kertlis/E+ via Getty Images

Thesis

BlackRock Floating Rate Income Trust (NYSE:BGT) is a closed end fund. The vehicle focuses on leveraged loans and has current income as its primary goal. The CEF comes from the BlackRock family of funds, and currently sports a five star Morningstar rating. One of the defining characteristics of this asset class is the short duration profile, and the CEF does not disappoint from this standpoint, with an overall duration of only 0.27 years.

We have been bullish this asset class for a while now, with Buy ratings assigned to BGT’s competitors:

- VVR: A 10% Yielding CEF That Is Actually Increasing Its Distribution rated a Buy late last year and up 19% since

- FTSL: Unleveraged Floating Rate Loans, 8.4% Yield rated a Buy mid 2023 and up since

When looking at a leveraged loan CEF it is important to get a sense of the research capabilities of the asset management platform, the fund’s leverage ratio, credit risk profile and historic track-record. BGT comes from a premier global asset manager, has a small ‘CCC’ bucket and a conservative leverage ratio of 25% (there are leveraged loan CEFs with 35%+ leverage ratios as an example). The fund has a very robust historic performance and benchmarks favorably with the golden standards in the leveraged loan CEF space.

While the Fed is signaling it is done raising rates for now, but data dependent, the markets are pricing a high rate environment for longer:

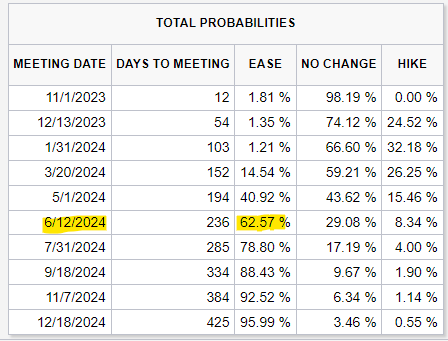

Rate Cut Probabilities (CME)

If we look at the forward Fed Funds curve and the implied rate probabilities, we will notice that market participants are not pricing in a Fed cut (above 50% probability) until mid 2024. A high rate environment for longer translates into floating rate assets being able to pass a high rate of interest to holders until the Fed starts cutting. Furthermore, the beauty of the asset class resides in its short duration, hence even if we have an unexpected spike in inflation and the Fed is forced to raise rates again, floating rate loans will not have a negative price impact.

At this juncture, with some deteriorating fundamentals but yields higher for longer, leveraged loan funds just make sense as a high dividend provider. Fixed rate funds run the risk of higher rates, while equities are held in place by the ‘Magnificent 7’ solely. As a retail investor, if you do not want to wait it out in cash, then floating rate loans is the place to allocate capital in today’s environment.

There is a lot to like about BGT – starting with the asset manager and the profile of the collateral pool, and ending with the floating rate nature of the underlying loans and the robust historic performance. The main risk factor to be aware of and consider is a credit spread shock, where the market sells off and credit spreads jump much higher, thus affecting the pricing. The same risk is borne by the fixed rate high yield market, so all else equal in below investment grade credits, a retail investor should choose floating rate loans given their duration hedge in this interest rate environment.

Analytics

AUM: $0.26 billion.

Sharpe Ratio: 0.83 (3Y).

Std. Deviation: 5.7 (3Y).

Yield: 11.7%.

Premium/Discount to NAV: -8%.

Z-Stat: 0.47.

Leverage Ratio: 25%

Duration: 0.27 years

Composition: Leveraged Loans

Performance

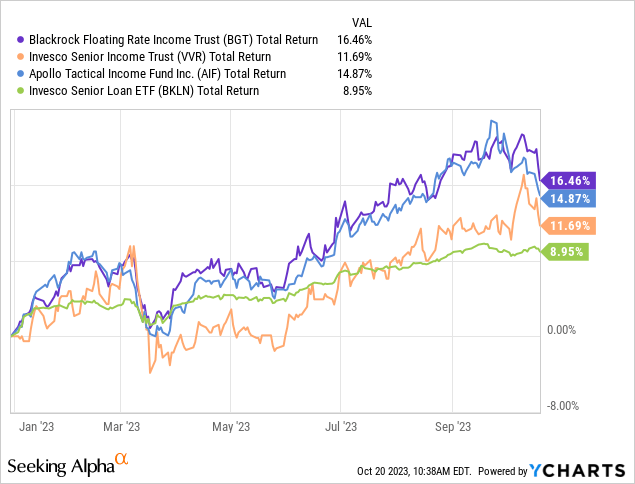

The CEF has outperformed this year when compared to its peer-group:

We are benchmarking the CEF against some of the ‘golden standards’ in the space, namely the Invesco Senior Income Trust (VVR) and the Apollo Tactical Income Fund (AIF), as well as the unleveraged ETF Invesco Senior Loan ETF (BKLN). BGT outperforms all its CEF peers, while BKLN lags due to its lack of leverage.

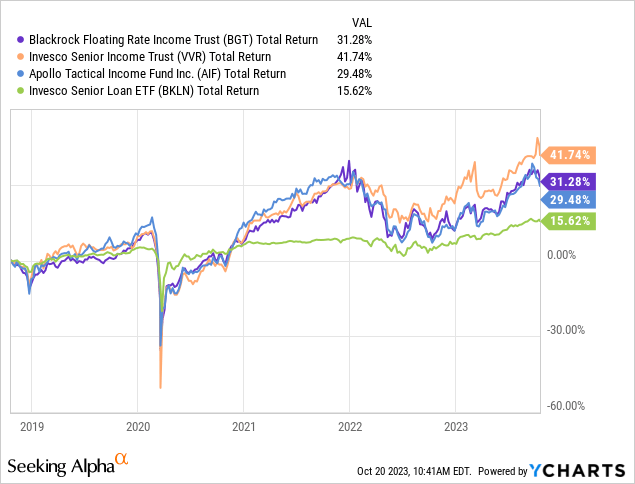

Longer term the story is similar, with BGT managing to post extremely robust total returns:

On a 5-year lookback VVR is the winner, however BGT and AIF have similar total return profiles.

Premium/Discount to NAV

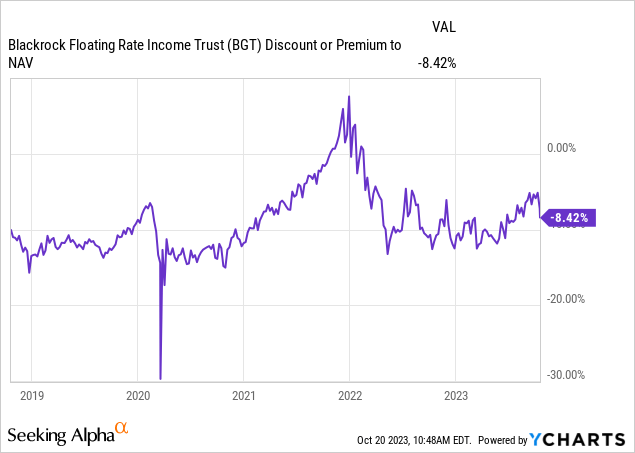

The fund’s discount to NAV has a close correlation to interest rates:

During normalized interest rate environments the CEF has a very stable discount to NAV that fluctuates around -10%. During the significant monetary easing experienced in 2020/2021, the CEF narrowed to flat to NAV due to its high yield.

We do not expect much of a windfall from discount narrowing in the next 12 months, and would not look at this factor as additive to the CEF’s returns for now.

Distributions

The fund does a good job of covering its distribution yield:

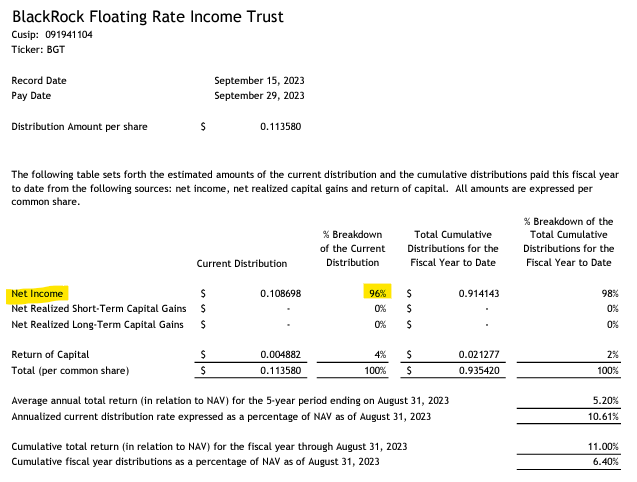

Section 19a Notice (Section 19 Notice)

As of the September payment date, 96% of the distribution came from the income received from the underlying loans, with only a 4% ROC utilization.

The math makes sense, with SOFR at 5.3% and spreads on leveraged loans at roughly 5%. When you add leverage on top you can see how the fund obtains its 11.7% distribution yield. As rates stay high for longer, expect a very good coverage for this distribution yield.

Collateral

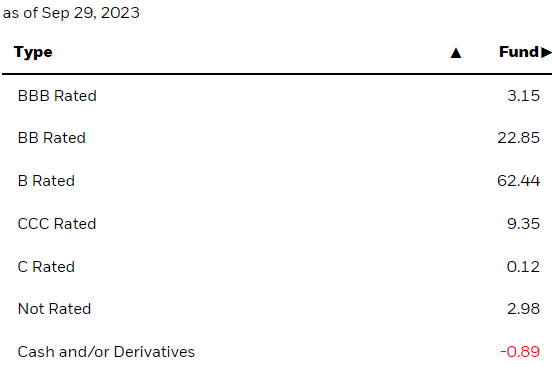

The fund is a middle-of the road one, with no excessive credit risk:

Ratings (Fund Website)

The name is overweight ‘B’ names which make up 62% of the portfolio, while the riskiest collateral, namely ‘CCC’ loans, represent just 9.35% of the fund.

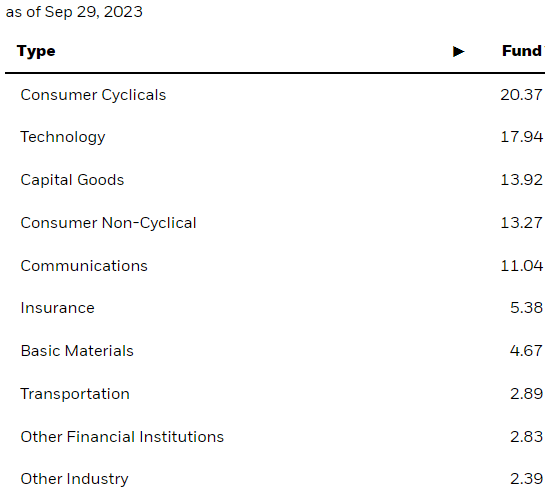

The same composition feature can be found in the sectoral distribution, where the industry concentration is balanced out:

Sectors (Fund Fact Sheet)

As an investor you do not want to see any sector above 25% of a fund, because it would represent an overweight positioning in a certain sector. While there are many funds which specialize on certain corners of the market, they are very forthcoming about their narrow focus and risk factors. In a middle-of-the-road leveraged loan CEF you want to see diversification.

Conclusion

BGT is a fixed income closed end fund. The CEF focuses on leveraged loans and comes from a premier asset manager. The fund has very robust historic returns, matching or even beating other ‘golden standards’ in the space, namely VVR and AIF.

The CEF has a conservative composition, with a low 25% leverage ratio and a collateral pool that does not take excessive risks via ‘CCC’ credits. The fund almost fully covers its distribution, and we expect it to continue to do so until the Fed starts cutting rates. Although the CEF trades at a -8% discount to NAV, we do not expect significant fluctuations there, and no real windfall from trading this risk factor here.

We like BGT for what it is, namely a vehicle that extracts a high yield from a floating rate below investment grade asset class. Both loans and BGT have low standard deviations, and have proven to be a very profitable tool since the Fed started raising rates in 2022. We are still bullish on this asset class and like this five star loan CEF here.