“LNG”), which has direct ownership (a 100% stake) of the Corpus Christi growth project. There’s also the subsidiary Cheniere Energy Partners (CQP), which has indirect ownership, through other subsidiaries, of the mature Sabmine Pass (6 trains) project. However, Cheniere Energy directly owns a 48.6% stake of Cheniere Energy Partners and indirectly owns another 2%. That means total ownership tops 50%, which enables LNG to consolidate the assets, and that’s what it does. What is that for? Most likely, it’s for taxation purposes. Why did we choose LNG for the overview? It’s because CQP doesn’t have the Corpus Christi growth project. Still, Cheniere Energy is ultimately a combination of 2 companies.

Company data

The LNG market and its prospects

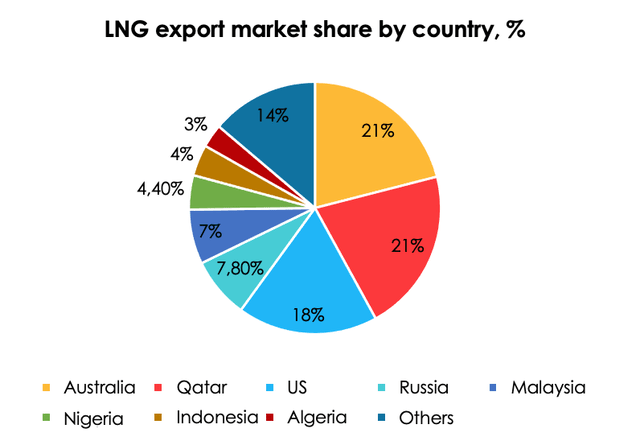

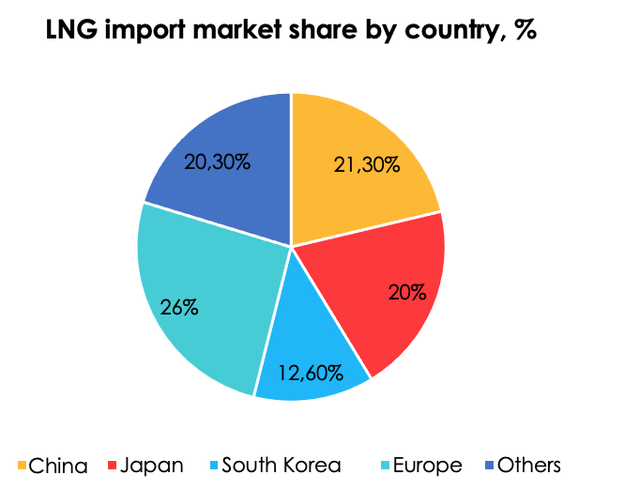

In 2021, the global LNG export market reached 387 mln tons or 513 bln cubic meters of dry gas equivalent, according to IGU. More than 50% of all LNG exports comes from only 3 countries: Australia, Qatar and the US, which are energy-surplus countries.

IGU

LNG consumption leaders are the European Union, Japan and China (power-hungry regions). As the situation around Nord Streams 1 and 2 is escalating, while business activity in Asian countries, particularly in China, is slowing down, European countries could make up more than 30% of the global import market.

IGU

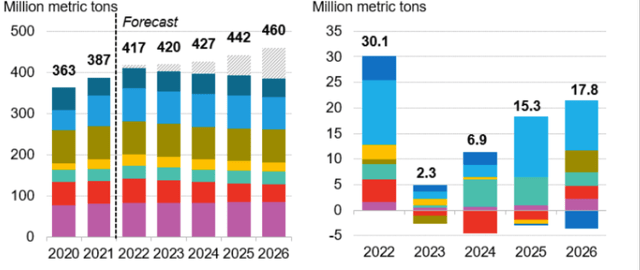

The prospects for the LNG market are directly dependent on the capacity for its export and demand for gas. Over the past 5 years, North America, particularly the US, has been steadily but surely approaching the leading position in terms of investment in the industry. It’s noteworthy that final investment decisions in North America were made for a volume in excess of 30 bln cubic meters in the first half of 2022, while the rest of the players had nothing to report, according to EIA.

EIA

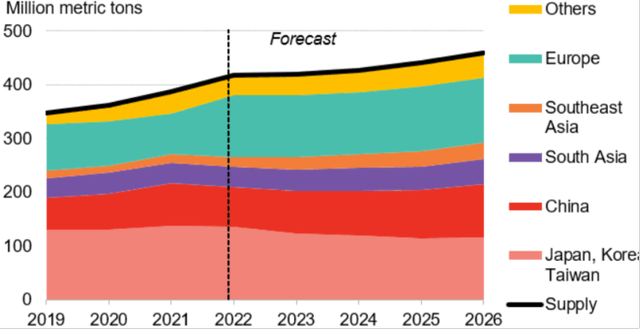

Bloomberg estimates that the US will be building the most LNG liquefaction capacity until 2026 and the world’s total LNG export potential will expand to 460 mln tons a year by 2026. It’s worth noting that, despite the global energy crisis, 2023 is expected to see the least new liquefaction capacity coming online.

Bloomberg

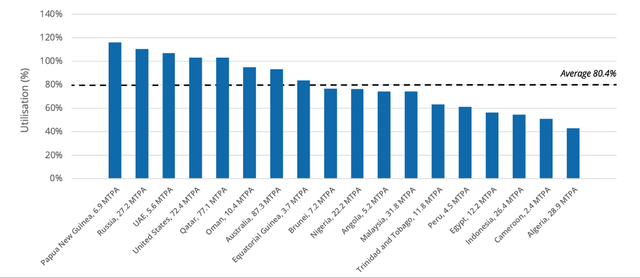

The ongoing energy crisis coupled with some of the slowest introduction of new capacity in 2023 will mean LNG capacity utilization will remain high across the globe. For example, 7 export markets out of 21 reached the capacity utilization of more than 90% in 2021, according to IGU, due to high demand for gas and the desire of Asian partners to conclude long-term supply contracts.

IGU

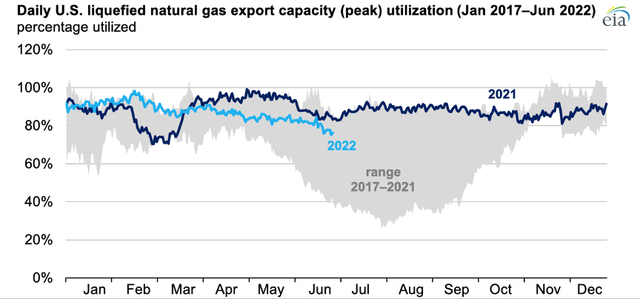

For example, according to the EIA, the average capacity utilization surpassed 80% in the US in first half of 2022. we expect that capacity utilization will reach 90%-100% in 4Q 2022 due to high demand for gas in the EU amid offtake of gas from storage facilities.

EIA

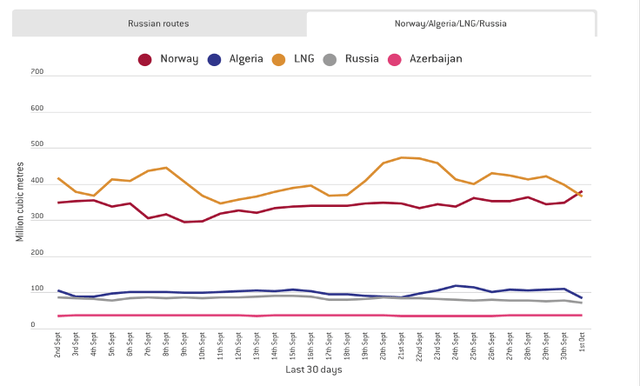

Let’s now talk about demand. The exacerbation of geopolitical situation in Eastern Europe and the halt of gas supplies to the EU through 2 main pipelines, the Nord Stream 1 and 2, have caused daily EU imports of Russian gas to total 0.5 bln cubic meters a week over the past 30 days (~30 bln cubic meters a year), according to Bruegel. Most imports come via the Turkish Stream and via transit across Ukraine. The gas hunger prompted a record surge of prices.

Bruegel

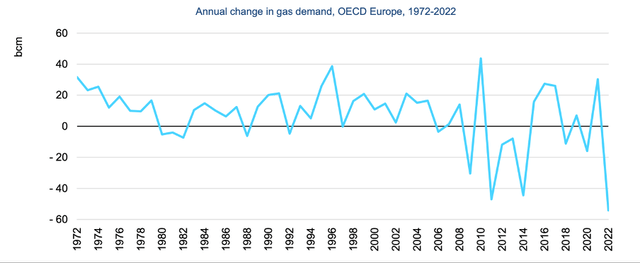

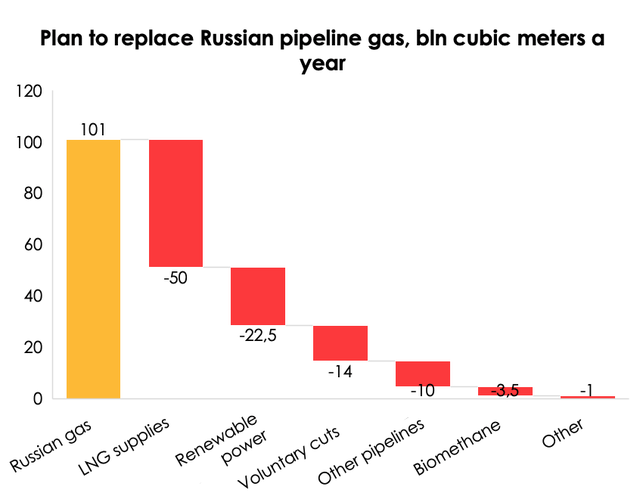

In an effort to stabilize the energy market and steer away from Russian gas (which made up about 30% or 100 bln cubic meters a year), EU countries are pursuing a plan to reduce gas consumption by a record 15% for the period from August 2022 to March 2023. As a result, EU demand for dry natural gas could fall by a record 50 bln cubic meters (36 mln tons of LNG equivalent a year), the most over the past 50 years, according to EIA.

EIA

The short-term plan to reduce Russian gas imports includes replacing about half of them with LNG (about 36 mln tons of LNG, or ~10% of the projected global export potential), according to EIA. And that’s a pot of gold. EU countries are now scouring the globe in attempts to get LNG anywhere they can.

EIA

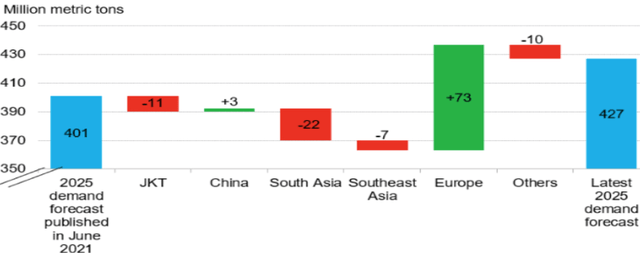

The long-term plan running to 2025, according to Bloomberg, aims to completely stop buying Russian gas, which creates a total of another 37 mln tons a year of demand after 2025. Therefore, before 2025 the EU will generate all new global demand for LNG, which we are already seeing from reports by suppliers. The EU makes up more than 80% of the company’s shipments, and that’s a long-term story.

Bloomberg

The global LNG market will be balanced until 2026. However, the faster pace of energy transition in the developing and developed countries will cause a shortage, which will set off a new round of energy crisis in the regions, according to Bloomberg.

Bloomberg

We believe that the LNG market continues to hold promise over the long term for a number of reasons:

- Given the accelerated phasing out of “dirty” types of fuel, the slow introduction of new LNG capacity will provoke its shortage, pushing prices up;

- The limited capacity is exacerbated by an insufficient number of tankers. There are 640 LNG tankers now operating in the market, according to IGU. As of this moment, construction is underway on another 216 LNG tankers, but it takes an average of 30-50 months to complete construction. Only about 35 new tankers will start operating in 2022, and no more than 40 in 2023. And there’s a lot of gas to replace!

The business of Cheniere Energy

As we have mentioned earlier, the company makes up more than 50% of US LNG exports, with an export potential of 45 mln tons of LNG a year at its liquefaction plants in Sabine Pass and Corpus Christi (a total of 9 trains).

EIA

More than 80% of LNG shipments go to EU countries, according to a recent report, and starting from 2Q 2022, the company began to conclude long-term contracts to supply LNG to MENA region countries (the Middle East and North Africa).

Company data

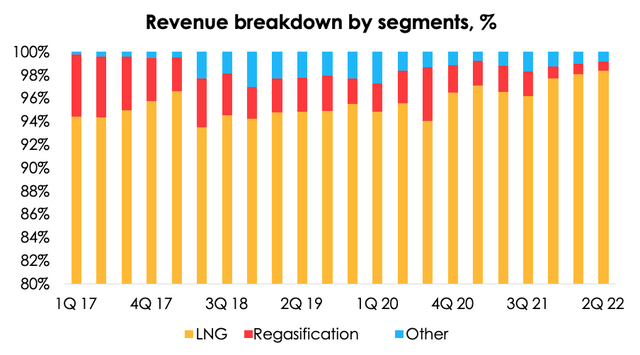

The company derives about 99% of its revenue from LNG sales, and the rest comes from the regasification services (for US LNG imports) and other revenue.

Company data

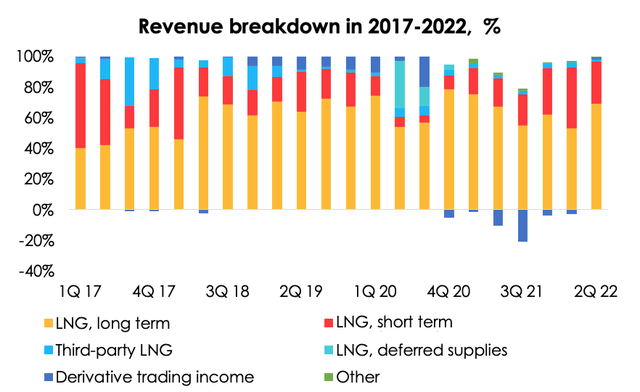

Furthermore, more than 60% of revenue in the LNG sales segment comes from long-term contracts. The company prefers to conclude long-term supply deals, however it reserves some volumes for short-term sales, which, given the high gas prices, allows it to earn an excess revenue. The company also makes hedges through derivatives, which is reflected in revenue and COGS either as profit or loss. However, hedging usually makes up no more than 15% of the total result.

Company data

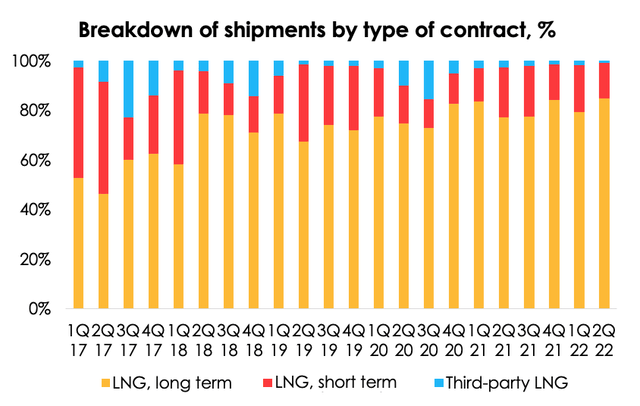

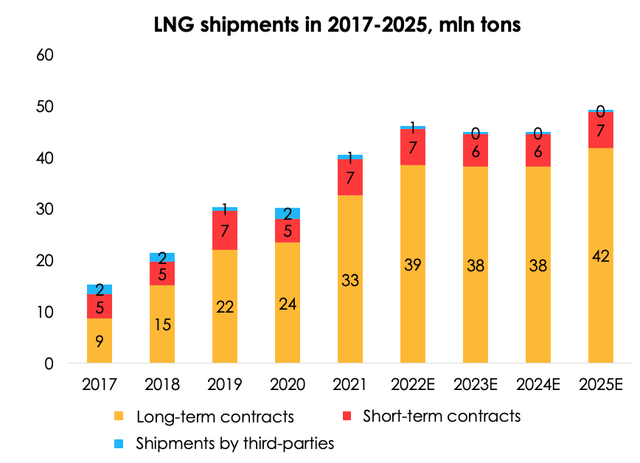

From the perspective of the volume of shipments, even as long-term contracts make up 60% of cash income, they make up the most part of physical LNG shipments (more than 80%). Given the escalation of tensions around the energy crisis, the company seeks to conclude more long-term contracts.

Company data

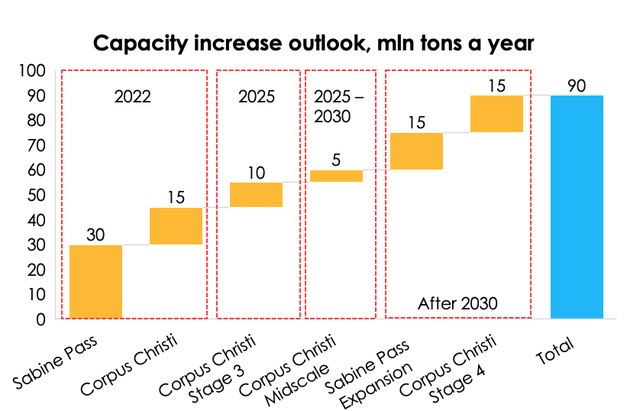

What’s the outlook for the company’s volumes? Cheniere Energy is a unique LNG company that not only has gained a significant market share, but also has plans for a many-fold increase of its supplies. Its capacity is expected to expand to 90 mln tons a year after 2030.

Company data

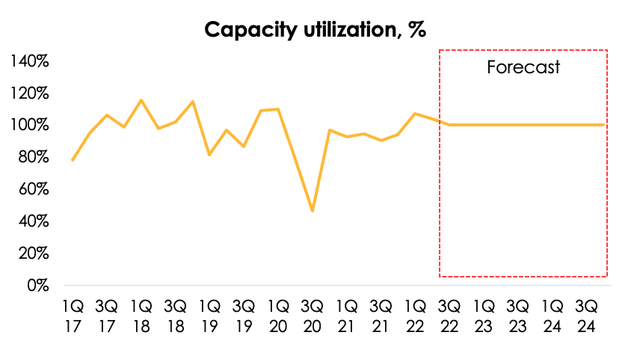

Cheniere Energy is one the few companies in the industry whose capacity utilization averages 90%. We expect that capacity utilization will average about 100% over the forecast period to meet EU demand for LNG.

Invest Heroes

We expect that high capacity utilization will stabilize LNG production at 45 mln tons a year, and will incrementally climb to 55 mln tons a year from 2026.

Invest Heroes

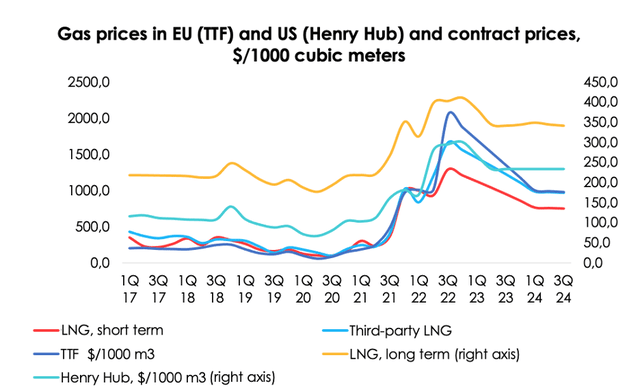

What about selling prices? Long-term LNG supply contracts are tied to US domestic gas prices (Henry Hub). Usually, contracts are reviewed once a quarter depending on the price situation. When forecasting US gas prices, we rely on EIA’s short-term expectations for domestic prices. The agency expects natural gas in the country to rise to $9 per mln BTU in 4Q 2022 amid seasonal demand, and to fall in 2023 to the average of $6 due to an acceleration of the country’s gas production. Short-term contract prices were tied to TTF prices, based on market expectations reflected in the futures curve. The average selling price until 2024 was $1437 per 1000 cubic meters.

Invest Heroes

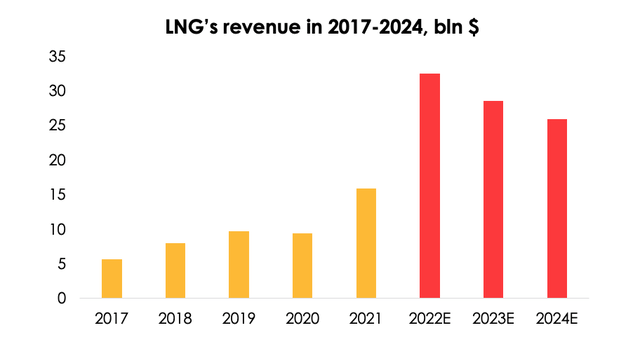

Financial results outlook

The company’s total revenue could rise by 104% y/y to $32.4 bln in 2022, and will reach $28.6 bln (-12% y/y) in 2023, which is in line with our expectations in terms of gas prices in the US and the EU. It’s worth noting that 2022 will be a year of considerable revenue growth for the company, as the business of LNG has largely become the main beneficiary of the global energy crisis.

Invest Heroes

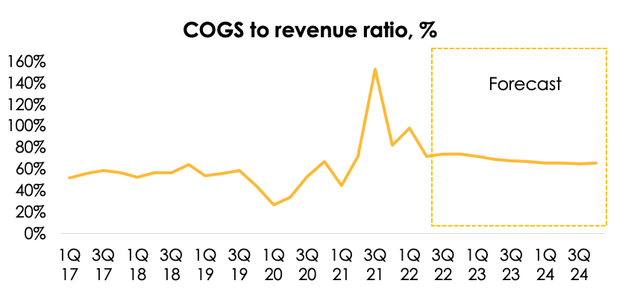

The company’s gross costs are fairly volatile, with their ratio to revenue fluctuating from 52% to 152% (in the event of losses from trading in derivatives). We expect that the COGS to revenue ratio will trend downward along with the decline of gas prices. The company has generally been able to maintain an average spread of about $200 per 1000 cubic meters between the selling price and costs, which we anticipate to continue over the forecast period.

Invest Heroes

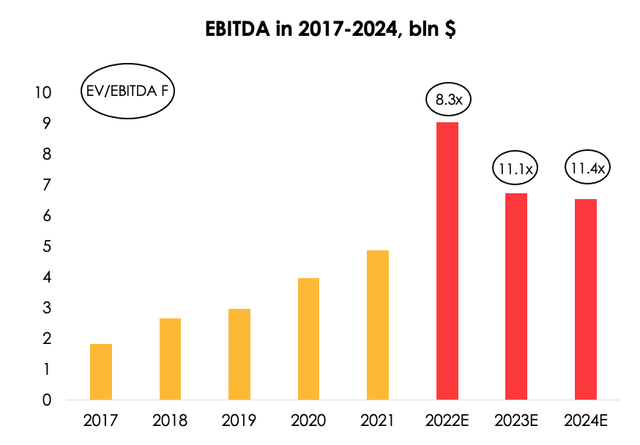

Therefore, LNG’s EBITDA is set to jump by 85% y/y to $9 bln in 2022 due to record high gas prices, and the metric will reach $6.7 bln (-26% y/y) in 2023 as the energy resources market will partly stabilize.

Invest Heroes

Valuation

Cheniere Energy is a unique company producing LNG in the US. The company was able to combine a mature project with growth projects.

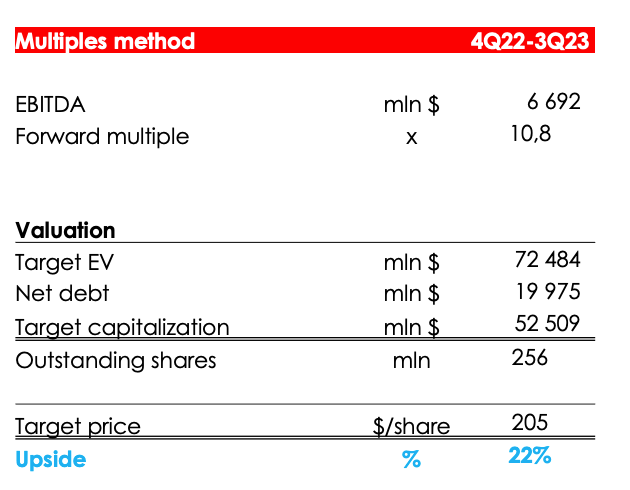

According to our estimates the fair value of stock price is $205. The upside is 22%. Status – Hold.

Invest Heroes

Conclusion

Cheniere Energy is one of the beneficiaries of the energy crisis in the world, including in the EU. The objective of the European countries to replace dry natural gas from Russia with imported LNG is conductive to long-term contracts. It’s noteworthy that all gas to be produced at the future growth project Corpus Christi Stage 3 has already been locked down in supply deals. The total volume of new contracts concluded in 2Q 2022 reached more than 140 mln tons of LNG through 2050.

We believe that it’s still too early to buy the company’s stock due to the market sentiment amid the high amount of gas in EU gas storage facilities and the restart of the Freeport LNG plant, which are putting pressure on gas prices, and consequently on LNG shares. An ideal entry point could arise when the EU boosts gas offtake from its underground storage facilities, which will push gas prices up.

To stay in touch with current situation, I think potential investors should pay attention to EIA outlooks, Bloomberg data and IGU reports.