atakan/iStock via Getty Images

Thesis

Bitcoin (BTC-USD) could be setting up for another bull run, even in the face of a hotter-than-expected January CPI report. So far, there is little evidence to claim that high inflation is bad (or good) for Bitcoin. I instead look to other factors such as the four-year halving cycle and adoption metrics to anticipate Bitcoin’s price movement.

The CPI Report

The January CPI report was released on Tuesday, February 14th. Inflation rose 0.5% month-over-month (0.4% expected), up 6.4% from last year (6.2% expected). Excluding food, energy, and shelter (because who needs those, right?), inflation rose more slowly at 0.2% month over month and 4% year over year.

Although inflation is still trending down from recent highs above 8%, it remains very elevated, and this month surprised to the upside. Obviously, high inflation is bad for the average consumer, but what about for investors?

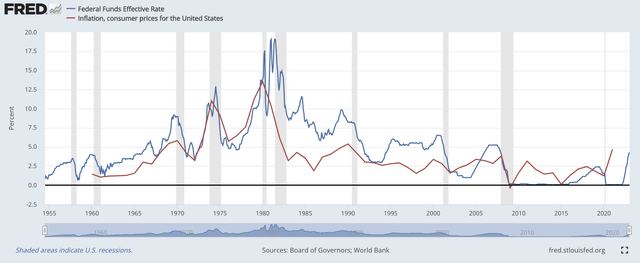

FRED

Investors have probably heard many times that decreasing inflation is likely to be good for stocks (and arguably cryptocurrency) because it means that the Fed can start lowering rates. As shown in the chart above, the Fed funds rate is often set slightly above the inflation rate. During past periods when the inflation rate spiked and passed the Fed funds rate (namely the 1970s), inflation didn’t peak until the Fed funds rate passed it.

This chart is somewhat behind, as the current Fed funds rate is 4.5%-4.75%. Although I could attempt to predict that this means the Fed will raise rates to at least 6.4% to match the current inflation rate, it’s difficult to say this for sure. After all, inflation is already falling despite the Fed funds rate being lower than the inflation rate, and that didn’t happen in the 1970s.

I do think it’s likely that because inflation increased faster than analysts expected this month, it’s also likely that analysts will increase their inflation targets/Fed funds rate targets and decrease their stock price targets in the short term. Despite this, I still believe it’s likely that rates will reach their peak this year, regardless of whether that’s closer to 5% or 7%. This means that stocks could have reached their bottom already, although nobody can say for sure. (It should also be noted that stocks had a positive return in the 1970s despite high rates/high inflation.)

Does CPI Impact The Crypto Forecast?

The theoretical correlation between stock prices and the Fed funds rate (and thus the CPI) is well-documented. But will the cryptocurrency market be impacted in the same way?

Crypto is barely a decade old, so we can’t look back to the 1970s for a historical example of what crypto does during a period of high inflation. Over the past decade, the potential use cases touted for Bitcoin and other cryptocurrencies have been quite varied, including:

- A risk-on asset (inflation is bad)

- A scarce store of value (inflation is good)

- A payment method (inflation is arguably good)

- A new asset class that’s not correlated with existing classes (inflation is irrelevant)

Despite touting some use cases that would make inflation good for Bitcoin, this hasn’t been the case so far. 2022 was the highest inflation year since Bitcoin was created, yet Bitcoin’s value was halved from $48K in early 2022 to $24K today. And as the belief that inflation peaked gained popularity this year, Bitcoin started the year off strong after bottoming below $16K. The small amount of history so far certainly implies that inflation is bad for Bitcoin.

Google News

However, it’s dangerous to make such sweeping assumptions from a small amount of data. For example, looking at only one day of data pictured above, one might conclude that hotter-than-expected inflation would be good for Bitcoin and bad for stocks. That’s the exact opposite of what one would conclude about Bitcoin in 2022. Overall, Bitcoin’s short-term movement following CPI reports has been difficult to predict. There is some evidence that sustained high inflation would be bad for Bitcoin, but not enough evidence to say this conclusively.

What Is The Crypto Forecast?

Rather than looking at the CPI to determine what Bitcoin’s price will do, I prefer to look at other factors that I believe are more relevant. Over the last decade, crypto has been one of the best-performing asset classes, despite facing tests like the COVID-19 crash and the 2018 tech wreck. By many metrics, crypto has been adopted as quickly as the internet, and its use cases have expanded rapidly to include applications like remittances and collectibles. The long-term trend is looking good for crypto.

Like past crashes, the recent crash has left some people questioning whether crypto will continue to be adopted rapidly going forward. But unlike previous crashes, this crash hasn’t generated many meaningful concerns from a usage perspective.

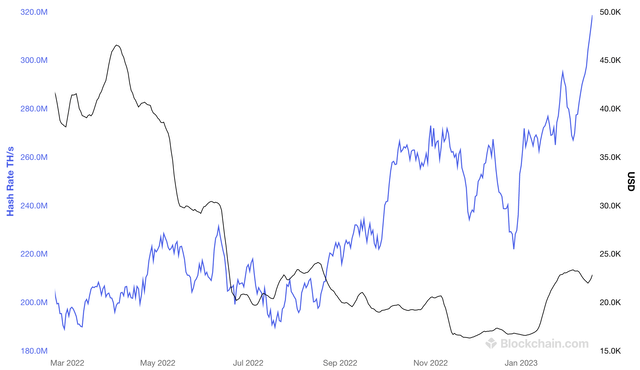

Blockchain.com

The above chart shows Bitcoin’s hash rate over time. The hash rate in terahash/second (purple line) has steadily increased and is now at its highest value ever. As I’ve previously written, a higher hash rate corresponds to more mining and better network security.

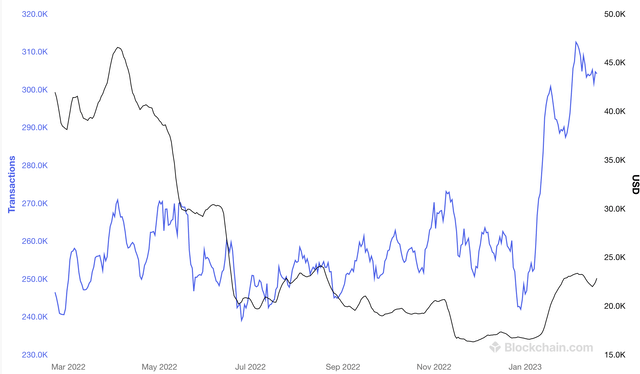

Blockchain.com

It’s a similar story when it comes to transactions per day, which is arguably a more important metric. The number of transactions per day (purple line) remained steady even as Bitcoin’s price crashed early last year, and the value recently spiked to new highs.

Why would Bitcoin’s price fall despite these strong usage metrics? It’s well-documented that since its inception, Bitcoin has rallied going into its halving event and subsequently crashed shortly after the halving completes. With the last halving completed in mid-2020, it appears that Bitcoin once again followed this cycle. While this pattern probably won’t hold up forever, investors should hope that Bitcoin once again rallies going into the next halving event in early 2024. I believe that the chances of a rally are higher if usage of the network continues to increase.

Admittedly, it’s also possible that external factors – including high CPI reports and the stock market selloff that they supposedly caused – partly contributed to Bitcoin’s recent price decline. Bitcoin certainly wouldn’t be the only high-tech asset to see its valuation reduced despite strong growth in recent years. Based on what we’ve seen in Bitcoin’s short history, Bitcoin investors should cautiously hope that inflation declines and stocks rise. However, I’ll once again stress that I don’t believe inflation is the most important factor for Bitcoin in the long term.

Conclusion

Bitcoin has been a top-performing asset despite its selloff last year, and the underlying story about Bitcoin being a stable, decentralized, and scarce asset hasn’t changed at all. Although there’s some evidence that high inflation is bad for Bitcoin, rapid adoption of the Bitcoin network has continued even in the face of its recent price crash. Thus, I continue to hold Bitcoin – as well as correlated cryptos Ethereum (ETH-USD) and Flow (FLOW-USD) – in anticipation of another bull run starting at some unpredictable time in the near future.