gorodenkoff

Failure is the condiment that offers success its taste.”― Truman Capote

At present, we take an in-depth take a look at a small biotech concern that had a current setback however nonetheless has some ‘pictures on objective‘. An evaluation follows under.

In search of Alpha

Firm Overview:

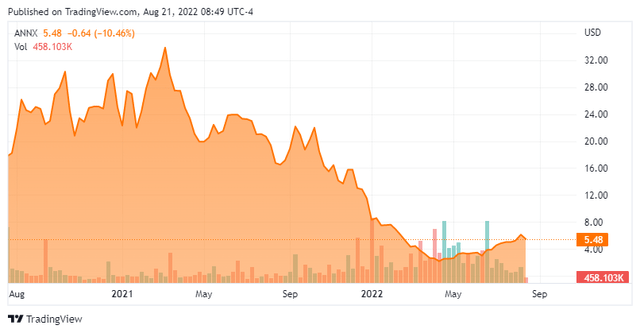

Annexon, Inc. (NASDAQ:ANNX) is a Brisbane, California based mostly clinical-stage biopharmaceutical concern centered on the event of therapies that deal with complement-mediated autoimmune, neurodegenerative, and ophthalmic issues. The corporate has three scientific property, all of which goal the initiating molecule of the classical complement pathway: C1q. Annexon was fashioned in 2011 and went public in 2020, elevating internet proceeds of $262.4 million at $17 per share. The inventory presently trades round $5.50 a share, translating to a market cap of roughly $360 million together with not too long ago issued warrants.

Complement System

For these unfamiliar, the complement system is a part of the physique’s immune system and is accountable for aiding within the elimination of microbes and broken cells by means of three pathways: the classical complement; the choice complement; and the lectin. Comprised of proteins produced by the liver, overactivation of the classical complement pathway may cause extreme immune and inflammatory issues. C1q is a protein complicated that’s a part of the classical complement pathway and is activated when it binds particular antigen-antibody complexes. When overactivated, it triggers a robust inflammatory cascade by means of the instigation of downstream pathway parts that may trigger tissue-damaging illnesses. Annexon’s precision medication platform is designed to provide C1q focusing on compounds to dam the early inflammatory cascade whereas preserving the helpful immune capabilities of the lectin and different complement pathways vital to the clearance of pathogens and broken cells.

Pipeline

From this platform Annexon has developed three scientific property.

ANX005. The corporate’s lead candidate is ANX005, an intravenously administered monoclonal antibody designed to totally inhibit C1q all through the physique and throughout the blood mind barrier to fight autoimmune and neurodegenerative illnesses. It’s presently present process analysis in 4 scientific trials, probably the most superior of which is a Part 2/3 scientific examine for the remedy of Guillain-Barre Syndrome [GBS], a uncommon, acute, autoimmune illness damaging the peripheral nervous system of ~15,000 sufferers in North America and Europe with no accredited therapies. The 180-patient, placebo-controlled trial is anticipated to readout in 2023 with main endpoint change from baseline in GBS Incapacity Scale. In a accomplished Part 1b examine, ANX005 was well-tolerated and achieved C1q suppression in each the peripheral and central nervous programs.

Nonetheless, ANX005’s Part 2 examine for Huntington’s illness [HD] has been the topic of great concern after an interim readout in early January 2022 revealed that regardless of half of the 28 sufferers within the trial (at the moment) experiencing scientific enchancment in illness development, 5 discontinued remedy, which considerably contradicted the corporate’s assertion that ANX005 had been typically well-tolerated. Shares of ANNX fell 34% to $7.26 within the subsequent buying and selling session, initiating a crash into the mid-2s.

A June seventh, 2022 information readout indicated that illness development was stabilized within the total HD inhabitants throughout each the six months of remedy and the three-month follow-up interval. 9 of twelve sufferers with excessive complement ranges demonstrated enchancment at week 24 and maintained it by means of week 36. Moreover, a biomarker for synapse loss remained typically constant over the nine-month examine interval. Most significantly, nobody else dropped from the examine and the three sufferers decided to have developed treatment-related negative effects had these occasions enhance or resolve after discontinuation. All three instances have been in sufferers with elevated antinuclear antibody (ANA) titers at baseline. No affected person with regular ANA titers skilled a extreme antagonistic occasion.

HD is a hereditary neurodegenerative dysfunction characterised by irregular involuntary actions, progressive dementia, despair, and psychosis. In HD, C1q inappropriately tags synapses within the mind, sparking their destruction, inducing neurodegeneration. Onset of signs sometimes happens between 30 to 50 years of age with loss of life from cardio-respiratory issues roughly 10 to twenty years thereafter. Though there’s treatment to deal with a few of HD’s signs, there are not any cures that handle its root trigger for the ~30,000 Individuals (80,000 globally) troubled.

The early June readout considerably validated Annexon’s precision medication strategy and triggered a 25% one-day rally to $4.06 a share. This information was later used to execute a non-public placement – extra on that under.

ANX005 can also be being studied in a Part 2 trial for the remedy of heat autoimmune hemolytic anemia (AIHA), a illness characterised by the presence of auto-antibodies that bind to purple blood cells. The temperature at which the binding happens determines the nice and cozy or chilly designation. Heat AIHA impacts ~30,000 sufferers globally, with ~11% progressing to loss of life. Information from the trial are anticipated in 2H22.

Lastly, ANX005 is present process Part 2 evaluation within the remedy of amyotrophic lateral sclerosis (ALS), the notorious devastating neurodegenerative illness that afflicts ~30,000 sufferers worldwide. A readout from the examine is anticipated in 2023.

The remedy has obtained Orphan Drug standing from the FDA for GBS and HD in addition to Quick Monitor designation for GBS.

ANX007. Annexon’s different asset in a Part 2 trial is ANX007, a formulation of an antigen-binding fragment [FAB] that’s designed to inhibit C1q regionally within the eye (initially) for sufferers with geographic atrophy [GA]. Often known as atrophic age-related macular degeneration, GA impacts greater than 5 million worldwide and has no accredited remedy choices. Topline information for the intravitreally administered remedy is anticipated in 1H23.

ANX009. The corporate can also be investigating ANX009, a subcutaneous formulation of a Fab designed to inhibit C1q solely within the vascular area for the remedy of lupus nephritis. An ongoing Part 1b trial is anticipated to provide preliminary information someday in 2H22.

Steadiness Sheet & Analyst Commentary:

Administration elected to leverage the considerably optimistic information from the HD trial into a really dilutive capital increase, executing a non-public placement that raised gross proceeds of $130 million, consisting of frequent inventory and pre-funded warrants representing 33.7 million shares at a value of ~$3.87, primarily doubling the entire shares excellent. Moreover, 8.4 million three-year frequent warrants with an train value of ~$5.81 have been issued. This transaction, which closed on July 11, 2022, elevated Annexon’s money place to ~$300 million with no debt, offering it an working runway into 2H25.

The Road is sanguine Annexon’s strategy, that includes two purchase and three outperform scores. Since second quarter outcomes posted earlier this month, 4 analyst companies together with JPMorgan and Needham have reissued Purchase scores with value targets proffered within the $22 to $30 vary.

Board member Muneer Satter used the non-public placement as a chance so as to add to his place, buying over 2.45 million shares, bringing his whole to 4.41 million, representing a 6% possession curiosity.

Verdict:

The market has reacted positively to the non-public placement, buying and selling 10% larger from the place the deal was priced. That rally has positioned Annexon’s market cap ~10% above money on its books. Though the HD trial discontinuations have been unnerving, ANX005 has been (or is being) examined on 170 topics throughout a number of trials and has been typically well-tolerated. The corporate plans to huddle with the FDA someday in 2H22 to debate subsequent steps for ANX005 within the remedy of HD. Throughout that very same interval, it can current Part 2 information on ANX005 within the remedy of heat AIHA and Part 1b outcomes on ANX009 towards lupus nephritis. 2023 will function scientific readouts for GBS, ALS, and GA. These catalysts signify a number of pictures on objective for a lot of indications that don’t have any particularly accredited remedy.

Though none of its accomplished trials have been powered for efficacy, it will seem that Annexon’s property are poised to generate statistically vital scientific leads to the upcoming information readouts. With its inventory buying and selling close to money, a would-be investor is receiving loads of potential upside that makes Annexon funding worthy. Due to this fact, ANNX appears to advantage a small ‘watch merchandise‘ place at this level.

The thoughts as soon as enlightened can not once more turn out to be darkish.”― Thomas Paine