Jeremy Poland/E+ via Getty Images

Investment Rundown

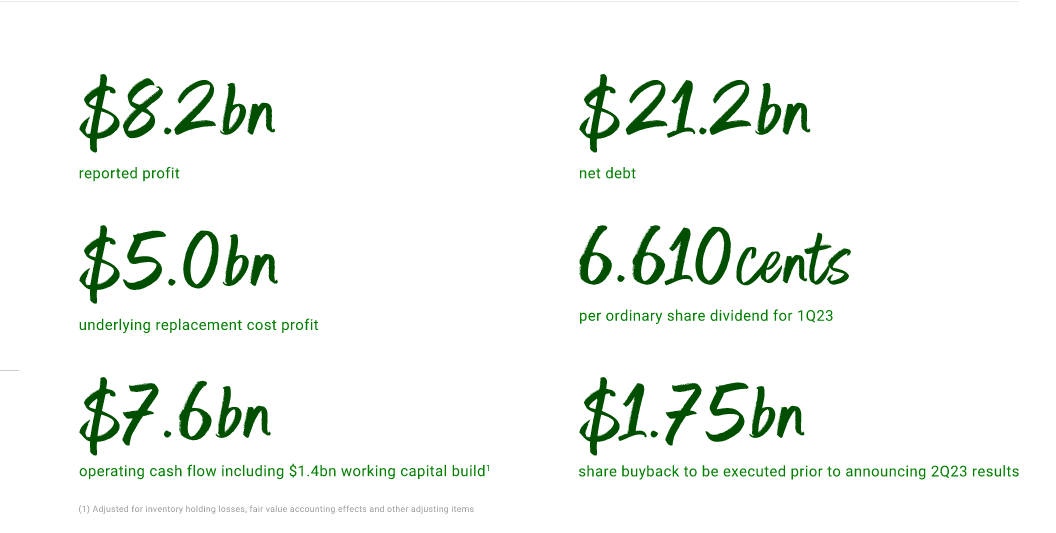

Where much of the appeal of investing in the oil industry has come from is that companies quite often deliver strong dividend yields and buyback programs. That seems to remain true with BP p.l.c. (NYSE:BP), a company that had a very solid start to 2023 and announced they are buying back shares worth $1.75 billion before they even announce the Q2 results of 2023. That sort of news makes BP out to be a very intriguing investment for people seeking exposure to the industry, but also want a position that consistently appreciates.

The fundamentals of BP remain solid and with 40% of excess FCF dedicated to improving the balance sheet, the company has done solid work over the last few years. The industry has traditionally traded at a pretty low multiple, but even now BP is valued under the industry’s 5-year average p/e of 8.7. In my view, BP deserves a richer multiple given the solid fundamentals and the dedicated capital going towards buybacks and dividends. I am rating BP stock a buy.

Company Segments

Within BP, there are three major business groups, these being Gas & low carbon energy, Production & operations, and lastly customers & products.

Within the first segment, they focus on low-carbon energy solutions such as wind, solar, and hydrogen. Recently, they are also moving into CCS projects aiming to capture carbon and reduce pollution. This is a relatively new market but one that sees strong demand and capital going towards. Where BP sees itself creating value here and generating revenues is through its integrated gas & LNG business, but also with gas trading and power trading.

The second business group is the operational heart of BP as it focuses on the production of hydrocarbon energy. Finding new prospects right now mostly circling existing projects and exiting hubs. This business group is also involved in the operations of oil and gas production assets, as well as refineries, terminals, and pipelines.

Lastly, the customer & products group focuses on driving new business initiatives for their customers and creating value through partnerships, and optimizing their many fuels value chains.

Earnings Highlights

Looking at the latest earnings from the company, they made it very clear they are intending on maintaining a strong conversion of FCF to distribute to shareholders. For Q1 2023, they distributed a dividend of $6.6 per share to their shareholders, and they have consistently maintained a strong dividend yield for their investors. With that dividend, BP has a yield of 4.56%, making it very appealing as a dividend addition to a portfolio in my opinion. Now there are better yields offered by other companies in the same industry, but where BP pulls ahead is the significant buybacks. The dividend and buyback plans seem to remain strong as BP generated $7.6 billion in operating FCF to start the year.

Q1 Highlights (Investor Presentation)

Over the last few years, BP has made strong progress towards paying down their long-term debts, and Q1 was no different in the TTM as BP has paid down over $13 billion in debts which results in them reaching a net debt of $21 billion. That means BP has a very low net debt/EBITDA of just 0.35 right now, highlighting the solid position the company is in currently.

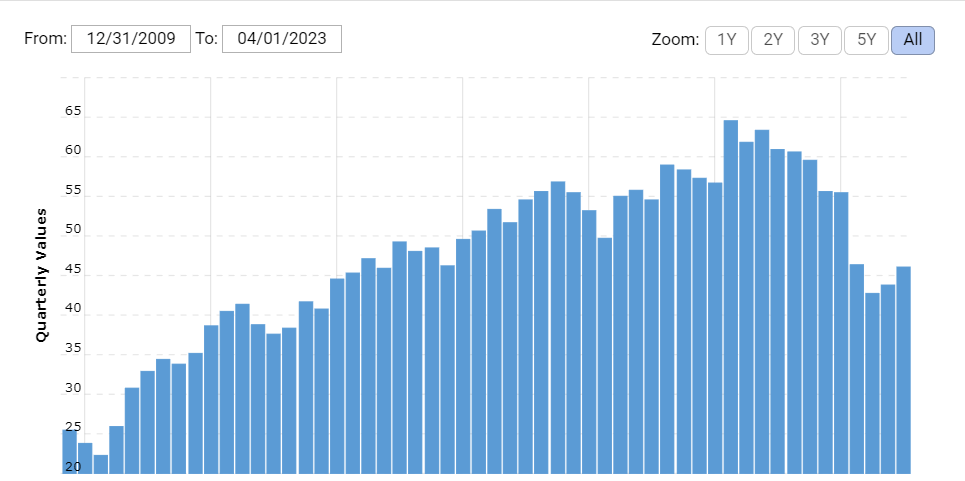

Debt History (Macrotrends)

The net debts peaked at around $63 billion but have since come down a fair bit. Looking ahead, I think that BP remains strong enough to maintain its current FCF plan where 60% of the surplus is going to shareholders.

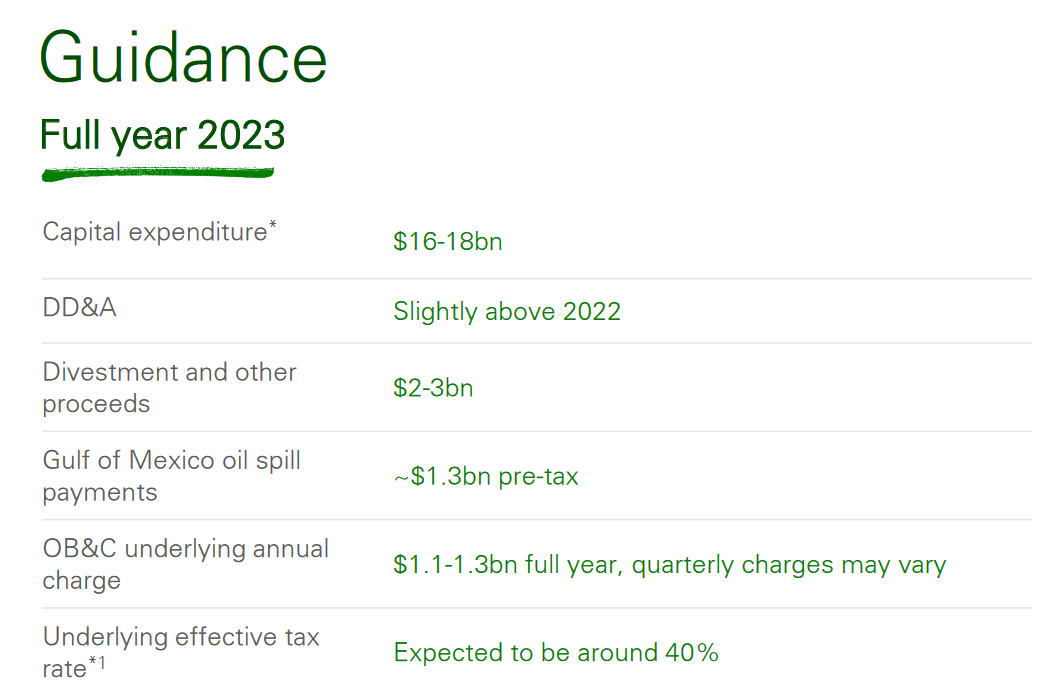

2023 Guidance (Q1 Earnings Presentation)

As for where BP sees the remaining year going, capital expenditures are to be between $16 – $18 billion, up significantly from 2022 which was $12 billion. I find it likely that we don’t see significant growth in the FCF given this upswing in the capital expenditures on a YoY basis. The outlook the company had regarding buybacks is that they will be able to commit at least $4 billion towards repurchasing if Brent barrel prices remain at $60. But it would also include an annual raise of 4% for its dividend yield.

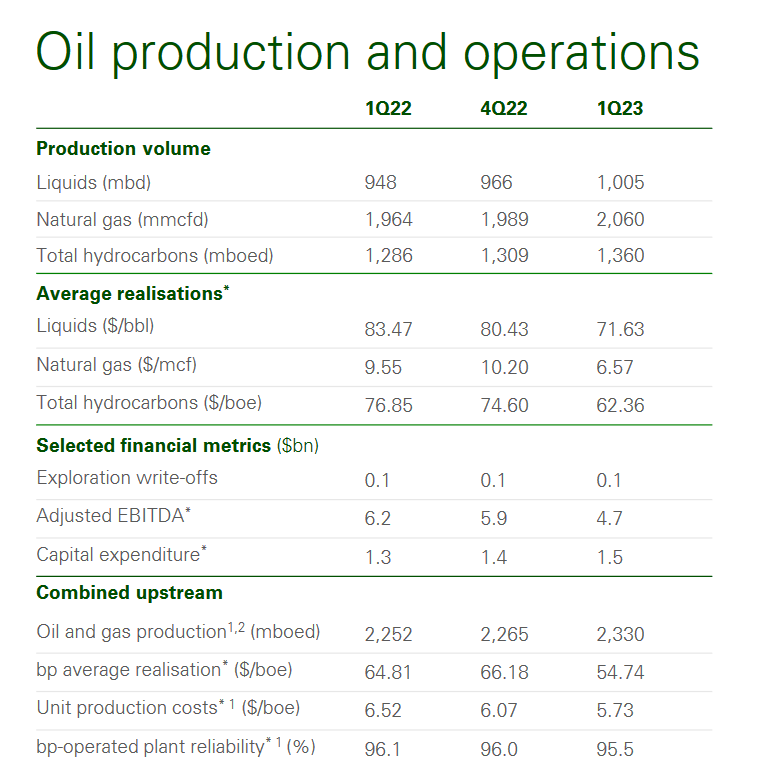

Oil Production (Q1 Report)

Lastly, the predictions from the quarter remain in my opinion very strong given the lower Brent oil prices we have compared to the 2022 levels. Production volumes were up across all parts of BP, the liquids, natural gas, and hydrocarbons all showed signs of strength. Now it’s up to BP to maintain this momentum and prove that investing in this sector remains attractive.

Risks

As the revenues of BP are largely driven by commodity prices, the risk that investors will have to face is buying a company that might experience volatility in revenues as a result of an unstable market environment. That has been the case with BP where revenues have been largely up and down the last 10 years or so. But I think the growth trajectory remains strong as oil is still a very prevalent way for us to generate energy and will continue to be for many more years. The prices for Brent oil seem to have been in a consistent decline for the last 12 months and that does make the EPS estimates for BP hard to be sure of. Downward revisions are very much possible if the market shows weakness or demand diminishes.

CCS Projects Potential

Touching briefly on the CCS projects that BP is moving into, it looks promising. BP has signed an agreement where they will take a 40% stake in the Viking carbon capture and storage project in the North Sea. That makes for three BP-led projects that revolve around hydrocarbon and CCS in the North-East of England which the UK government has chosen BP for.

But apart from that, BP also announced plans for a low-carbon green energy cluster in Valencia, Spain. The project aims to refine up to 2GW of electrolysis in total capacity by 2030. All in an attempt to make the BP Castellon refinery a world-scale green hydrogen site.

I find the new invites to move into CCS very appealing as the market for it seems to be growing at a very fast rate right now, with a 14% CAGR now until 2032. Government incentives are making this growth realistic as beneficial as investment tax credits and funding are being pushed, and for BP and others to capitalize on this, they are right now taking the necessary steps in my opinion.

Final Words

As for my final words about BP, I think the valuation right now looks very appealing. A p/e of under 6 makes it trade under the sector’s average of 8.7. Some risks are Brent oil has been on a steady decline, but I think that in years, it will eventually normalize and BP will have plenty of time to accumulate strong cash flows and distribute a significant portion of it to shareholders. The incentive here for shareholders is to remain invested as BP is spending heavily on buying back shares. Until Q2 2023 the outstanding shares are expected to be reduced by nearly 2% as BP aims to deploy $1.75 billion for buybacks.

The massive presence that BP has accumulated over its 113 years in the energy business makes its position almost grown too large to fail. A phrase that shouldn’t be thrown around too easily. But BP has done very well in pursuing and being selected for several governmental projects, like the CCS projects in the North-East of England. As a result, BP is a buy for me, and as long as Brent oil prices remain above $60, BP will continue to deliver strongly in terms of FCF and EPS growth.