The Strategic Petroleum Reserve storage at the Bryan Mound site in Freeport, Texas, Oct. 19.

Photo:

Brandon Bell/Getty Images

White House officials accuse OPEC and its allies of manipulating oil prices, but then what do you call what President Biden is trying to do? Three weeks before Election Day, Mr. Biden is ordering 15 million more barrels released from the nation’s Strategic Petroleum Reserve (SPR) to reduce gasoline prices.

The new releases are a sign of political desperation. Crude price climbed after OPEC+ this month announced a two million barrels a day cut in production. This is really closer to one million barrels a day since many countries aren’t meeting their quotas now. But as day follows night, U.S. gas prices have increased, and the political timing couldn’t be worse for Democrats.

The Administration says its planned drawdown will add about 500,000 barrels a day to global supply in December. That’s misleading. About one million barrels a day on average have been released since this spring. The drawdowns were scheduled to end next month, so the new releases will merely prevent supply from contracting more than it otherwise would.

The Administration first started tapping the SPR last fall to combat rising gas prices. Please, Mr. President, stop calling it “Putin’s price hike.” Russian exports have fallen a mere 560,000 barrels a day from pre-Ukraine war levels on a global supply of 101 million.

The main problem is that oil demand has outstripped supply amid the post-pandemic economic recovery owing to a lack of investment, especially in the U.S., which had been the world’s swing producer. U.S. production has been flat since May. Now the swing producers are Saudi Arabia and the United Arab Emirates. OPEC countries and their allies, which account for 45% of global oil production, accounted for 85% of new supply in September.

The Biden SPR releases have probably helped reduce prices at the margin. But one risk was always that crude prices would rise when the releases tapered off. And here we are.

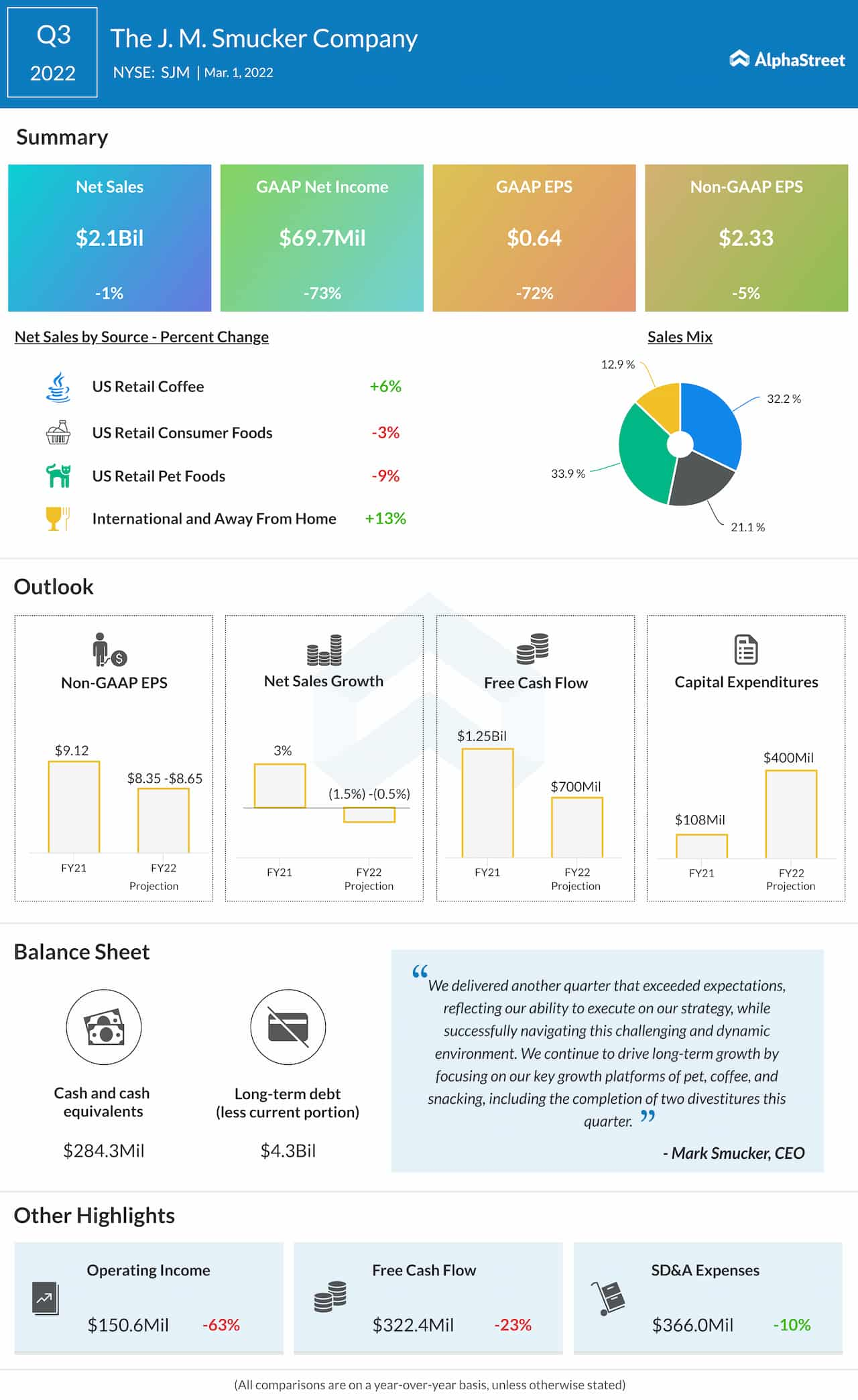

The Administration said Wednesday it may continue releases as long as “conditions”—i.e., political conditions—require, but this is unsustainable. The SPR has fallen by about 210 million barrels since last fall. (See the chart nearby.) The Administration says the 400 million or so barrels that remain are “more than ready to respond to energy security needs today.” That’s also far from clear.

One reason is that the Administration is fast depleting the medium-sour grade crude in the reserve that is most useful to U.S. refineries. Much of what remains is a light-sweet crude produced from shale, much of which gets exported. Future releases could compete with U.S. shale in the tight global refining market and even discourage investment in shale production.

A true national emergency could also fast deplete the reserve. That’s why previous Presidents performed only three emergency releases: Operation Desert Storm in 1991 (17.3 million barrels), Hurricane Katrina in 2005 (20.8 million), and the Libya oil disruptions in 2011 (30.6 million). Though prices exceeded $90 a barrel from 2011 to 2014,

Barack Obama

didn’t resort to emergency drawdowns to reduce gas prices.

What brought down oil prices and kept them low last decade was the shale fracking boom. U.S. production increased by seven million barrels a day between 2011 and 2019 but plunged early in the pandemic. The Trump Administration floated buying oil for the SPR to prevent producers from shutting in wells, which can do long-term damage to production.

But Democrats refused to appropriate the money to keep oil pumping from marginal wells, calling it a “bailout for Big Oil.” This is one reason oil production beyond the Permian basin has been flat or declining since summer 2020. U.S. production is still about 1.1 million barrels a day below the pre-pandemic peak. (See the nearby chart.)

The Administration now says it plans to encourage “near-term production” by announcing its “intent” to repurchase oil for the reserve when the price of West Texas Intermediate (WTI) crude oil falls to $67 to $72 a barrel. Who knows when this will happen since the Saudis have indicated their intent to keep prices around $90 to $100 a barrel.

We’ve been writing for months that Mr. Biden could deflate oil prices by giving a simple speech declaring an end to his political war on fossil fuels. Instead he resorts to gimmicks like the SPR releases and cozies up to dictators. Hours after OPEC announced its production cut, news leaked that the White House plans to ease sanctions on Venezuela to liberate its oil production.

Perhaps the Administration hoped the leak would reduce oil prices. It didn’t. Neither did Wednesday’s SPR announcement. Markets are smarter than Administration officials think, and so are voters.

Copyright ©2022 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Appeared in the October 20, 2022, print edition.