A newly uncovered public doc reveals that the Bitcoin Coverage Institute, a analysis and advocacy group in the USA, has drafted an government order that goals to designate Bitcoin as a strategic reserve asset. This proposed order is designed to take impact instantly upon being signed by President-elect Donald Trump on his first day in workplace.

New Draft Requires Bitcoin Acquisition Via Treasury’s ESF

In accordance with the draft, as world finance more and more integrates digital property, the USA should adapt its monetary methods to keep up its stability and management within the world financial system.

The doc characterizes Bitcoin as a decentralized, finite store-of-value asset, akin to digital gold, which may improve the resilience of the US greenback and help American financial pursuits.

If enacted, the manager order would designate Bitcoin as an appropriate asset for acquisition throughout the Treasury Division’s Change Stabilization Fund (ESF), establishing a Strategic Bitcoin Reserve as a everlasting nationwide asset for the good thing about all People.

The draft emphasizes the significance of making a Bitcoin reserve to bolster the US financial system and safe American monetary dominance within the years to return.

By designating Bitcoin as a strategic asset held by the federal government, the proposal goals to diversify the property throughout the ESF, thereby safeguarding nationwide financial safety and guaranteeing a aggressive benefit within the twenty first century.

Moreover, it seeks to place the US as a worldwide chief within the digital property trade, attracting capital, expertise, and sound companies to thrive inside its borders.

To boost confidence on this initiative, the draft outlines that the Strategic Bitcoin Reserve could be administered by the Secretary of the Treasury, with provisions for normal audits, safety requirements, and reporting measures.

Inside seven days of the order being signed, any BTC held by federal companies, together with the US Marshals Service, could be prohibited from being bought or encumbered. As an alternative, it might be transferred to the strategic reserve upon acquisition of authorized title.

Moreover, the draft instructs the Secretary of the Treasury to implement an acquisition program for Bitcoin inside 60 days of the order’s signing. This might facilitate the administration and procurement of Bitcoin beneath the ESF.

Trump’s Potential Day-One Government Order

Whereas this doc represents solely a draft and neither Trump nor members of the upcoming administration have publicly commented on it, curiosity in such measures has been rising in latest days.

Notably, Jack Mallers, founder and CEO of Strike, just lately indicated that Trump is contemplating a day-one government order to determine a Strategic Bitcoin Reserve. Throughout an interview, Mallers acknowledged, “I additionally know that Trump is a day one government order.”

His remarks prompted discussions in regards to the potential implications of such an order, significantly within the context of the Greenback Stabilization Act, which may grant the president broad authority to guard the greenback.

Trump’s latest statements have additional fueled hypothesis surrounding the institution of a Bitcoin reserve. In a speech on the New York Inventory Change, he remarked, “We’re gonna do one thing nice with crypto,” and when requested about the potential of the U.S. making a reserve akin to its oil reserves, he replied, “Sure, I feel so.”

On the time of writing, BTC is consolidating on the $104,000 stage, down 2.5% within the 24-hour timeframe.

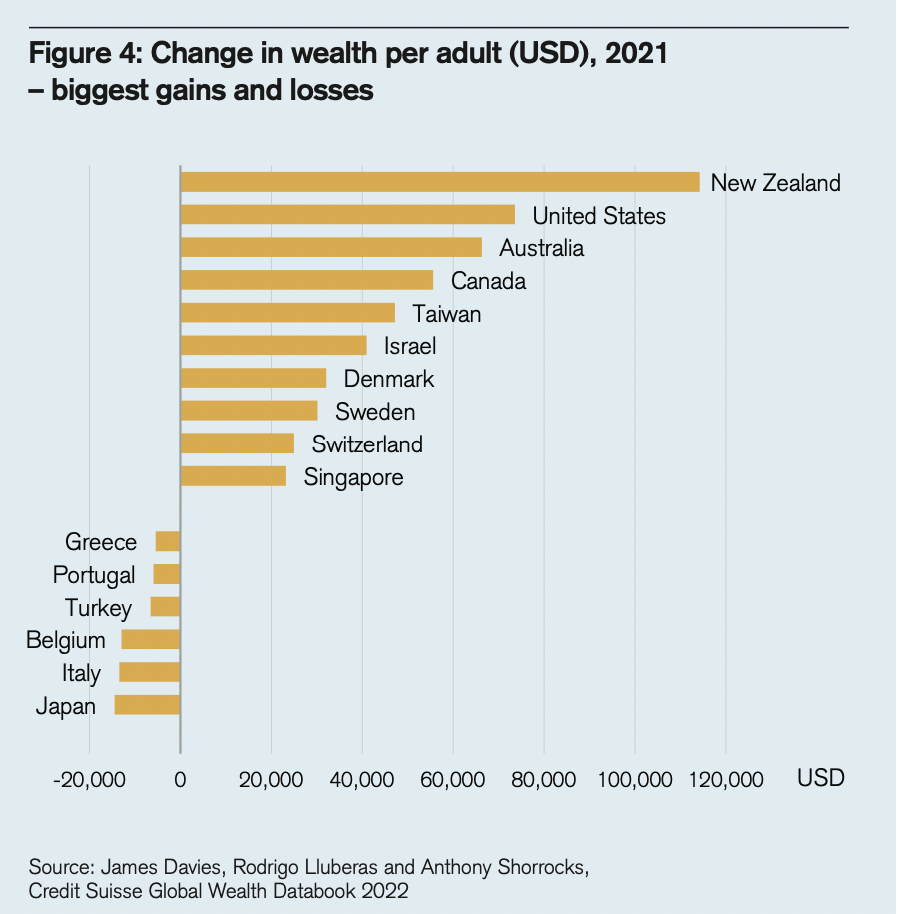

Featured picture from DALL-E, chart from TradingView.com