[ad_1]

lorozco3D/iStock through Getty Photos

Ascend Wellness Holdings (Ascend) (OTCQX:AAWH) is a diversified multi-state operator within the US hashish markets. The agency employs roughly 1,500 individuals and was based by Abner Kurtin, a lifelong investor and former Managing Director of Baupost Group, a legendary hedge fund. On this article, I’ll clarify why their increasing footprint, compelling valuation, and bearish sentiment make Ascend a high choose for hashish buyers.

1. Increasing Footprint

Ascend’s present footprint consists of 20 dispensaries in 5 states. Illinois is their core market, with eight retail shops and one cultivation/processing facility. Michigan is one other robust state, with 6 present retail, 2 extra deliberate, and one cultivation/processing facility. Massachusetts and Ohio are their different two present markets. These core states give Ascend publicity to 4 of the highest 9 leisure markets and a top-three medical market with Ohio.

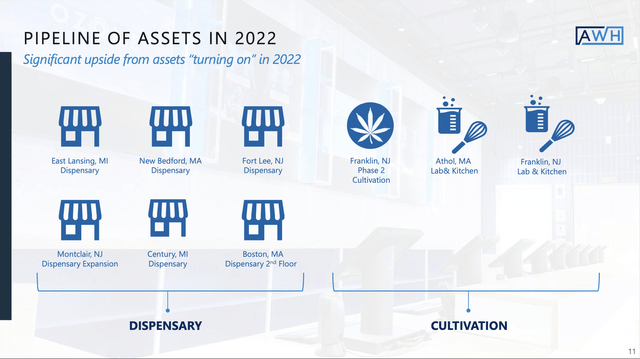

Much more thrilling are the belongings coming on-line in 2022. New Jersey is transitioning from medical solely to grownup use and Ascend is effectively positioned to capitalize. It’s the seventh-most populated state and a lot of the state’s estimated $2.2 billion in authorized and illicit gross sales comes from the normal market.

New Jersey authorized adult-use gross sales in February 2021, however has been gradual in rolling out this system. Many anticipated a number of MSOs to get approval on the New Jersey CRC assembly on March twenty fourth, nonetheless the state was not prepared. Shortly after that assembly, regulators introduced an unscheduled assembly for April eleventh. Present hypothesis is {that a} handful of operators could also be licensed. As soon as authorized, the soonest adult-use gross sales can begin is 30 days later.

When New Jersey opens, Ascend is prepared with prime areas in Fort Lee and Montclair, plus cultivation, labs and a kitchen in Franklin. Their prime dispensary areas is not going to solely entice New Jersey residents, but additionally neighboring New Yorkers that don’t but have entry to authorized hashish.

Ascend Investor Roadshow Presentation March 2022

2. Valuation

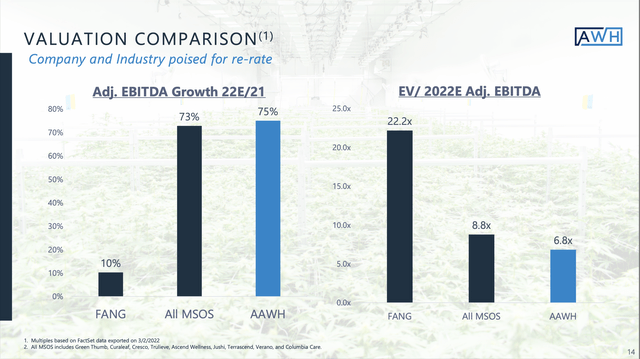

US hashish multi-state operators are priced like worth shares, whereas having upside much like many development corporations. The primary comparability is to the famed “FANG” shares: Fb (FB), Amazon (AMZN), Netflix (NFLX) and Google (GOOG) (GOOGL). This basket is perceived as among the many quickest rising and highest-quality corporations in America.

Nevertheless, when evaluating adjusted EBITDA with a basket of eight MSOs, the hashish shares are rising 7.3x sooner. From a valuation perspective, the MSO basket is 60% cheaper, and Ascend’s valuation is much more compelling.

Ascend Investor Roadshow Presentation March 2022

Ascend can also be low-cost when in comparison with friends. Beneath is a basket of tier 2 hashish shares with their respective enterprise values divided by adjusted EBITDA. On common, Ascend trades at a forty five% low cost to the basket.

Enterprise Worth/Adj. EBITDA

|

MSO |

2021 |

2022 |

2023 |

|

TerrAscend |

37.0 |

21.2 |

12.1 |

|

Columbia Care |

25.1 |

9.8 |

6.4 |

|

Ayr Wellness |

13.4 |

6.9 |

4.0 |

|

Jushi |

45.6 |

12.7 |

5.9 |

|

Ascend |

10.0 |

7.4 |

4.1 |

|

Common |

26.2 |

11.6 |

6.5 |

|

Ascend Low cost |

61.8% |

36.2% |

36.9% |

FactSet knowledge as of 04/05/22

3. Sentiment

Sentiment is outlined as an perspective, thought, or judgment prompted by feeling. As buyers, we at all times have to weigh sentiment versus fundamentals to evaluate how a lot of our expectations are priced into present valuations. It’s an artwork, not a science.

I’m lively on Twitter and r/weedstocks on Reddit. Each are glorious sources for studying and seeing how buyers are feeling. Recently, sentiment is as bearish as I’ve seen it. Whereas exhausting to quantify, I’ve witnessed a pickup in bearish views, anger over losses, and a few revered voices lastly tossing within the towel.

To quantify sentiment, I checked out two imperfect metrics for context. First is how broadly shares are adopted on Looking for Alpha. The common for the tier-two basket is 3,782 followers, whereas Ascend has a paltry 458 followers, 88% lower than the common. For perspective, Tilray (TLRY) has 137,000.

Looking for Alpha Followers

|

MSO |

SA Followers |

|

TerrAscend |

4,940 |

|

Columbia Care |

3,890 |

|

Ayr Wellness |

4,470 |

|

Jushi |

5,150 |

|

Ascend |

458 |

|

Common |

3,782 |

|

Ascend Followers vs Common |

12.1% |

Supply: Looking for Alpha knowledge as of 04/05/22

Subsequent, I measured average-daily dollar-volume traded. Ascend trades 89% much less greenback quantity than the common of the tier-two basket. Quantity doesn’t immediately measure sentiment, however while you put collectively the items it paints an image that the majority hashish buyers usually are not following, a lot much less buying and selling Ascend.

Common Day by day Greenback Quantity Traded

|

MSO |

Avg $ Quantity |

|

TerrAscend |

1,650,000 |

|

Columbia Care |

985,490 |

|

Ayr Wellness |

1,229,900 |

|

Jushi |

726,110 |

|

Ascend |

103,950 |

|

Common |

939,080 |

|

Ascend Quantity vs Common |

11.1% |

Supply: Yahoo Finance knowledge as of 04/05/22

A chunk of the dollar-volume puzzle is that Ascend is the one high 10 MSO not included within the trade’s largest ETF, AdvisorShares MSOS. This fund manages about $1 billion, making it the most important within the hashish area. When the ETF receives inflows, we see a wave of shopping for throughout the underlying names. Jungle Java on Twitter tracks this each day. Not being on this stream of flows is a adverse at the moment, however the potential for inclusion sooner or later might supply significant upside.

Potential Threat

One concern probably clouding sentiment—and perhaps making MSOS reluctant – is Ascend’s pending lawsuit with MedMen. From Ascend’s perspective, MedMen has a case of vendor’s regret and backed out of a $73 million deal to purchase their New York license. Ascend gave them $8.5 million up entrance, the switch obtained regulatory approval, and MedMen refuses to relinquish the license. Given that is one in all simply 10 licenses within the state, it’s a prized asset as New York transitions from medical-only to wider grownup use.

I don’t have an edge in predicting authorized outcomes, however after studying the out there paperwork and speaking with the Ascend group, it’s obscure MedMen’s case. Upon decision, this might develop into a really precious asset bought at low-cost value. Successful the lawsuit may swing sentiment and usher in buyers ready for decision.

Conclusion

Ascend is among the premier US hashish multi-state operators. They’re effectively managed, have an increasing footprint, and compelling valuation. This backdrop when mixed with few followers, low quantity, and a fatigued investor base presents a chance. We should always search shares the place fundamentals are bettering and nobody cares.

I like to recommend Ascend for buyers with a high-risk tolerance and long-time horizon. The highest-down hashish commerce will play out in a collection of stair-step occasions. Now’s the time to be shopping for at engaging valuations and Ascend is an under-appreciated story.

[ad_2]

Source link